Comments on the

German GAAP Financial

Statements of PUMA SE

PUMA SE’s financial statements have been prepared pursuant to the rules of the German Handelsgesetzbuch (HGB – German Commercial Code).

PUMA SE is the parent company of the PUMA Group. PUMA SE’s results are significantly influenced by the directly and indirectly held subsidiaries and shareholdings. The business development of PUMA SE is essentially subject to the same risks and opportunities as the PUMA Group.

PUMA SE is responsible for the wholesale business in the DACH region, consisting of the home market of Germany, Austria and Switzerland. Furthermore, PUMA SE is also responsible for the pan-European distribution for individual key accounts and sourcing products from European production countries as well as global licensing management. In addition, PUMA SE acts as a holding company within the PUMA Group and is as such responsible for international product development and merchandising, international marketing, and the global areas of finance, operations as well as PUMA’s strategic direction.

Sales rose in the financial year 2018 by 7.3% to € 675.3 million. The increase resulted from both increased product sales and commission income from license management and higher other sales. Revenue from PUMA SE product sales increased by 8.9% to € 329.5 million. The licensing and commission income included in sales increased by 4.6% to € 303.0 million. The other revenue, which mainly consisted of recharges of costs to affiliated companies, rose by 16.2% to € 42.8 million.

Other operating income amounted to € 50.8 million in 2018 (previous year: € 60.7 million) and includes in particular realized and unrealized gains from currency conversion related to the measurement of receivables and payables in foreign currencies.

The total expenditure from material expenses, personnel expenses, depreciations / amortizations and other operating expenses increased only slightly compared to the previous year by 0.9% to € 838.8 million (previous year: € 831.0 million). The increase in material expenses was associated with the increase in sales. Depreciation / amortization increased primarily due to investments in the new administration building in Herzogenaurach, and continued investments in IT.

Other operating expenses fell compared to the previous year, which is mainly attributable to the reduction in losses from currency conversion. In addition, the transfer of individual sponsoring contracts to affiliated companies contributed to the decline in other expenses.

The financial result decreased compared to the previous year by 23.7% to € 212.9 million. The decline was due in particular to lower dividends from affiliated companies. This was offset by higher income from the transfer of profits from affiliated companies. As in the previous year, there were no write-downs on financial assets in 2018.

Income before taxes decreased in 2018 by 27.4% from € 137.9 million to € 100.1 million. Taxes on income amounted to € 16.8 million (previous year: € 9.3 million) and were mainly composed of expenses for withholding taxes for the current year totaling € 9.3 million and income tax for the current year totaling € 1.0 million and totaling € 6.5 million for previous years. Net income amounted to € 83.3 million compared to € 128.7 million in the previous year.

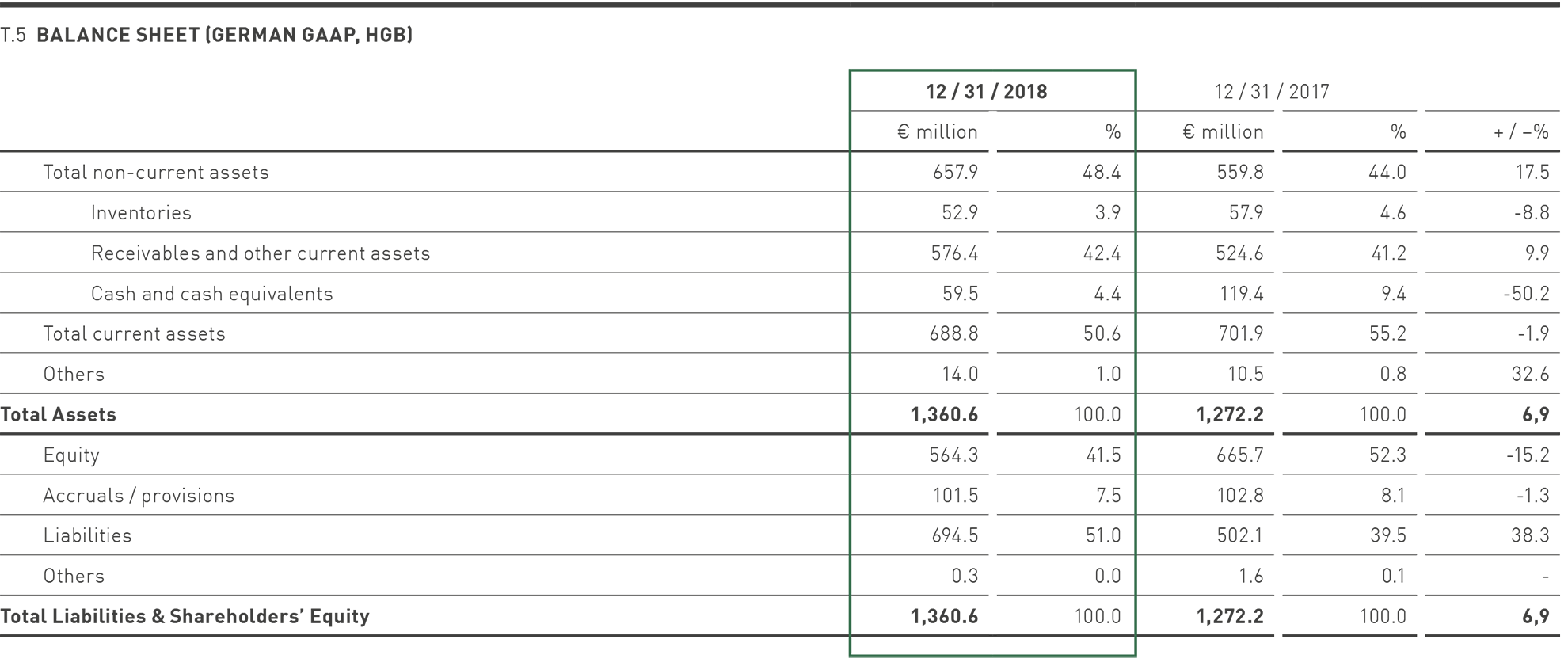

Non-current assets increased in 2018 by 17.5% to € 657.9 million. The increase is mainly due to capital increases at subsidiaries of PUMA SE, which led to an increase in shareholdings. Investments in the new administrative building in Herzogenaurach and in IT also contributed to the increase.

Within current assets, inventories decreased by 8.8% to € 52.9 million. By contrast, trade receivables and receivables from affiliated companies rose compared to the previous year by 9.9% to € 576.4 million. This development is due to the increase in sales and financing requirements of affiliated companies at the reporting date. Cash and cash equivalents decreased compared to the previous year by 50.2% to € 59.5 million.

On the liability side, equity decreased, in spite of the net income for 2018, by 15.2% to € 564.3 million. This was due to the distribution of the € 186.8 million one-time special dividend for the financial year 2017 in 2018. This led to a decrease in the equity ratio at the balance sheet date from 52.3% to 41.5%. Provisions remained virtually unchanged from the previous year. The increase in liabilities by 38.3% to € 694.5 million resulted mainly from the issuance of promissory note loans of € 160.0 million in 2018.

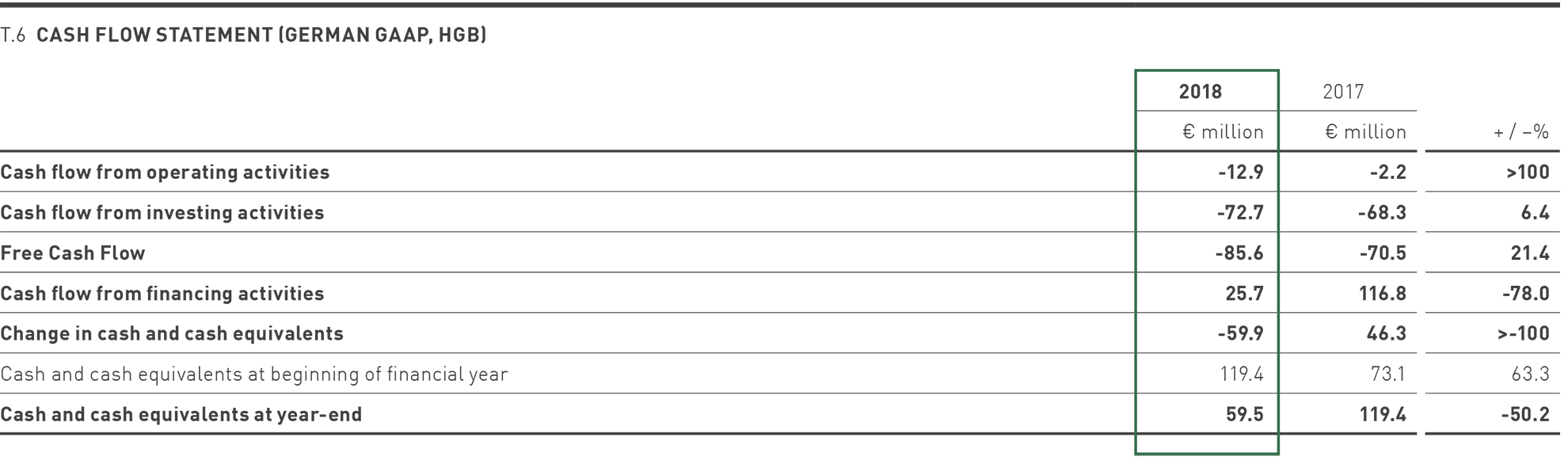

Cash flow from operating activities decreased compared to the previous year to € -12.9 million. This is primarily due to an increase in working capital at the balance sheet date, due to higher receivables from affiliated companies. Cash outflow from investing activities rose from € -68.3 million to € -72.7 million due to the increased investment in non-current assets. This led to a decline in free cash flow from € -70.5 million in the previous year to € -85.6 million in 2018.

Cash flow from financing activities showed a cash inflow of € 25.7 million in 2018 (previous year: € 116.8 million). In 2018, this was primarily caused by the distribution of the special dividend for the year 2017 in 2018. On the other hand, PUMA SE issued promissory note loans. This led to an overall reduction in cash and cash equivalents from € 119.4 million to € 59.5 million. In addition, PUMA SE has access to a syndicated credit line of € 350.0 million, which was not utilized as of the balance sheet date. This facility is used for general corporate financing, such as the financing of short-term, seasonal requirements from the purchase of goods.

Outlook

In line with the Group forecast, PUMA SE expects an increase in sales of around 10% and a moderate increase in earnings before taxes for the financial year 2019.

Relationships with affiliated companies

At the end of the dependent company report of the Management Board for the financial year 2018, the following statement was given: “Under the circumstances which were known to the Management Board at the time when the transactions listed in the report on relationships with affiliated companies were made, PUMA SE received an appropriate consideration in all cases. There were no reportable measures taken or not taken in the reporting period”.