1. GENERAL 1

Under the PUMA brand name, PUMA SE and its subsidiaries are engaged in the development and sale of a broad range of sports and sports lifestyle products, including footwear, apparel and accessories. The company is a European stock corporation (Societas Europaea/SE) and parent company of the PUMA Group; its registered office is on PUMA WAY 1, 91074 Herzogenaurach, Germany. The competent registry court is in Fürth (Bavaria).

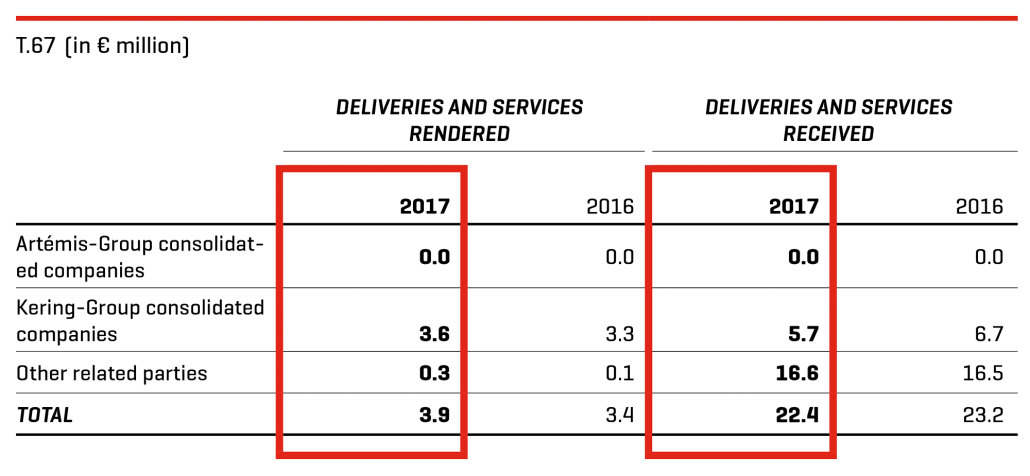

The PUMA Group is included in the consolidated financial statements of Kering S.A., Paris, which are available on the website www.kering.com and are published by the Autorité des Marchés Financiers (AMF). The Kering Group, in turn, is included in the consolidated financial statements of Financière Pinault S.C.A., which are not published.

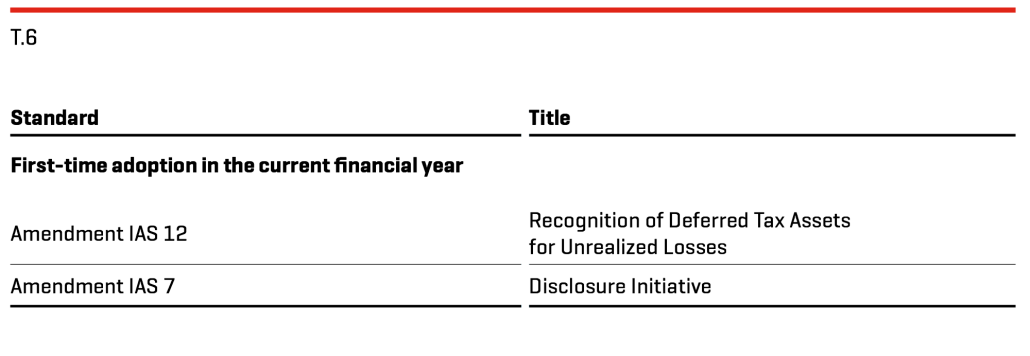

The consolidated financial statements of PUMA SE and its subsidiaries (hereinafter shortly referred to as the Group or PUMA) were prepared in accordance with the International Financial Reporting Standards (IFRS) accounting standards issued by the International Accounting Standards Board (IASB), as they are to be applied in the EU and the supplementary accounting principles to be applied in accordance with Section 315e (1) of the German Commercial Code. The IASB standards and interpretations, as they are to be applied in the EU, which are mandatory for financial years as of January 1, 2017 have been applied.

The following standards and interpretations have been released, but will only take effect in later reporting periods and are not applied earlier by the group:

IFRS 9 contains regulations for the recognition, measurement and derecognition as well as for hedge accounting. This means that the accounting of financial instruments carried out previously under IAS 39 (Financial Instruments: Recognition and Measurement) can now be completely replaced by accounting under IFRS 9. This includes, among other things, a new impairment model based on expected credit defaults. IFRS 9 also contains new regulations on the application of hedge accounting.

The new standard is to be applied for financial years beginning on or after January 1, 2018. PUMA will apply IFRS 9 for the first time for the financial year beginning on January 1, 2018; the adjustment of the previous year’s figures is waived in accordance with the transitional provisions of IFRS 9.

PUMA does not expect any significant effects from the first-time application of IFRS 9. With regard to the new impairment model of IFRS 9 for the value adjustment of debt instruments, PUMA does not expect any significant change in the amount of the value adjustments, as PUMA mainly has current trade receivables with no interest component. In addition, the majority of trade receivables are insured against credit risk, which limits the amount of the expected loss. PUMA will apply the hedge accounting rules prospectively as of January 1, 2018. It is expected that all existing hedge accounting relationships will also meet the requirements for hedge accounting in accordance with IFRS 9.

The introduction of IFRS 9 is accompanied by changes to IFRS 7, which will lead to additional disclosures in the notes to the financial statements in the future.

IFRS 15 prescribes when and in what amount revenues are to be recognized. The standard provides a single, principle-based, five-step model that applies to all contracts with customers. In the future, the date of revenue recognition will be determined by the transfer of control to the customer. In each case, a check must be carried out as to whether the power of disposition is transferred to the customer on a period or specific time basis. In addition, more comprehensive disclosures in the notes to the financial statements require that more informative and relevant information be made available to users of the financial statements than previously.

The standard and the clarifications published in April 2016 must be applied to financial years beginning on or after January 1, 2018. PUMA will apply IFRS 15 for the first time for the financial year beginning on January 1, 2018; the adjustment of the previous year’s figures is waived in accordance with the transitional provisions of the modified retrospective approach in IFRS 15. The transitional facilitations available for modified retrospective application are to be utilized. Based on the analyses carried out, no reconciliation effects are to be expected in the opening balance sheet in 2018 when IFRS 15 is applied for the first time.

Further findings in the course of the implementation of IFRS 15 confirm that there will be no material effects on the consolidated financial statements of PUMA as PUMA has not concluded any long-term contracts and multi-component agreements. In addition, the following key statements can be made:

- For revenues from the sale of products, no conversion effects are expected, since control is generally transferred to the customer when the products are delivered and sales revenues and thus income continue to be recognized at this point in time.

- The accounting for licensing of trademark rights does not result in any changes to the previous accounting treatment, as the previous presentation corresponds to future regulations.

- With regard to the new requirements for the disclosure of payments to customers, it is expected that in individual cases there may be differences in accounting, which will lead to the disclosure of payments to customers as a reduction in sales revenue rather than the recognition of operating expenses. Overall, however, this is not expected to have a significant effect on accounting.

- With regard to the balance sheet presentation, IFRS 15 results in a shift in connection with reimbursement liabilities, which were previously reported under other provisions. The amount of the reimbursement liabilities will continue to be disclosed separately in the notes to the financial statements. Overall, however, this is not expected to have a significant effect on accounting.

- The sales-related warranty services cannot be purchased separately and do not lead to services that go beyond the assurance of the specifications at the time of the transfer of risk. They therefore fall under assurance type warranties, which continue to be accounted for in accordance with IAS 37.

However, the new IFRS 15 will require additional quantitative and qualitative disclosures in the notes.

The new IFRS 16 standard will mean that in the future all leases will have to be accounted for in the form of a right of use and a corresponding leasing obligation. In all cases, the presentation in the income statement is made as a financing transaction, i. e.,the right of use is generally depreciated on a straight-line basis and the lease liability is carried forward using the effective interest method. However, it is expected that the application facilitation for short-term leases with a term of less than 12 months and leased assets of low value will be utilized.

The new standard is to be applied for financial years beginning on or after January 1, 2019. No decision has been made yet with regard to the method of first-time application. It is planned that PUMA will make its decision on the first-time application of IFRS 16 in the first half of 2018 and announce its decision in the financial report for the first half of 2018.

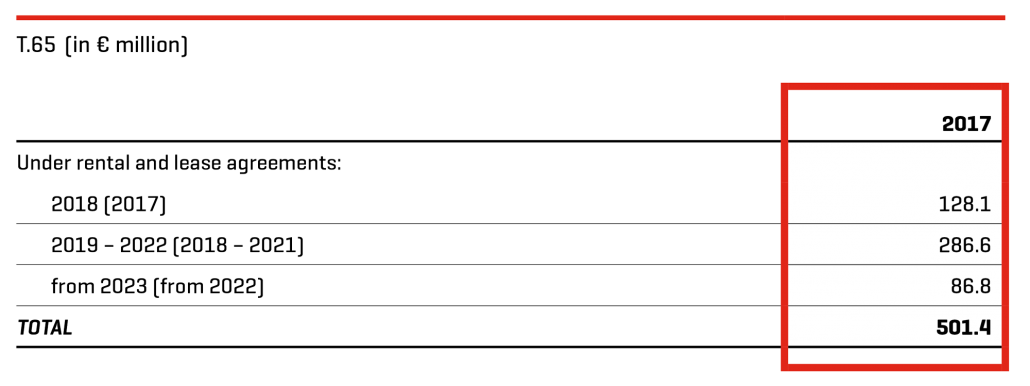

PUMA mainly concludes leasing contracts as an operating lessee. The application of IFRS 16 has the following effects on the presentation of the Group’s net assets, financial position and results of operations: With regard to the minimum lease payments from operating leases reported under other financial obligations, the first-time application of IFRS 16 will lead to an increase in non-current assets due to the recognition of rights of use. Accordingly, financial liabilities will increase as a result of the disclosure of the corresponding liabilities. This will therefore lead to a significant increase in balance sheet total and a corresponding reduction in the equity ratio of the PUMA Group. In addition, the nature of the expenses arising from these leases will change, as IFRS 16 replaces the operating lease expenses previously recognized on a straight-line basis with depreciation of rights of use and interest expenses for liabilities. This will therefore have a positive effect on operating income (EBIT) in the income statement. In addition, IFRS 16 requires the repayment share of lease payments that are not classified as short-term or low-value leases to be shown as part of the cash flow from financing activities, with the result that the cash flow from operating activities will improve.

This year, a project group was set up to deal intensively with the effects and implementation of the new requirements during the course of the project. The quantitative effects on the PUMA consolidated financial statements cannot yet be reliably described. The current operating lease volume is shown under Note 28 (Other Financial Obligations: Obligations from Operating Leases). It is currently expected that the conversion effect will mainly affect the properties leased by PUMA (retail, offices and warehouses).

The company does not anticipate the remaining standards mentioned above to have a significant impact on the consolidated financial statements.

The preparation of the consolidated financial statements was based on historical acquisition and manufacturing costs, with the exception of the profit or loss assessment of financial assets and liabilities at fair value.

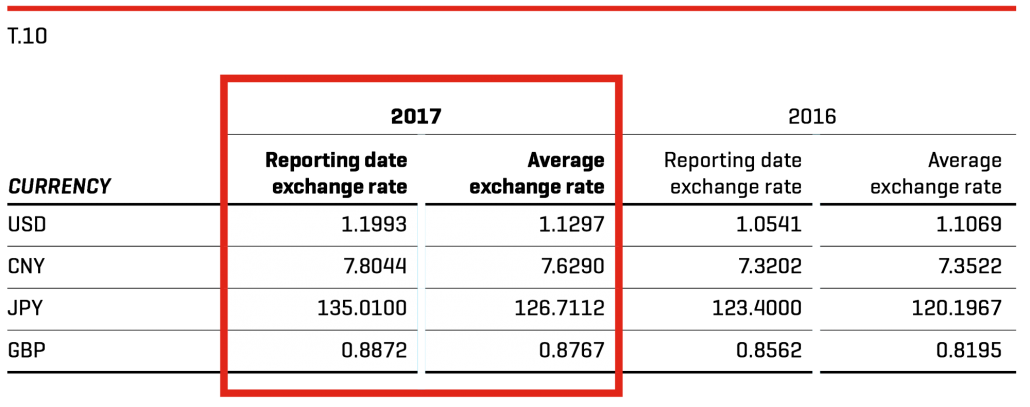

The items contained in the financial statements of the individual Group companies are measured based on the currency that corresponds to the currency of the primary economic environment in which the company operates. The consolidated financial statements are prepared in euros (EUR or €). The presentation of amounts in € million with one decimal place may lead to rounding differences since the calculation of individual items is based on figures presented in thousands.

The cost of sales method is used for the income statement.

2. SIGNIFICANT CONSOLIDATION, ACCOUNTING AND VALUATION PRINCIPLES

CONSOLIDATION PRINCIPLES

The consolidated financial statements were prepared as of December 31, 2017, the reporting date of the annual financial statements of the PUMA SE parent company, on the basis of uniform accounting and valuation principles according to IFRS, as applied in the EU.

Subsidiaries are companies in which the Group has existing rights that give it the current ability to direct the relevant activities. The main activities are those that have a significant influence on the profitability of the company. Control is therefore considered to exist if the Group is exposed to variable returns from its relationship with a company and has the power to govern those returns through its control of the relevant activities. As a rule, control is based on PUMA’s direct or indirect majority of the voting rights. Consolidation begins at the point in time from which control is possible. It ends when this no longer exists.

The capital consolidation of the subsidiaries acquired after January 1, 2005 is based on the acquisition method. Upon initial consolidation, the assets, debts and contingent liabilities that can be identified as part of a business combination are stated at their fair value as of the acquisition date, regardless of the non-controlling interests (previously referred to as minority interest). At the time of the acquisition, there is a separately exercisable right to vote on whether the interests of the non-controlling shareholders are valued at fair value or at proportional net asset value.

The surplus of the acquisition costs arising from the purchase that exceeds the Group’s share in the net assets stated at fair value is reported as goodwill. If the acquisition costs are lower than the amount of the net assets stated at fair value, the difference is reported directly in the income statement.

Pursuant to the contractual arrangement with the joint venture partners, PUMA is already the beneficial owner of controlling interests. The companies are fully included in the consolidated financial statements and, therefore, non-controlling interests are not disclosed. The present value of the capital shares attributable to the non-controlling shareholders and the present value of the residual purchase prices expected due to corporate performance are included in the capital consolidation as acquisition costs for the holdings. If there are any subsequent deviations, for acquisitions before January 1, 2010, these lead to a subsequent adjustment of the acquisition costs not affecting income. For business combinations as of January 1, 2010, the costs that can be directly allocated to the acquisition as well as subsequent deviations in the present value of expected residual purchase prices are recognized in the income statement pursuant to the application of the amended IFRS 3.

With respect to the remaining controlling interests, losses attributable to non-controlling interests are allocated to the latter even if this results in a negative balance in non-controlling interests.

Receivables within the Group are offset against internal liabilities. As a general rule, any set-off differences arising from exchange rate fluctuations are recognized in the income statement to the extent that they accrued during the reporting period. If receivables and liabilities are long-term and capital-replacing in nature, the currency difference is recognized directly in equity and under Other Comprehensive Income.

In the course of the expense and income consolidation, inter-company sales and intra-group income are offset against the expenses attributable to them. Interim profits not yet realized within the Group as well as intra-group investment income are eliminated by crediting them in the income statement.

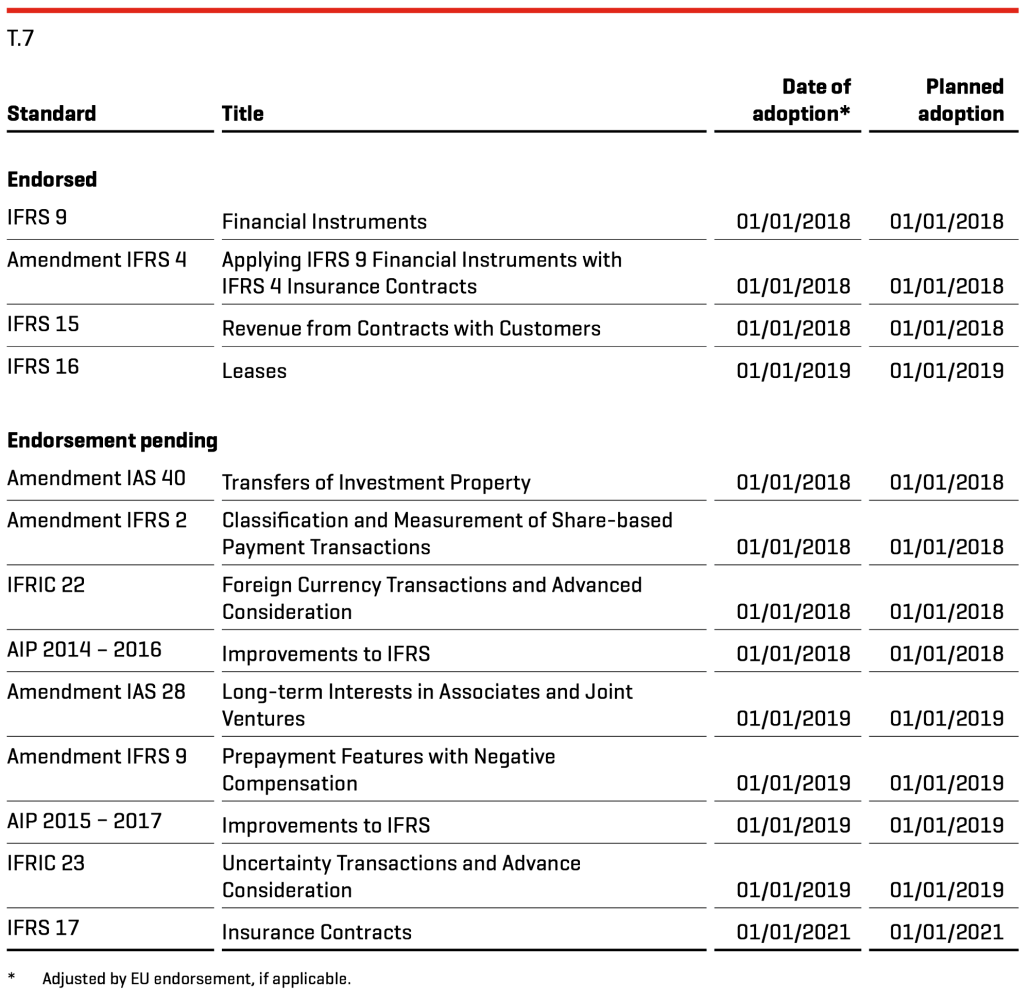

GROUP OF CONSOLIDATED COMPANIES

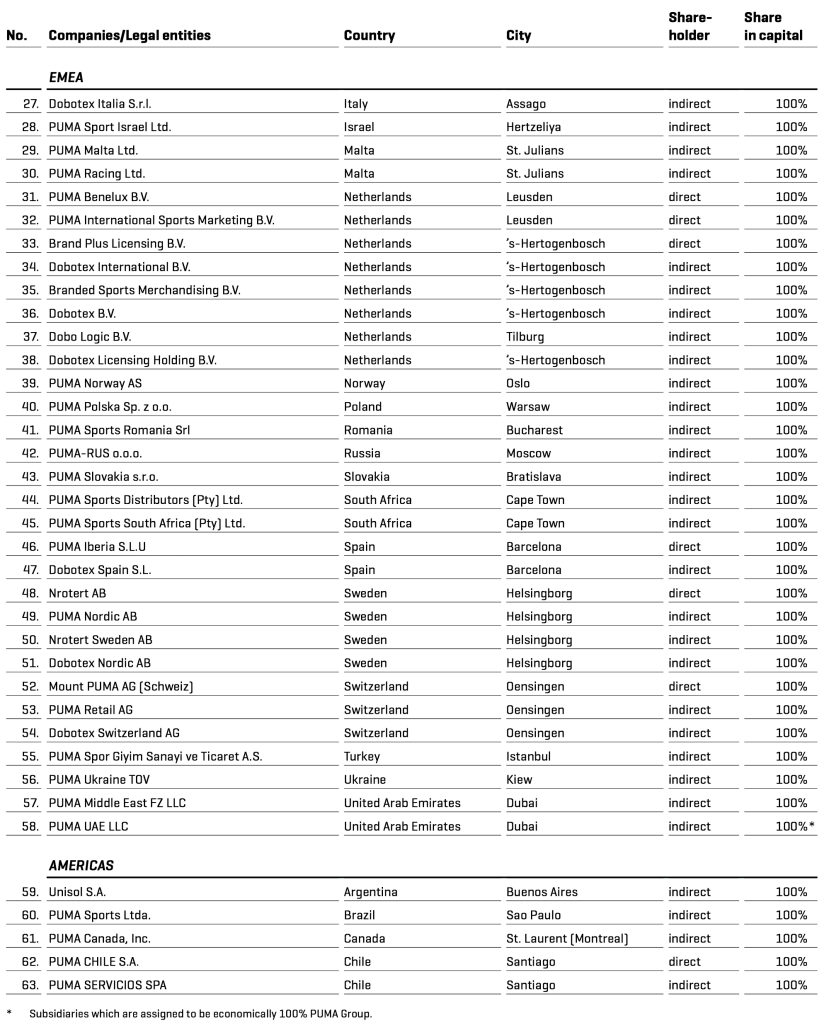

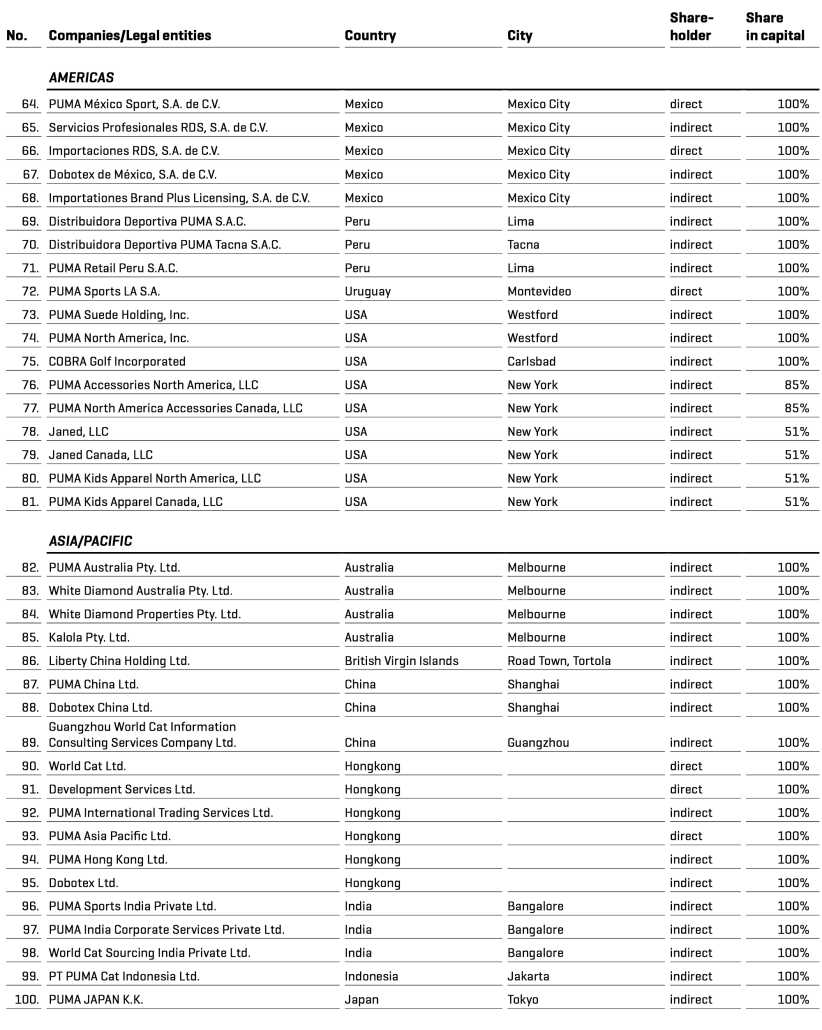

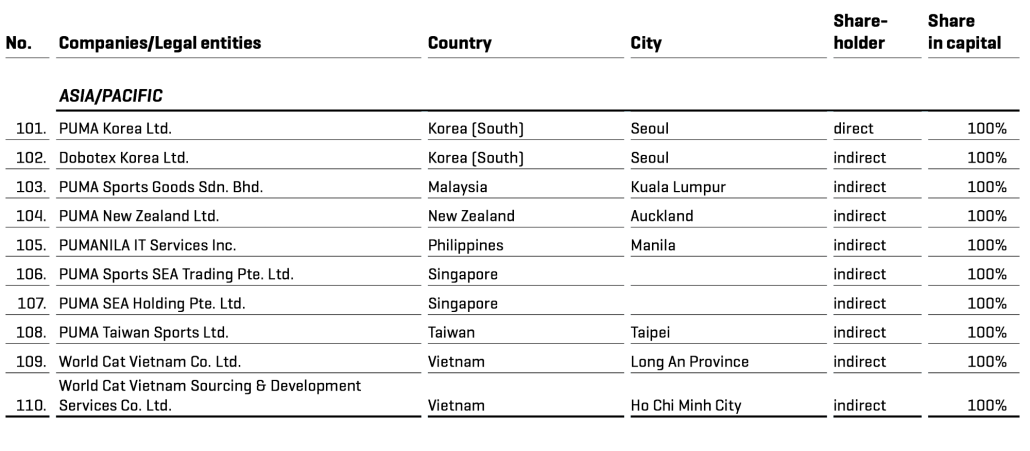

In addition to PUMA SE, the consolidated financial statements include all subsidiaries in which PUMA SE directly or indirectly holds existing rights that give it the current ability to direct the relevant activities. At present, control of all Group companies is based on a direct or indirect majority of voting rights. Associated companies are accounted for in the Group using the equity method. The changes in the number of Group companies (including the parent company PUMA SE) were as follows:

The following changes occurred within the group of consolidated companies in financial year 2017:

The additions to the group of consolidated companies relate to the establishment of the companies PUMA North America Accessories Canada, LLC and Dobotex Nordic AB.

Furthermore, the company PUMA Information Technology Services Philippines Company Limited Inc. was renamed PUMANILA IT Services Inc. during the financial year.

These changes in the group of consolidated companies did not have a significant effect on the net assets, financial position and results of operations.

CURRENCY CONVERSION

As a general rule, monetary items in foreign currencies are converted in the individual financial statements of the Group companies at the exchange rate valid on the balance sheet date. Any resulting currency gains and losses are immediately recognized in the income statement. Non-monetary items are converted at historical acquisition and manufacturing costs.

The assets and liabilities of foreign subsidiaries, the functional currency of which is not the euro, have been converted to euros at the average exchange rates valid on the balance sheet date. Expenses and income have been converted at the annual average exchange rates. Any differences resulting from the currency conversion of net assets relative to exchange rates that had changed in comparison with the previous year, were adjusted against equity.

DERIVATIVE FINANCIAL INSTRUMENTS/HEDGE ACCOUNTING

Derivative financial instruments are recognized at fair value at the time a contract is entered into and thereafter. At the time a hedging instrument is concluded, PUMA classifies the derivatives either as hedges of a planned transaction (cash flow hedge) or as hedges of the fair value of a recognized asset or liability (fair value hedge).

At the time when the transaction is concluded, the hedging relationship between the hedging instrument and the underlying transaction as well as the purpose of risk management and the underlying strategy are documented. In addition, assessments as to whether the derivatives used in the hedge accounting compensate effectively for a change in the fair value or the cash flow of the underlying transaction are documented at the beginning of and continuously after the hedge accounting.

Changes in the market value of derivatives that are intended and suitable for cash flow hedges and that prove to be effective are adjusted against equity, taking into account deferred taxes. If there is no complete effectiveness, the ineffective part is recognized in the income statement. The amounts recognized in equity are recognized in the income statement during the same period in which the hedged planned transaction affects the income statement. If, however, a hedged future transaction results in the recognition of a non-financial asset or a liability, gains or losses previously recorded in equity are included in the initial valuation of the acquisition costs of the respective asset or liability.

Changes in the fair value of derivatives that qualify for and are designated as fair value hedges are recognized directly in the consolidated income statement, together with changes in the fair value of the underlying transaction attributable to the hedged risk. The changes in the fair value of the derivatives and the change in the underlying transaction attributable to the hedged risk are reported in the consolidated income statement under the item relating to the underlying transaction.

The fair values of the derivative instruments used to hedge planned transactions and to hedge the fair value of a recognized asset or liability are shown under other current financial asserts or other current financial liabilities.

LEASING

Leases are to be classified either as finance leases or operating leases. Leases where the Company, in its capacity as the lessee, is responsible for all significant opportunities and risks that arise from the use of the lease object are treated as finance leases. All other leases are classified as operating leases. The lease payments from operating leases are recorded as an expense over the term of the contract.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash and bank balances. To the extent that bank deposits are not immediately required to finance current assets, they are invested as risk-free fixed-term deposits, presently for a term of 3 months. The total amount of cash and cash equivalents is consistent with the cash and cash equivalents stated in the cash flow statement.

INVENTORIES

Inventories are valued at acquisition or manufacturing costs or at the lower net realizable values derived from the selling price on the balance sheet date. As a general rule, the acquisition cost of the merchandise is determined using the average cost method. Value adjustments are adequately recorded, depending on age, seasonality and realizable market prices, in a manner that is standard throughout the Group.

RECEIVABLES AND OTHER ASSETS

Receivables and other assets are initially stated at fair value, taking into account transaction costs and subsequently valued at amortized costs after deduction of value adjustments. In the case of value adjustments, all identifiable risks in the form of an individual risk assessment are adequately taken into account on the basis of empirical values and, if credit insurance exists, this is also included in the amount of the value adjustment.

Adjustments are conducted in principle if, after the entry record of the financial asset, there are objective indications for an adjustment, which has an effect on the expected future cash flow from that financial instrument. Significant financial difficulties of a debtor, an increased probability that a creditor becomes insolvent or enters into a clean-up procedure, as well as a breach of contract, e. g. a cancellation or delay in interest or amortization payments, all count as indicators for an existing adjustment. The amount of the adjustment loss corresponds to the difference between the carrying amount and the cash value of the expected cash flows.

The non-current assets contain loans and other assets. Non-taxable non-current assets are discounted in principle at cash value if the resulting effect is significant.

NON-CURRENT INVESTMENTS

The investments reported under non-current financial assets are classified as available for sale. This category includes financial instruments that do not represent loans and receivables or held-to-maturity investments and are not measured at fair value through profit or loss. The categories held-to-maturity investments and financial assets at fair value through profit or loss are not applied within the PUMA Group.

All purchases and disposals of non-current investments are recorded on the trade date. Non-current investments are initially recognized at fair value plus transaction costs. They are also recognized at fair value in subsequent periods if this can be reliably determined. Unrealized gains and losses are recognized in the overall result, taking into account deferred taxes. The gain or loss on disposal of long-term investments is recognized in profit or loss.

If there is material objective evidence of impairment of the non-current investments, they are written down in the income statement. In the case of equity investments categorized as available-for-sale, a significant or prolonged decline in the fair value of the assets below their acquisition cost is to be regarded as objective evidence of impairment. The same applies if there is no longer an active market for listed shares.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at acquisition costs, net of accumulated depreciation. The depreciation period depends on the expected useful life of the respective item. The straight-line method of depreciation is applied. The useful life depends on the type of the assets involved. Buildings are subject to a useful life of between ten and fifty years and a useful life of between three to ten years is assumed for moveable assets. The acquisition costs of property, plant and equipment also include interest on borrowings in accordance with IAS 23, insofar as these accrue and the effect is significant.

Repair and maintenance costs are recorded as an expense as of the date on which they were incurred. Substantial improvements and upgrades are capitalized to the extent that the criteria for capitalization of an asset item apply.

As a general rule, lease objects, the contractual basis of which is to be classified as a finance lease are shown under property, plant and equipment; initially they are accounted for at fair value or the lower present value of the minimum lease payments and net of accumulated depreciation in subsequent accounting periods.

GOODWILL

Goodwill resulting from a business acquisition is calculated based on the difference between the purchase price and the fair value of the acquired asset and liability items. Goodwill from acquisitions is largely attributable to the intangible infrastructure acquired and the associated opportunity to make a positive contribution to corporate value.

Goodwill amounts are allocated to the Group’s cash-generating units that are expected to benefit from the synergy effects resulting from the business combination.

An impairment test of goodwill per cash-generating unit (usually the countries) is performed once a year as well as whenever there are indicators of impairment and can result in an impairment loss. There is no reversal of an impairment loss for goodwill.

OTHER INTANGIBLE ASSETS

Acquired intangible assets largely consist of concessions, intellectual property rights and similar rights. These are valued at acquisition costs, net of accumulated amortization. The useful life of intangible assets is between three and ten years. Depreciation is done on a straight-line basis.

If the capitalization requirements of IAS 38.57 Intangible Assets are met cumulatively, expenses in the development phase for internally generated intangible assets are capitalized at the time they arise. In subsequent periods, internally generated intangible assets and acquired intangible assets are measured at cost less accumulated amortization and impairment losses. In the Group, own work capitalized is generally depreciated on a straight-line basis over a useful life of three years.

The item also includes acquired trademark rights, which are assumed to have an indefinite useful life in light of the history of the brands and due to the fact that the brands are continued by PUMA.

IMPAIRMENT OF ASSETS

Intangible assets with an indefinite useful life are not written down according to schedule, but are subjected to an annual impairment test. Property, plant and equipment and other intangible assets with finite useful lives are tested for impairment if there is any indication of impairment in the value of the asset concerned. In order to determine whether there is a requirement to record the impairment of an asset, the recoverable amount of the respective asset (the higher amount of the fair value less costs to sell and value in use) is compared with the carrying amount of the asset. If the recoverable amount is lower than the carrying amount, the difference is recorded as an impairment loss. The test for impairment is performed, if possible, at the level of the respective individual asset, otherwise at the level of the cash-generating unit. Goodwill, on the other hand, is tested for impairment only at the cash-generating unit level. If it is determined within the scope of the impairment test that an asset needs to be written down, then the goodwill, if any, of the cash- generating unit is written down initially and, in a second step, the remaining amount is distributed proportionately over the remaining assets. If the reason for the recorded impairment no longer applies, a reversal of impairment loss is recorded to the maximum amount of the written down cost. There is no reversal of an impairment loss for goodwill.

Impairment tests are performed using the discounted cash flow method. For determining the fair value less costs to sell and value in use, the expected cash flows are based on corporate planning data. Expected cash flows are discounted using an interest rate in line with market conditions.

HOLDINGS IN ASSOCIATED COMPANIES

Associated companies represent shareholdings, over which PUMA has a significant influence, but which do not qualify as subsidiaries or joint ventures. Significant influence is generally assumed when PUMA holds, directly or indirectly, at least 20%, but less than 50%, of the voting rights.

Holdings in associated companies are accounted for using the equity method. Here, the shares are initially recognized at their acquisition cost and are subsequently adjusted for the pro rata changes in the Company’s net assets that are attributable to PUMA. Any recognized goodwill is shown in the carrying amount of the associated company.

Within the scope of the impairment test, the carrying amount of a company valued at equity is compared with its recoverable amount provided that there is an indication that the asset has decreased in value. If the recoverable amount is lower than the carrying amount, the difference is recorded as an impairment loss. If the reasons for the previously recorded impairment no longer apply, a write-up is recognized in the income statement.

FINANCIAL DEBT, OTHER FINANCIAL LIABILITIES AND OTHER LIABILITIES

As a general rule, these entries are recognized at their acquisition cost, taking into account transaction costs and subsequently recognized at amortized cost. Non-interest or low-interest-bearing liabilities with a term of at least one year are recognized at present value, taking into account an interest rate in line with market conditions and are compounded until their maturity at their repayment amount. Liabilities from finance lease agreements are recorded as of the beginning of the lease transaction at the amount of the present value of the minimum lease amount or at the lower fair value and are adjusted by the repayment amount of the lease installments.

As a general rule, current financial liabilities also include those long-term loans that that have a maximum residual term of up to one year.

PROVISIONS FOR PENSIONS AND SIMILAR OBLIGATIONS

In addition to defined benefit plans, some companies apply defined contribution plans, which do not result in any additional pension commitment other than the current contributions. The pension provision under defined benefit plans is generally calculated using the projected unit credit method. This method takes into account not only known pension benefits and pension rights accrued as of the reporting date, but also expected future salary and pension increases. The defined benefit obligation (DBO) is calculated by discounting expected future cash outflows at the rate of return on senior, fixed-rate corporate bonds. The currencies and maturity periods of the underlying corporate bonds are consistent with the currencies and maturity periods of the obligations to be satisfied. In some of the plans, the obligation is accompanied by a plan asset. In that case, the pension provision shown is reduced by the plan asset.

Revaluations, consisting of actuarial profits and losses, changes resulting from use of the asset ceiling and return on plan assets (without interest on the net debt) are immediately recorded under Other Comprehensive Income. The revaluations recorded in Other Comprehensive Income are part of the retained earnings and are no longer reclassified into calculation of profit and loss. Past service costs are recorded as an expense if changes are made to the plan.

OTHER PROVISIONS

Provisions are recognized if the Group, as a result of a past event, has a current obligation and this obligation is likely to result in an outflow of resources with economic benefits, the amount of which can be reliably estimated. The provisions are recognized at their settlement value as determined on the basis of the best possible assessment and are not offset by income. Provisions are discounted if the resulting effect is significant.

Provisions for the expected expenses from warranty obligations pursuant to the respective national sales contract laws are recognized at the time of sale of the relevant products, according to the best estimate in relation to the expenditure needed in order to fulfill the Group’s obligation.

Provisions are also recognized to account for onerous contracts. An onerous contract is assumed to exist where the unavoidable costs for fulfilling the contract exceed the economic benefit arising from this contract.

Provisions for restructuring measures are also recorded if a detailed, formal restructuring plan has been produced, which has created a justified expectation that the restructuring measures will be carried out by those concerned due to its implementation starting or its major components being announced.

TREASURY SHARES

Treasury stock is deducted from equity at its market price as of the date of acquisition, plus incidental acquisition costs. Pursuant to the authorization of the Annual General Meeting, treasury stock can be repurchased for any authorized purpose, including the flexible management of the Company’s capital requirements.

EQUITY COMPENSATION PLANS/MANAGEMENT INCENTIVE PROGRAM

In accordance with IFRS 2, stock-based compensation systems are recognized at fair value and recorded under personnel costs. PUMA has stock-based compensation systems in the form of stock options (SOP) involving compensation in shares and in the form of virtual shares with cash compensation.

The expenses associated with the SOP are determined from the fair value of the options as of the grant date, without taking into account the impact of non-market-oriented exercise hurdles (e. g. forfeited options if the eligible employee leaves the company prematurely). The expense is recorded by distributing it as personnel costs over the vesting period until the options are vested and is recognized as a capital reserve. Non-market-oriented exercise hurdles are adjusted in accordance with current expectations and the assessment of expected exercisable options is reviewed on each balance sheet date. The resulting gains and losses are recognized in the income statement and recorded through a corresponding adjustment in equity over the remaining period up to the vesting date.

For share-based remunerations with cash compensation, a liability is recorded for the services received and measured with its fair value upon addition. Until the debt is cleared, its fair value is recalculated on every balance sheet date and on the settlement date and all changes to the fair value are recognized in the income statement.

RECOGNITION OF SALES REVENUES

Revenues from the sale of products (sales revenues) are recognized at the time of the transfer of the significant opportunities and risks associated with the ownership of the goods and products sold to the buyer if it is likely that the Group will derive the economic benefit from the sale. The amount of the recognized sales revenues is based on the fair value of the consideration received or to be received, taking into account returns, discounts and rebates.

ROYALTY AND COMMISSION INCOME

Income from royalties is recognized in the income statement in accordance with the invoices to be submitted by the license holders. In certain cases, values must be estimated in order to permit accounting on an accrual basis. Commission income is invoiced if the underlying purchase transaction is classified as realized.

ADVERTISING AND PROMOTIONAL EXPENSES

Advertising expenses are recognized in the income statement as of the date of their accrual. As a general rule, promotional expenses stretching over several years are recognized as an expense over the contractual term on an accrual basis. Any expenditure surplus resulting from this allocation of expenses after the balance sheet date are recognized in the form of an impairment of assets or a provision for anticipated losses in the financial statements.

PRODUCT DEVELOPMENT

PUMA continuously develops new products in order to meet market requirements and market changes. Research costs are expensed in full at the time they are incurred. Development costs are also recognized as an expense when they do not meet the recognition criteria of IAS 38 Intangible Assets.

FINANCIAL RESULT

The financial results include the results from associated companies as well as interest income from financial investments and interest expense from loans and financial instruments. Financial results also include interest expenses from discounted non-current liabilities and from pension provisions that are associated with acquisitions of business enterprises or arise from the valuation of pension commitments.

Exchange rate effects that can be directly allocated to an underlying transaction are shown in the respective income statement item.

INCOME TAXES

Current income taxes are determined in accordance with the tax regulations of the respective countries where the Company conducts its operations.

DEFERRED TAXES

Deferred taxes resulting from temporary valuation differences between the IFRS and tax balance sheets of individual Group companies and from consolidation procedures are charged to each taxable entity and shown either as deferred tax assets or deferred tax liabilities. Deferred tax assets may also include claims for tax reductions that result from the expected utilization of existing losses carried forward to subsequent years and which is sufficiently certain to materialize. Deferred tax assets or liabilities may also result from accounting treatments that do not affect net income. Deferred taxes are calculated on the basis of the tax rates that apply to the reversal in the individual countries and that are in force or adopted as of the balance sheet date.

Deferred tax assets are shown only to the extent that the respective tax advantage is likely to materialize. Value adjustments are recognized on the basis of the past earnings situation and the business expectations for the foreseeable future, if this criterion is not fulfilled.

ASSUMPTIONS AND ESTIMATES

The preparation of the consolidated financial statements requires some assumptions and estimates that have an impact on the amount and disclosure of the recognized assets and liabilities, income and expenses, as well as contingent liabilities. The assumptions and estimates are based on premises, which in turn are based on currently available information. In individual cases, the actual values may deviate from the assumptions and estimates made; as a result there is a risk of adjustments to the carrying amount of the assets and liabilities concerned in future periods. Consequently, future periods involve a risk of adjustment to the carrying amount of the assets and liabilities concerned.

All assumptions and estimates are continuously reassessed. They are based on historical experiences and other factors, including expectations regarding future global and industry-related trends that appear reasonable under the current circumstances. Assumptions and estimates are made in particular in the measurement of goodwill and brands, pension obligations, derivative financial instruments and taxes. The most significant forward-looking assumptions and sources of estimation and uncertainty as of the reporting date concerning the above-mentioned items are discussed below.

GOODWILL AND BRANDS

A review of the impairment of goodwill is based on the calculation of the value in use. In order to calculate the value in use, the Group must estimate the future cash flows from those cash-generating units to which the goodwill is allocated. To this end, the data used were from the three-year plan, which is based on forecasts of the overall economic development and the resulting industry-specific consumer behavior. Another key assumption concerns the determination of an appropriate interest rate for discounting the cash flow to present value (discounted cash flow method). The relief from royalty method is used to value brands. See section 10 for further information, in particular regarding the assumptions used for the calculation.

PENSION OBLIGATIONS

Pension obligations are determined using an actuarial calculation. This calculation is contingent on a large number of factors that are based on assumptions and estimates regarding the discount rate, the expected return on plan assets, future wage and salary increases, mortality and future pension increases. Due to the long-term nature of the commitments made, the assumptions are subject to significant uncertainties. Any change in these assumptions has an impact on the carrying amount of the pension obligations. The Group determines at the end of each year the discount rate applied to determine the present value of future payments. This discount rate is based on the interest rates of corporate bonds with the highest credit rating that are denominated in the currency in which the benefits are paid and the maturity of which corresponds to that of the pension obligations. See section 15 for further information, in particular regarding the parameters used for the calculation.

TAXES

Tax items are determined taking into account the various prevailing local tax laws and the relevant administrative opinions and, due to their complexity, may be subject to different interpretations by persons subject to tax on the one hand and the tax authorities on the other hand. Differing interpretations of tax laws may result in subsequent tax payments for past years; depending on the management’s assessment, these differing opinions may be taken into account.

The recognition of deferred taxes, in particular with respect to tax losses carried forward, requires that estimates and assumptions be made concerning future tax planning strategies as well as expected dates of initial recognition and the amount of future taxable income. The taxable income from the relevant corporate planning is derived for this judgment. This takes into account the past financial position and the business development expected in the future. Active deferred tax assets on losses carried forward are recorded in the event of companies incurring a loss only if it is highly likely that future positive income will be achieved that can be offset against these tax losses carried forward. Please see section 8 for further information and detailed assumptions.

DERIVATIVE FINANCIAL INSTRUMENTS

The assumptions used for estimating derivative financial instruments are based on the prevailing market conditions as of the balance sheet date and thus reflect the fair value. See section 24 for further information.

3. CASH AND CASH EQUIVALENTS

As of December 31, 2017, the Group has € 415.0 million (previous year: € 326.7 million) in cash and cash equivalents. The average effective interest rate of financial investments was 0.5% (previous year: 0.7%). There are no restrictions on disposition.

4. INVENTORIES

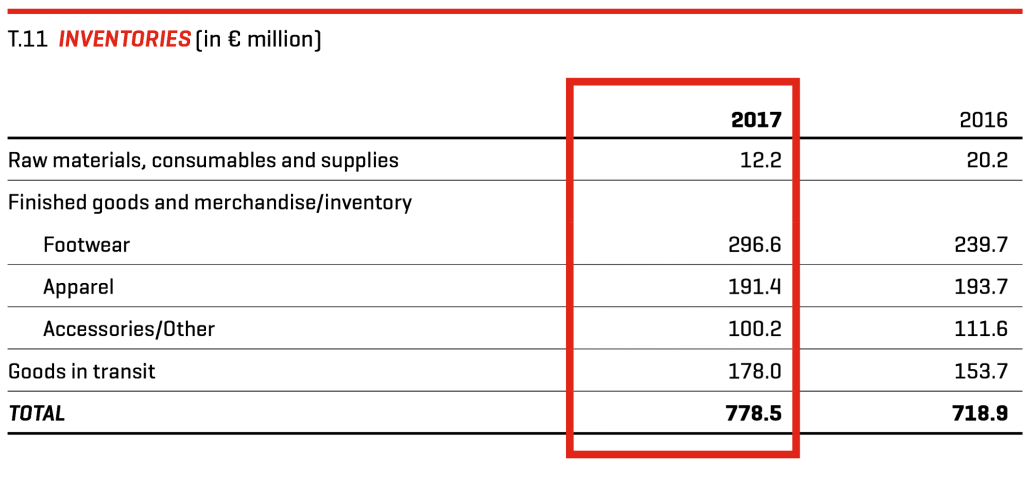

Inventories are allocated to the following main groups:

The table shows the carrying amounts of the inventories net of value adjustments. Of the value adjustments of € 51.5 million (previous year: € 44.0 million), approx. 69.6% (previous year approx. 69.0%) were recognized as expense under costs of sales in the 2017 financial year.

The amount of inventories recorded as an expense during the period mainly includes the cost of sales shown in the consolidated income statement.

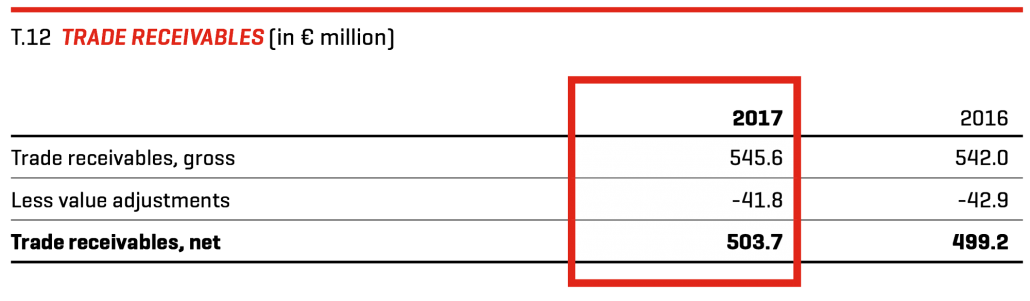

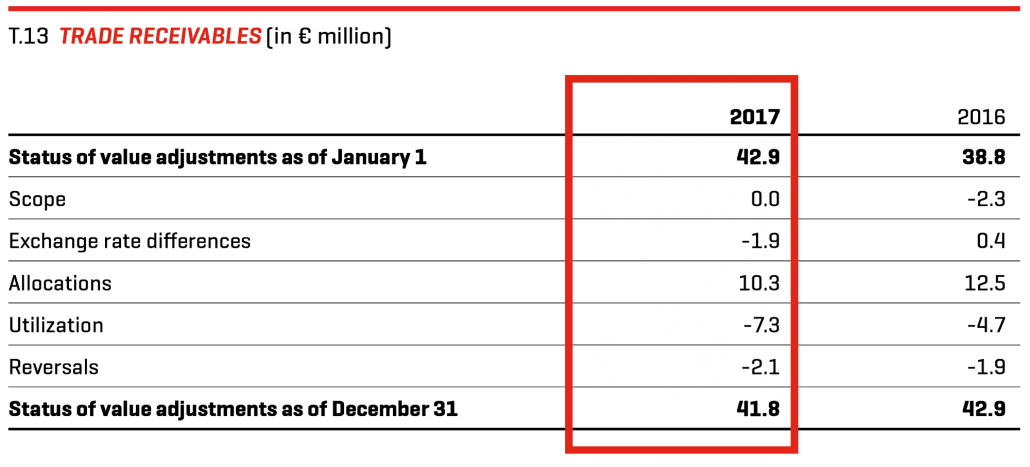

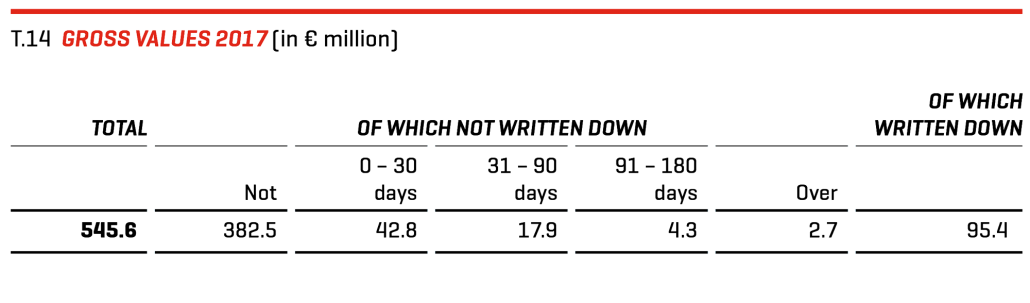

With respect to trade receivables that were not written down, PUMA assumes that the debtors will satisfy their payment obligations.

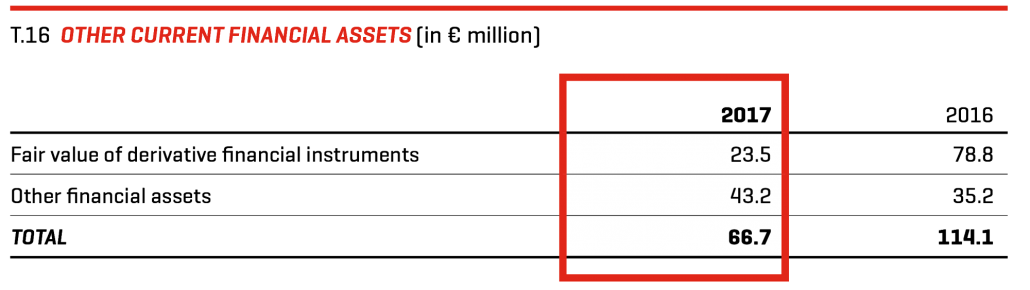

6. OTHER CURRENT FINANCIAL ASSETS

This item consists of:

The amount shown is due within one year. The fair value corresponds to the carrying amount.

The decrease of derivative financial instruments is mainly due to the decline of the US dollar exchange rate.

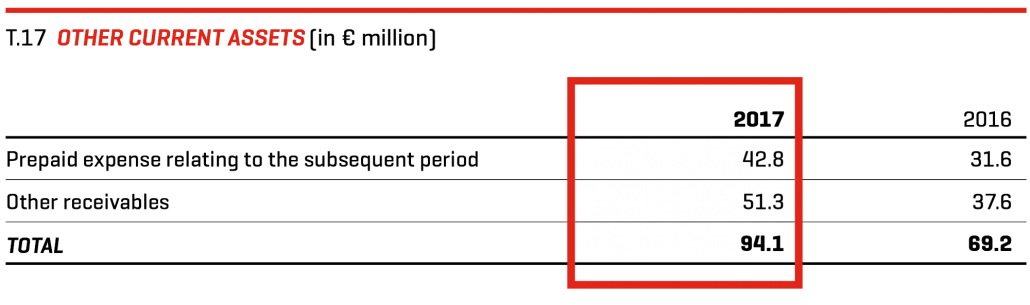

7. OTHER CURRENT ASSETS

This item consists of:

The amount shown is due within one year. The fair value corresponds to the carrying amount.

Other receivables mainly include VAT receivables amounting to € 35.9 million (previous year: € 17.8 million).

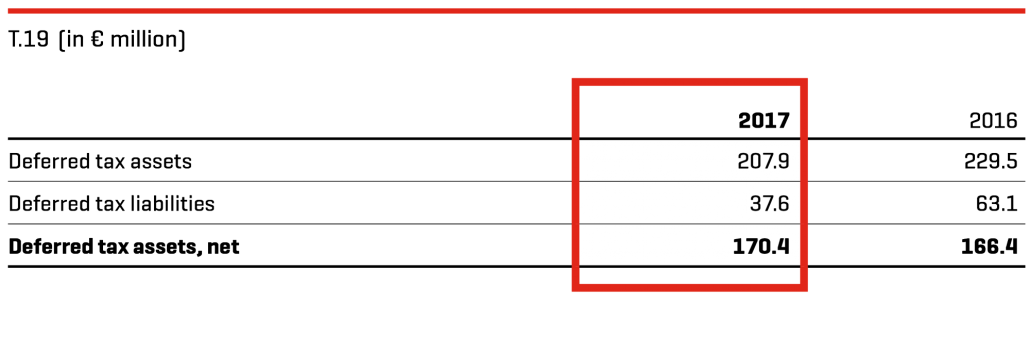

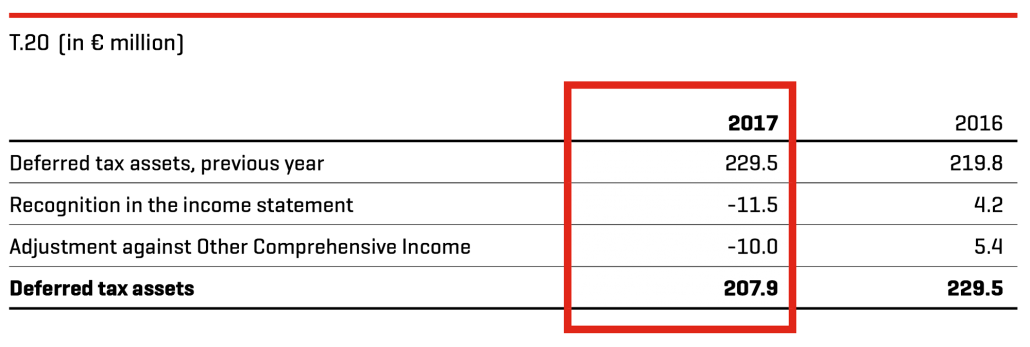

8. DEFERRED TAXES

Deferred taxes relate to the items shown below:

€ 97.9 million of the deferred tax assets are current (previous year: € 85.3 million) and € 10.7 million of the deferred tax liabilities are current (previous year: € 11.3 million).

As at December 31, 2017, tax losses carried forward amounted to a total of € 542.9 million (previous year: € 596.9 million). This results in a deferred tax asset of € 148.2 million (previous year: € 171.8 million). Deferred tax liabilities were recognized for these items in the amount at which the associated tax advantages are likely to be realized in the form of future profits for income tax purposes. As a result deferred tax assets of € 56.0 million for tax loss carryforwards (previous year: € 61.5 million) were not recognized; of this amount € 54.4 million (previous year: € 59.3 million) are vested, but € 13.4 million (previous year: € 13.4 million) can never be used due to a lack of future expectations. The remaining unrecognized deferred tax assets of € 1.6 million will expire within the next seven years.

In addition, no deferred taxes were recognized for deductible temporary differences amounting to € 13.9 million (previous year: € 5.0 million).

The effects of the US tax reform finally resolved at the end of 2017 on tax loss carryforwards and temporary differences were taken into account when measuring deferred tax assets and liabilities as of December 31, 2017. Due to the tax rate reduction, an adjustment of € 0.9 million was recorded in the income statement.

Deferred tax liabilities for withholding taxes from possible dividends on retained earnings of subsidiaries that serve to cover the financing needs of the respective company were not accumulated, since it is most likely that such temporary differences will not be cleared in the near future.

Deferred tax assets and liabilities are netted if they relate to a taxable entity and can in fact be netted. Accordingly, they are shown in the balance sheet as follows:

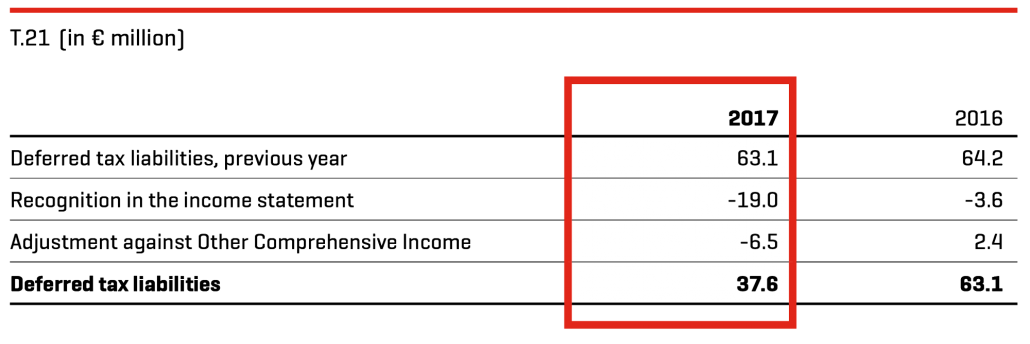

The changes in deferred tax assets were as follows:

The changes in deferred tax liabilities were as follows:

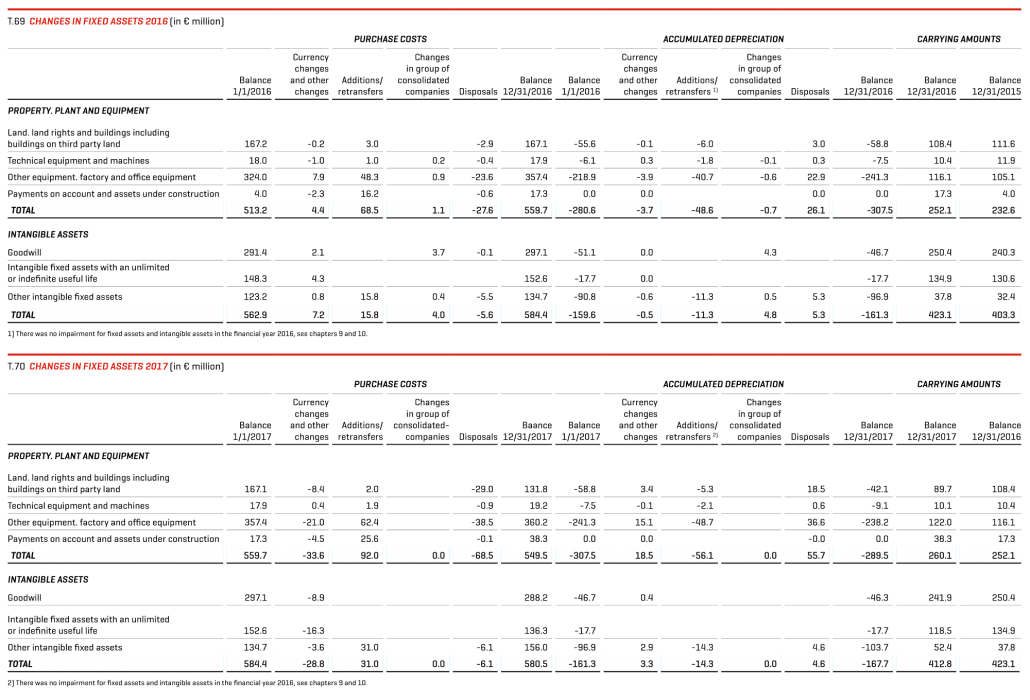

9. PROPERTY, PLANT AND EQUIPMENT

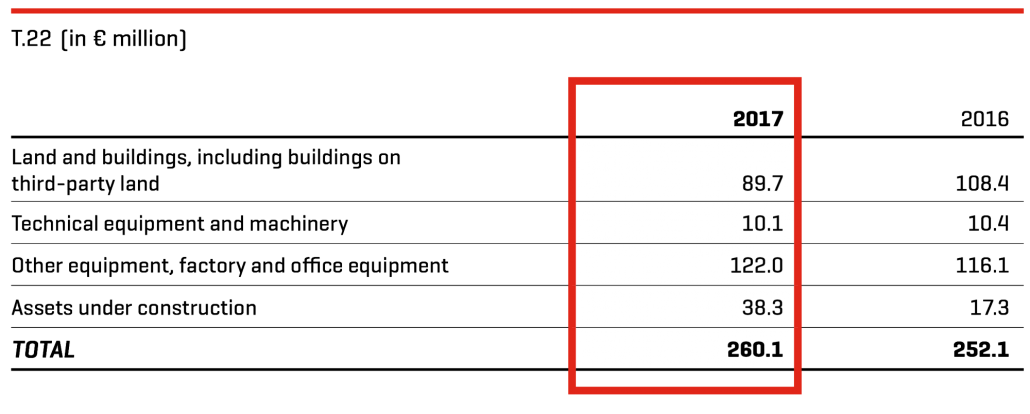

Property, plant and equipment at their carrying amounts consist of:

The carrying amount of property, plant and equipment is derived from the acquisition costs. Accumulated depreciation of property, plant and equipment amounted to €289.5 million (previous year:

€ 307.5 million).

Other equipment, operating and office equipment includes leased assets (finance leases) amounting to € 0.2 million (previous year: € 0.3 million) and in technical equipment and machinery, € 0.4 million (previous year: € 0.5 million) relates to finance leases.

The changes in property, plant and equipment in the 2017 financial year are shown in Changes in Fixed Assets in Appendix 1 to the notes of the consolidated financial statemens. As in the previous year, there were no impairment expenses that exceed current depreciation during the reporting year.

10. INTANGIBLE ASSETS

This item mainly includes goodwill, intangible assets with indefinite useful lives and assets associated with the Company’s own retail activities.

Goodwill and intangible assets with indefinite useful lives are not amortized according to schedule. Impairment tests were performed in the past financial year using the discounted cash flow method. These was based on data from the respective three-year plan. The recoverable amount was determined on the basis of the value in use. This did not result in an impairment loss.

The cash-generating unit CPG – COBRA PUMA Golf includes intangible assets in association with the COBRA brand, with an indefinite useful life of € 118.6 million (previous year: € 134.9 million). The carrying amount of the COBRA brand is significant in comparison to the overall carrying amount of the intangible assets with an indefinite useful life. This is allocated to the Central Unit segment. The recoverable amount of the COBRA brand (level 3) was determined using the relief from royalty method. A discount rate of 7.3% p. a. was applied (previous year: 6.8% p. a.) and, unchanged from the previous year, a license rate of 8% and a 3% growth rate were used.

In 2017, development costs in connection with COBRA brand golf clubs amounting to € 1.8 million (previous year: € 1.9 million) were capitalized. Development costs are allocated to the item Other Intangible Assets in Changes in Fixed Assets. Current amortization of development costs amounted to € 0.6 million in 2017 (previous year: € 0.0 million).

The changes in intangible assets in the 2017 financial year are shown in Changes in Fixed Assets of Appendix 1 to the notes of the consolidated financial statemens. Other intangible assets include advance payments in the amount of € 8.7 million (previous year: € 2.0 million).

Current amortization of intangible assets amounting to € 14.3 million (previous year: € 11.3 million) are included in other operating expenses. Distribution expenses accounted for € 2.1 million of this amount (previous year: € 2.2 million), € 0.1 million was attributable to product management/merchandising expenses (previous year: € 0.0 million), € 0.6 million to development (previous year: € 0.0 million) and € 11.5 million to administrative and general expenses (previous year: € 9.1 million). As in the previous year, there were no impairment expenses that exceed current depreciation.

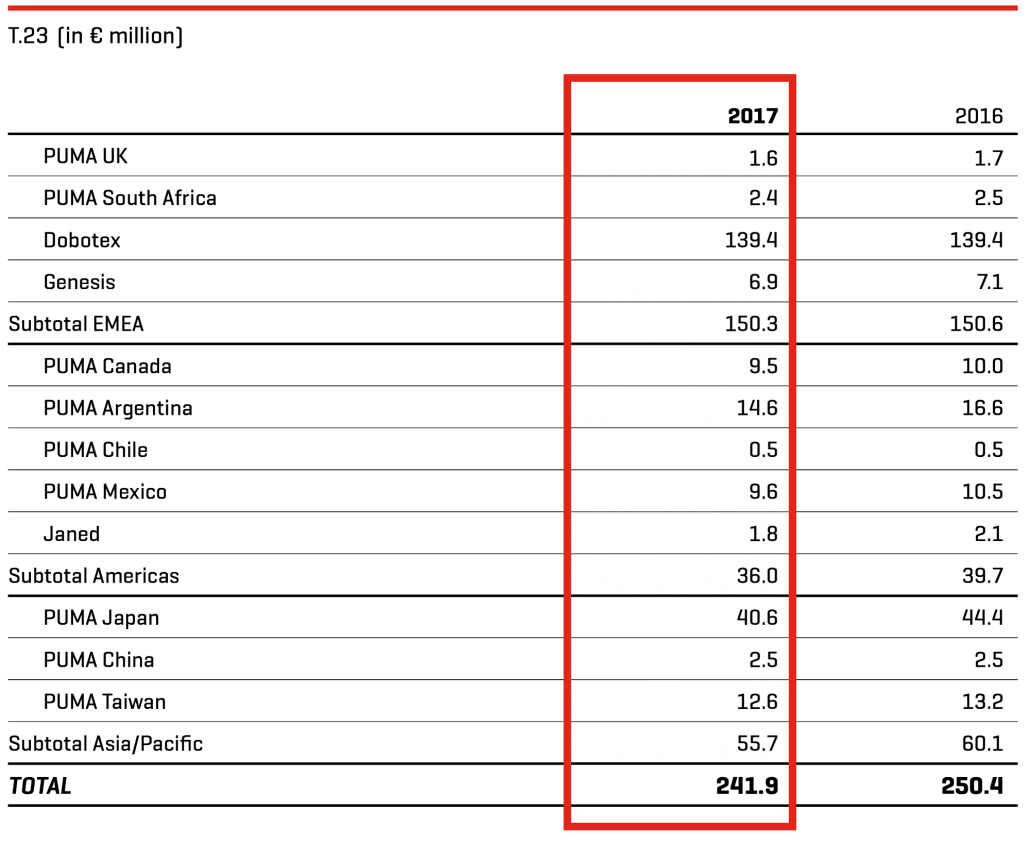

Goodwill is allocated to the Group’s identifiable cash-generating units (CGUs) according to the country where the activity is carried out. Summarized by regions, goodwill is allocated as follows:

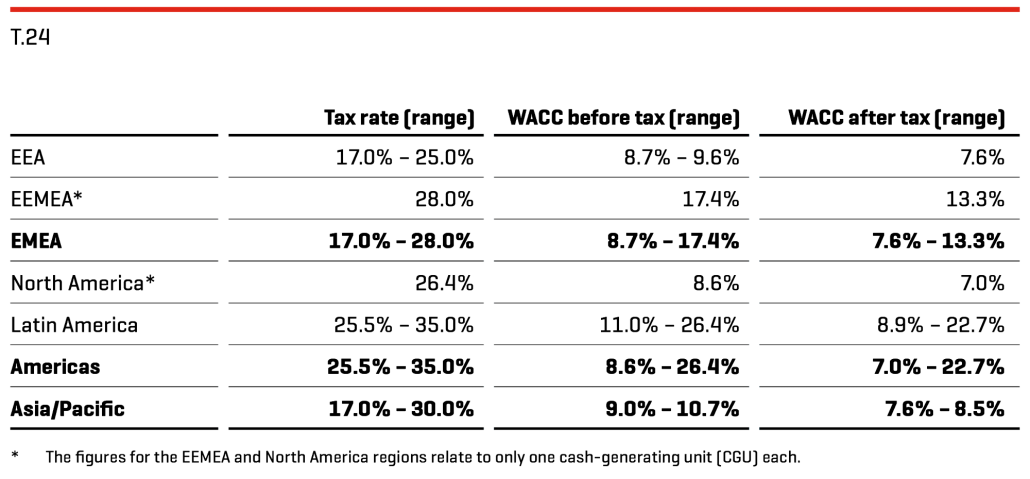

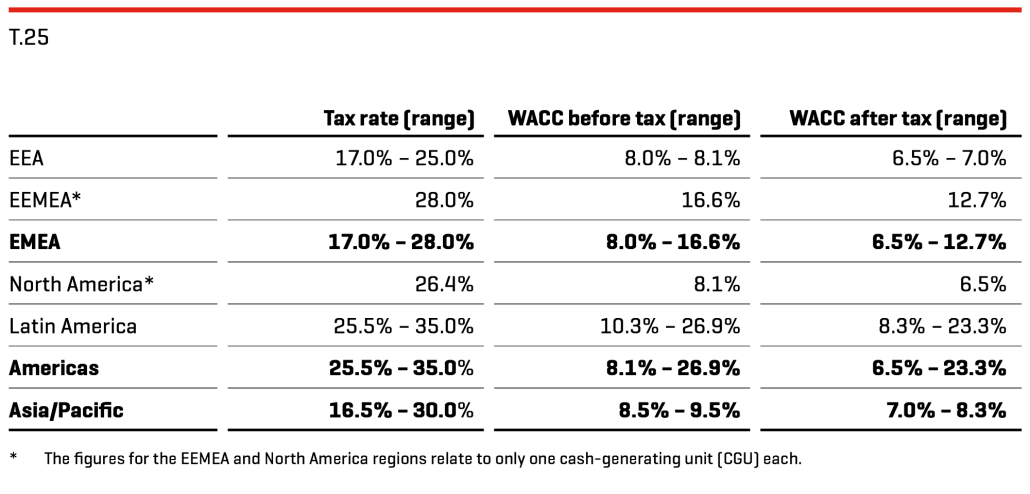

Assumptions used in conducting the impairment test in 2017:

The tax rates used for the impairment test correspond to the actual tax rates in the respective countries. The cost of capital (WACC) was derived from observable market data.

In addition, a growth rate of 3% is generally assumed. A growth rate of less than 3% was only used in justified exceptional cases.

The cash-generating unit Dobotex includes goodwill of € 139.4 million (previous year: € 139.4 million), which is significant in comparison to the total carrying amount of goodwill. The cash-generating unit corresponds to a business area of PUMA which is allocated to the Central Unit. The recoverable amount was determined by calculating the value in use using a discount rate of 7.6% p. a. (previous year: 6.5% p. a.) and a growth rate of 2% (previous year: 2%).

Sensitivity analyses with regard to the impairment tests carried out at the balance sheet date show that an increase in discount rates of one percentage point each and a reduction in growth rates of one percentage point each result in an indication of impairment with regard to intangible assets with an unlimited or indefinite useful life of € 11.8 million. The corresponding sensitivity analyses with regard to goodwill do not provide any indication of impairment.

The sensitivity analysis with a one percentage point increase in the discount rate and the sensitivity analysis with a one percentage point reduction of the growth rate do not show any indication of impairment.

The following table contains the assumptions for the performance of the impairment test in the previous year:

A growth rate of 3% was generally assumed and a growth rate of under 3% has only been used in exceptional cases where this is justified.

The 19.6% interest in Wilderness Holdings Ltd. is shown under holdings in associated companies. It is accounted for using the equity method, as there is a significant influence. The carrying amount of the shares amounts to € 16.6 million (previous year: € 16.5 million).

The following overview shows the aggregated benchmark data of the associated companies recognized at equity. The values represent the values based on the entire company and do not relate to the shares attributable to the PUMA Group.

PUMA’s share of the net earnings of Wilderness Holdings Ltd. amounts to € 1.6 million (previous year: € 1.2 million). Dividends received amount to € 0.8 million (previous year: € 0.7 million).

The balance sheet date of Wilderness Holdings Ltd. is February 28, 2017. The above information relates to the Company’s financial information as at December 31.

The non-current investments relate to the 5.0% shareholding in Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien (BVB) with registered office in Dortmund, Germany.

Other financial assets mainly include rental deposits in the amount of € 19.2 million (previous year: € 19.9 million). The other non-current non-financial assets mainly include deferrals in connection with promotional and advertising agreements.

In the 2017 financial year, there were no indicators of impairment of other non-current assets.

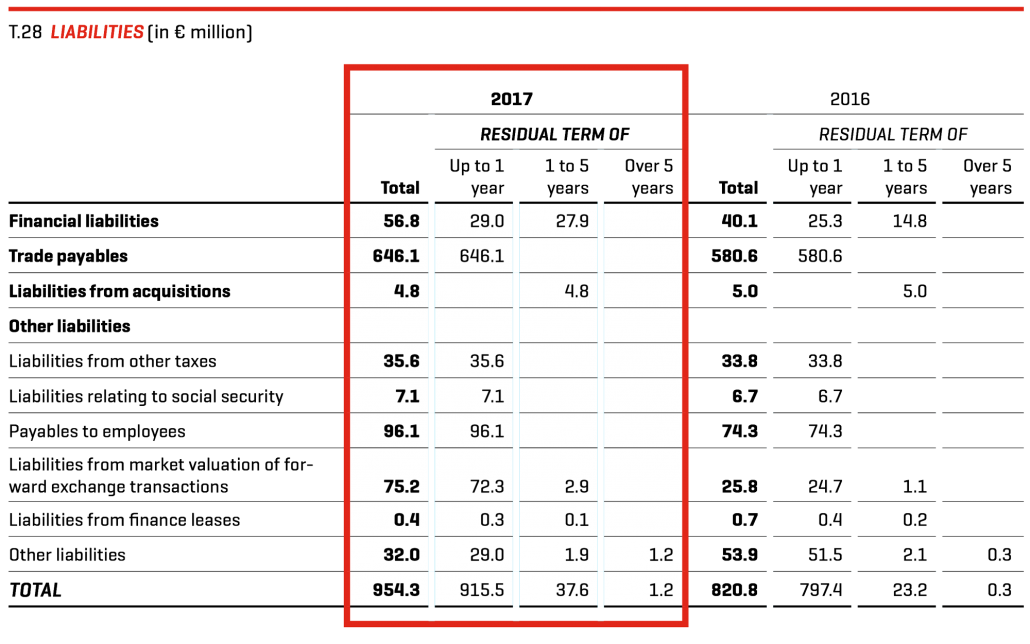

13. LIABILITIES

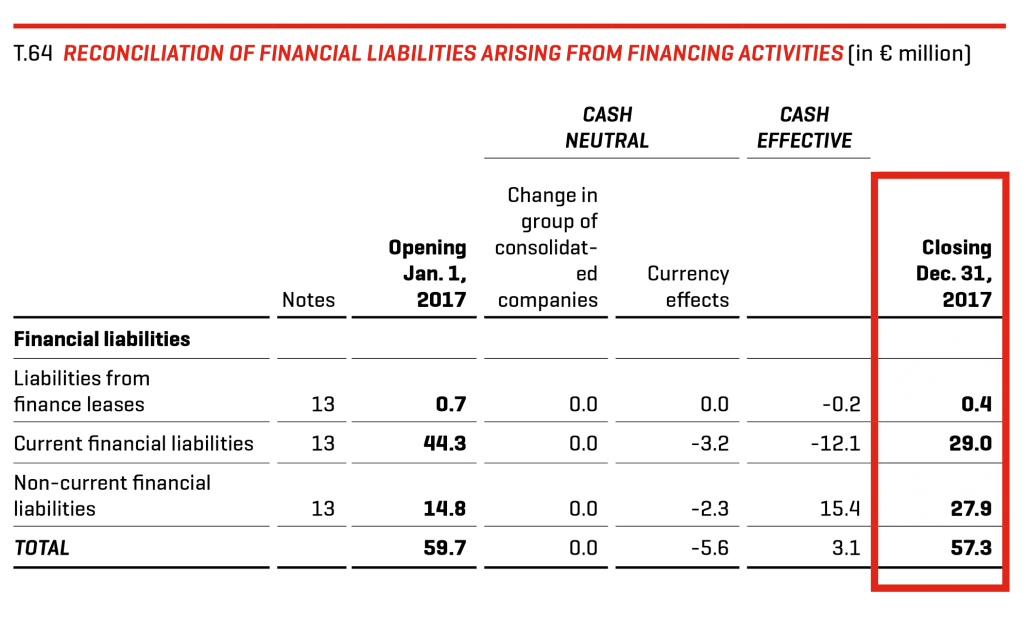

The residual terms of liabilities are as follows:

PUMA has confirmed credit facilities amounting to a total of € 497.1 million (previous year: € 487.6 million). There were no changes in the financial liabilities (previous year: € 4.6 million) from lines of credit granted only until further notice. Unutilized credit lines totaled € 440.2 million as of December 31, 2017, compared to € 433.1 million the previous year.

The effective interest rate of the financial liabilities ranged between 1.0% and 14.7% (previous year: 1.0% to 12.25%).

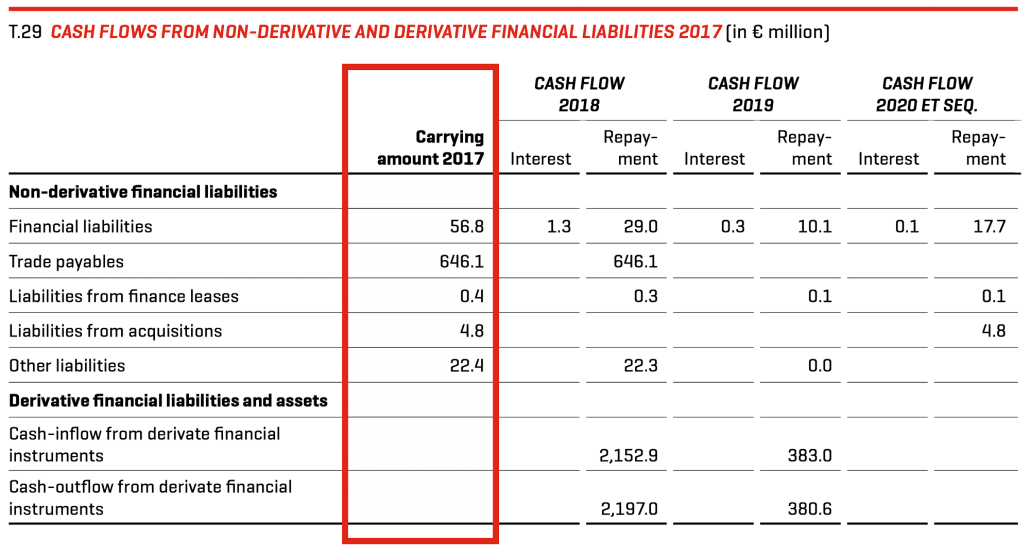

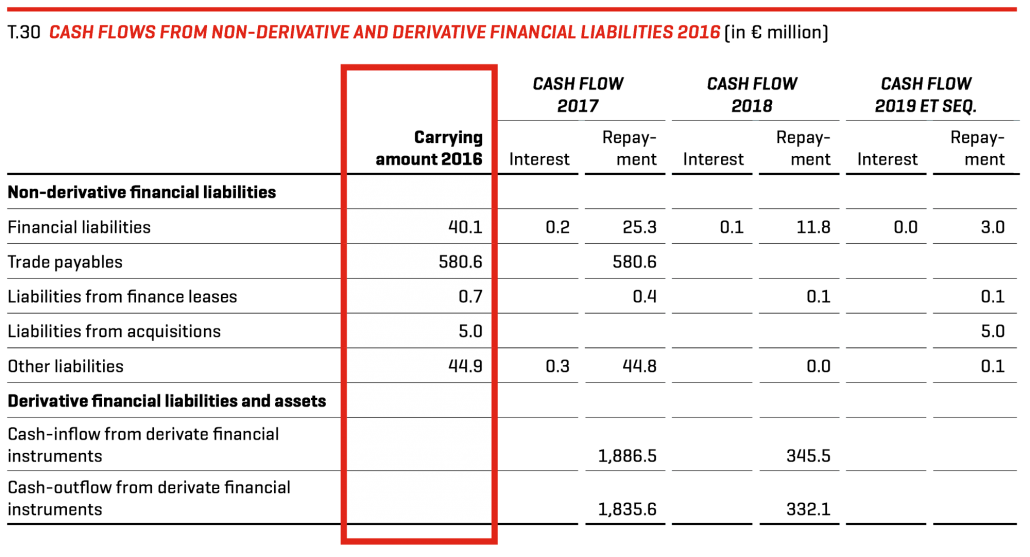

The table below shows the cash flows of the original financial liabilities and of the derivative financial instruments with a positive and negative fair value:

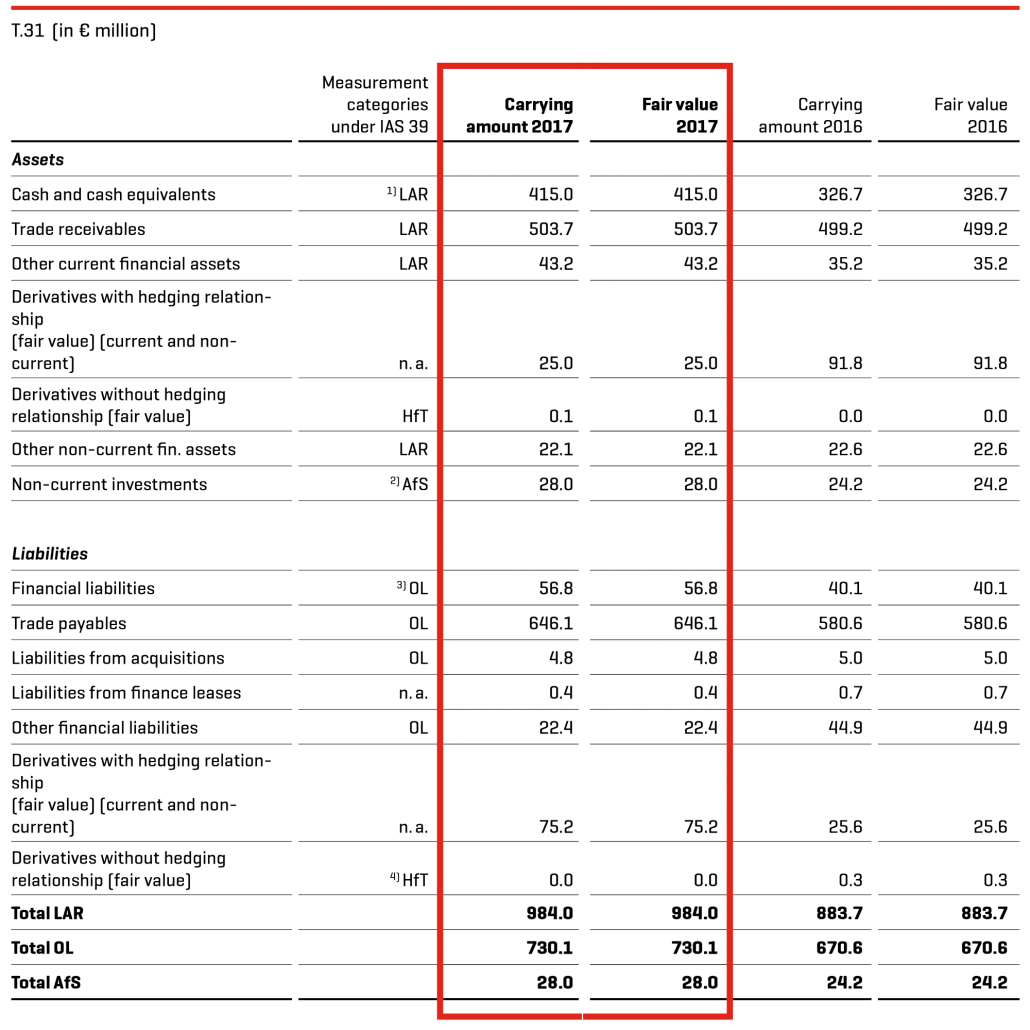

14. ADDITIONAL DISCLOSURES ON FINANCIAL INSTRUMENTS

Financial instruments that are measured at fair value in the balance sheet were determined using the following hierarchy:

Level 1: Use of prices quoted on active markets for identical assets or liabilities.

Level 2: Use of input factors that do not involve the quoted prices stated under Level 1, but can be observed for the asset or liability either directly (i. e., as price) or indirectly (i. e., derivation of prices).

Level 3: Use of factors for the valuation of the asset or liability that are based on non-observable market data.

The fair value of financial assets classified as available-for-sale was determined in accordance with Level 1. The market values of derivative assets or liabilities were determined on the basis of Level 2.

Cash and cash equivalents, trade receivables and other assets have a short residual maturity. Accordingly, as of the reporting date, the carrying amount approximates fair value. Receivables are stated at nominal value, taking into account deductions for default risk.

Accordingly, as of the reporting date, the carrying amount of loans receivable approximates fair value.

The fair values of other financial assets correspond to their carrying amount, taking into account prevailing market interest rates. Other financial assets include € 22.6 million (previous year: € 22.6 million) that were pledged as rental deposits at usual market rates.

The current liabilities to banks can be repaid at any time. Accordingly, as of the reporting date, the carrying amount approximates fair value. The non-current bank liabilities consist of fixed-interest loans. The reported carrying amounts correspond to the repayment amounts. Non-current bank loans are reported under other non-current financial liabilities.

Trade payables have a short residual maturity. The recognized values approximate fair value.

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions of business enterprises lead to payments. The resulting nominal amounts were discounted at a reasonable market interest rate, depending on the expected date of payment. As of the end of the financial year, the market interest rate only affects one company and is 0.6% (previous year: 0.4%).

The fair values of other financial liabilities are determined based on the present values, taking into account the prevailing interest rate parameters.

The fair values of derivatives with a hedging relationship at the balance sheet date are determined on the basis of current market parameters, i. e., reference prices observable on the market, taking into account forward premiums and discounts. The discounted result of the comparison of the forward price on the reporting date with the forward price on the valuation date is included in the measurement. The fair values are also checked for the counterparty’s non-performance risk. In doing this, PUMA calculates credit value adjustments (CVA) or debt value adjustments (DVA) on the basis of an up/down method, taking current market information into account. No material deviations were found, so that no adjustments were made to the fair value determined.

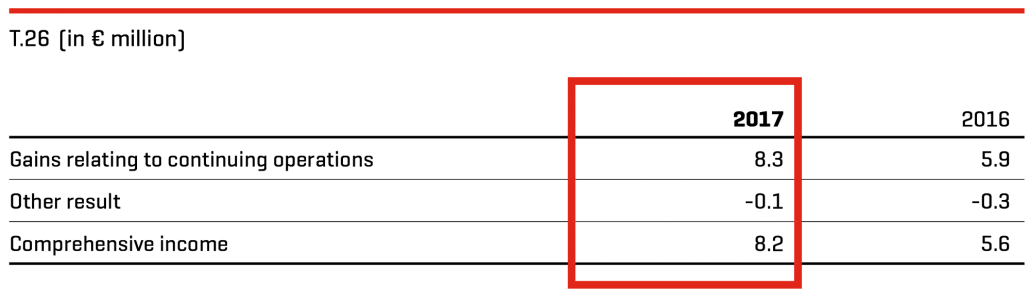

Net income by measurement categories:

The net income was determined by taking into account interest rates, currency exchange effects, impairment losses as well as gains and losses from sales.

General administrative expenses include write-downs of receivables.

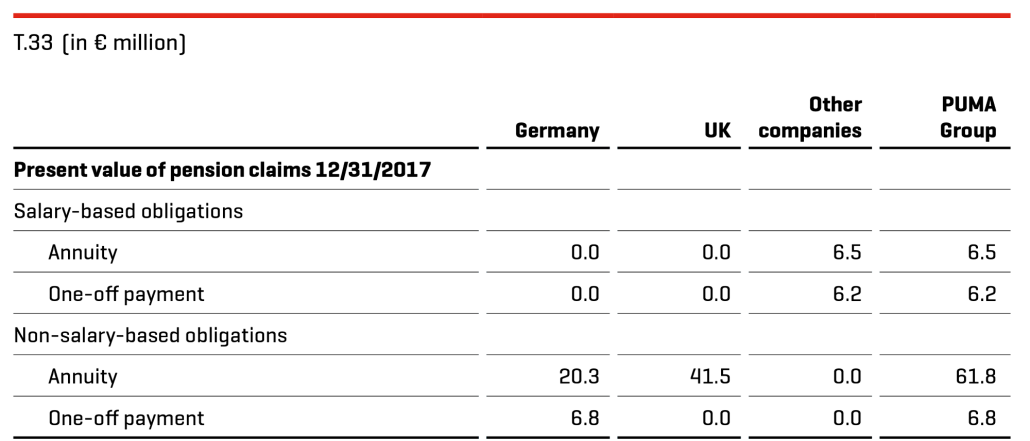

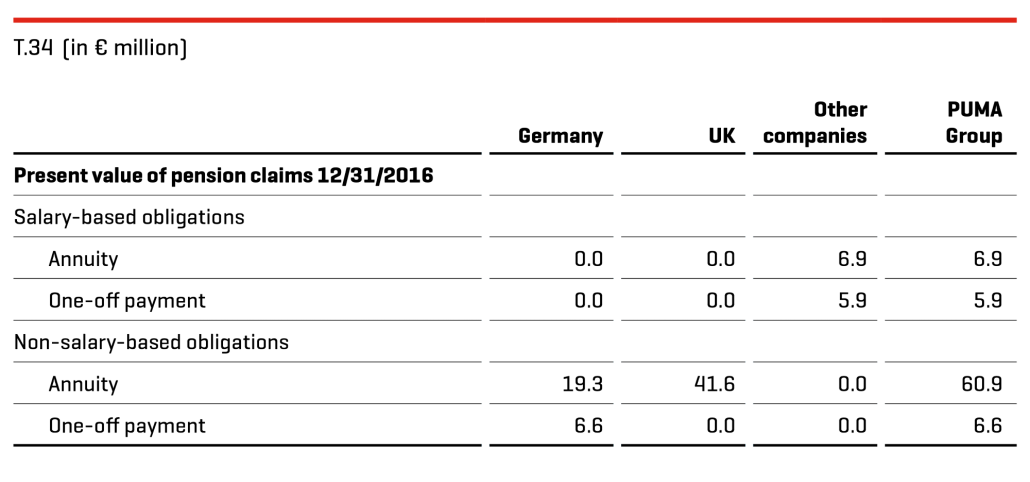

15. PENSION PROVISIONS

Pension provisions result from employees’ claims for benefits, which are based on the statutory or contractual regulations applicable in the respective country, in the event of invalidity, death or when a certain retirement age has been reached. Pension commitments in the PUMA Group include both benefit- and contribution-based pension commitments and include both obligations from current pensions and rights to pensions payable in the future. The pension entitlements are financed by both provisions and funds.

The risks associated with the pension commitments mainly concern the usual risks of benefit-based pension plans in relation to possible changes in the discount rate and, to a minor degree, inflation trends and recipient longevity. In order to limit the risks of changed capital market conditions and demographic developments, plans with the maximum obligations were agreed or insured a few years ago in Germany and the UK for new hires. The specific risk of obligations based on salary is low within the PUMA Group. The introduction of an annual cap in 2016 for pensionable salary in the UK plan now covers this risk for the highest obligations. The UK plan is therefore classified as a non-salary obligation.

The following values were determined in the previous year:

The main pension arrangements are described below:

The general pension scheme of PUMA SE generally provides for pension payments to a maximum amount of € 127.82 per month and per eligible employee. It was closed for new members beginning in 1996. In addition, PUMA SE provides individual commitments (fixed sums in different amounts) as well as contribution-based individual commitments (in part from salary conversion). The contribution-based commitments are insured plans. There are no statutory minimum funding requirements. At the end of 2017, the obligation attributable to pension entitlements in Germany (PUMA SE) amounted to € 27.1 million (previous year: € 25.9 million), representing 33.3% of the total commitment. The fair value of the plan assets relative to domestic obligations amounts to € 16.4 million. The corresponding pension provision amounts to € 10.7 million.

The defined benefit plan in the United Kingdom has not been available to new hires since 2006. This defined benefit plan includes salary and length of service-based commitments to provide old age, invalidity and surviving dependents’ retirement benefits. In 2016, a growth cap of 1% p. a. was introduced on the pensionable salary. Partial capitalization of the old-age pension is permitted. There are statutory minimum funding requirements. The obligations regarding pension claims under the defined benefit plan in the UK amount to € 41.5 million at the end of 2017 (previous year: € 41.6 million) and represents 51.1% of the total obligation. The obligation is covered by assets amounting to € 32.0 million. The provision amounts to € 9.5 million.

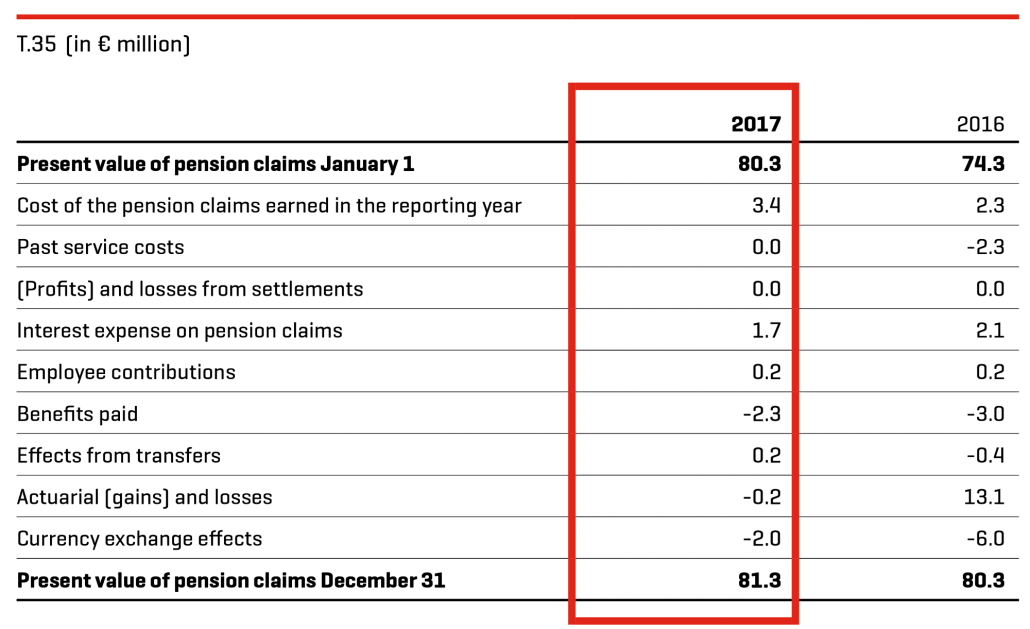

The changes in the present value of pension claims are as follows:

The changes in the plan assets are as follows:

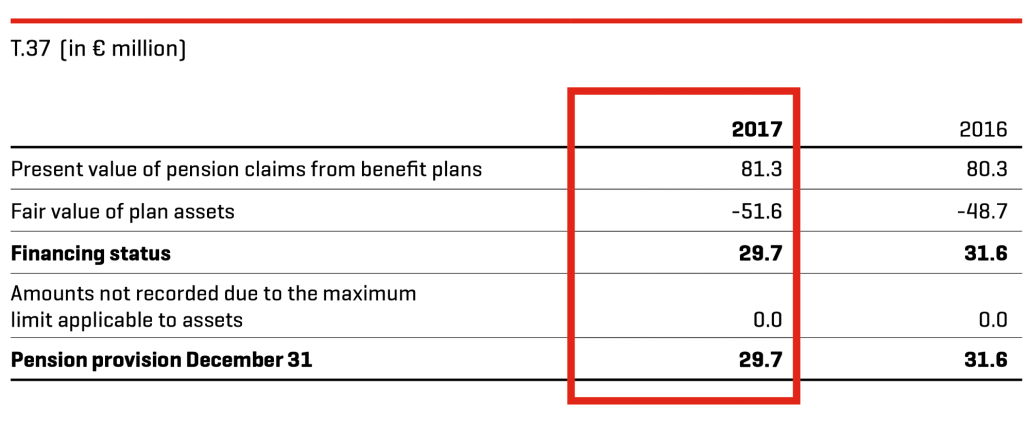

The pension provision for the Group is derived as follows:

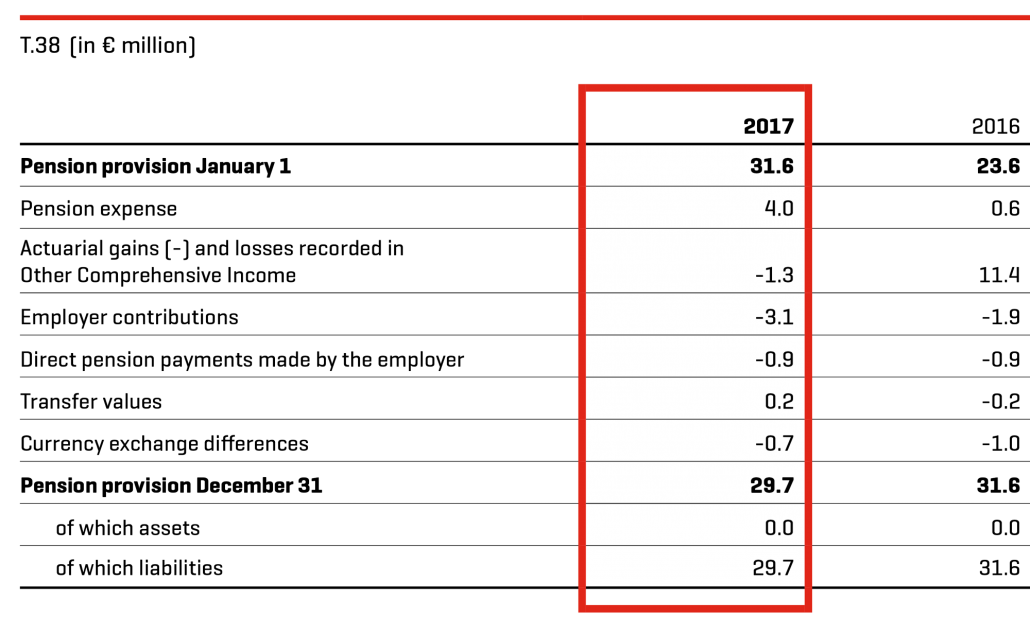

In 2017, benefits paid amounted to € 2.3 million (previous year: € 3.0 million). Contributions in 2018 are expected to amount to € 2.2 million. Of this, € 0.9 million is expected to be paid directly by the employer. Contributions to external plan assets amounted to € 3.1 million in 2013 (previous year: € 1.9 million). Contributions in 2018 are expected to amount to € 1.7 million.

The changes in pension provisions are as follows:

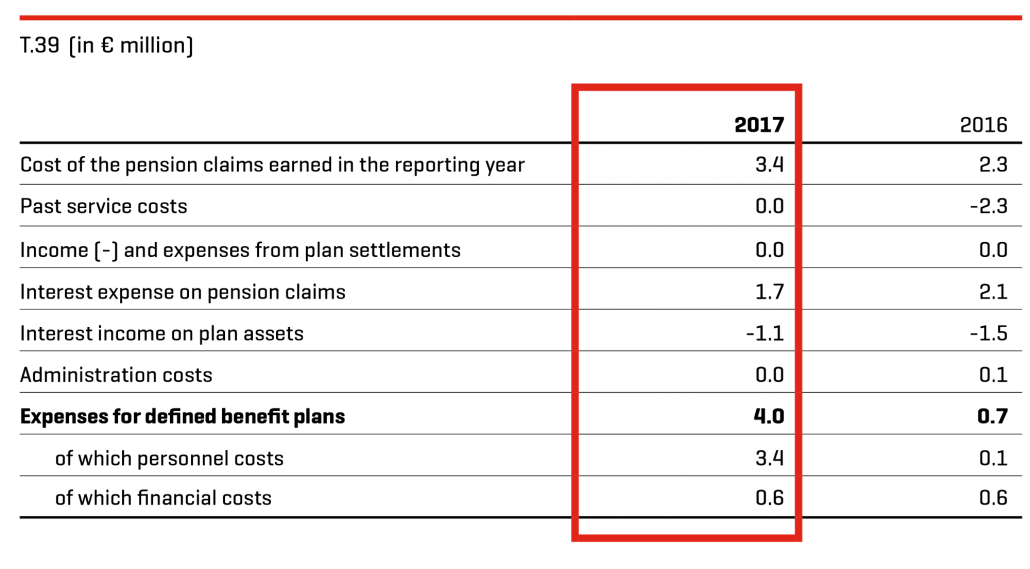

The expenses in the 2017 financial year are structured as follows:

In addition to the defined benefit pension plans, PUMA also makes contributions to defined contribution plans. Payments for the financial year 2017 amounted to € 11.7 million (previous year: € 11.0 million).

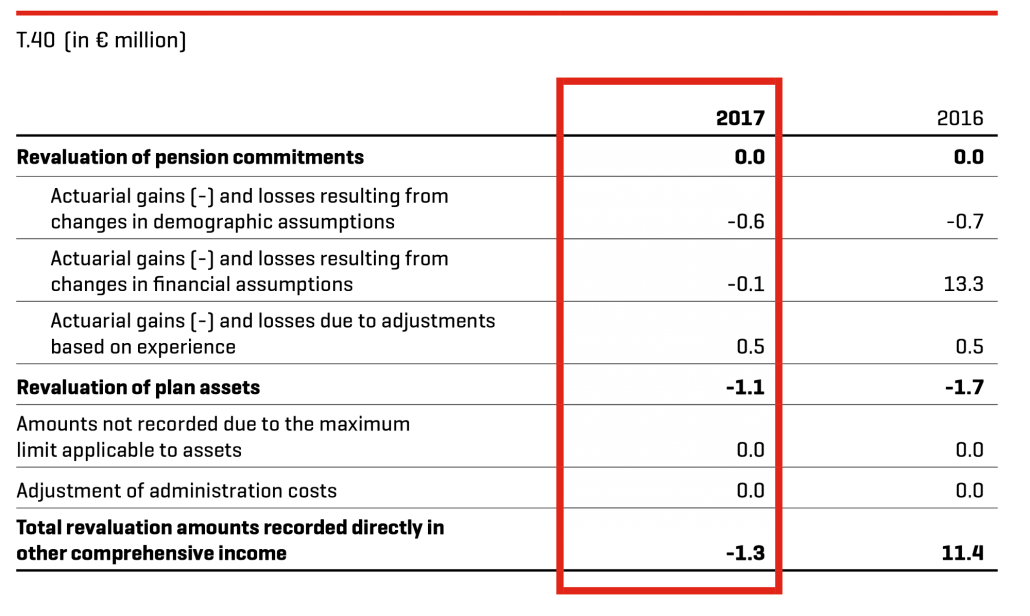

Actuarial gains and losses recorded in Other Comprehensive Income:

Plan assets still do not include the Group’s own financial instruments or real estate used by Group companies.

The plan assets are used exclusively to fulfill defined pension commitments. Legal requirements exist in some countries for the type and amount of financial resources that can be chosen; in other countries (for example Germany) they can be chosen freely. In the UK, a board of trustees made up of Company representatives and employees is in charge of asset management. Its investment strategy is aimed at long-term profits and low volatility. It was revised in 2017 and the risk profile was reduced.

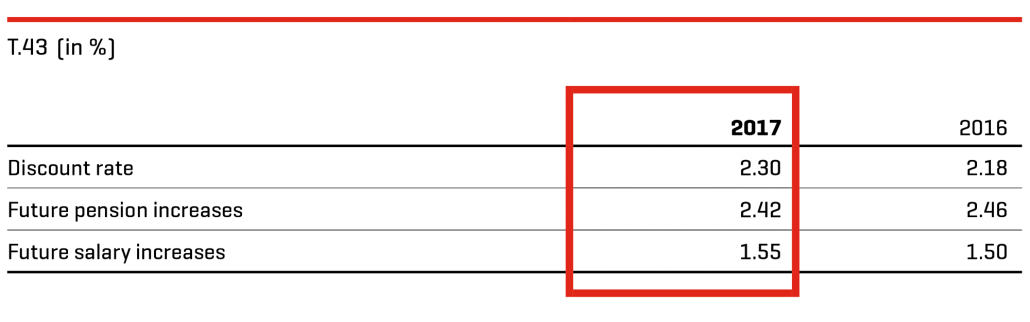

The following assumptions were used to determine pension obligations and pension expenses:

The indicated values are weighted average values. A standard interest rate of 1.75% was applied for the eurozone (previous year: 1.25%).

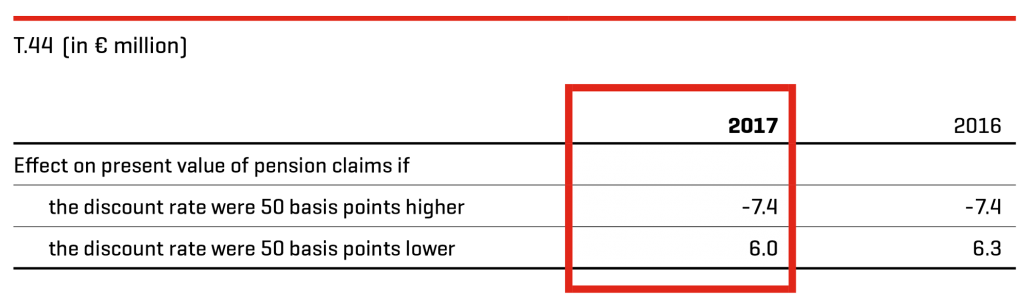

The following overview shows how the present value of pension claims from benefit plans would have been affected by changes to significant actuarial assumptions.

Salary and pension trends have only a negligible effect on the present value of pension claims due to the structure of the benefit plans.

The weighted average duration of pension commitments is 19 years.

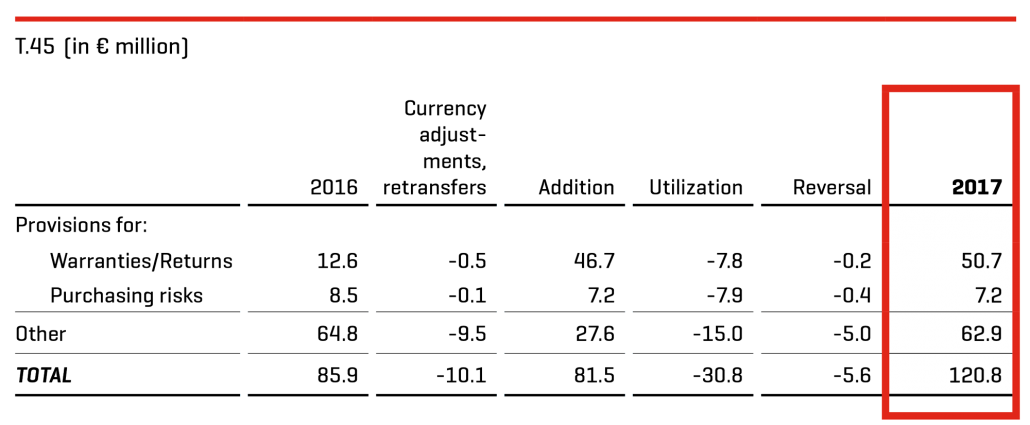

16. OTHER PROVISIONS

The warranty/return provision is determined on the basis of the historical value of sales generated during the past six months. It is expected that the majority of these expenses will fall due within the first six months of the next financial year. The warranty/return provision does not include any non-current provisions (previous year: € 1.9 million).

Purchasing risks relate primarily to materials and molds that are required for the manufacturing of shoes.

The other provisions consist of risks in connection with litigation amounting to € 30.0 million (previous year: € 28.7 million) and provisions for anticipated losses from pending transactions and other risks in the amount of € 32.9 million (previous year: € 36.1 million). Other provisions include € 34.6 million (previous year: € 27.9 million) in non-current provisions.

Short-term provisions are expected to be paid out in the following year, while long-term provisions are not expected to be paid out until the end of the following year at the earliest.

17. LIABILITIES FROM THE ACQUISITION OF BUSINESS ENTITIES

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions of business enterprises lead to payments. The resulting nominal amounts were discounted at a reasonable market interest rate, depending on the expected date of payment.

The existing purchase price liability relates to the acquisition of Genesis Group International Ltd. and is made up as follows:

18. SHAREHOLDERS’ EQUITY

SUBSCRIBED CAPITAL

The subscribed capital corresponds to the subscribed capital of PUMA SE. As of the balance sheet date, the subscribed capital amounted to € 38.6 million and is divided into 15,082,464 bearer shares. Each no-par-value share corresponds to € 2.56 of the subscribed capital (share capital).

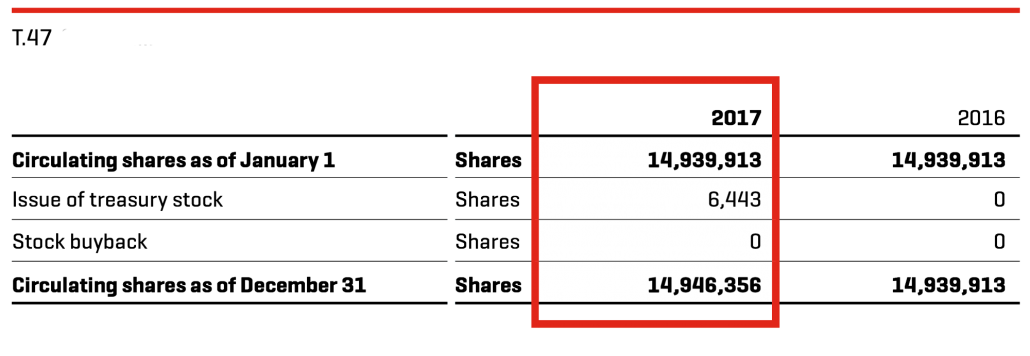

Changes in the circulating shares:

CAPITAL RESERVE

The capital reserve includes the premium from issuing shares, as well as amounts from the grant, conversion and expiration of share options.

RETAINED EARNINGS AND NET PROFIT

Retained earnings and net profit include the net income of the financial year as well as the income of the companies included in the consolidated financial statements achieved in the past to the extent that it was not distributed.

RESERVE FROM THE DIFFERENCE RESULTING FROM CURRENCY CONVERSION

The equity item for currency conversion serves to record the differences from the conversion of the financial statements of subsidiaries with non-euro accounting compared to the date of first consolidation of the subsidiaries.

CASH FLOW HEDGES

The cash flow hedges item includes the market valuation of derivative financial instruments. The item in the amount of € -44.8 million (previous year: € 54.3 million) is offset by deferred taxes in the amount of € 3.7 million (previous year: € -0.5 million).

TREASURY STOCK

The resolution adopted by the Annual General Meeting on May 6, 2015 authorized the company to purchase treasury shares up to a value of 10% of the share capital until May 5, 2020. If purchased through the stock exchange, the purchase price per share may not exceed or fall below 10% of the closing price for the Company’s shares with the same attributes in the XETRA trading system (or a comparable successor system) during the last 3 trading days prior to the date of purchase.

The Company did not make use of the authorization to purchase treasury stock during the reporting period. As of the balance sheet date, the Company holds a total of 136,108 PUMA shares in its own portfolio, which corresponds to 0.9% of the subscribed capital.

AUTHORIZED CAPITAL

As of December 31, 2017, the Company’s Articles of Association provide for authorized capital totaling € 15,000,000:

Pursuant to Section 4.2. of the Articles of Association, the Administrative Board is authorized to increase the Compan’s share capital by April 11, 2022 by up to € 15,000,000 (Authorized Capital 2017) by issuing new no-par value bearer shares against cash and/or non-cash contributions on one or more occasions. In the event of capital increases against cash contributions, the new shares can also be acquired in whole or in part by one or several banks as determined by the Administrative Board, subject to the obligation to offer these to the shareholders for subscription (indirect subscription right). The shareholders are basically entitled to a subscription right. However, the Administrative Board is authorized to exclude shareholders’ subscription rights in whole or in part in the cases specified in Paragraph 4.2. of the Articles of Association.

The Administrative Board of PUMA SE did not make use of the existing authorized capital in the current reporting period.

DIVIDENDS

The amounts eligible for distribution relate to the net income of PUMA SE, which is determined in accordance with German Commercial Law.

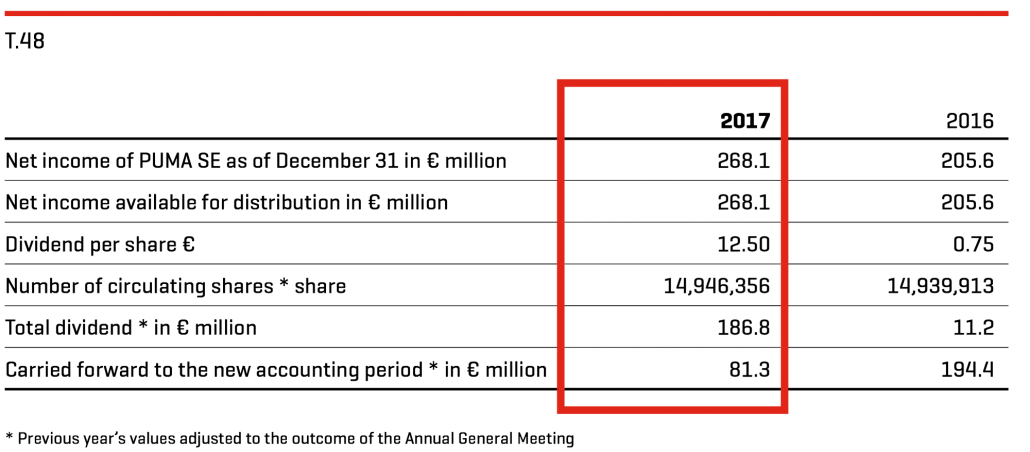

The Managing Directors and the Administrative Board will propose to the Annual General Meeting that a one-off dividend of € 12.50 per circulating share or a total of € 186.8 million (with respect to the circulating shares as of December 31), be distributed to the shareholders from the net income of PUMA SE for the 2017 financial year.

Appropriation of the Net Income of PUMA SE:

NON-CONTROLLING INTERESTS

The non-controlling interests remaining as of the balance sheet date relate to PUMA Accessories North America, LLC with €4.9 million (previous year: € 1.1 million), Janed, LLC with € 21.3 million (previous year: € 11.9 million), PUMA Kids Apparel North America, LLC with € 1.3 million (previous year: € 0.6 million), Janed Canada, LLC, with € 2.4 million (previous year: € 0.8 million), PUMA North America Accessories Canada, LLC with € 0.5 million and PUMA Kids Apparel Canada, LLC, with € 0.8 million (previous year: € 0.9 million).

CAPITAL MANAGEMENT

The Group’s objective is to retain a strong equity base in order to maintain both investor and market confidence and to strengthen future business performance.

Capital management relates to the consolidated equity of PUMA. This is shown in the consolidated balance sheet as well as the reconciliation statement concerning Changes in Equity.

19. EQUITY COMPENSATION PLANS/MANAGEMENT INCENTIVE PROGRAM

In order to provide long-term incentives and thereby retain the management staff in the Company, PUMA uses share-based compensation systems in the form of stock option programs (SOP) and in the form of virtual shares with cash compensation.

The current programs are described below:

EXPLANATION OF “SOP”

Pursuant to the resolution of the Annual General Meeting of April 22, 2008, a stock option program, SOP 2008, was accepted in the form of a Performance Share Program. Conditional capital was created for this purpose and the Supervisory Board and the Board of Management of PUMA AG (as of July 25, 2011 change of form into SE) were authorized to grant subscription rights to the members of the Board of Management and other executives of the Company and of affiliated subsidiary companies for five years (after the registration of the conditional capital in the commercial register), but for at least three months after the end of the Annual General Meeting in 2013.

The term of the subscription rights issued and to be issued is five years and these subscription rights can be exercised after two years at the earliest, provided, however, that the price of the PUMA share has increased by at least 20% as of the date granted. In contrast to traditional stock option programs, the equivalent amount of the increase in value of the PUMA share since the date granted is serviced with shares, whereby the beneficiary pays an option price of € 2.56 per share granted if the share was issued as part of a capital increase. If employees leave the company, then their options rights expire.

Furthermore, pursuant to the authorization, the Administrative Board, in accordance with the recommendations of the Corporate Governance Code, may limit, fully or partially, the scope and contents of subscription rights issued to the company’s Managing Directors in the event of extraordinary, unforeseen developments. This option is also available to the Board of Management with respect to the other executives concerned.

The programs were valued using a binomial model or a Monte Carlo simulation.

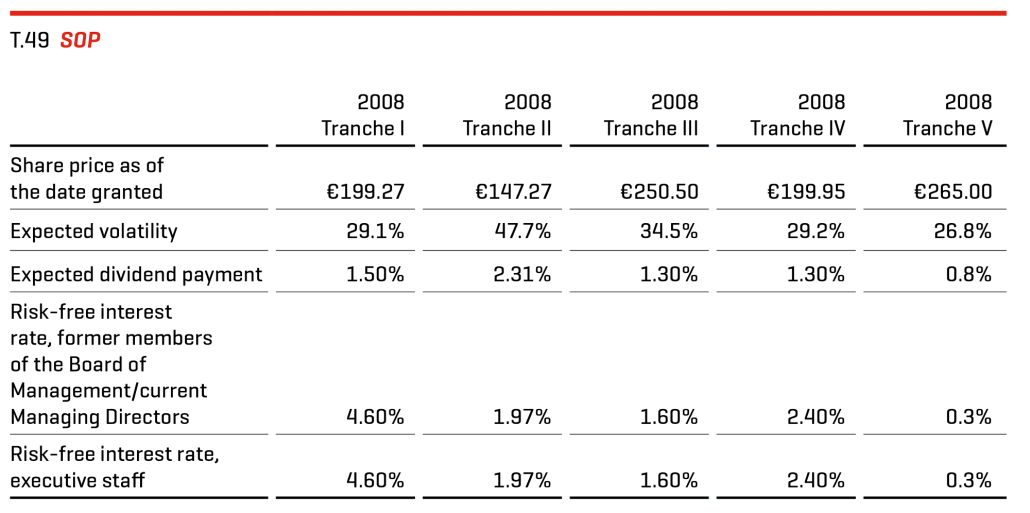

The following parameters were used to determine the fair value:

The historical volatility during the year prior to the date of valuation was used to determine the expected volatility.

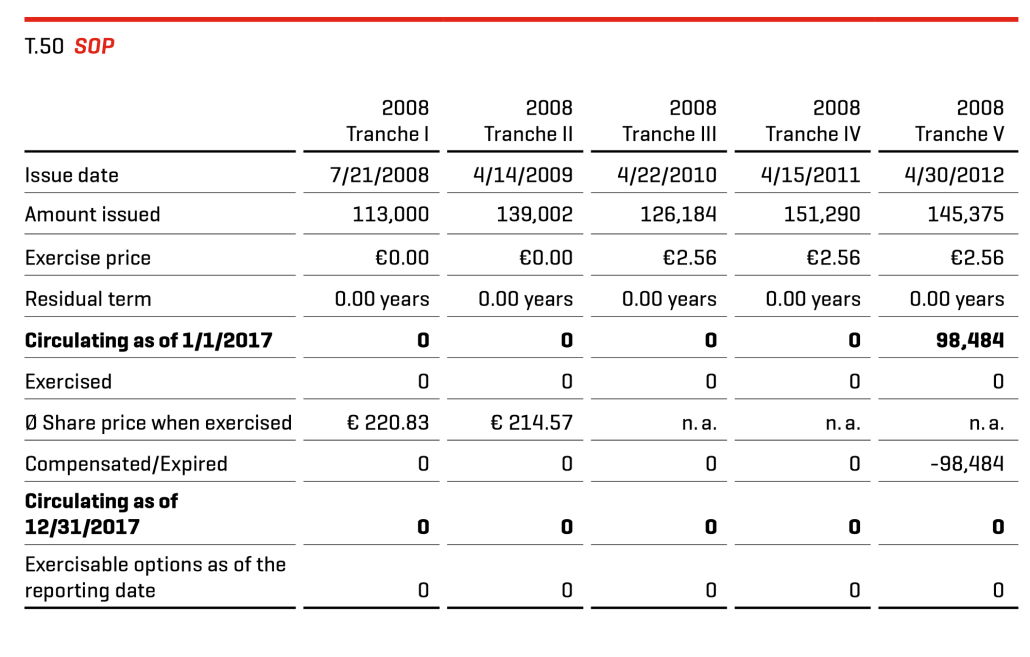

Changes in the SOP during the financial year:

Pursuant to Section 5 of the Option Terms and Conditions, every year the options are subject to a vesting period from December 15 for up to ten trading days after the Annual General Meeting. Accordingly, no options can be exercised as of the reporting date.

As of the date of allocation, the average fair value per option was € 49.44 for Tranche I – 2008. Taking into account the vesting period, there are no expenses for the current financial year. Of the options in circulation, 0 options belong to the previous members of the Board of Management of PUMA AG or the current Managing Directors.

Pursuant to the allocation, the average fair value per option was € 53.49 for Tranche II – 2008. Taking into account the vesting period, there are no expenses for the current financial year. Of the options in circulation, 0 options belong to the previous members of the Board of Management of PUMA AG or the current Managing Directors.

Pursuant to the allocation, the average fair value per option was € 61.81 for Tranche III – 2008. Taking into account the vesting period, there are no expenses for the current financial year. Of the options in circulation, 0 options belong to the previous members of the Board of Management of PUMA AG or the current Managing Directors.

Pursuant to the allocation, the average fair value per option was € 40.14 for Tranche IV – 2008. Taking into account the vesting period and the expiration, there are no expenses for the current financial year. A total of 0 options belong to the previous members of the Board of Management of PUMA AG or the current Managing Directors at the end of the year.

Pursuant to the allocation, the average fair value per option was € 44.59 for Tranche V – 2008. Taking into account the vesting period, there are no expenses for the current financial year. Tranche V was terminated against payment of a cash settlement. A total of 0 options belonged to the current Managing Directors at the end of the year.

The SOP 2008 stock option program expired at the end of the 2017 financial year.

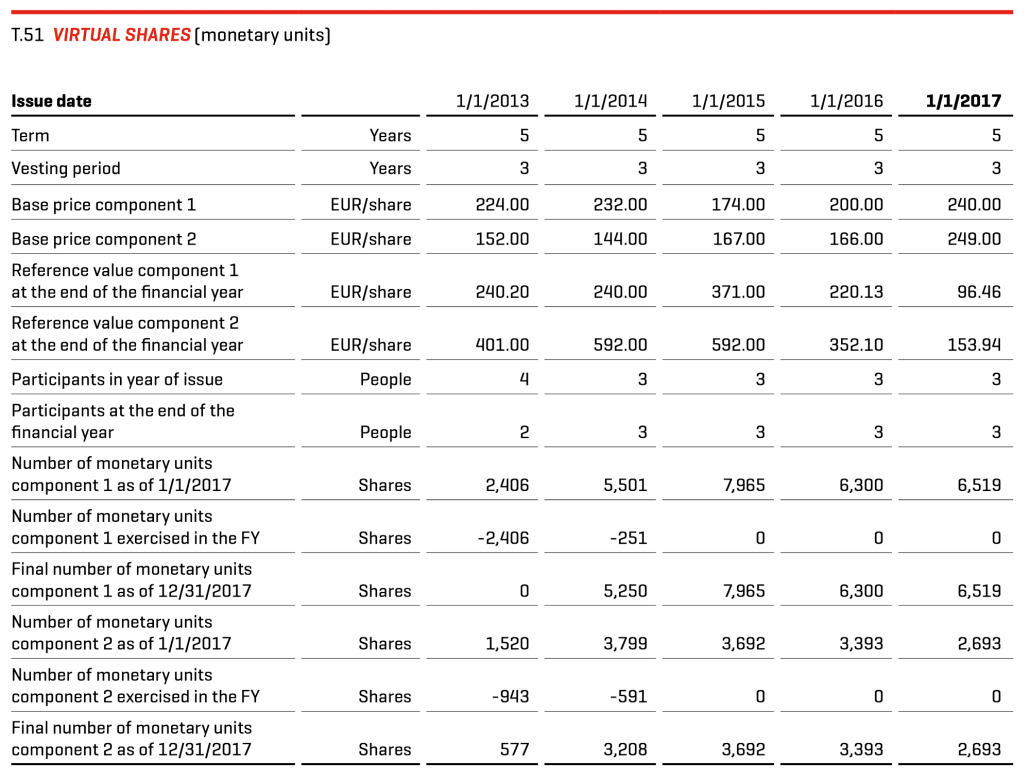

EXPLANATION OF “VIRTUAL SHARES,” TERMED “MONETARY UNITS”

Monetary units were granted on an annual basis in 2013 as part of a management incentive program. Monetary units are based on the PUMA and Kering share performance. Each of these monetary units entitles the holder to a cash payment at the end of the term. This is dependent on the year-end price determined for the PUMA share (component 1), which is weighted at 70% and on the year-end price determined for the Kering share (component 2), which is weighted at 30%. Component 1 compares the success with the average virtual stock appreciation rights of the last 30 days of the previous year. Component 2, on the other hand, measures success by comparing the performance of the Kering share against the average performance of a reference portfolio in the luxury and sports sector over the same period. These monetary units are subject to a vesting period of three years. After that, there is an exercise period of two years (in the period in April and October) which can be freely used by participants for the purposes of execution. The fundamental exercise condition after the vesting period is the existence of an active employment relationship with PUMA.

In the financial year 2017, an expense of € 8.4 million was established for this purpose on the basis of the employment contract commitments to the managing directors.

This commitment consisting of share-based remuneration transactions with cash compensation is recorded as personnel provisions and revalued on every balance sheet date at fair value. Expenses are likewise recorded over the vesting period. Based on the market price on the balance sheet date, the provision for both programs amounts to € 12.2 million at the end of the financial year.

EXPLANATION OF THE “GAME CHANGER 2017” PROGRAM

In addition, another global long term incentive program called Game Changer 2017 was launched in 2014. Participants in this program consist mainly of top executives reporting to the managing directors and individual key positions in the PUMA Group. The aim of this program is to bind this group of employees to the company on a long-term basis and to allow them to share in the medium-term success of the Company.

The term of the program is 3 years and is based on the medium-term objectives of the PUMA Group in terms of EBIT (70%), working capital (15%) and gross profit margin (15%). For this purpose, a corresponding provision is set up each year when the respective currency-adjusted targets are met. The resulting savings were paid out to the participants in March 2017. The payment was subject to the condition that the individual participant was in an unterminated employment relationship with a company of the PUMA Group as of December 31, 2016. No further expenses were incurred for this program in the year under review.

EXPLANATION OF THE “GAME CHANGER 2018” PROGRAM

In 2015, the global Game Changer 2018 program was launched, which is subject to the same parameters as the Game Changer 2017 program (employment relationship until 12/31/2017 and payout March 2018). Provisions of €1.0 million were set aside for this program in the year under review.

EXPLANATION OF THE “GAME CHANGER 2019” PROGRAM

In 2016, the global Game Changer 2019 program was launched, which is subject to the same parameters as the Game Changer 2017 program (employment relationship until 12/31/2018 and payout March 2019). Provisions of € 1.4 million were set aside for this program in the year under review.

EXPLANATION OF THE “GAME CHANGER 2020” PROGRAM

In 2017, the global Game Changer 2020 program was launched, which is subject to the same parameters as the Game Changer 2017 program (employment relationship until 12/31/2019 and payout March 2020). Provisions of € 1.4 million were set aside for this program in the year under review.

EXPLANATION OF THE MOMENTUM 2020 PROGRAM

In addition, a global program called Momentum was launched in 2017, which is subject to the same parameters (employment until December 31, 2019 and payout in March 2020) as the Game Changer programs. The difference to the Game Changer programs lies in the different participants. While the participants in the Game Changer programs consist of top executives, the Momentum program includes employees who are not part of this group. Provisions of € 0.9 million were set aside for this program in the year under review.

20. OTHER OPERATING INCOME AND EXPENSES

According to the respective functions, other operating income and expenses include personnel, advertising, sales and distribution expenses as well as rental and leasing expenditure, travel costs, legal and consulting expenses and other general expenses. Typical operating income that is associated with operating expenses was offset. Rental and lease expenses associated with the Group’s own retail stores include sales-dependent rental components.

Other operating income and expenses are allocated based on functional areas as follows:

Within the sales and distribution expenses, marketing/retail expenses account for a large proportion of the operating expenses. In addition to advertising and promotional expenses, they also include expenses associated with the Group’s retail activities. Other sales and distribution expenses include logistic expenses and other variable sales and distribution expenses.

Administrative and general expenses include expenses for the statutory auditor of PUMA SE in the amount of € 0.9 million (previous year: € 0.9 million).

Of this, € 0.7 million is allocated to auditing expenses (previous year: € 0.6 million), € 0.2 million to other assurance services (previous year: € 0.2 million) and € 0.0 million to tax advisory services (previous year: € 0.1 million).

Other operating income includes other income of € 0.3 million (previous year: € 0.2 million). In the previous year, this item also included allocations of development costs amounting to € 0.7 million.

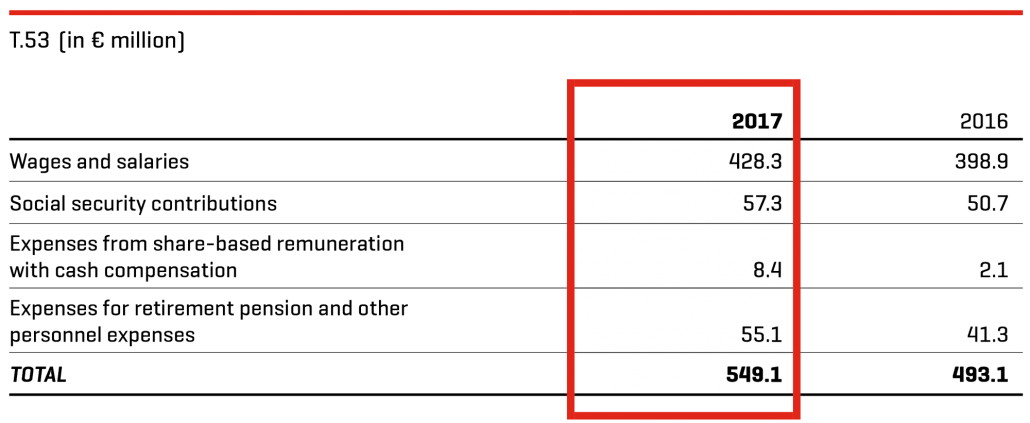

Overall, other operating expenses include personnel costs, which consist of:

In addition, cost of sales includes personnel costs in the amount of € 12.8 million (previous year: € 15.3 million).

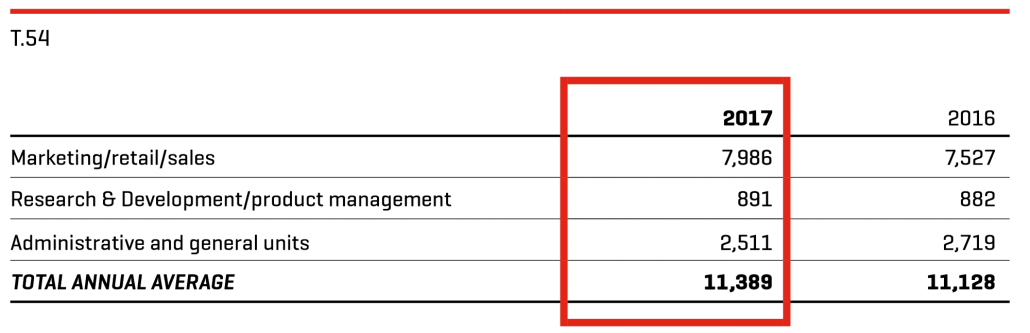

The average number of employees for the year was as follows:

As of the end of the year, a total of 11,787 individuals were employed (previous year: 11,495).

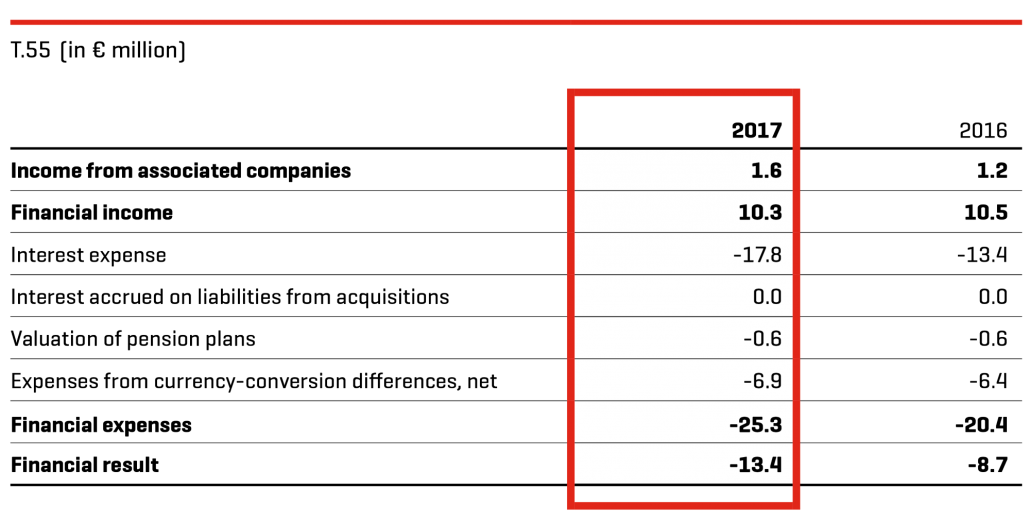

21. FINANCIAL RESULT

This financial result consists of:

Income from associated companies results exclusively from the shareholding in Wilderness Holdings Ltd. (see also section 11).

Financial income includes only interest income.

Interest expenses result from financial liabilities and expenses in connection with currency derivatives.

Moreover, the financial result includes a total of € 6.9 million in expenses from currency conversion differences (previous year: expense of € 6.4 million), which are attributable to financing activities.

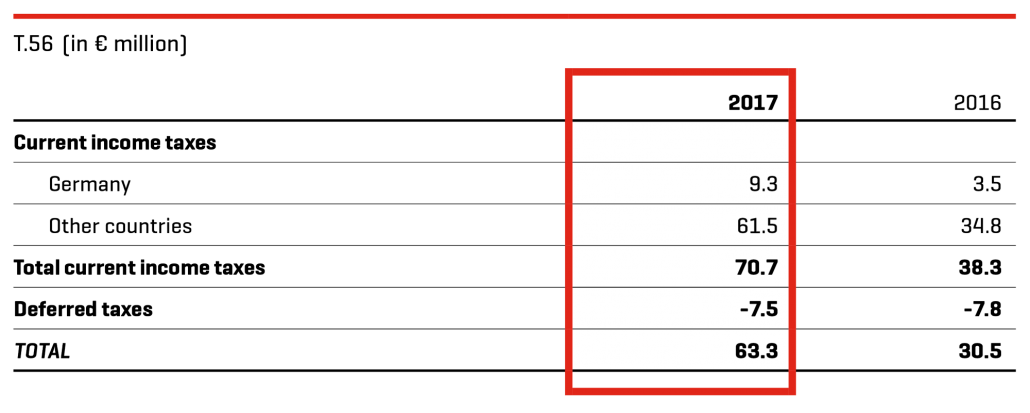

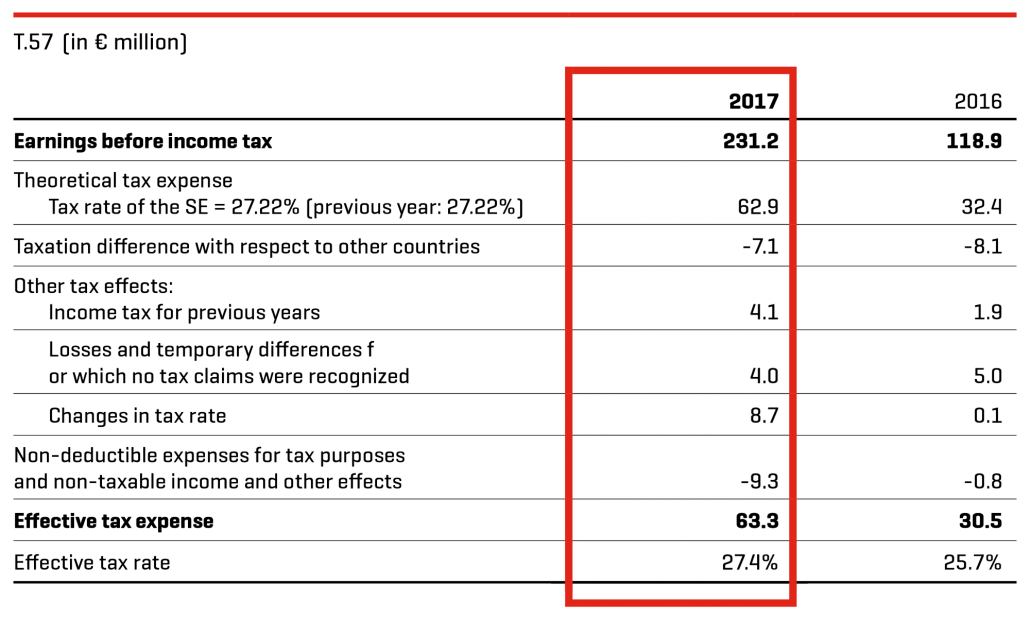

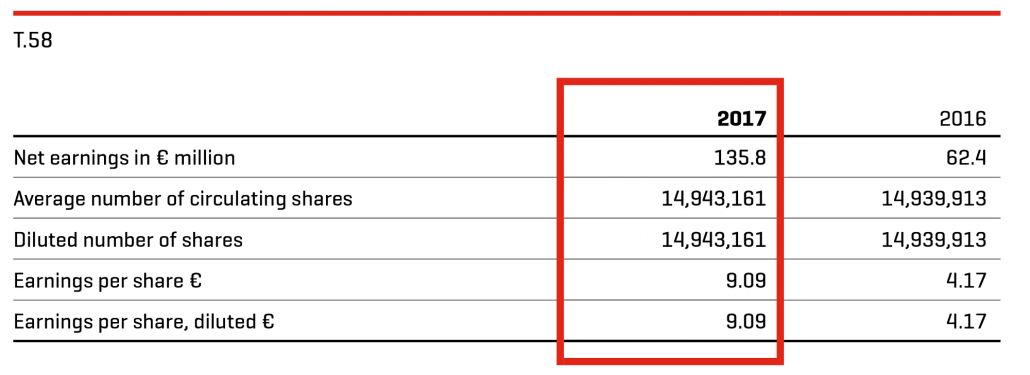

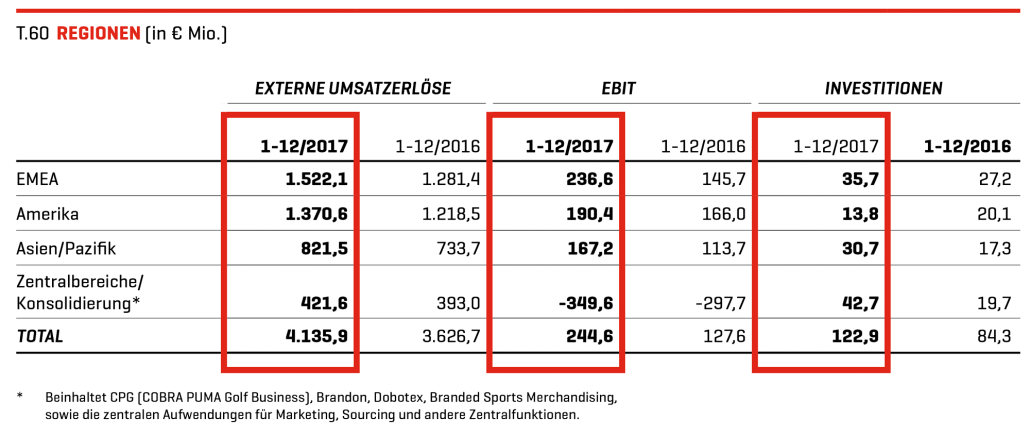

22. INCOME TAXES