Notes to the

Consolidated Financial

Statements

1. General

Under the “PUMA” brand name, PUMA SE and its subsidiaries are engaged in the development and sale of a broad range of sports and sports lifestyle products, including footwear, apparel and accessories. The company is a European stock corporation (Societas Europaea / SE) and parent company of the PUMA Group; its registered office is on PUMA WAY 1, 91074 Herzogenaurach, Germany. The competent registry court is in Fürth (Bavaria), the register number is HRB 13085.

The consolidated financial statements of PUMA SE and its subsidiaries (hereinafter shortly referred to as the “Group” or “PUMA”) were prepared in accordance with the “International Financial Reporting Standards (IFRS)” accounting standards issued by the International Accounting Standards Board (IASB), as they are to be applied in the EU, and the supplementary accounting principles to be applied in accordance with Section 315e (1) of the German Commercial Code. The IASB standards and interpretations, as they are to be applied in the EU, which are mandatory for financial years as of January 1, 2018, have been applied.

The preparation of the consolidated financial statements was based on historical acquisition and manufacturing costs, with the exception of the profit or loss assessment of financial assets and liabilities at fair value.

The items contained in the financial statements of the individual Group companies are measured based on the currency that corresponds to the currency of the primary economic environment in which the company operates. The consolidated financial statements are prepared in Euros (EUR or €). The presentation of amounts in millions of Euros with one decimal place may lead to rounding differences since the calculation of individual items is based on figures presented in thousands.

The cost of sales method is used for the income statement.

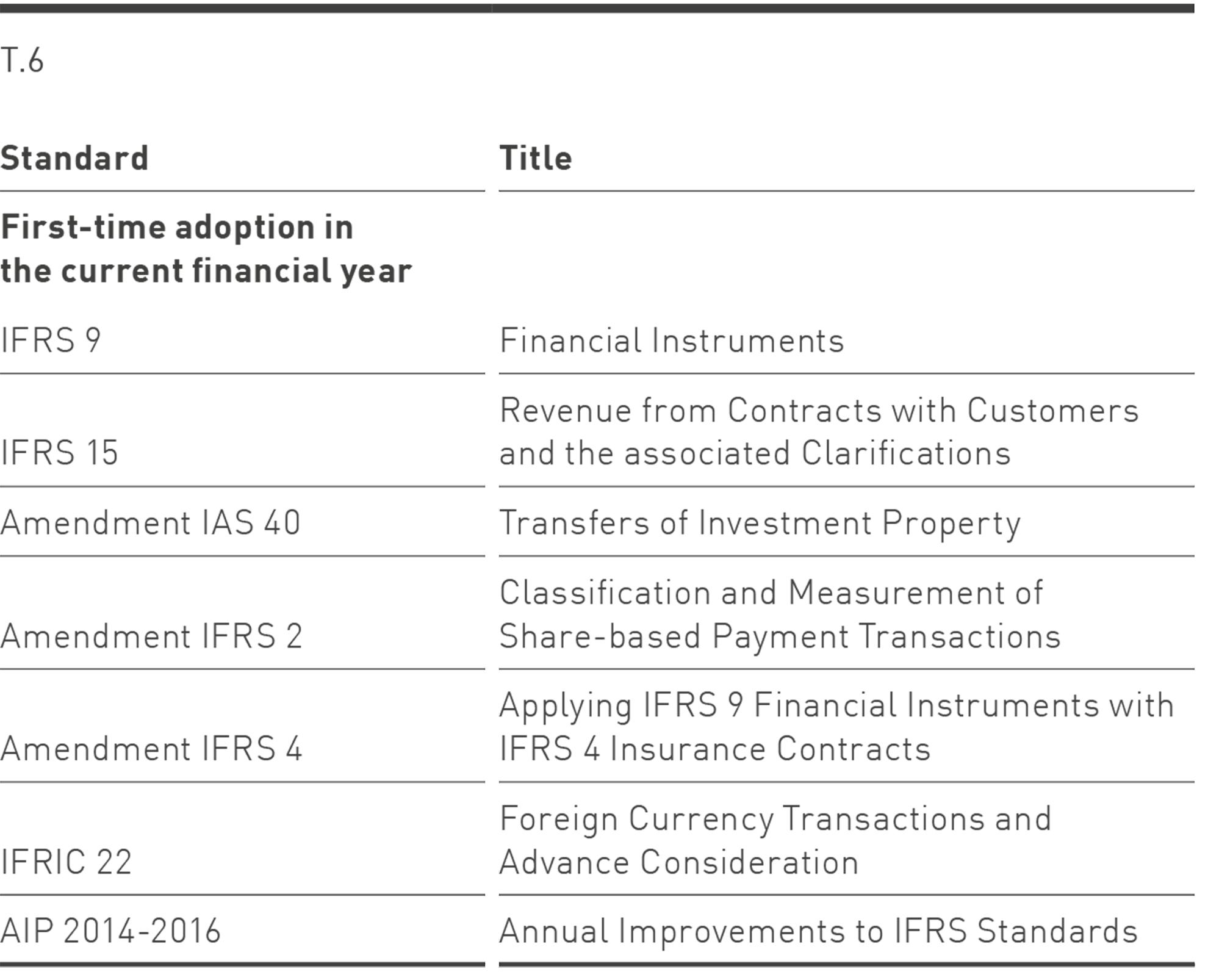

The following new and amended standards and interpretations have been used for the first time in the current financial year:

The standards and interpretations used for the first time as of January 1, 2018 had the following effects on the consolidated financial statements:

Adoption of IFRS 9-Financial Instruments

In the past financial year, PUMA adopted the new standard IFRS 9 Financial Instruments (as amended in July 2014) and the associated amendments to other IFRS standards. In accordance with the transition rules of IFRS 9, the previous year’s figures were not adjusted. In relation to the accounting of hedge relationships, PUMA made use of the elective right to continue applying the rules of IAS 39 for hedge accounting.

The first-time adoption of IFRS 9 in the past financial year had no significant effect on the asset, financial and earnings position of the PUMA Group.

IFRS 9 contains regulations for the recognition, measurement and derecognition of financial instruments. Thus the accounting of financial instruments that was previously performed under IAS 39 (Financial instruments: recognition and measurement) was replaced in the current financial year by accounting under IFRS 9. This includes, among other things, a new impairment model based on expected credit defaults.

Under IFRS 9, the subsequent measurement of financial instruments is carried out according to the classification at “amortized cost” (AC), at “fair value through profit or loss” (FVPL) or at “fair value through other comprehensive income” (FVOCI). The classification is based on two criteria: the Group’s business model

for asset management and the question whether the contractual cash flows of the financial instruments represent “exclusively payments of principal and interest” toward the outstanding principal amount. The evaluation of the Group’s business model was carried out at the date of first-time adoption, January 1, 2018. The judgment of whether the contractual cash flows from debt instruments consist solely of principal and interest was made based on the facts and circumstances at the date of initial recognition of the assets.

The first-time adoption of IFRS 9 had no effect on the opening balance as of January 1, 2018.

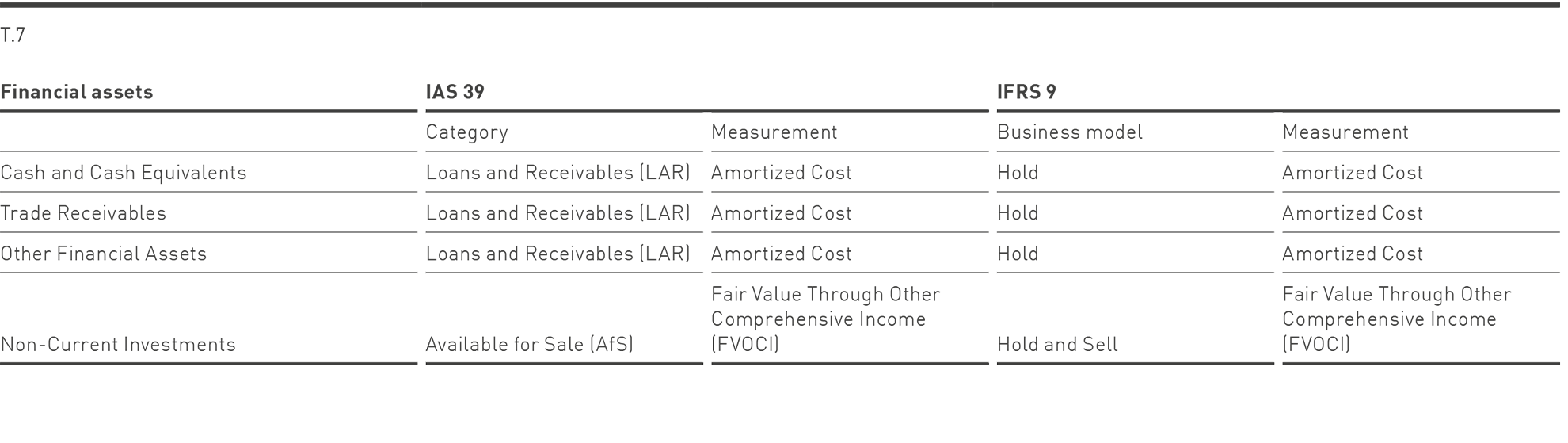

The following table shows an overview of the classification and measurement of financial assets under IAS 39 in comparison to IFRS 9. There were no changes with respect to the measurement.

The categories “Held to Maturity” (HtM) and “Assets at fair value through profit or loss” (AFV) have not been used at PUMA so far. Accordingly, there are no financial instruments to be assigned in the past financial year to the business model “Sell” and measured under IFRS 9 at “fair value through profit or loss” (FVPL).

For non-current investments (equity instruments), IFRS 9 continues to allow measurement at fair value through other comprehensive income (FVOCI). But if these investments are sold or written down, the unrealized gains and losses from these investments as of this date are to be transferred in future to retained earnings under IFRS 9 and not posted to the income statement as previously specified in IAS 39.

The classification and measurement of financial liabilities under IFRS 9 is carried out largely with the same specifications as under IAS 39. The Group has so far not measured any “liabilities at fair value through profit or loss” (LFV). Accordingly, there were no changes in relation to the classification and measurement of the financial liabilities.

With respect to the new impairment model of IFRS 9 for the value adjustment of debt instruments, there was no major change in the amount of the value adjustments, since PUMA particularly holds current trade receivables. These trade receivables do not include interest components and, in most cases, credit insurance is in place to limit the amount of the anticipated loss. Accordingly, it was not necessary to adjust the amount of the value adjustments in the opening balance as of January 1, 2018.

The introduction of IFRS 9 led to changes in IFRS 7 and required additional disclosures in the Notes to the Consolidated Financial Statements.

Adoption of IFRS 15-Revenue from Contracts with Customers

In the past financial year, PUMA adopted for the first time the new standard IFRS 15 Revenue from Contracts with Customers (as amended in April 2016). In accordance with the transition rules of the modified retrospective approach in IFRS 15, the previous year‘s figures were not adjusted.

IFRS 15 prescribes when and in what amount revenues are to be recognized. The standard provides a single, principle-based, five-step model that applies to all contracts with customers. The date of revenue recognition will be determined by the transfer of control to the customer. In each case, a check must be carried out as to whether the power of disposition is transferred to the customer on a period or specific time basis.

In the course of the first-time adoption of IFRS 15, no significant changes were identified in relation to the date and amount of revenue recognition. For revenues from the sale of products, there were no conversion effects, since control is generally transferred to the customer when the products are delivered and revenues and income continue to be recognized at this point in time. There were likewise no changes from the accounting treatment of the granting of trademark rights, since the previous accounting approach matched the rules of IFRS 9. In addition, PUMA has not entered into any long-term contracts and multi-component agreements.

The changed recognition and measurement methods with respect to revenue recognition are described in chapter 2 of the Notes in the paragraph on “Recognition of Sales Revenues.” Apart from additional disclosures in the Notes regarding the sales revenues, the adoption of IFRS 15 in the past financial year had no significant effect on the asset, financial and earnings position of the PUMA Group.

The effect of the first-time adoption of IFRS 15 in the past financial year on individual relevant items of the financial statements is explained below.

The change in the balance-sheet presentation of refund liabilities led to a transfer on the liabilities side of € 50.2 million from the Other Current Provisions to the Other Current Liabilities. Moreover, this led to a rise in inventories in the amount of € 27.2 million with no effect on income; these now also include customers’ product refund claims. On the liabilities side, this likewise led to an increase in the Other Current Liabilities. As a result, there was an increase of € 27.2 million in total assets and liabilities with the first-time adoption as of January 1, 2018.

Another effect of the first-time adoption of IFRS 15 is related to the presentation of customer bonuses, which were previously recognized under Trade Liabilities and now are likewise assigned to the Other Current Liabilities as part of the refund liabilities. As a result, there was a transfer of € 46.8 million with the first-time adoption as of January 1, 2018.

The amounts of the refund claim and the refund obligation as of December 31, 2018 are indicated separately in the Notes.

There was no effect on equity in the opening balance as of January 1, 2018 due to the first-time adoption of IFRS 15.

The effects on the relevant items of the financial statements as of January 1, 2018 are comprised as follows:

The first-time adoption of IFRS 15 in the past financial year led in specific cases to a different presentation of payments to customers in the income statement. Such payments to customers were henceforth recognized as a reduction in sales revenues rather than as an increase in operating expenses. In total, payments to customers amounting to € 25.3 million were thus recognized differently in the income statement. This did not have a significant effect on the PUMA Group’s earnings position.

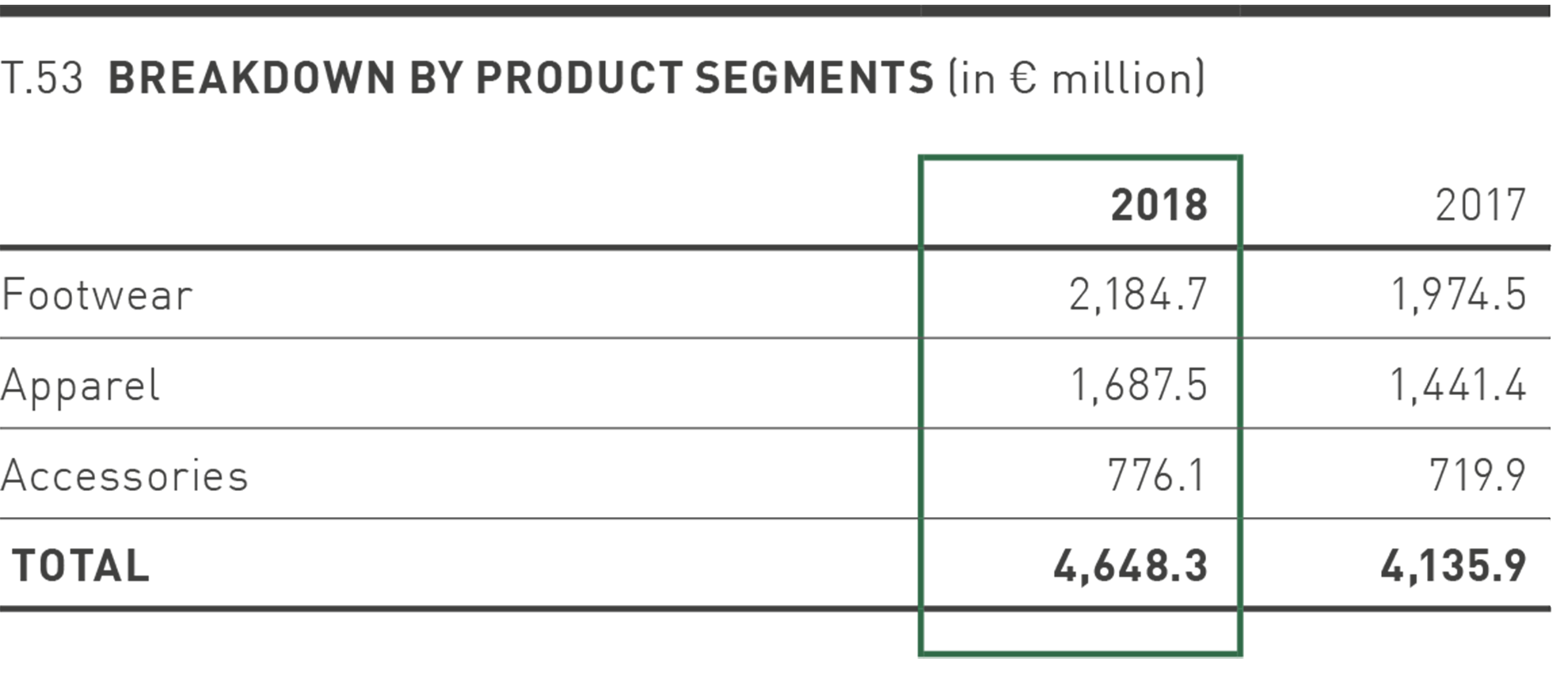

In addition, due to the first-time adoption of IFRS 15, more comprehensive disclosures in the notes to the financial statements were required in order to provide more informative and relevant information to users of the financial statements than previously. The required breakdown of revenues from contracts with customers can be found in chapter 20 of the Notes to the Consolidated Financial Statements.

The first-time adoption of the other standards and interpretations applicable as of January 1, 2018 did not have any effect on the consolidated financial statements.

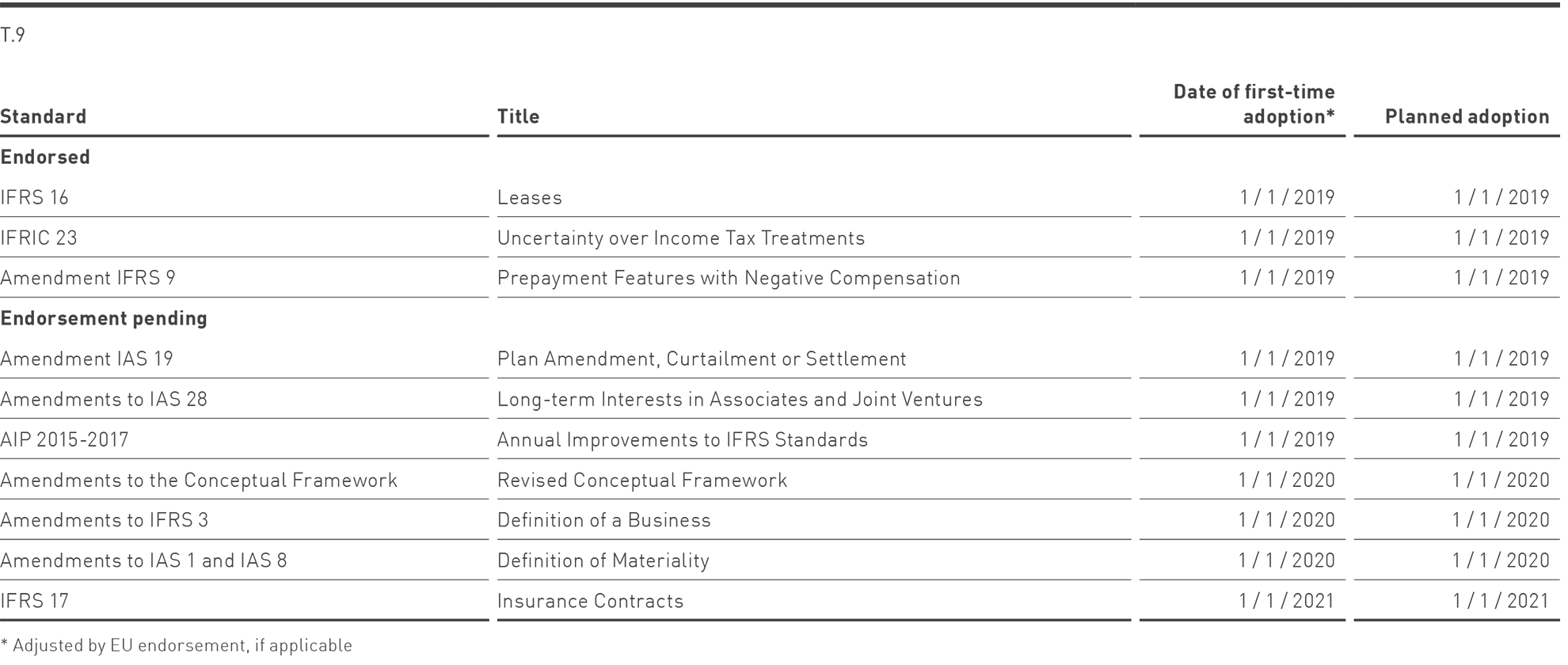

The new standard IFRS 16 Leases will mean that, in the future, all leases will have to be capitalized in the balance sheet in form of a right of use asset and a corresponding leasing liability. In all cases, the presentation in the income statement is made as a financing transaction, i.e. the right of use is generally depreciated on a straight-line basis and the lease liability is carried forward using the effective interest method.

The new standard is to be applied for financial years beginning on or after January 1, 2019. With regard to the first-time adoption, PUMA has decided to apply the modified retrospective method. Thus, there was no adjustment of the previous year’s figures. In addition, PUMA has decided to utilize the application facilitation for short-term leases with a term of less than 12 months and leased assets of low value.

PUMA mainly concludes leasing contracts as an operating lessee. The application of IFRS 16 results in the following effects on the presentation of the Group’s asset, financial and earnings position:

With regard to the minimum rental payments for operating lease agreements, which are shown under Other Financial Obligations, the adoption of IFRS 16 will lead to an increase in non-current assets due to the balance-sheet recognition of rights of use. Accordingly, financial liabilities will increase as a result of the recognition of the corresponding liabilities. This will therefore lead to a significant increase in balance sheet total and a corresponding reduction in the equity ratio of the PUMA Group. In addition, the nature of the expenses arising from these leases will change, as IFRS 16 replaces the operating lease expenses previously recognized on a straight-line basis with depreciation of rights of use and interest expenses for liabilities. This will therefore have a positive effect on operating result (EBIT) in the income statement. In addition, IFRS 16 requires the repayment share of lease payments that are not classified as short-term or low-value leases to be shown as part of the cash flow from financing activities, with the result that the cash flow from operating activities will improve.

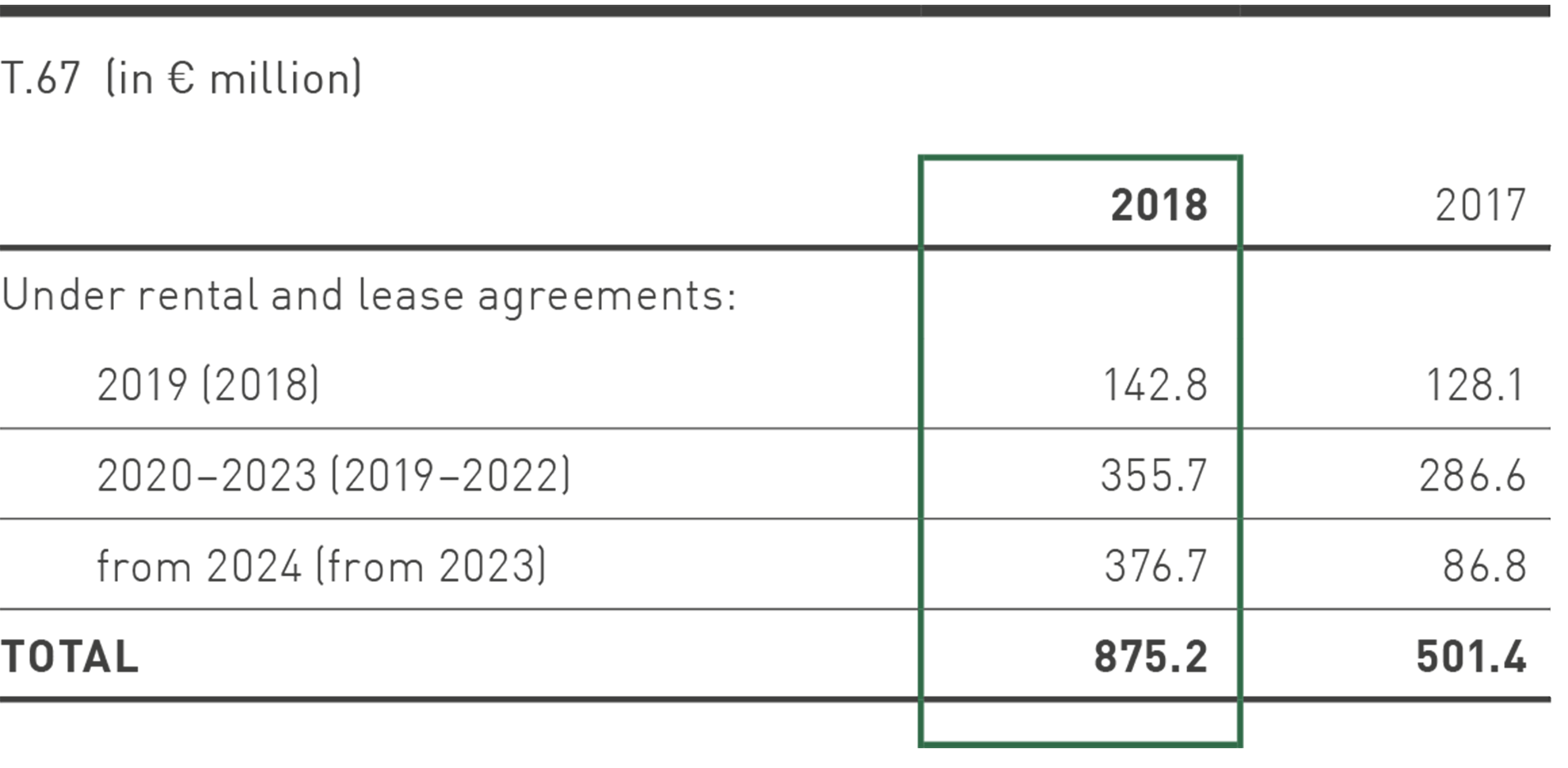

The present operating lease volume is shown in the Notes under chapter 28 (Other Financial Obligations: Obligations from Operating Lease). It is expected that the conversion effect will mainly affect the properties leased by PUMA (retail, offices and warehouses). A provisional quantitative estimate shows that in this regard as of January 1, 2019 the Group will record a right of use on the balance sheet in the amount of € 618 million and a corresponding lease liability. The provisional effects on the income statement in the financial year 2019, taking into account further lease contracts that will be entered into in 2019, show a reduction in lease expenses by around € 153 million, an increase in amortizations by around € 137 million and an increase in interest expenses by around € 26 million.

Under IAS 17, all lease payments for operating leases were recognized under Cash Flow from Operating Activities. The adoption of IFRS 16 in the financial year 2019 will lead to an increase of around € 145 million in Cash Flow from Operating Activities and an equivalent reduction in Cash Flow from Financing Activities.

The company does not anticipate the remaining standards mentioned above to have a significant impact on the consolidated financial statements.

2. Significant Consolidation, Accounting and Valuation Principles

Consolidation Principles

The consolidated financial statements were prepared as of December 31, 2018, the reporting date of the annual financial statements of the PUMA SE parent company, on the basis of uniform accounting and valuation principles according to IFRS, as applied in the EU.

Subsidiaries are companies in which the Group has existing rights that give it the current ability to direct the relevant activities. The main activities are those that have a significant influence on the profitability of the company. Control is therefore considered to exist if the Group is exposed to variable returns from its relationship with a company and has the power to govern those returns through its control of the relevant activities. As a rule, control is based on PUMA’s direct or indirect majority of the voting rights. Consolidation begins at the point in time from which control is possible. It ends when this no longer exists.

The capital consolidation of the subsidiaries acquired after January 1, 2005 is based on the acquisition method. Upon initial consolidation, the assets, debts and contingent liabilities that can be identified as part of a business combination are stated at their fair value as of the acquisition date, regardless of the non-controlling interests. At the time of the acquisition, there is a separately exercisable right to vote on whether the interests of the non-controlling shareholders are valued at fair value or at proportional net asset value.

The surplus of the acquisition costs arising from the purchase that exceeds the Group’s share in the net assets stated at fair value is reported as goodwill. If the acquisition costs are lower than the amount of the net assets stated at fair value, the difference is reported directly in the income statement.

Based on the structure of agreements with shareholders holding non-controlling interests in specific Group companies, PUMA is already the economic owner when it has a majority stake. The companies are fully included in the consolidated financial statements and, therefore, non-controlling interests are not disclosed. The present value of the capital shares attributable to the non-controlling shareholders and the present value of the residual purchase prices expected due to corporate performance are included in the capital consolidation as acquisition costs for the holdings. The costs directly attributable to the purchase and later differences of the present values of the expected residual purchase prices are recognized in the income statement in accordance with IFRS 3.

With respect to the remaining controlling interests, losses attributable to non-controlling interests are allocated to the latter even if this results in a negative balance in non-controlling interests.

Receivables within the Group are offset against internal liabilities. As a general rule, any set-off differences arising from exchange rate fluctuations are recognized in the income statement to the extent that they accrued during the reporting period. If receivables and liabilities are long-term and capital-replacing in nature, the currency difference is recognized directly in equity and under Other Comprehensive Income.

In the course of the expense and income consolidation, inter-company sales and intra-group income are offset against the expenses attributable to them. Interim profits not yet realized within the Group as well as intra-group investment income are eliminated by crediting them in the income statement.

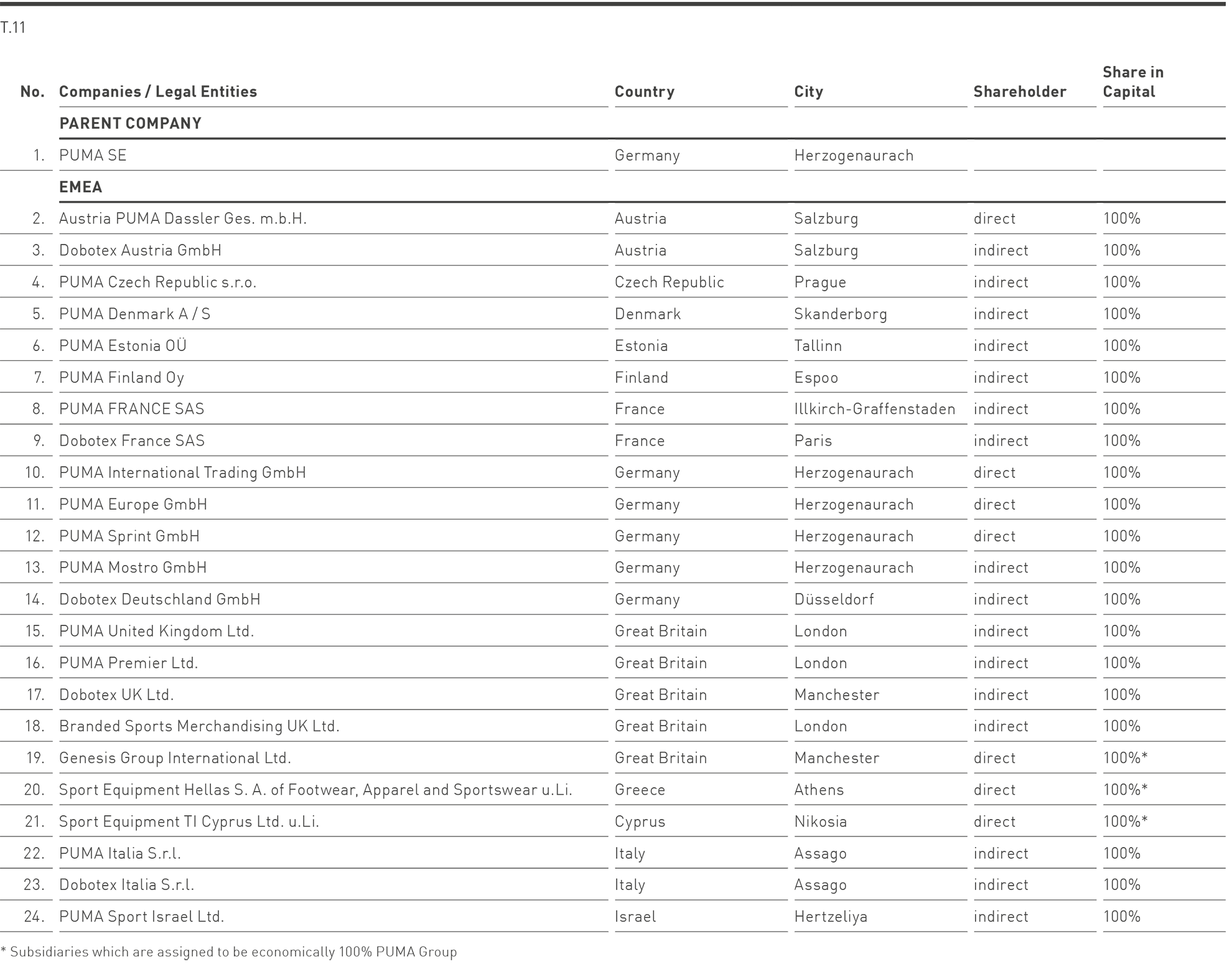

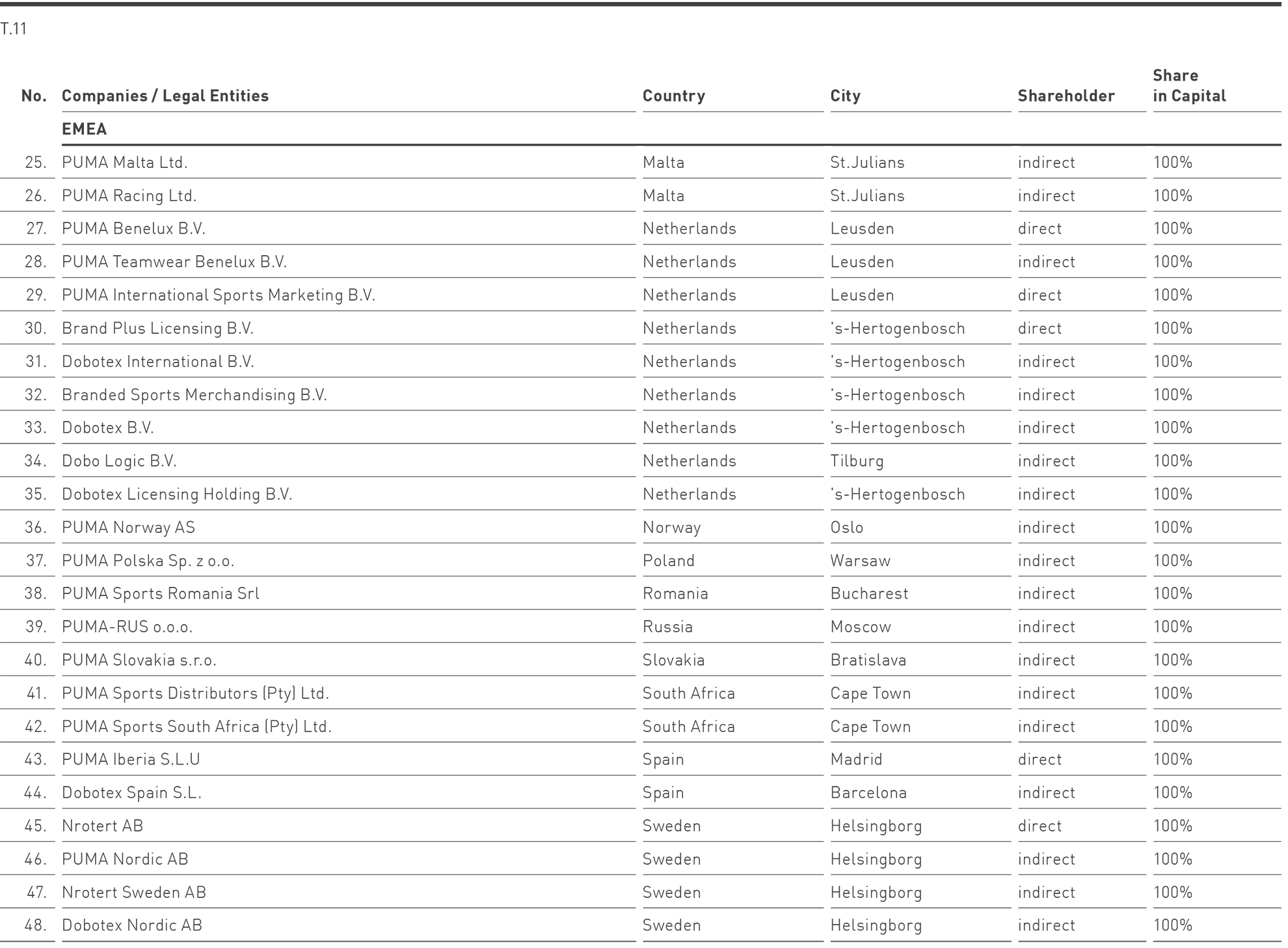

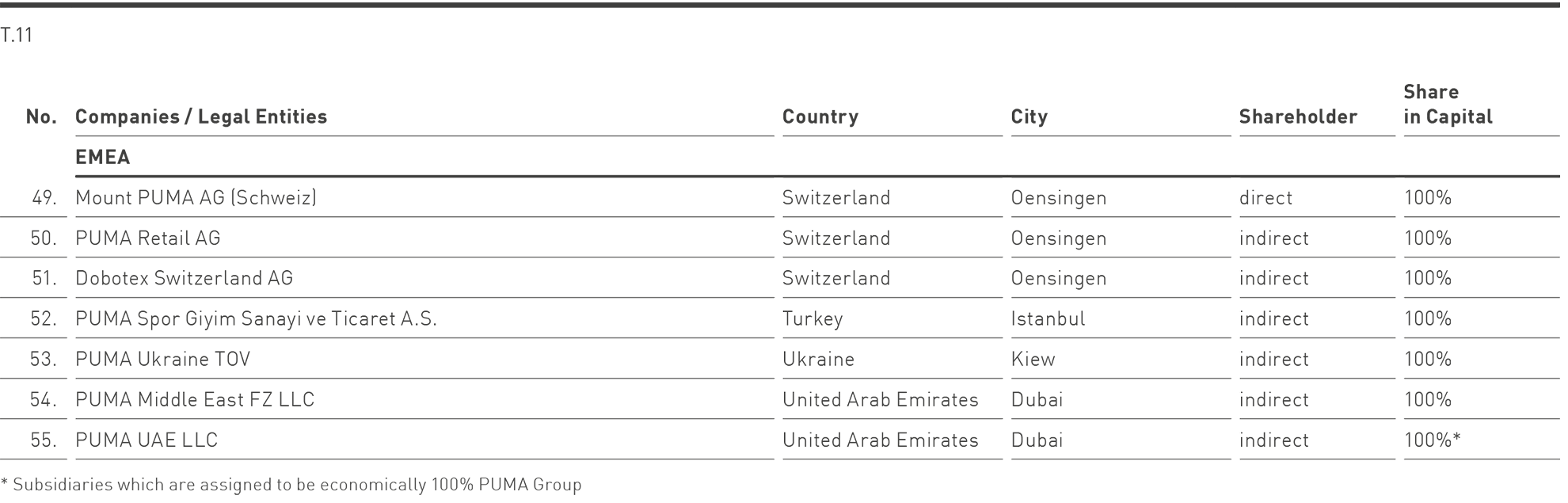

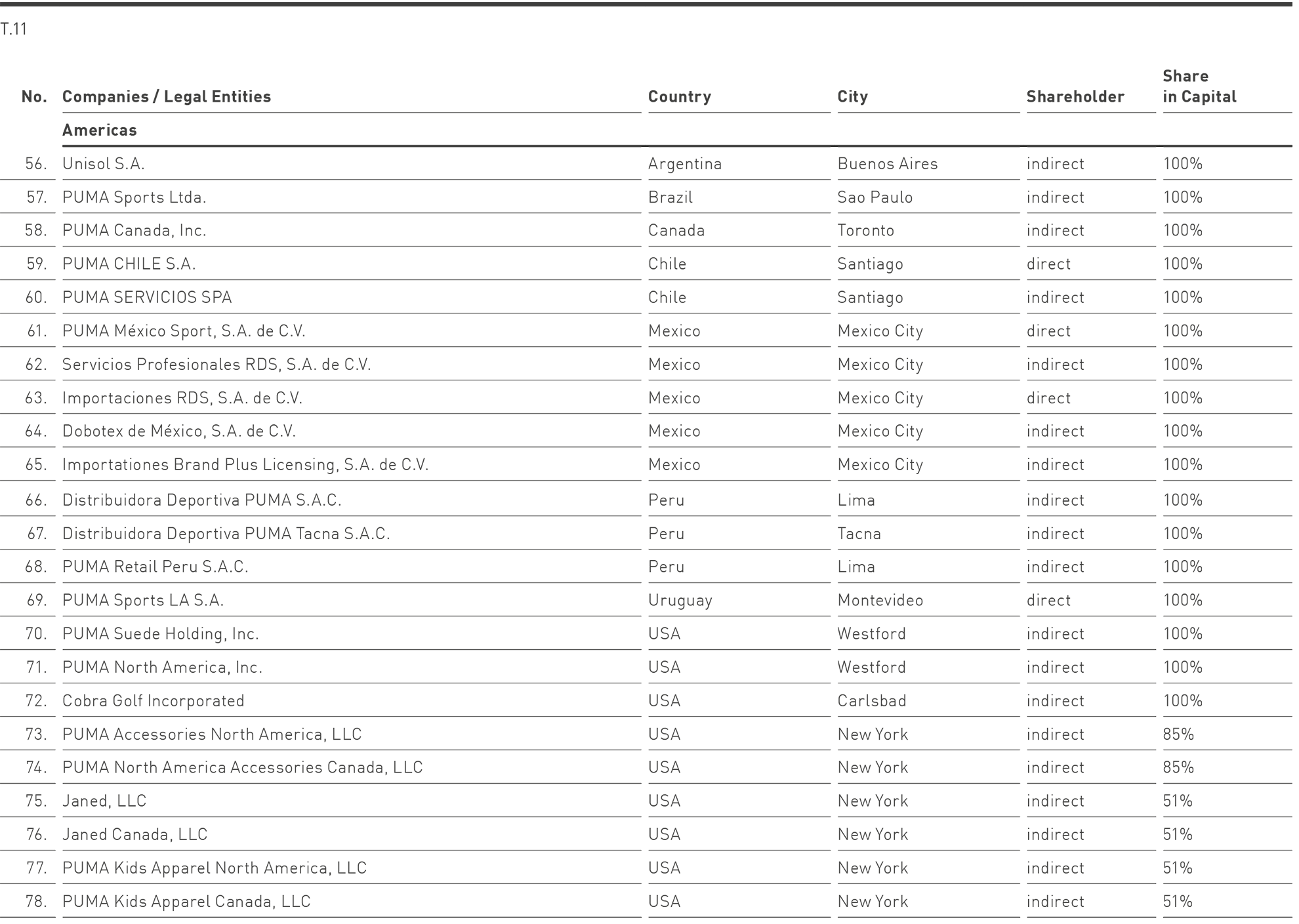

Group of consolidated companies

In addition to PUMA SE, the consolidated financial statements include all subsidiaries in which PUMA SE directly or indirectly holds existing rights that give it the current ability to direct the relevant activities. At present, control of all Group companies is based on a direct or indirect majority of voting rights. Associated companies are accounted for in the Group using the equity method.

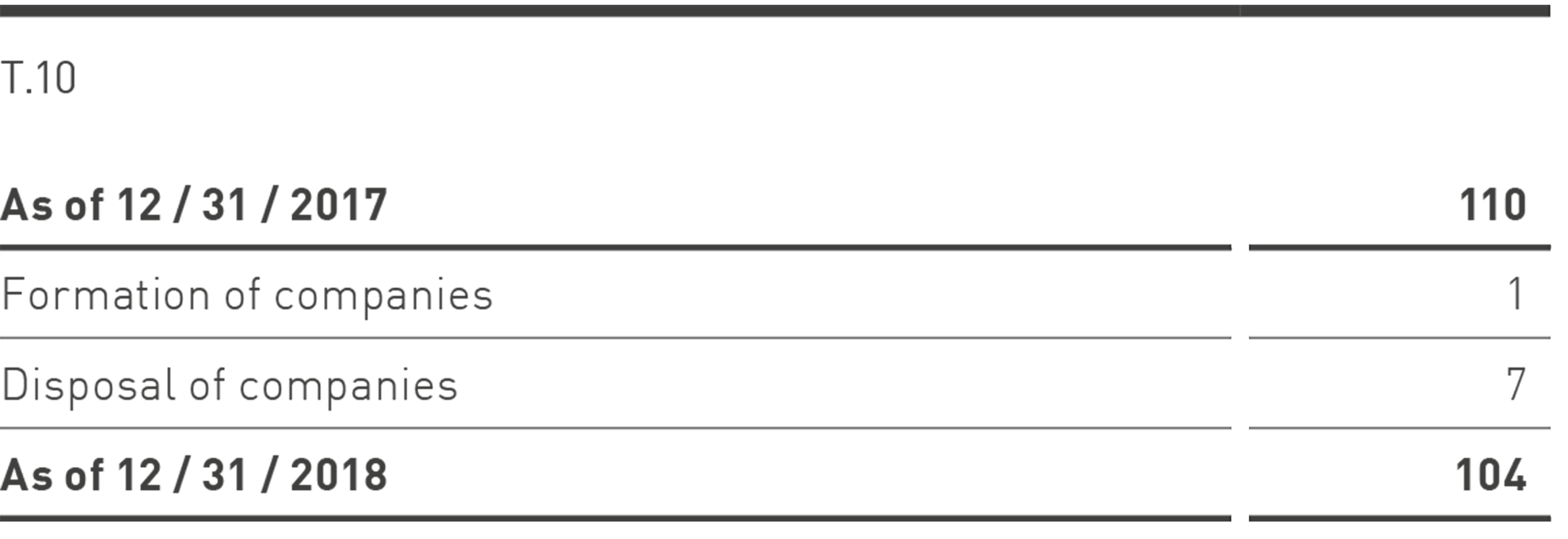

The changes in the number of Group companies (including the parent company PUMA SE) in the financial year 2018 were as follows:

The addition to the group of consolidated companies relates to the formation of PUMA Teamwear Benelux B.V., Netherlands.

The disposals in the group of consolidated companies relate to the liquidation of the companies PUMA Sport Hrvatska d.o.o., Croatia, Liberty China Holding Ltd, British Virgin Islands, Kalola Pty. Ltd., Australia and World Cat Vietnam Co. Ltd, Vietnam. In addition, PUMA Vertrieb GmbH, Germany was merged and Admiral Teamsports Ltd., Great Britain, was sold.

In addition, the shares in Wilderness Holdings Ltd., Botswana, were sold.

The changes in the group of consolidated companies did not have a significant effect on the net assets, financial position and results of operations.

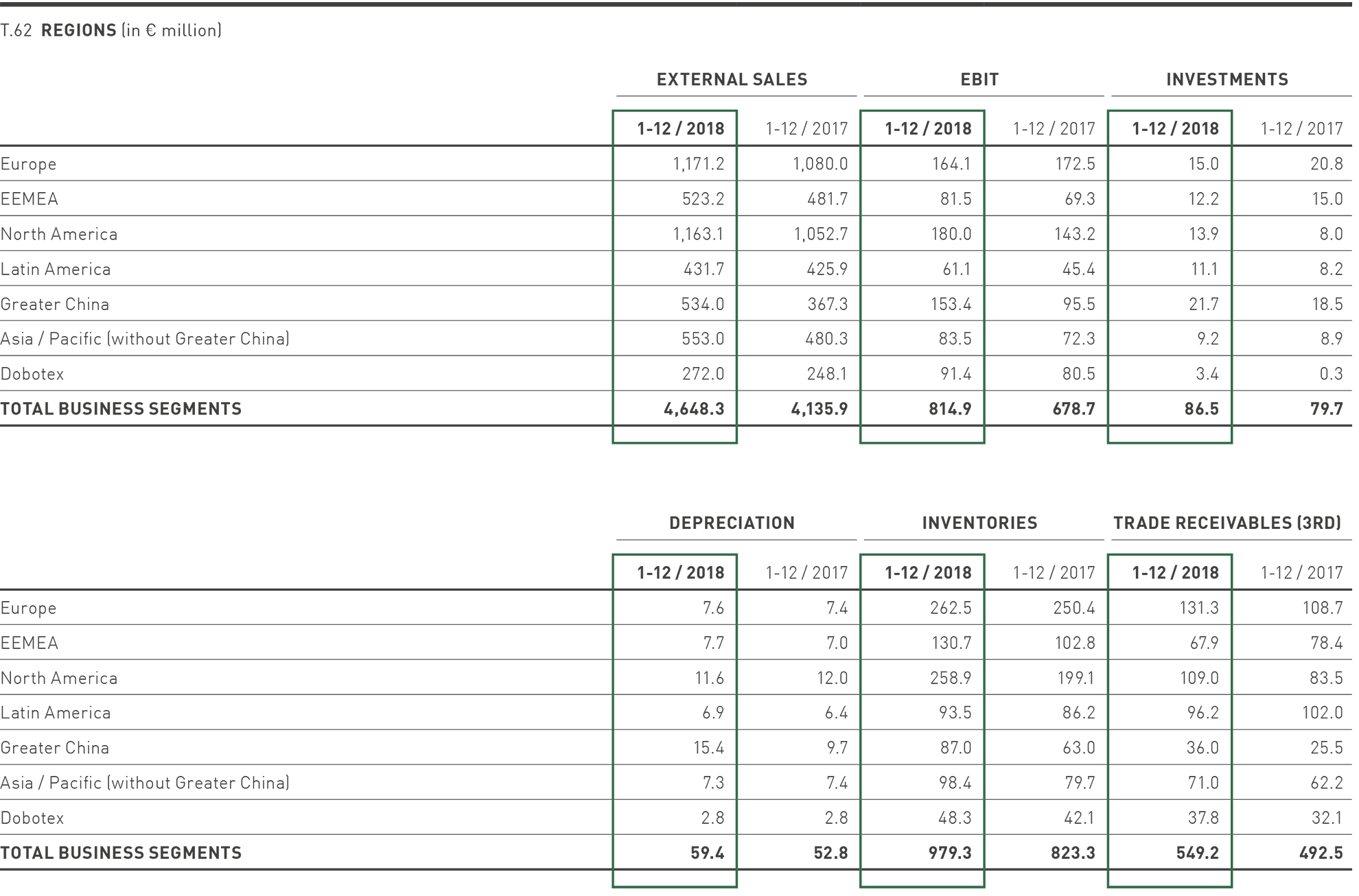

The Group companies are allocated to regions as follows:

PUMA Mostro GmbH, PUMA Sprint GmbH, PUMA International Trading GmbH and PUMA Europe GmbH have made use of the exemption under Section 264 (3) of the HGB.

Currency Conversion

As a general rule, monetary items in foreign currencies are converted in the individual financial statements of the Group companies at the exchange rate valid on the balance sheet date. Any resulting currency gains and losses are immediately recognized in the income statement. Non-monetary items are converted at historical acquisition and manufacturing costs.

The assets and liabilities of foreign subsidiaries, the functional currency of which is not the Euro, have been converted to Euros at the average exchange rates valid on the balance sheet date. Expenses and income have been converted at the annual average exchange rates. Any differences resulting from the currency conversion of net assets relative to exchange rates that had changed in comparison with the previous year, were adjusted against equity.

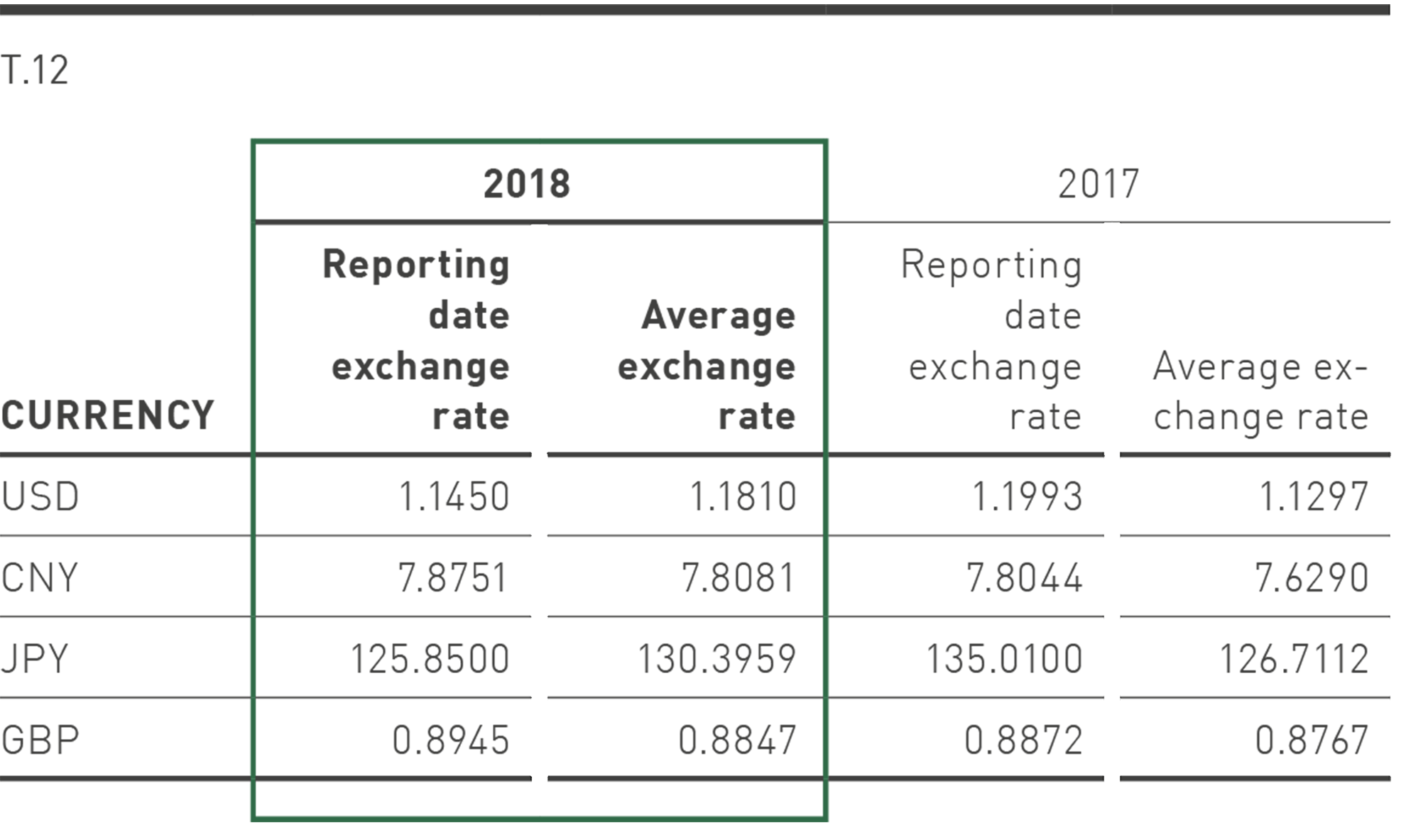

The significant conversion rates per Euro are as follows:

The currency area Argentina has been in a hyperinflationary environment since 2018. The effects on the consolidated financial statements was analyzed in accordance with IAS 29 and IAS 21.42. The application of the aforementioned standards would have resulted in an increase of € 10.3 million in assets (mainly property, plant and equipment and intangible assets as well as inventories), a decrease of € 0.2 million in liabilities and an adjustment of € 10.5 million in shareholders‘ equity. Furthermore, the operating result (EBIT) would have decreased by € 2.2 million. The effects were deemed immaterial and did not lead to an adjustment in the Group accounting.

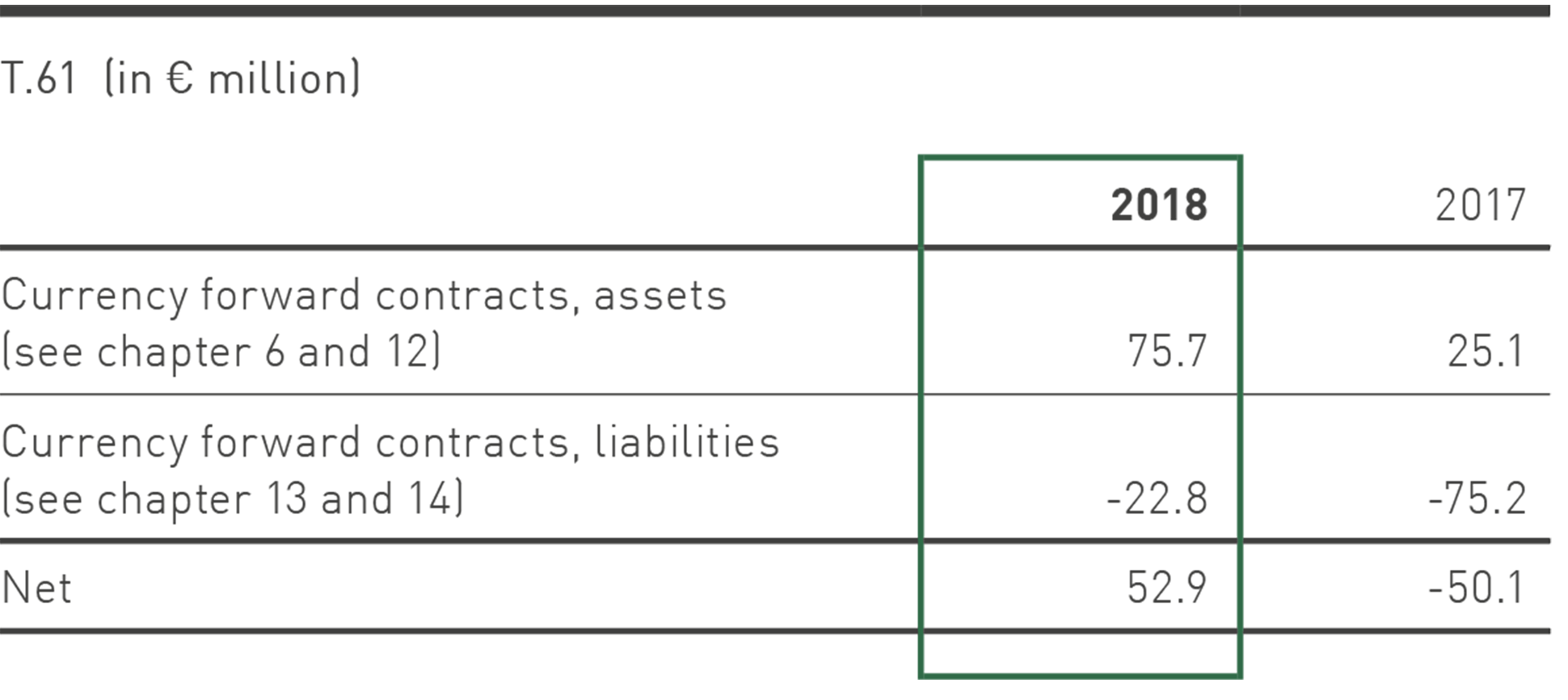

Derivative Financial Instruments / Hedge Accounting

Derivative financial instruments are recognized at fair value at the time a contract is entered into and thereafter. At the time a hedging instrument is concluded, PUMA classifies the derivatives either as hedges of a planned transaction (cash flow hedge) or as hedges of the fair value of a recognized asset or liability (fair value hedge).

At the time when the transaction is concluded, the hedging relationship between the hedging instrument and the underlying transaction as well as the purpose of risk management and the underlying strategy are documented. In addition, assessments as to whether the derivatives used in the hedge accounting compensate effectively for a change in the fair value or the cash flow of the underlying transaction are documented at the beginning of and continuously after the hedge accounting.

Changes in the market value of derivatives that are intended and suitable for cash flow hedges and that prove to be effective are adjusted against equity, taking into account deferred taxes. If there is no complete effectiveness, the ineffective part is recognized in the income statement. The amounts recognized in equity are recognized in the income statement during the same period in which the hedged planned transaction affects the income statement. If, however, a hedged future transaction results in the recognition of a non-financial asset or a liability, gains or losses previously recorded in equity are included in the initial valuation of the acquisition costs of the respective asset or liability.

Changes in the fair value of derivatives that qualify for and are designated as fair value hedges are recognized directly in the consolidated income statement, together with changes in the fair value of the underlying transaction attributable to the hedged risk. The changes in the fair value of the derivatives and the change in the underlying transaction attributable to the hedged risk are reported in the consolidated income statement under the item relating to the underlying transaction.

The fair values of the derivative instruments used to hedge planned transactions and to hedge the fair value of a recognized asset or liability are shown under other current financial assets or other current financial liabilities.

Leasing

Leases are to be classified either as finance leases or operating leases. Leases where the Company, in its capacity as the lessee, is responsible for all significant opportunities and risks that arise from the use of the lease object are treated as finance leases. All other leases are classified as operating leases. The lease payments from operating leases are recorded as an expense over the term of the contract.

Cash and Cash Equivalents

Cash and cash equivalents include cash and bank balances. To the extent that bank deposits are not immediately required to finance current assets, they are invested as risk-free fixed-term deposits, presently for a term of up to three months. The total amount of cash and cash equivalents is consistent with the cash and cash equivalents stated in the cash flow statement.

Cash and cash equivalents, which are valued at amortized cost, are subject to the value adjustment requirements under IFRS 9 “Financial Instruments.” PUMA monitors the credit risk of these financial instruments, taking into consideration the economic situation, the external credit rating and / or the premiums for credit default swaps (CDS) of other financial institutions. The credit risk from cash and cash equivalents is classified as immaterial, due to the relatively short terms and the investment-grade credit rating.

Inventories

Inventories are valued at acquisition or manufacturing costs or at the lower net realizable values derived from the selling price on the balance sheet date. The acquisition cost of merchandise is determined using an averaging method. Value adjustments are adequately recorded, depending on age, seasonality and realizable market prices, in a manner that is standard throughout the Group.

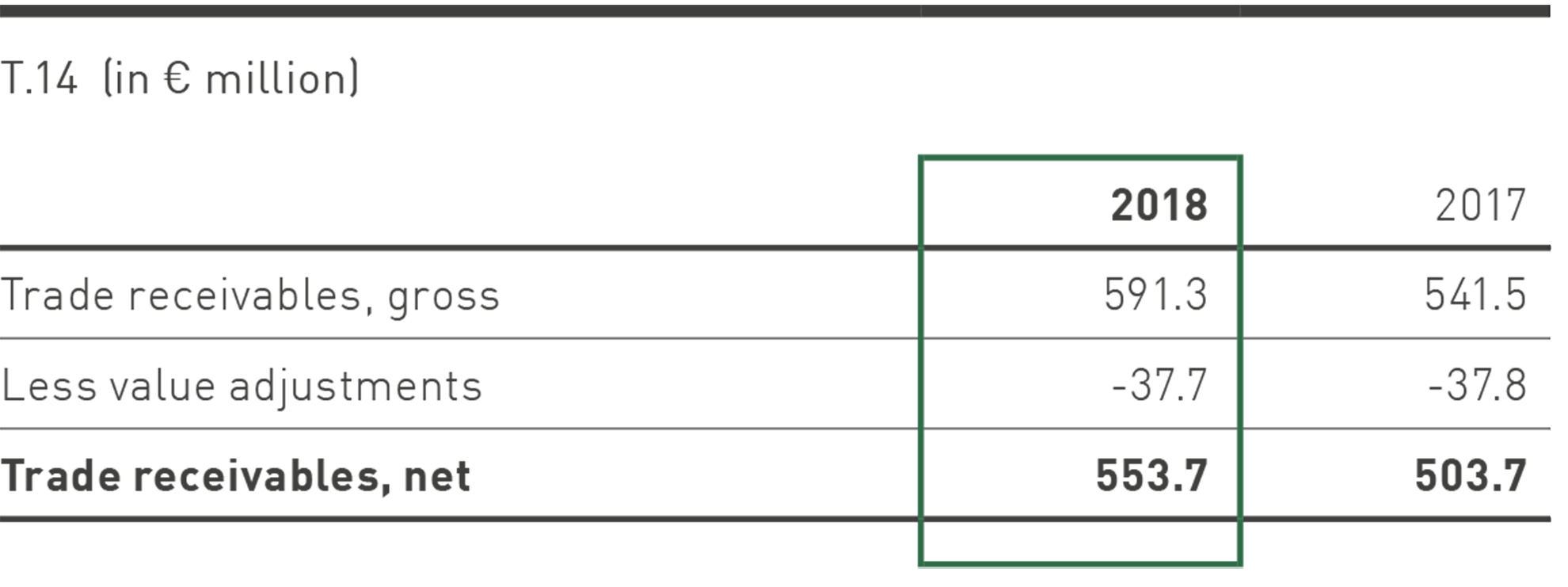

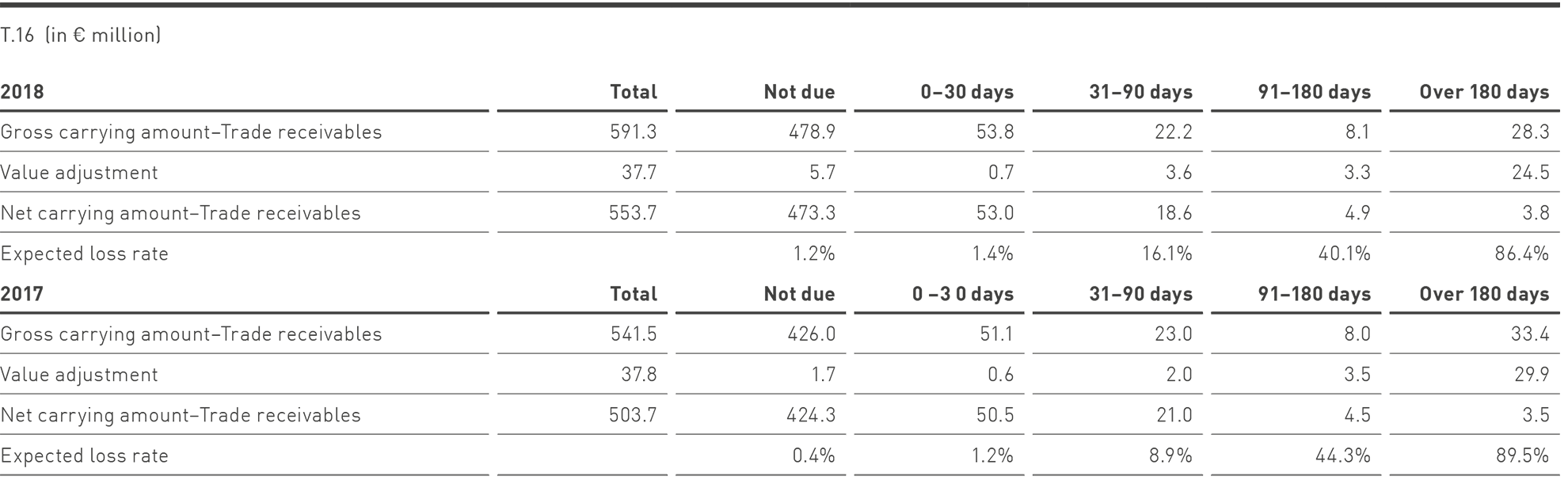

Trade Receivables

Trade Receivables are initially measured at the transaction price and subsequently at amortized cost with deduction of value adjustments. The transaction price according to IFRS 15 “Revenue from Contracts with Customers” is the amount of the consideration expected by the company for the delivery of goods or the provision of services to customers, not taking into account the amounts collected for outside third parties.

For determining the value adjustments to trade receivables, PUMA uniformly applies the simplified method in order to determine the lifetime expected credit losses in accordance with the specifications of IFRS 9 “Financial Instruments”. Therefore, trade receivables are classified by geographic region into suitable groups with shared credit risk characteristics. The expected credit losses are calculated using a matrix that presents the age structure of the receivable claims and depicts a likelihood of loss for the individual maturity bands of the claims on the basis of historic credit loss events and future-based factors. The percentage rates for the loss likelihoods are checked regularly to ensure they are up to date.

If objective indications of a credit impairment are found regarding the trade receivables of a certain customer, a detailed analysis of the specific credit risk of this customer is conducted and an individual value adjustment is recognized for the trade receivables with respect to this customer. If a credit insurance is in place, it is taken into account in the amount of the value adjustment.

Other assets

Other assets are initially stated at fair value, taking into account transaction costs, and subsequently valued at amortized costs after deduction of value adjustments.

Other Financial Assets are classified based on the business model for control and the cash flows of the financial assets. In the Group, financial assets are held exclusively under a business model that provides for “holding” the asset until maturity, in order to collect the contractual cash flows. Therefore, the subsequent valuation of the Other Financial Assets is always carried out at amortized cost. The business model “trading” and the category “measured at fair value through profit or loss” (FVPL) are not used.

The non-current assets contain loans and other assets. Non-interest bearing non-current assets are discounted in principle at cash value if the resulting effect is significant.

Non-Current Investments

The investments recognized under Non-Current Financial Assets belong to the category “measured at fair value through other comprehensive income” (FVOCI), since these investments are held over the long term for strategic reasons.

All purchases and disposals of non-current investments are recorded on the trade date. Non-current investments are initially recognized at fair value plus transaction costs. They are also recognized at fair value in subsequent periods if this can be reliably determined. Unrealized gains and losses are recognized in Other Comprehensive Income, taking into account deferred taxes. The gain or loss on disposal of long-term investments is transferred to retained earnings.

The category “measured at fair value through profit or loss” (FVPL) is not used in the Group.

Property, Plant and Equipment

Property, plant and equipment are stated at acquisition costs, net of accumulated depreciation. The depreciation period depends on the expected useful life of the respective item. The straight-line method of depreciation is applied. The useful life depends on the type of the assets involved. Buildings are subject to a useful life of between ten and fifty years, and a useful life of between three to ten years is assumed for movable assets. The acquisition costs of property, plant and equipment also include interest on borrowings in accordance with IAS 23, insofar as these accrue and the effect is significant.

Repair and maintenance costs are recorded as an expense as of the date on which they were incurred. Substantial improvements and upgrades are capitalized to the extent that the criteria for capitalization of an asset item apply.

As a general rule, lease objects, the contractual basis of which is to be classified as a finance lease, are shown under property, plant and equipment; initially they are accounted for at fair value or the lower present value of the minimum lease payments and net of accumulated depreciation in subsequent accounting periods.

Goodwill

Goodwill resulting from a business acquisition is calculated based on the difference between the purchase price and the fair value of the acquired asset and liability items. Goodwill from acquisitions is largely attributable to the intangible infrastructure acquired and the associated opportunity to make a positive contribution to corporate value.

Goodwill amounts are allocated to the Group’s cash-generating units that are expected to benefit from the synergy effects resulting from the business combination.

An impairment test of goodwill per cash-generating unit (usually the countries) is performed once a year as well as whenever there are indicators of impairment and can result in an impairment loss. There is no reversal of an impairment loss for goodwill. See chapter 10 for further information, in particular regarding the assumptions used for the calculation.

Other Intangible Assets

Acquired intangible assets largely consist of concessions, intellectual property rights and similar rights. These are measured at acquisition costs, net of accumulated depreciation. The useful life of intangible assets is between three and ten years. Depreciation is carried out on a straight-line basis.

If the capitalization requirements of IAS 38.57 “Intangible Assets” are met cumulatively, expenses in the development phase for internally generated intangible assets are capitalized at the time they arise. In subsequent periods, internally generated intangible assets and acquired intangible assets are measured at cost less accumulated amortization and impairment losses. In the Group, own work capitalized is generally depreciated on a straight-line basis over a useful life of 3 years.

The item also includes acquired trademark rights, which are assumed to have an indefinite useful life in light of the history of the brands and due to the fact that the brands are continued by PUMA.

Impairment of Assets

Intangible assets with an indefinite useful life are not written down according to schedule, but are subjected to an annual impairment test. Property, plant and equipment and other intangible assets with finite useful lives are tested for impairment if there is any indication of impairment in the value of the asset concerned. In order to determine whether there is a requirement to record the impairment of an asset, the recoverable amount of the respective asset (the higher amount of the fair value less costs to sell and value in use) is compared with the carrying amount of the asset. If the recoverable amount is lower than the carrying amount, the difference is recorded as an impairment loss. The test for impairment is performed, if possible, at the level of the respective individual asset, otherwise at the level of the cash-generating unit. Goodwill, on the other hand, is tested for impairment only at the cash-generating unit level. If it is determined within the scope of the impairment test that an asset needs to be written down, then the goodwill, if any, of the cash-generating unit is written down initially and, in a second step, the remaining amount is distributed proportionately over the remaining assets. If the reason for the recorded impairment no longer applies, a reversal of impairment loss is recorded to the maximum amount of the amortized cost. There is no reversal of an impairment loss for goodwill.

Impairment tests are performed using the discounted cash flow method. For determining the fair value less costs to sell and value in use, the expected cash flows are based on corporate planning data. Expected cash flows are discounted using an interest rate in line with market conditions.

The impairment test for trademarks with an indefinite useful life is subjected to an impairment test based on the relief-from-royalty method within the financial year or when the occasion arises. If indications of a value impairment of a self-used trademark should arise, the recoverability of the trademark is not only valued individually using the relief-from-royalty method, but the recoverable amount of the cash-generating unit to which the trademark is to be allocated is determined.

See chapter 10 for further information, in particular regarding the assumptions used for the calculation.

Holdings in associated companies

Associated companies represent shareholdings, over which PUMA has a significant influence, but which do not qualify as subsidiaries or joint ventures. Significant influence is generally assumed when PUMA holds, directly or indirectly, at least 20 percent, but less than 50 percent, of the voting rights.

Holdings in associated companies are accounted for using the equity method. Here, the shares are initially recognized at their acquisition cost and are subsequently adjusted for the pro rata changes in the Company’s net assets that are attributable to PUMA. Any recognized goodwill is shown in the carrying amount of the associated company.

Within the scope of the impairment test, the carrying amount of a company valued at equity is compared with its recoverable amount provided that there is an indication that the asset has decreased in value. If the recoverable amount is lower than the carrying amount, the difference is recorded as an impairment loss. If the reasons for the previously recorded impairment no longer apply, a write-up is recognized in the income statement.

Financial Debt, Other Financial Liabilities and Other Liabilities

As a general rule, these items are recognized at their acquisition cost, taking into account transaction costs and subsequently measured at amortized cost. Non-interest or low-interest-bearing liabilities with a term of at least one year are recognized at present value, taking into account an interest rate in line with market conditions, and are compounded until their maturity at their repayment amount. Liabilities from finance lease agreements are recorded as of the beginning of the lease transaction at the amount of the present value of the minimum lease amount, or at the lower fair value, and are adjusted by the repayment amount of the lease installments.

The category “measured at fair value through profit or loss” (FVPL) is not used in the Group in relation to financial liabilities.

As a general rule, current financial liabilities also include those long-term loans that that have a maximum residual term of up to one year.

Provisions for Pensions and Similar Obligations

In addition to defined benefit plans, some companies apply defined contribution plans, which do not result in any additional pension commitment other than the current contributions. The pension provision under defined benefit plans is generally calculated using the projected unit credit method. This method takes into account not only known pension benefits and pension rights accrued as of the reporting date, but also expected future salary and pension increases. The defined benefit obligation (DBO) is calculated by discounting expected future cash outflows at the rate of return on senior, fixed-rate corporate bonds. The currencies and maturity periods of the underlying corporate bonds are consistent with the currencies and maturity periods of the obligations to be satisfied. In some of the plans, the obligation is accompanied by a plan asset. In that case, the pension provision shown is reduced by the plan asset.

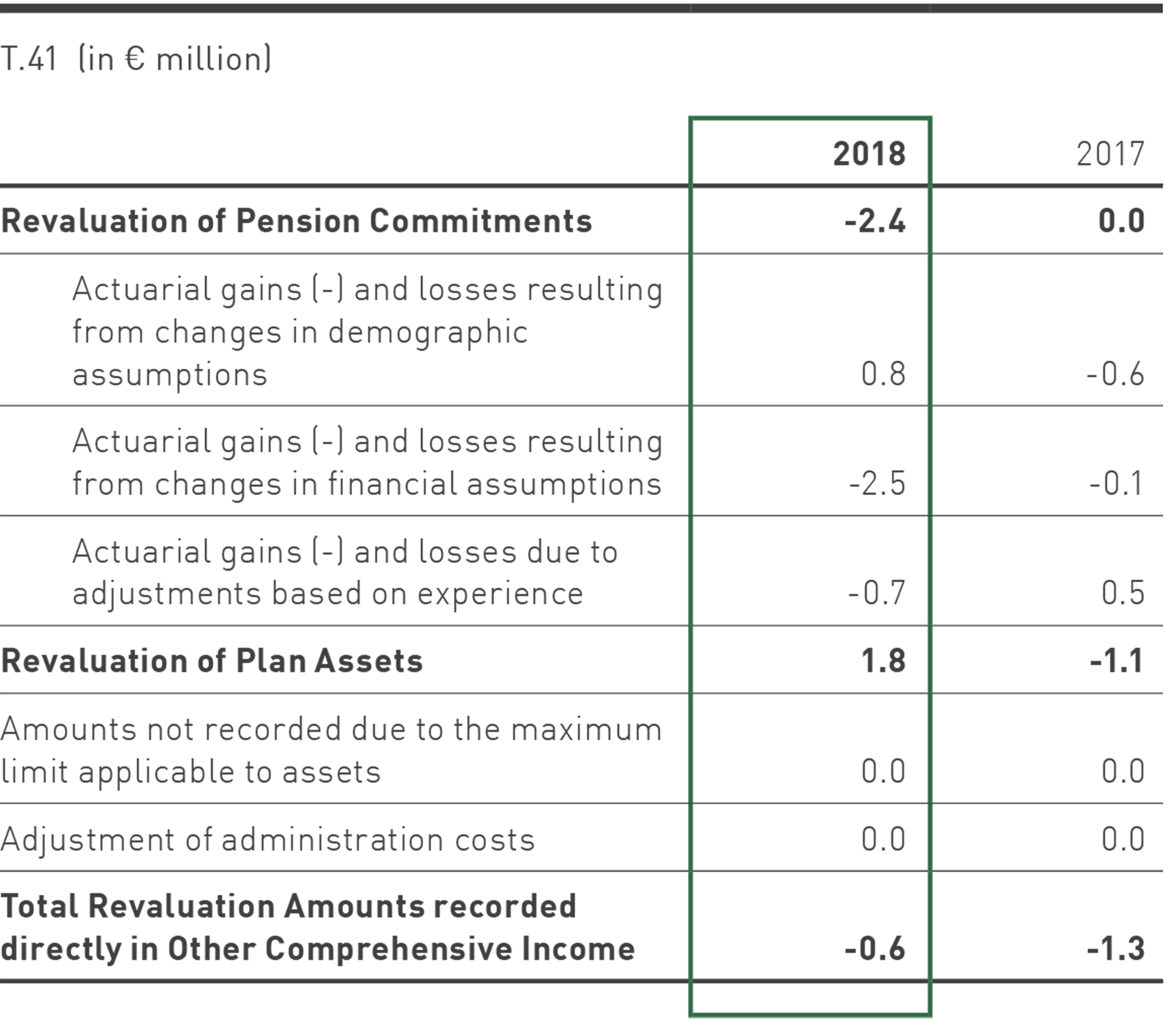

Revaluations, consisting of actuarial profits and losses, changes resulting from use of the asset ceiling and return on plan assets (without interest on the net debt) are immediately recorded under Other Comprehensive Income. The revaluations recorded in Other Comprehensive Income are part of the retained earnings and are no longer reclassified into calculation of profit and loss. Past service costs are recorded as an expense if changes are made to the plan.

Other Provisions

Provisions are recognized if the Group, as a result of a past event, has a current obligation and this obligation is likely to result in an outflow of resources with economic benefits, the amount of which can be reliably estimated. The provisions are recognized at their settlement value as determined on the basis of the best possible assessment and are not offset by income. Provisions are discounted if the resulting effect is significant.

Provisions for the expected expenses from warranty obligations pursuant to the respective national sales contract laws are recognized at the time of sale of the relevant products, according to the best estimate in relation to the expenditure needed in order to fulfill the Group’s obligation.

Provisions are also recognized to account for onerous contracts. An onerous contract is assumed to exist where the unavoidable costs for fulfilling the contract exceed the economic benefit arising from this contract.

Provisions for restructuring measures are also recorded if a detailed, formal restructuring plan has been prepared, which has created a justified expectation that the restructuring measures will be carried out by those concerned due to its implementation starting or its major components being announced.

Treasury shares

Treasury stock is deducted from equity at its market price as of the date of acquisition, plus incidental acquisition costs. Pursuant to the authorization of the Annual General Meeting, treasury stock can be repurchased for any authorized purpose, including the flexible management of the Company’s capital requirements.

Management Incentive Programs

PUMA uses cash-settled share-based payments and key performance indicator-based long-term incentive programs.

For share-based remunerations with cash compensation, a liability is recorded for the services received, and measured with its fair value upon recognition. Until the debt is cleared, its fair value is recalculated on every balance sheet date and on the settlement date and all changes to the fair value are recognized in the income statement.

During the three-year term of the respective programs, the medium-term targets of the PUMA Group with regard to EBIT, cash flow and gross profit margin are determined for key figure-based compensation procedures and recognized in the income statement with their respective degree of target achievement.

Recognition of Sales Revenues

The Group recognizes sales revenues from the sale of sporting goods. The sales revenues are measured at fair value of the consideration to which the Group expects to be entitled from the contract with the customer, taking into account returns, discounts and rebates. Amounts collected on behalf of third parties are not included in the sales revenues. The Group records sales revenues at the time when PUMA fulfills its performance obligation to the customer and has transferred the promised product to the customer.

The Group sells footwear, apparel and accessories both to wholesalers and directly to customers through its own retail stores. Meanwhile, the sales-related warranty services cannot be purchased separately and do not lead to services that go beyond the assurance of the specifications at the time of the transfer of risk. Accordingly, the Group records warranties in the balance sheet in conformity with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

In the case of sales of products to wholesalers, the revenue is recorded at the date on which the right of disposal for the products is transferred to the customer, in other words, when the products have been shipped to the specific location of the wholesaler (delivery). After delivery, the wholesaler bears the inventory risk and has full right of disposal over the manner and means of distribution and the selling price of the products. In the case of sales to end customers in the Group’s own retail stores, the sales revenues are recorded at the date when the right of disposal of the products is transferred to the end customer, in other words, the date on which the end customer buys the products in the retail shop. The payment of the purchase price is due immediately with the purchase of the products by the customer.

Under certain conditions and according to the contractual stipulations, the customer has the ability to exchange products or return them for a credit. The amount of the expected returns is estimated on the basis of experience and is deducted from sales revenues by a provision for returns. The asset value of the right arising from the product return claim is recorded under Inventories, and leads to a corresponding reduction of Cost of Sales.

Royalty and Commission Income

The Group records Royalty and Commission Income from the licensing of trademark rights to third parties. Income from royalties is recognized in the income statement in accordance with the statements to be submitted by the license holders. In certain cases, values must be estimated in order to permit accounting on an accrual basis. Commission income is invoiced if the underlying purchase transaction is classified as realized.

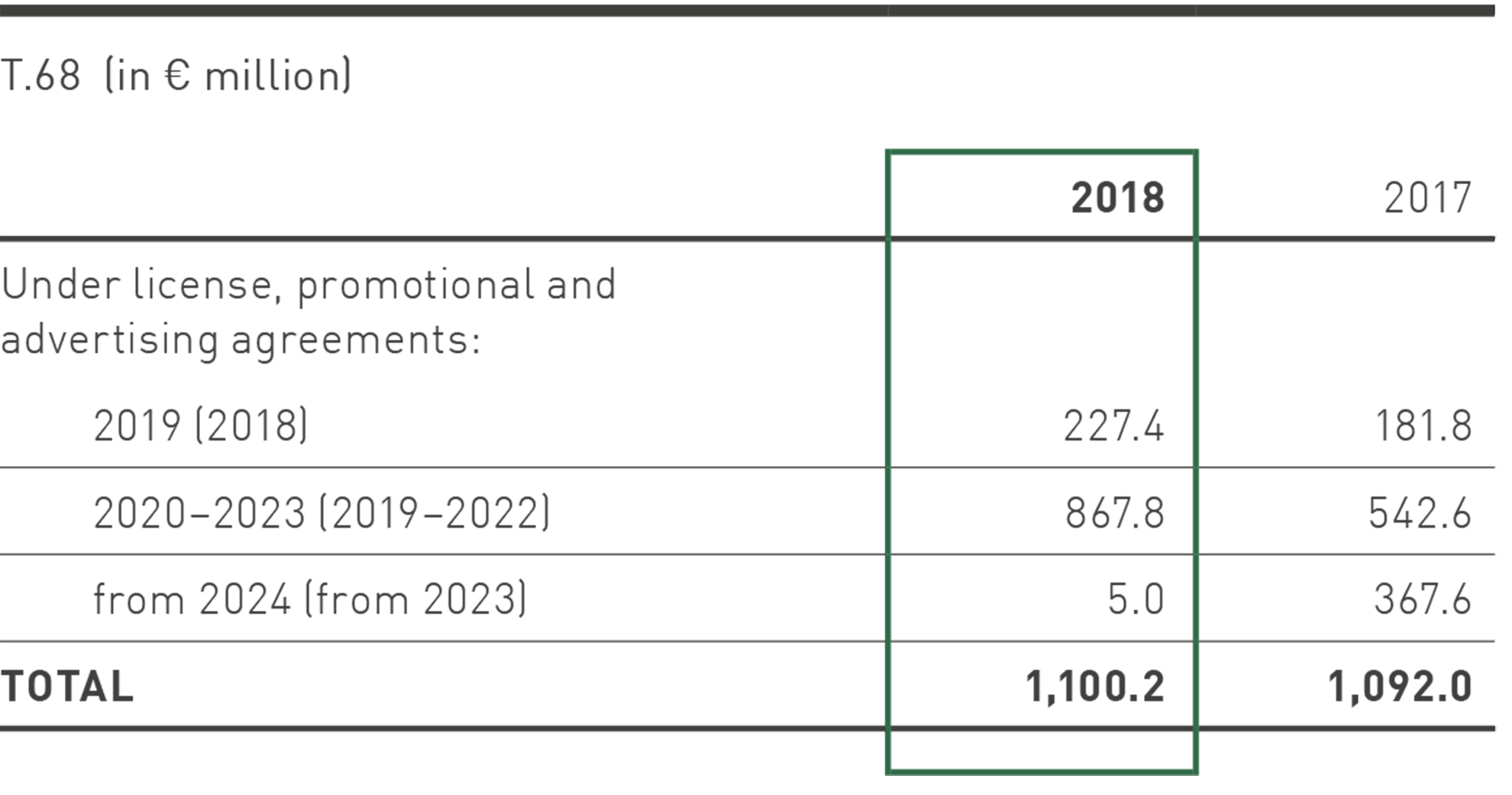

Advertising and Promotional Expenses

Advertising expenses are recognized in the income statement as of the date of their accrual. As a general rule, promotional expenses stretching over several years are recognized as an expense over the contractual term on an accrual basis. Any expenditure surplus resulting from this allocation of expenses after the balance sheet date are recognized in the form of an impairment of assets or a provision for anticipated losses in the financial statements.

Product Development

PUMA continuously develops new products in order to meet market requirements and market changes. Research costs are expensed in full at the time they are incurred. Development costs are also recognized as an expense when they do not meet the recognition criteria of IAS 38 “Intangible Assets”.

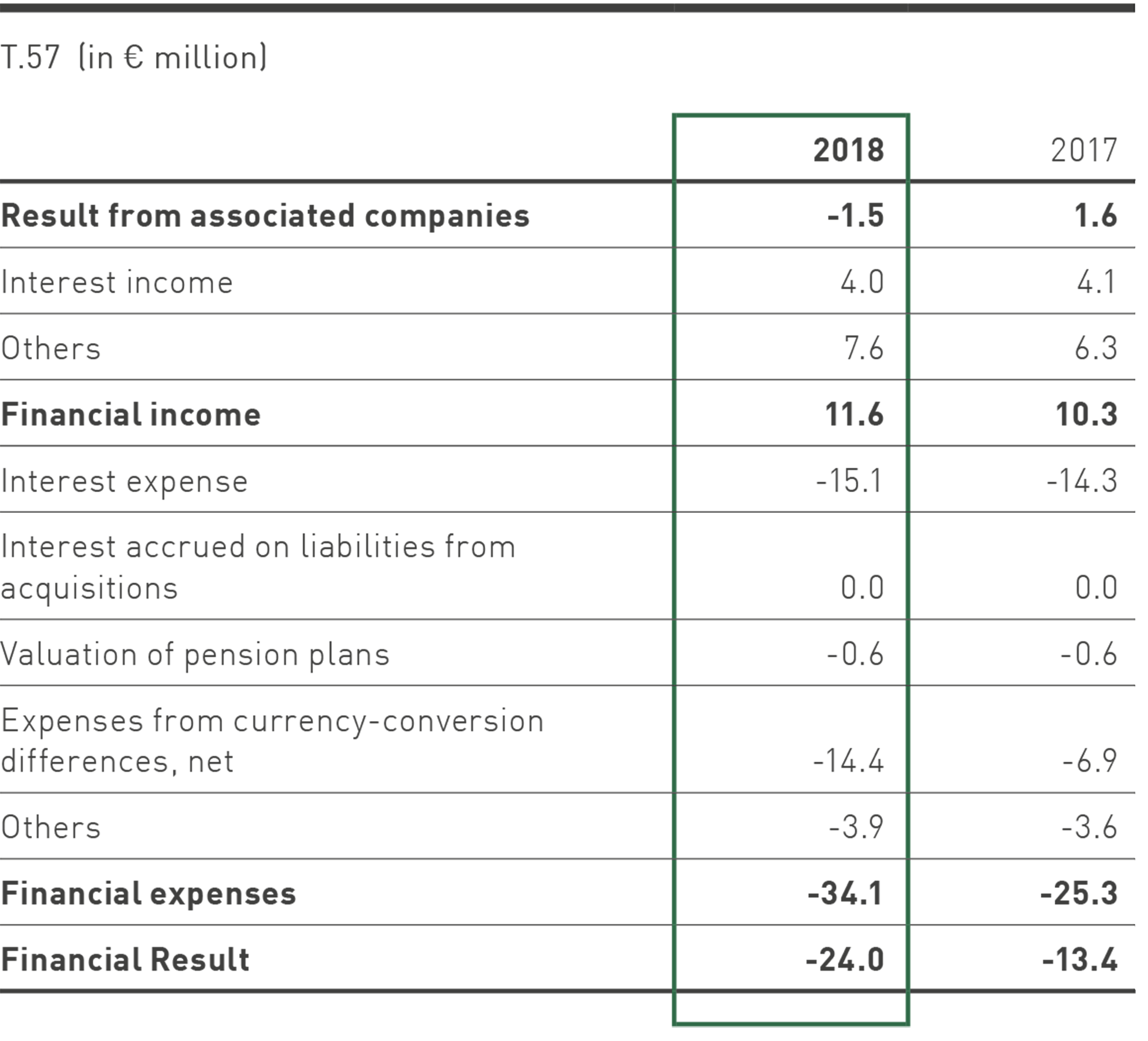

Financial Result

The financial result includes the results from associated companies as well as interest income from financial investments and interest expenses from loans and in connection with financial instruments. Financial results also include interest expenses from discounted non-current liabilities and from pension provisions that are associated with acquisitions of business enterprises or arise from the valuation of pension commitments.

Exchange rate effects that can be directly allocated to an underlying transaction are shown in the respective income statement item.

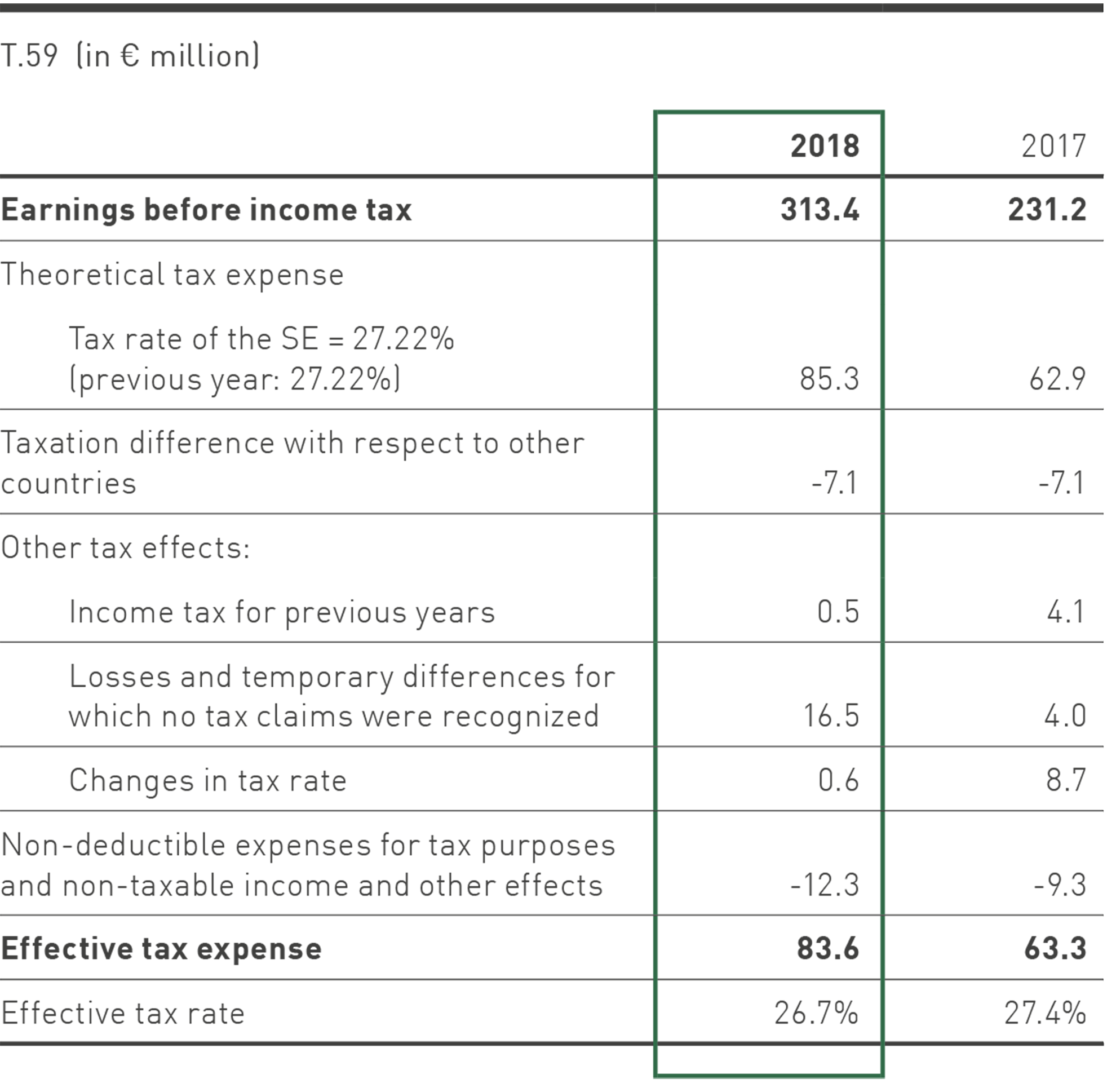

Income Taxes

Current income taxes are determined in accordance with the tax regulations of the respective countries in which the Company conducts its operations.

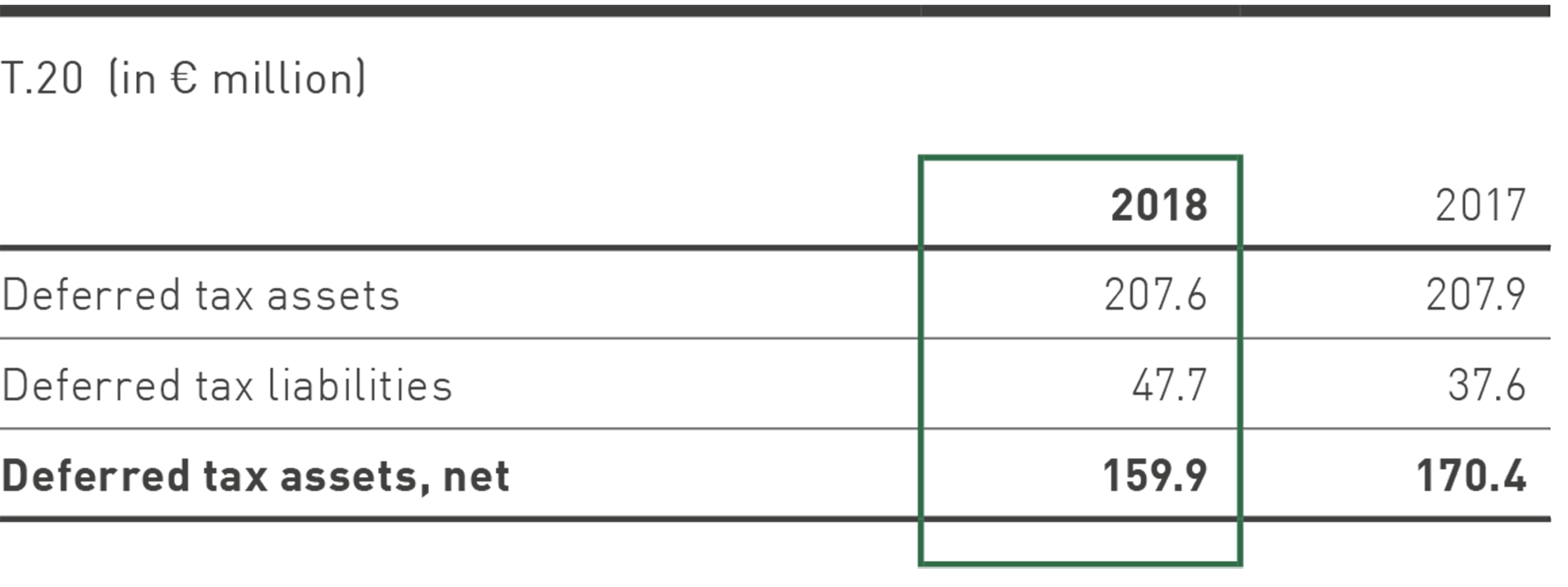

Deferred taxes

Deferred taxes resulting from temporary valuation differences between the IFRS and tax balance sheets of individual Group companies and from consolidation procedures are charged to each taxable entity and shown either as deferred tax assets or deferred tax liabilities. Deferred tax assets may also include claims for tax reductions that result from the expected utilization of existing losses carried forward to subsequent years and which is sufficiently certain to materialize. Deferred tax assets or liabilities may also result from accounting treatments that do not affect the income statement. Deferred taxes are calculated on the basis of the tax rates that apply to the reversal in the individual countries and that are in force or adopted as of the balance sheet date.

Deferred tax assets are shown only to the extent that the respective tax advantage is likely to materialize. Value adjustments are recognized on the basis of the past earnings situation and the business expectations for the foreseeable future, if this criterion is not fulfilled.

Assumptions and Estimates

The preparation of the consolidated financial statements requires some assumptions and estimates that have an impact on the amount and disclosure of the recognized assets and liabilities, income and expenses, as well as contingent liabilities. The assumptions and estimates are based on premises, which in turn are based on currently available information. In individual cases, the actual values may deviate from the assumptions and estimates made. Consequently, future periods involve a risk of adjustment to the carrying amount of the assets and liabilities concerned. If the actual development differs from the expectation, the premises and, if necessary, the carrying amounts of the relevant assets and debts are adjusted with an effect on profit or loss.

All assumptions and estimates are continuously reassessed. They are based on historical experiences and other factors, including expectations regarding future global and industry-related trends that appear reasonable under the current circumstances. Assumptions and estimates are made in particular with regard to evaluating the control of companies with non-controlling shares and in the measurement of goodwill and brands, pension obligations, derivative financial instruments and taxes. The most significant forward-looking assumptions and sources of estimation and uncertainty as of the reporting date concerning the above-mentioned items are discussed below.

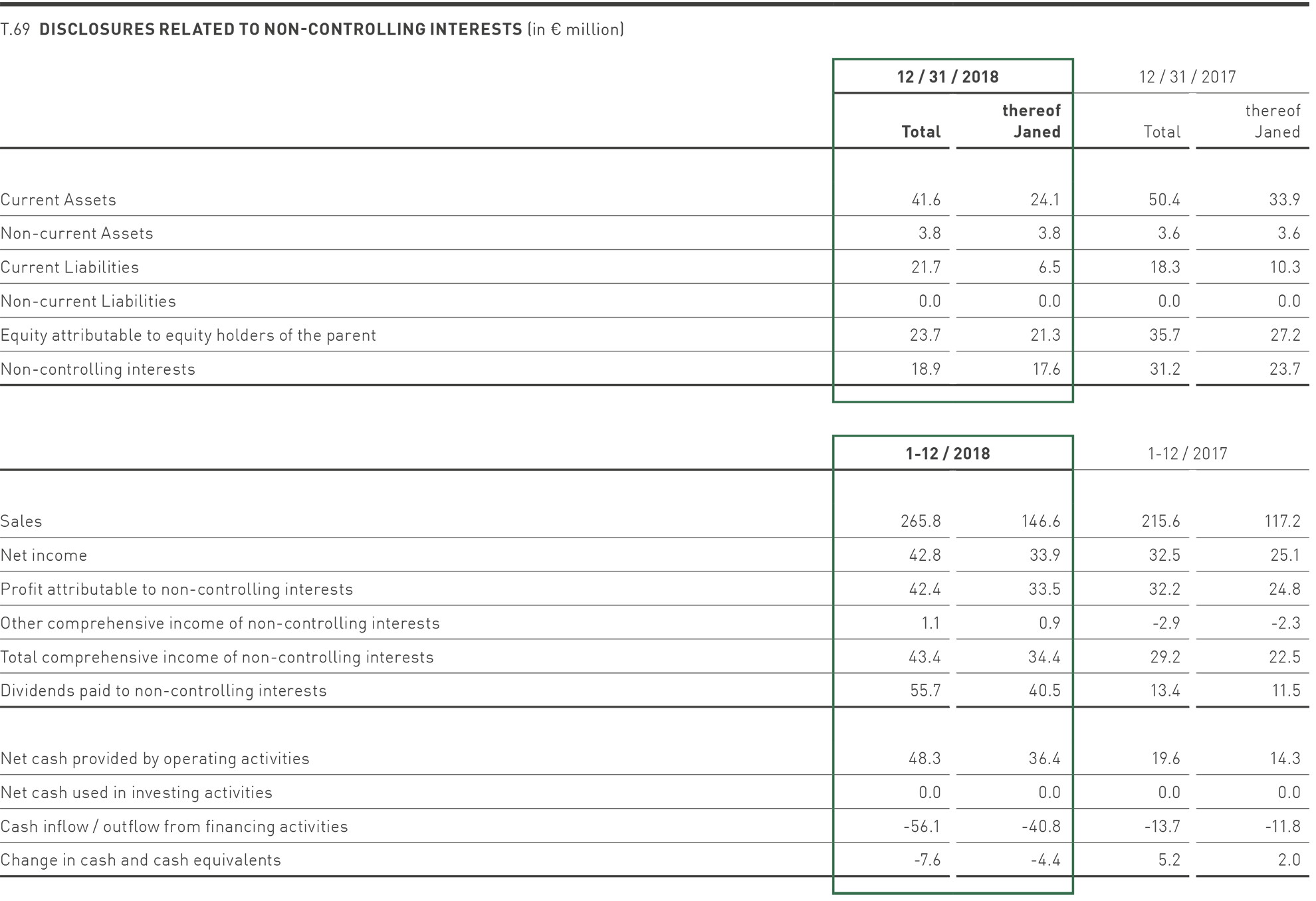

Evaluation of control of companies with non-controlling interests

The Group holds 51% of the capital of Janed LLC, Janed Canada LLC, PUMA Kids Apparel North America LLC and PUMA Kids Apparel Canada LLC and 85% of the capital of PUMA Accessories North America LLC and PUMA North America Accessories Canada LLC. With regards to these companies, the profit participation deviates from the existing capital shares in favour of the identical non-controlling shareholder. PUMA, on the other hand, receives increased license fees.

The contractual agreements of these companies stipulate that PUMA has the majority of the voting rights in the general meeting and thus has the power over these companies. PUMA is exposed to fluctuating returns from sales-related license fees and controls the relevant activities of the companies. Accordingly, the companies are included in the consolidated financial statements as subsidiaries by way of full consolidation, with non-controlling interests reported.

Goodwill and Brands

A review of the impairment of goodwill is based on the calculation of the value in use. In order to calculate the value in use, the Group must estimate the future cash flows from those cash-generating units to which the goodwill is allocated. To this end, the data used were from the three-year plan, which is based on forecasts of the overall economic development and the resulting industry-specific consumer behavior. Another key assumption concerns the determination of an appropriate interest rate for discounting the cash flow to present value (discounted cash flow method). Trademarks are valued using the relief-from-royalty method taking into account an unchanged royalty rate of 8%. See chapter 10 for further information, in particular regarding the assumptions used for the calculation.

Pension Obligations

Pension obligations are determined using an actuarial calculation. This calculation is contingent on a large number of factors that are based on assumptions and estimates regarding the discount rate, the expected return on plan assets, future wage and salary increases, mortality and future pension increases. Due to the long-term nature of the commitments made, the assumptions are subject to significant uncertainties. Any change in these assumptions has an impact on the carrying amount of the pension obligations. At the end of each year, the Group determines the discount rate applied to determine the present value of future payments. This discount rate is based on the interest rates of corporate bonds with the highest credit rating that are denominated in the currency in which the benefits are paid and the maturity of which corresponds to that of the pension obligations. See chapter 15 for further information, in particular regarding the parameters used for the calculation.

Taxes

Tax items are determined taking into account the various prevailing local tax laws and the relevant administrative opinions and, due to their complexity, may be subject to different interpretations by persons subject to tax on the one hand and the tax authorities on the other hand. Differing interpretations of tax laws may result in subsequent tax payments for past years; depending on the management’s assessment, these differing opinions may be taken into account.

The recognition of deferred taxes, in particular with respect to tax losses carried forward, requires that estimates and assumptions be made concerning future tax planning strategies as well as the expected timing and amount of future taxable income. The taxable income from the relevant corporate planning is derived for this judgment. This takes into account the past financial position and the business development expected in the future. Deferred tax assets on losses carried forward are recorded in the event of companies incurring a loss only if it is highly probable that future positive income will be achieved that can be offset against these tax losses carried forward. Please see chapter 8 for further information and detailed assumptions.

Derivative Financial Instruments

The assumptions used for estimating derivative financial instruments are based on the prevailing market conditions as of the balance sheet date and thus reflect the fair value. See chapter 25 for further information.

3. Cash and Cash Equivalents

As of December 31, 2018, the Group has € 463.7 million (previous year: € 415.0 million) in cash and cash equivalents. The average effective interest rate of financial investments was 0.8% (previous year: 0.5%). There are no restrictions on disposition.

4. Inventories

Inventories are allocated to the following main groups:

The table shows the carrying amounts of the inventories net of value adjustments. Of the value adjustments of € 64.4 million (previous year: € 51.5 million), approx. 68.1% (previous year approx. 69.6%) were recognized as expense under costs of sales in the 2018 financial year.

The amount of inventories recorded as an expense during the period is substantially equivalent to the cost of sales shown in the consolidated income statement.

The right to return goods represents the merchandise value of the products when the customer’s right to return is exercised.

6. Other Current Financial Assets

This item consists of:

The amount shown is due within one year. The fair value corresponds to the carrying amount.

The increase of derivative financial instruments is mainly due to a higher US-Dollar exchange rate.

7. Other Current Assets

This item consists of:

The amount shown is due within one year. The fair value corresponds to the carrying amount.

Other receivables mainly include VAT receivables amounting to € 41.9 million (previous year: € 35.9 million).

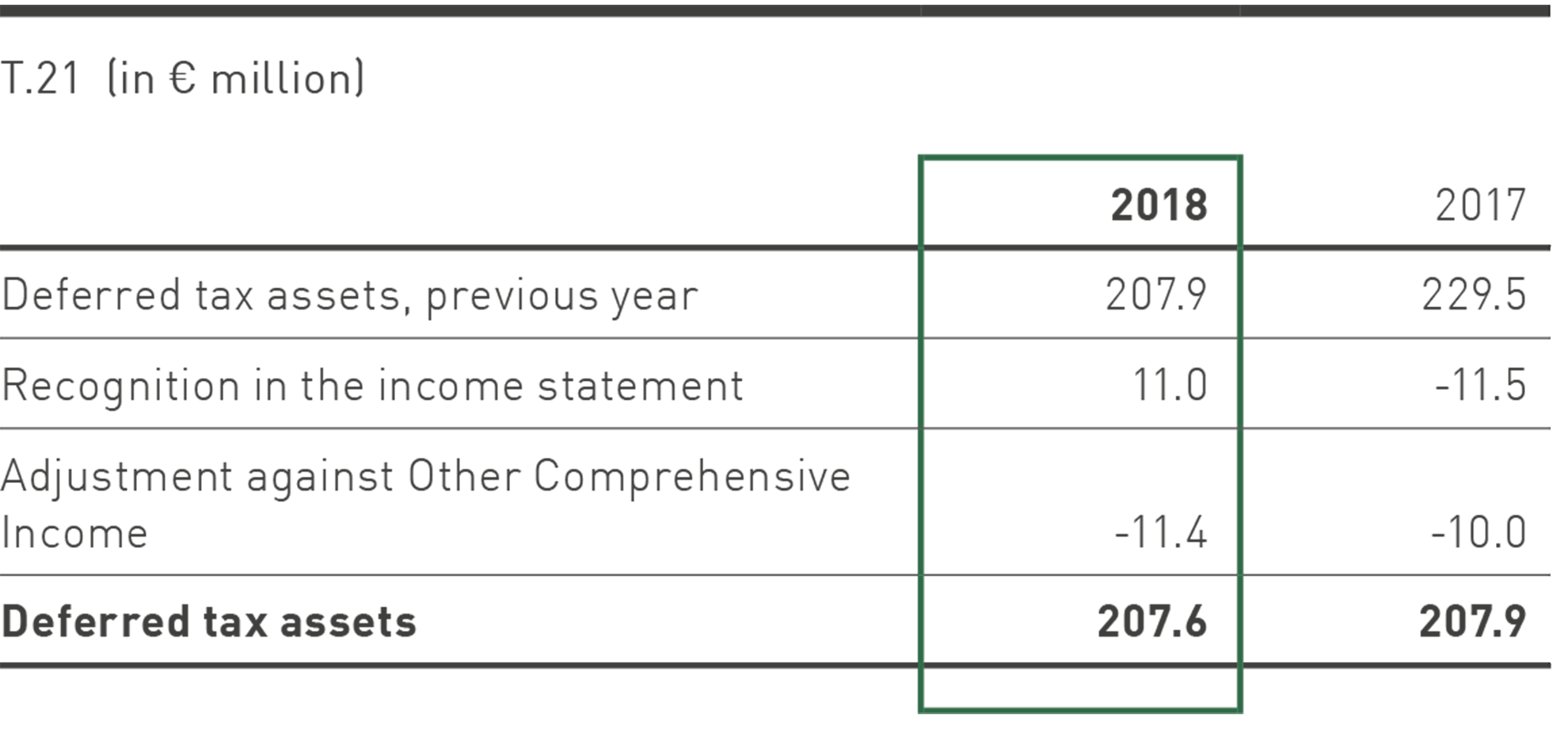

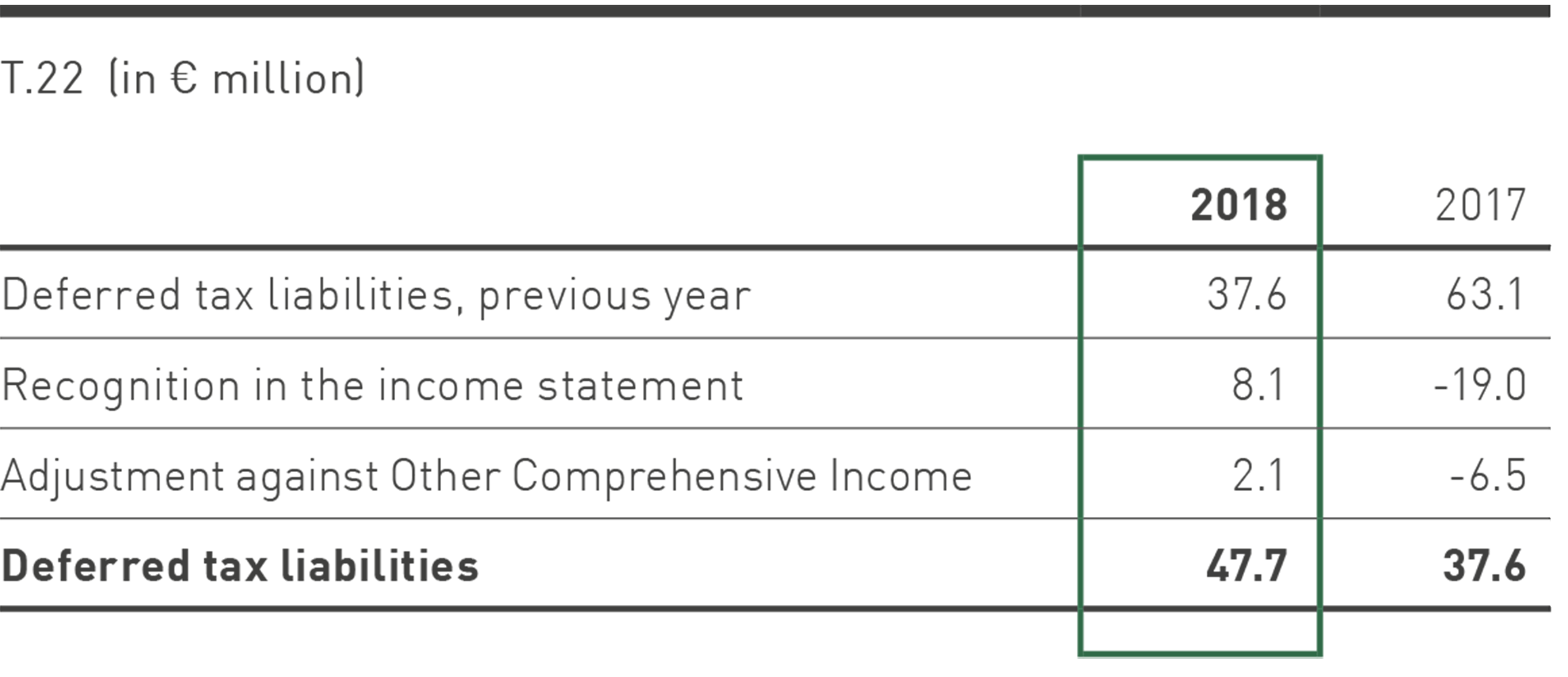

8. Deferred taxes

Deferred taxes relate to the items shown below:

Of the deferred tax assets, € 105.5 million (previous year: € 97.9 million) are current, and of the deferred tax liabilities € 11.8 million (previous year: € 10.7 million) are current.

As of December 31, 2018, tax losses carried forward amounted to a total of € 541.1 million (previous year: € 542.9 million). This results in a deferred tax asset of € 147.6 million (previous year: € 148.2 million). Deferred tax assets were recognized for these items in the amount at which the associated tax advantages are likely to be realized in the form of future profits for income tax purposes. Accordingly, deferred tax assets for tax loss carryforwards in the amount of € 71.4 million (previous year: €56.0 million) were not recognized; of these, € 71.1 million (previous year: € 54.4 million) cannot expire, but € 13.3 million (previous year: € 13.4 million) will never be usable due to the absence of future expectations. The remaining unrecognized deferred tax assets of € 0.3 million (previous year: € 1.6 million) will expire within the next seven years.

In addition, no deferred taxes were recognized for deductible temporary differences amounting to € 4.8 million (previous year: € 13.9 million).

Deferred tax liabilities for withholding taxes from possible dividends on retained earnings of subsidiaries that serve to cover the financing needs of the respective company were not accumulated, since it is most likely that such temporary differences will not be cleared in the near future.

Deferred tax assets and liabilities are netted if they relate to a taxable entity and can in fact be netted. Accordingly, they are shown in the balance sheet as follows:

The changes in deferred tax assets were as follows:

The changes in deferred tax liabilities were as follows:

9. Property, Plant and Equipment

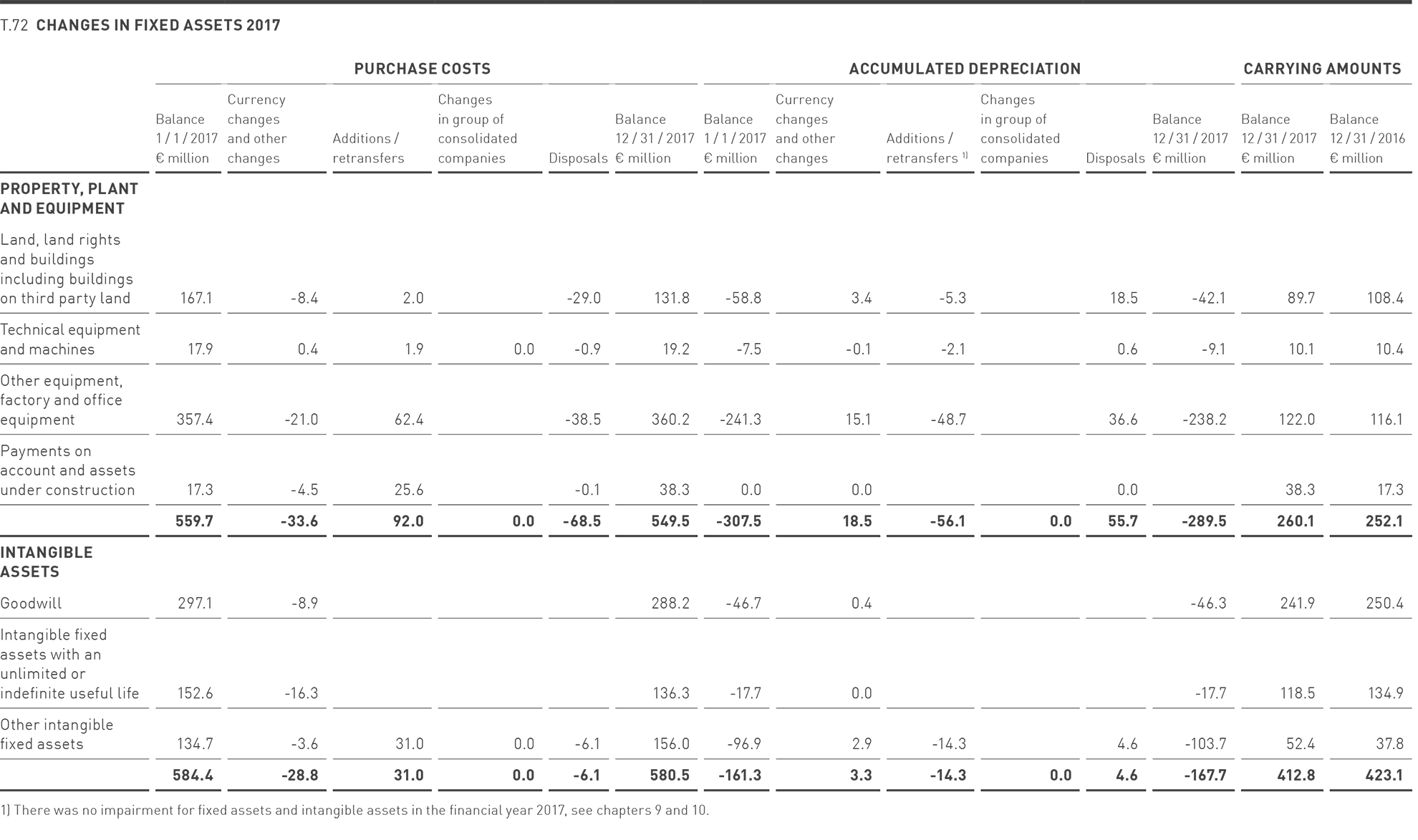

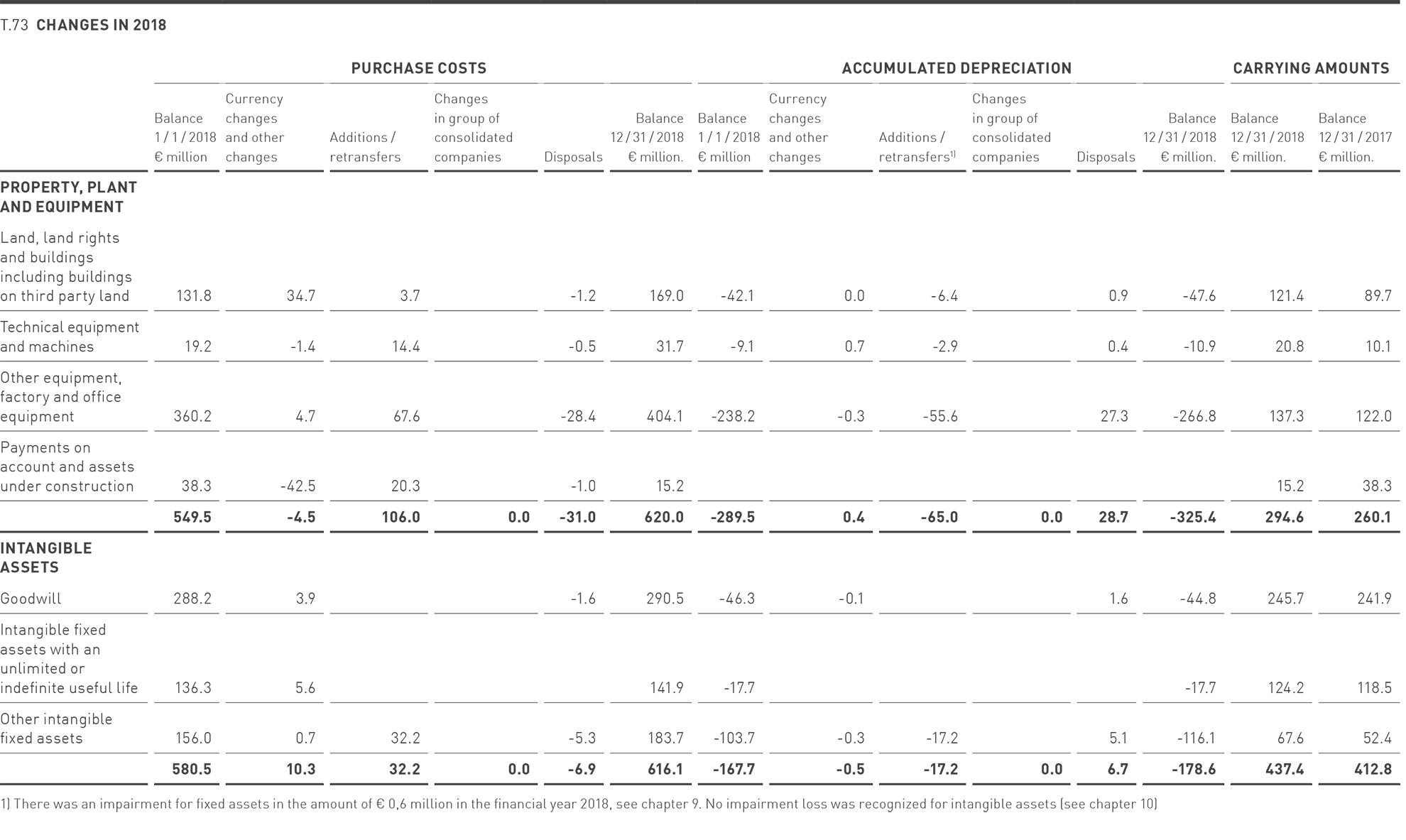

Property, plant and equipment at their carrying amounts consist of:

The carrying amount of property, plant and equipment is derived from the acquisition costs. Accumulated depreciation of property, plant and equipment amounted to € 325.4 million (previous year: € 289.5 million).

The item Other equipment, factory and office equipment includes leased objects (finance leasing) in the amount of € 0.2 million (previous year: € 0.2 million), and under the item Technical equipment and machines, € 8.3 million (previous year: € 0.4 million) relates to finance leasing.

The changes in property, plant and equipment in the 2018 financial year are shown in “Changes in Fixed Assets” in Appendix 1 to the notes of the consolidated financial statements. Impairment expenses that exceed current depreciation during the reporting year are included in the amount of € 0.6 million (previous year: € 0.0 million).

10. Intangible Assets

Intangible assets mainly include goodwill, intangible assets with indefinite useful lives, assets associated with the Company’s own retail activities, and software licenses.

Goodwill and intangible assets with indefinite useful lives are not amortized according to schedule. Impairment tests with regard to goodwill were performed in the past financial year using the discounted cash flow method. These were based on data from the respective three-year plan. The recoverable amount was determined on the basis of the value in use. This did not result in an impairment loss.

In connection with the Golf business unit (CPG–Cobra PUMA Golf), the Cobra brand exists as an intangible asset with an indefinite useful life of € 124.2 million (previous year: € 118.6 million). The carrying amount of the Cobra brand is significant in comparison to the overall carrying amount of the intangible assets with an indefinite useful life. The latter was assigned to the North America business segment, where the headquarters of Cobra PUMA Golf is located. The recoverable amount of the Cobra brand (level 3) was determined using the relief from royalty method. A discount rate of 6.1% p.a. (previous year: 7.3% p.a.), a royalty rate of 8% (previous year: 8%) and a 2% growth rate (previous year: 3%) were applied.

If indications of a value impairment of a self-used trademark should arise, the trademark is not only valued individually using the relief-from-royalty method, but the recoverable amount of the cash-generating units to which the trademark is to be attributed is determined. There were no indications of this in 2018.

In the financial year, development costs in connection with Cobra brand golf clubs amounting to € 1.7 million (previous year: € 1.8 million) were capitalized. Development costs are allocated to the item Other Intangible Assets in “Changes in Fixed Assets”. Current amortization of development costs amounted to € 1.1 million in the financial year (previous year: € 0.6 million).

The changes in intangible assets in the financial year are shown in “Changes in Fixed Assets” of Appendix 1 to the notes of the consolidated financial statements. Other intangible assets include advance payments in the amount of € 21.3 million (previous year: € 8.7 million).

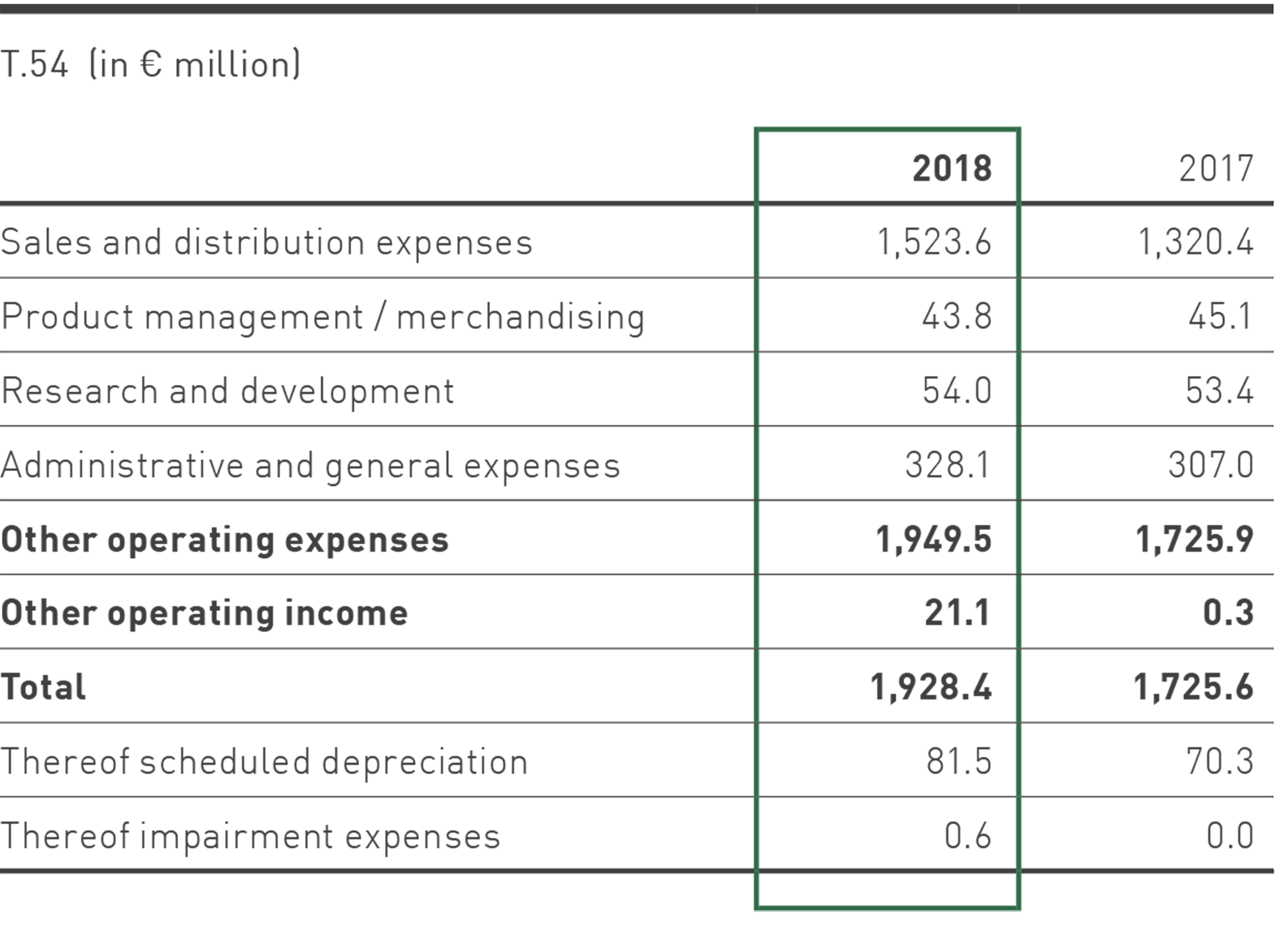

The current amortization of intangible assets in the amount of € 17.2 million (previous year: € 14.3 million) is included in the Other operating expenses. Of this, € 3.5 million pertains to sales and distribution expenses (previous year:

€ 2.1 million), € 1.2 million to expenses for product management / merchandising (previous year: € 0.1 million), € 0.0 million to development expenses (previous year: € 0.6 million) and € 12.5 million to administrative and general expenses (previous year: € 11.5 million). As in the previous year, there were no impairment expenses that exceed current depreciation.

Goodwill is allocated to the Group’s identifiable cash-generating units (CGUs) according to the country where the activity is carried out. Summarized by regions, goodwill is allocated as follows:

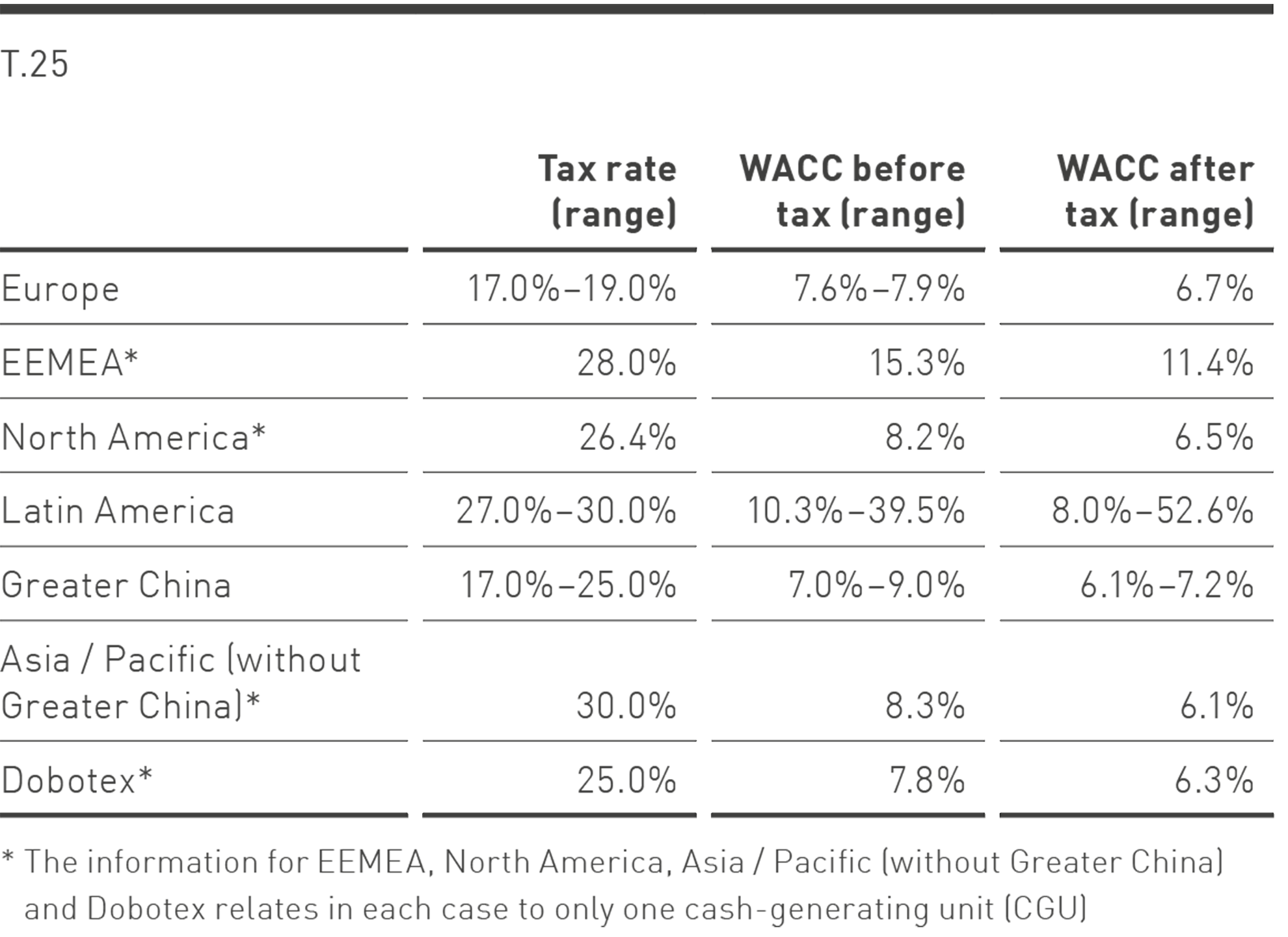

Assumptions used in conducting the impairment test in 2018:

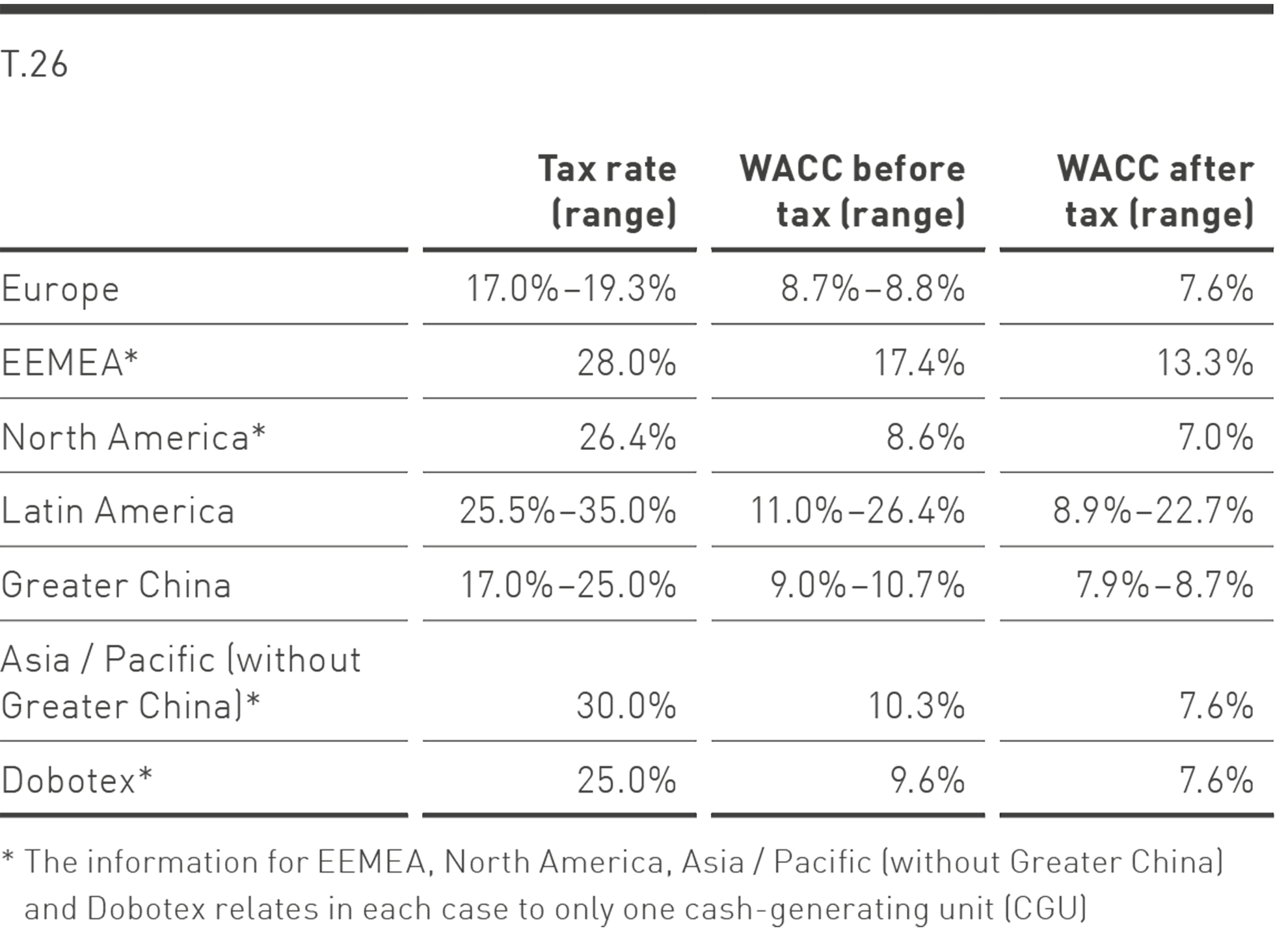

The tax rates used for the impairment test correspond to the actual tax rates in the respective countries. The cost of capital (WACC) was derived from observable market data.

In addition, a growth rate of 2% (previous year: 3%) is generally assumed. A growth rate of less than 2% (previous year: less than 3%) was only used in justified exceptional cases. The reduction of the growth rate in the perpetual annuity reflects a lower long-term inflation expectation.

The cash-generating unit ‘Dobotex’ includes goodwill of € 139.4 million (previous year: € 139.4 million), which is significant in comparison to the overall carrying amount of the goodwill. The recoverable amount was determined by a value-in-use calculation with a discount rate of 7.8% p.a. (previous year: 7.6% p.a.) and a growth rate of 2% (previous year: 2%).

balance sheet date show that neither an increase in discount rates of one percentage point each nor a reduction in growth rates of one percentage point each results in any indication of impairment. The sensitivity analysis with a one percentage point increase in the discount rate and the sensitivity analysis with a one percentage point reduction of the growth rate likewise do not show any indication of impairment.

The following table contains the assumptions for the performance of the impairment test in the previous year:

A growth rate of 3% was generally assumed, and a growth rate of under 3% has only been used in exceptional cases where this is justified.

11. Holdings in associated companies

Due to the loss of significant influence in Wilderness Holdings Ltd. in May 2018, the valuation of the investment using the equity method was discontinued. The investment was then sold in July 2018. The income / expenses in connection with the end of at-equity valuation and the sale are recognized under Other operating income and expenses.

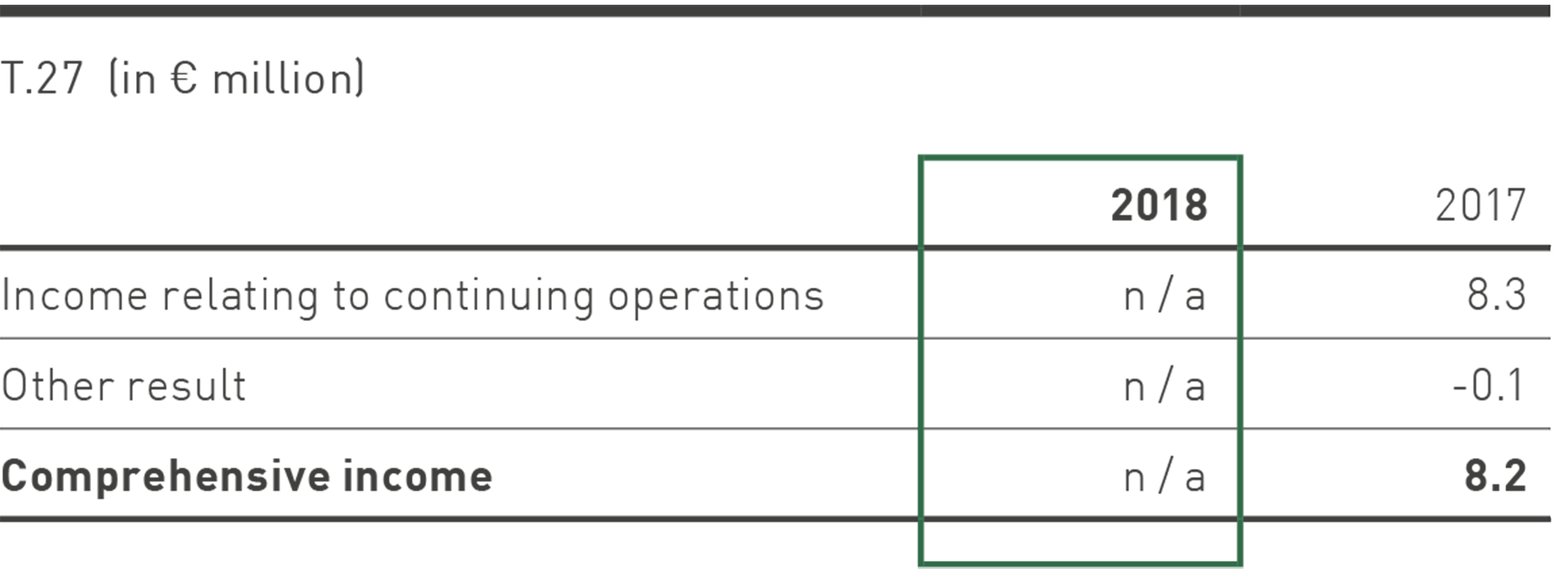

The following overview shows the aggregated benchmark data of the associated companies recognized at equity. The values represent the values based on the entire company and do not relate to the shares attributable to the PUMA Group. Due to the end of the equity method, data are no longer presented for 2018.

Dividends received amount to € 0.6 million (previous year: € 0.8 million).

The balance sheet date of Wilderness Holdings Ltd. is February 28, 2018.

12. Other Non-current Assets

Other non-current financial and non-financial assets consist of:

The non-current investments relate to the 5.0% shareholding in Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien (BVB) with registered office in Dortmund, Germany.

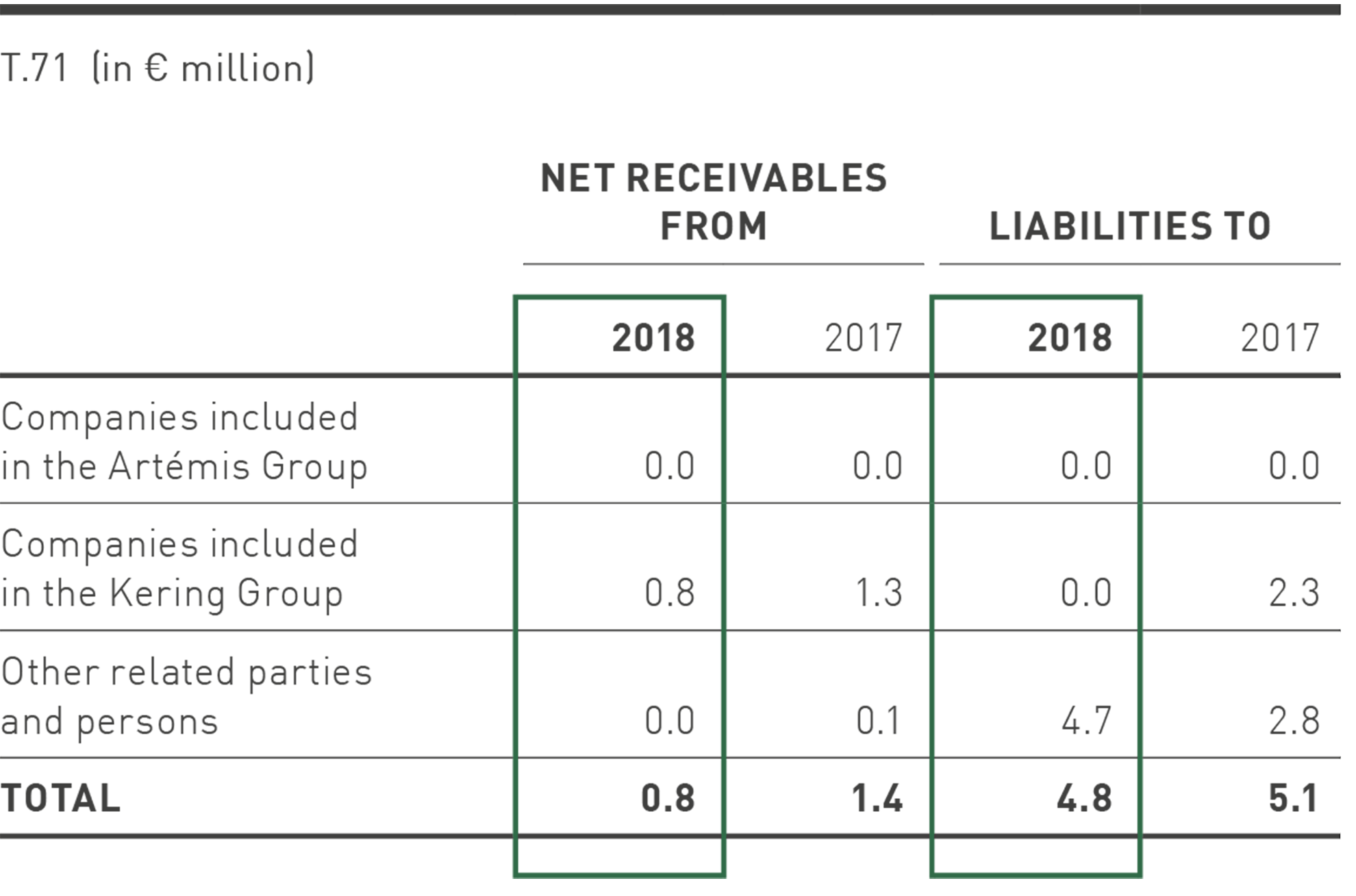

The other financial assets mainly include rental deposits of € 22.5 million (previous year: € 19.2 million). The other non-current non-financial assets mainly include deferrals in connection with promotional and advertising agreements.

In the 2018 financial year, there were no indicators of impairment of other non-current assets.

13. Liabilities

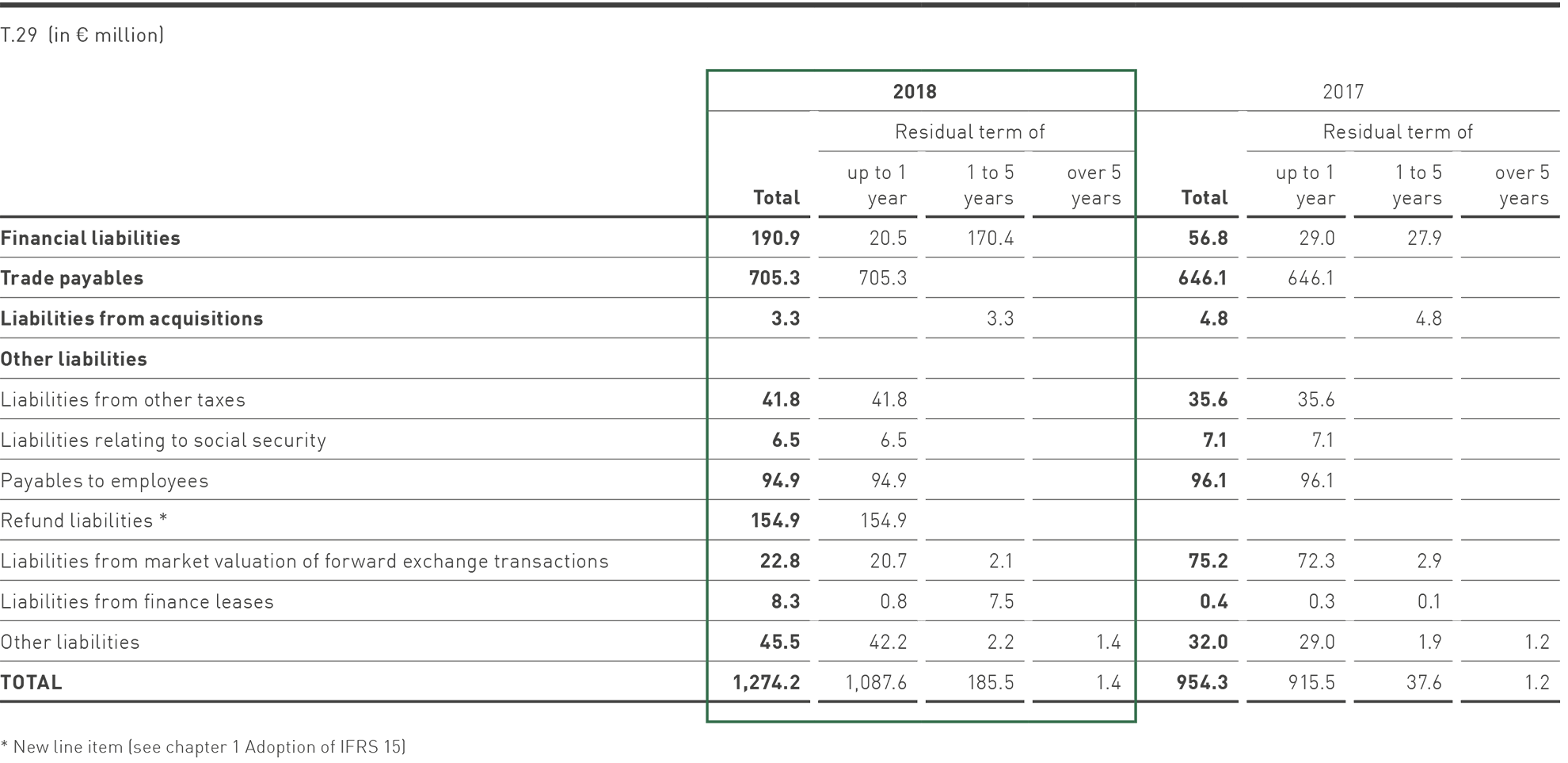

The residual terms of liabilities are as follows:

PUMA has confirmed credit facilities amounting to a total of € 691.9 million (previous year: € 497.1 million). Under financial liabilities, € 1.5 million (previous year: € 0.0 million) was utilized from credit lines granted only until further notice. Unutilized credit lines totaled € 501.0 million as of December 31, 2018, compared to € 440.2 million the previous year.

The effective interest rate of the financial liabilities ranged between 0.1% and 8.4% (previous year: 1.0% to 14.7%).

The liabilities from refund obligations result from contracts with customers and include obligations from customer return rights as well as obligations connected with customer bonuses.

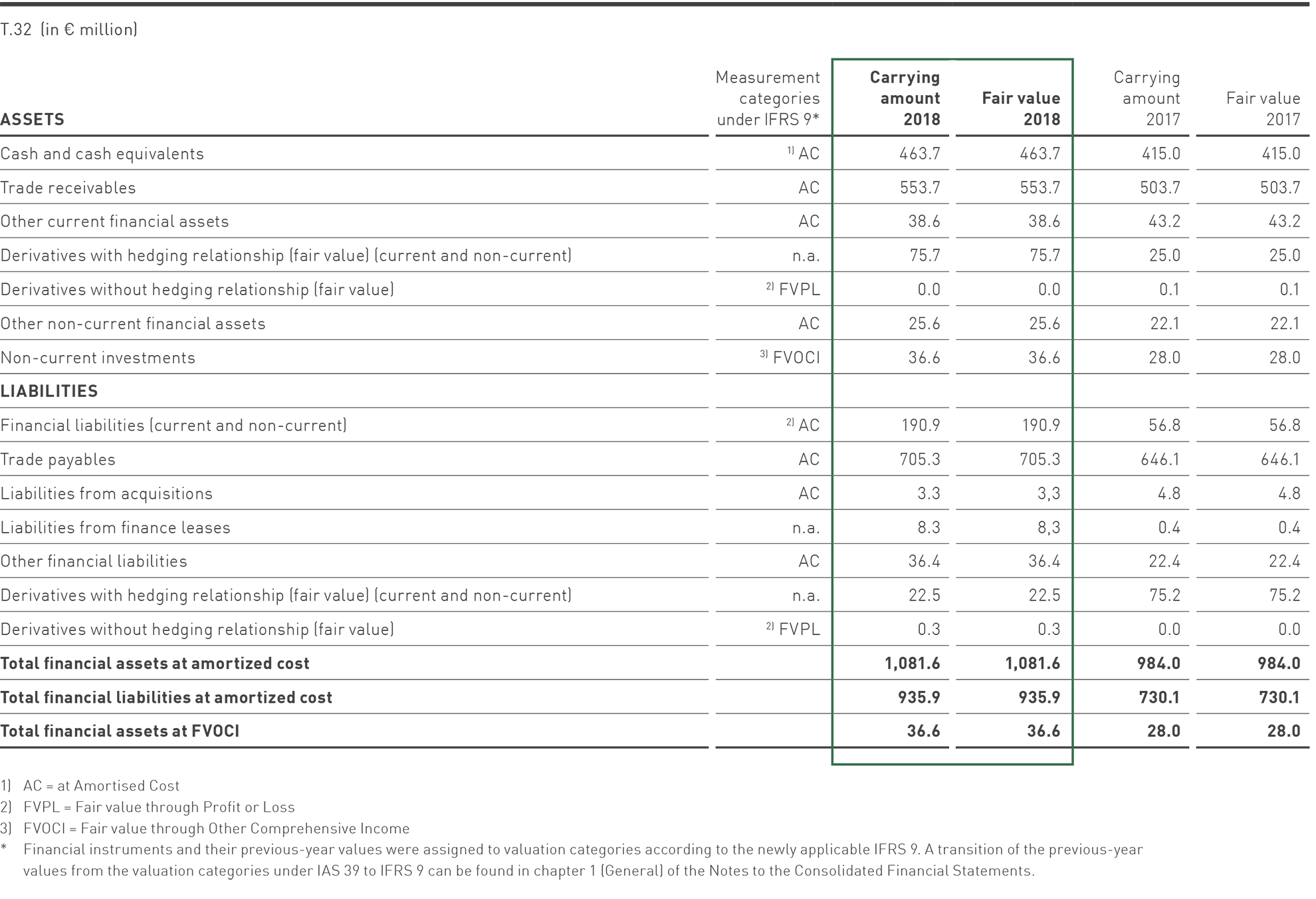

Financial instruments that are measured at fair value in the balance sheet were determined using the following hierarchy:

Level 1: Use of prices quoted on active markets for identical assets or liabilities..

Level 2: Use of input factors that do not involve the quoted prices stated under Level 1, but can be observed for the asset or liability either directly (i.e., as price) or indirectly (i.e., derivation of prices).

Level 3: Use of factors for the valuation of the asset or liability that are based on non-observable market data.

The fair value of the financial assets of the category “fair value through OCI” (FVOCI) was determined on the basis of Level 1. The market values of derivative assets or liabilities were determined on the basis of Level 2.

Cash and cash equivalents, trade receivables and other assets have a short residual maturity. Accordingly, as of the reporting date, the carrying amount approximates fair value. Receivables are stated at nominal value, taking into account deductions for default risk.

The carrying amount of loans receivable approximates the fair value as of the reporting date.

The fair values of other financial assets correspond to their carrying amount, taking into account prevailing market interest rates. Other financial assets include € 30.4 million (previous year: € 25.7 million) that were pledged as rental deposits at usual market rates.

The current liabilities to banks can be repaid at any time. Accordingly, as of the reporting date, the carrying amount approximates fair value. The non-current bank liabilities consist of fixed-interest loans. The carrying amounts correspond to the repayment amounts.

Trade payables have a short residual maturity. The carrying amounts therefore approximate fair value.

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions of business enterprises lead to payments. The resulting nominal amounts were discounted at a reasonable market interest rate, depending on the expected date of payment. As of the end of the financial year, the market interest rate only affects one company and is 0.7% (previous year: 0.6%).

The fair values of other financial liabilities are determined based on the present values, taking into account the prevailing interest rate parameters.

The fair values of derivatives with a hedging relationship at the balance sheet date are determined on the basis of current market parameters, i.e. reference prices observable on the market, taking into account forward premiums and discounts. The discounted result of the comparison of the forward price on the reporting date with the forward price on the valuation date is included in the measurement. The fair values are also checked for the counterparty’s non-performance risk. In doing this, PUMA calculates credit value adjustments (CVA) or debt value adjustments (DVA) on the basis of an up / down method, taking current market information into account. No material deviations were found, so that no adjustments were made to the fair value determined.

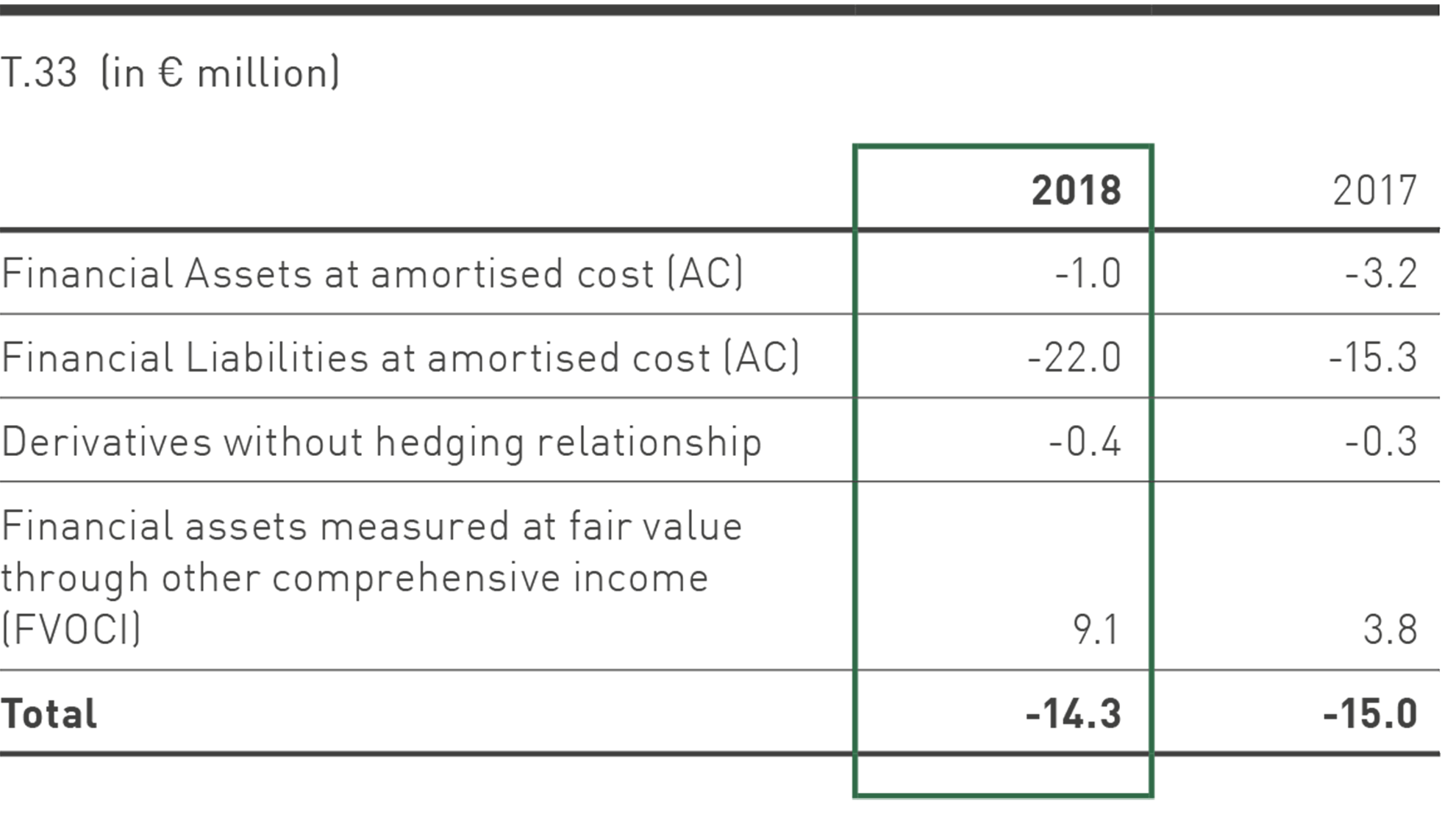

Net result by measurement categories:

The net result was determined by taking into account interests, currency exchange effects, impairment losses as well as gains and losses from sales.

General administrative expenses include the write-downs of receivables.

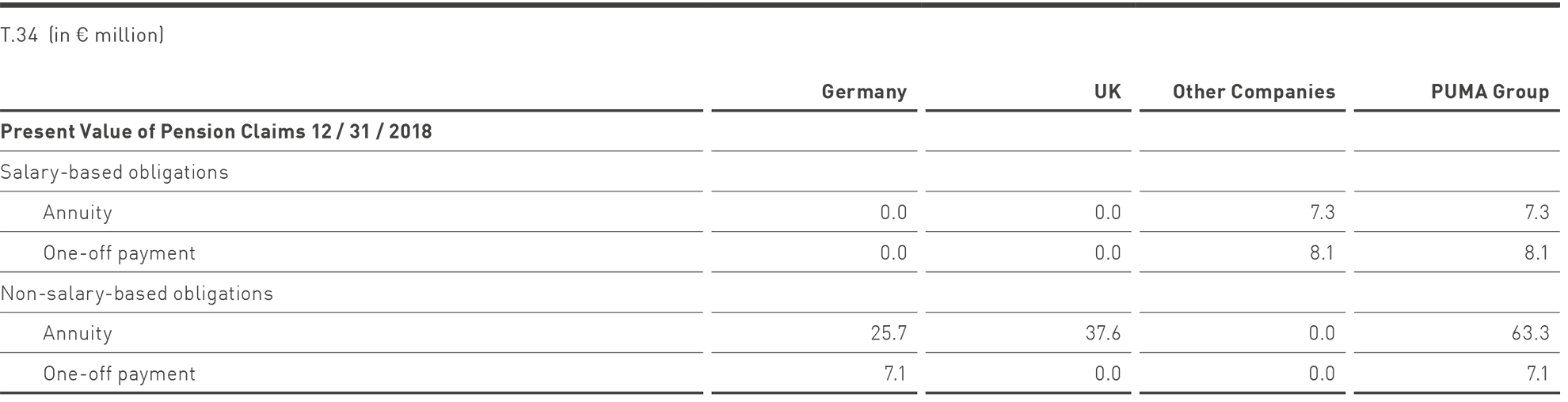

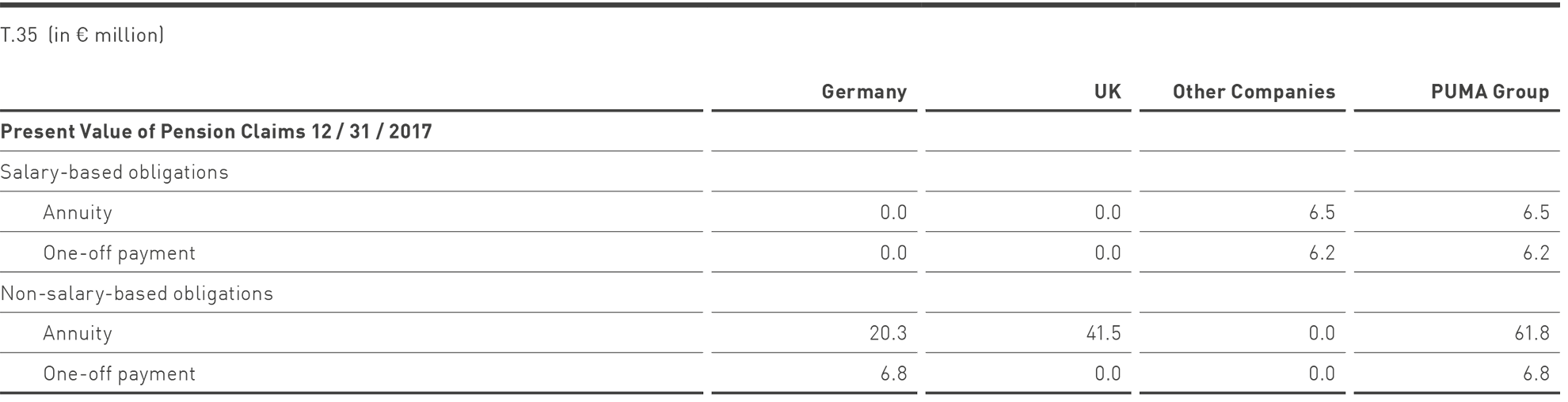

15. Pension Provisions

Pension provisions result from employees’ claims for benefits, which are based on the statutory or contractual regulations applicable in the respective country, in the event of invalidity, death or when a certain retirement age has been reached. Pension commitments in the PUMA Group include both benefit- and contribution-based pension commitments and include both obligations from current pensions and rights to pensions payable in the future. The pension entitlements are financed by both provisions and funds.

The risks associated with the pension commitments mainly concern the usual risks of benefit-based pension plans in relation to possible changes in the discount rate and, to a minor degree, inflation trends and recipient longevity. In order to limit the risks of changed capital market conditions and demographic developments, plans with the maximum obligations were agreed or insured a few years ago in Germany and the UK for new hires. The specific risk of obligations based on salary is low within the PUMA Group. The introduction of an annual cap in 2016 for pensionable salary in the UK plan now covers this risk for the highest obligations. The UK plan is therefore classified as a non-salary obligation.

The main pension arrangements are described below:

The general pension scheme of PUMA SE generally provides for pension payments to a maximum amount of € 127.82 per month and per eligible employee. It was closed for new members beginning in 1996. In addition, PUMA SE provides individual commitments (fixed sums in different amounts) as well as contribution-based individual commitments (in part from salary conversion). The contribution-based commitments are insured plans. There are no statutory minimum funding requirements. The scope of obligation for domestic pension claims amounts to € 32.7 million at the end of 2018 (previous year: € 27.1 million) and thus comprises 38.1% of the total obligation. The fair value of the plan assets relative to domestic obligations amounts to € 22.3 million. The corresponding pension provision amounts to € 10.3 million.

The defined benefit plan in the United Kingdom has not been available to new hires since 2006. This defined benefit plan includes salary and length of service-based commitments to provide old age, invalidity and surviving dependents’ retirement benefits. In 2016, a growth cap of 1% p.a. was introduced on the pensionable salary. Partial capitalization of the old-age pension is permitted. There are statutory minimum funding requirements. The obligations regarding pension claims under the defined benefit plan in the UK amount to € 37.6 million at the end of 2018 (previous year: € 41.5 million) and thus accounts for 43.9% of the total obligation. The obligation is covered by assets amounting to € 30.5 million. The provision amounts to € 7.1 million.

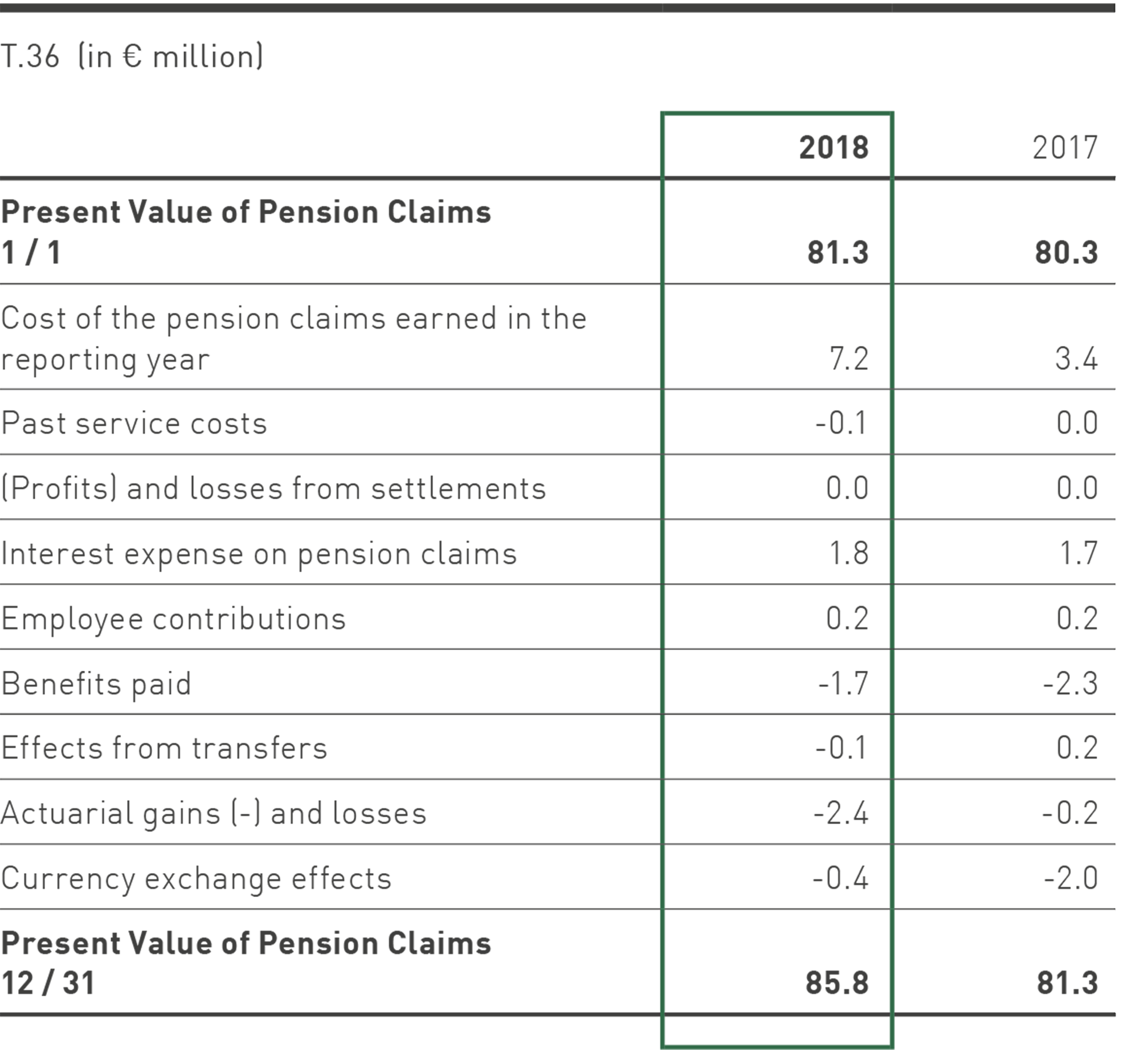

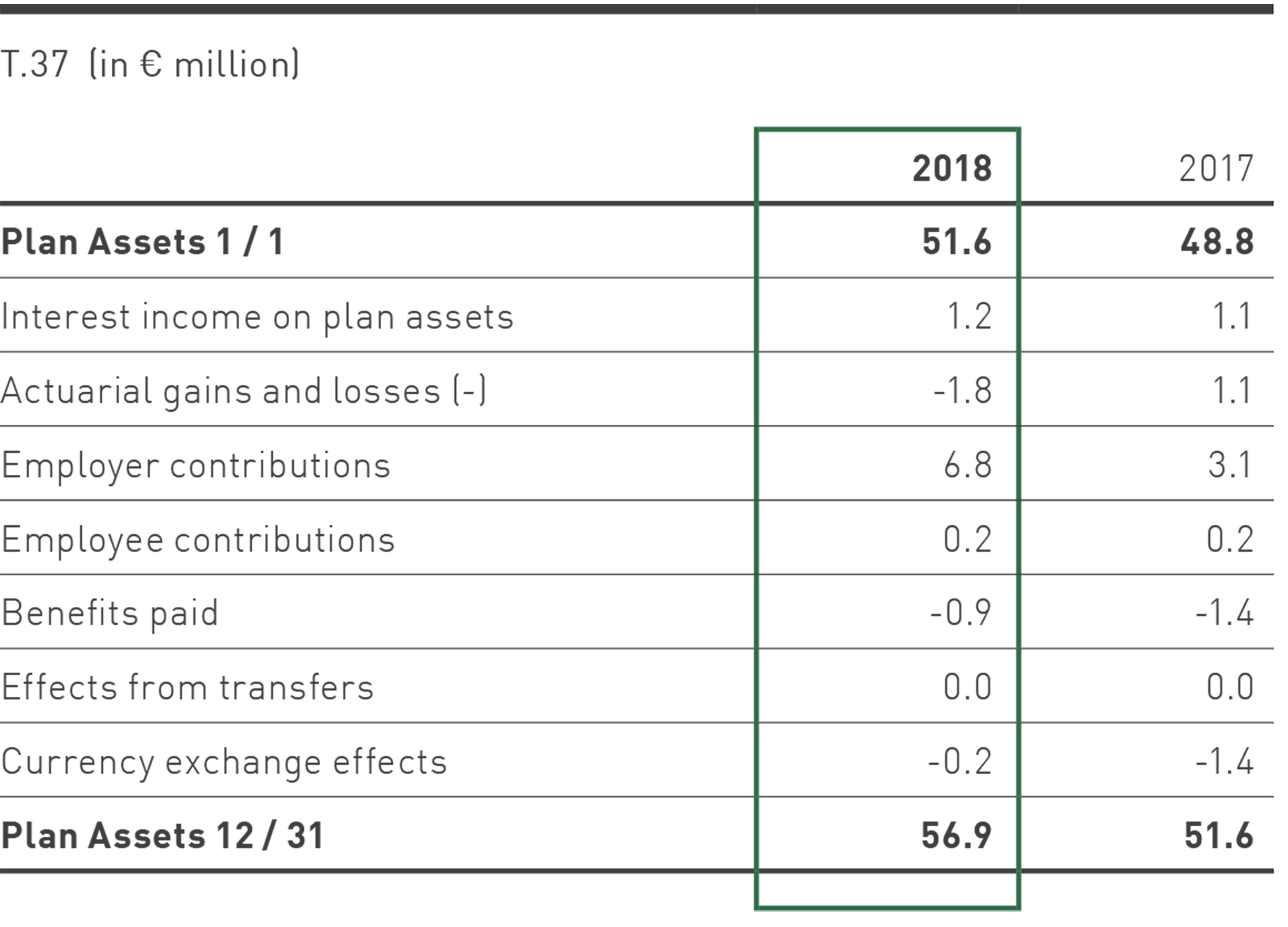

The changes in the plan assets are as follows:

The pension provision for the Group is derived as follows::

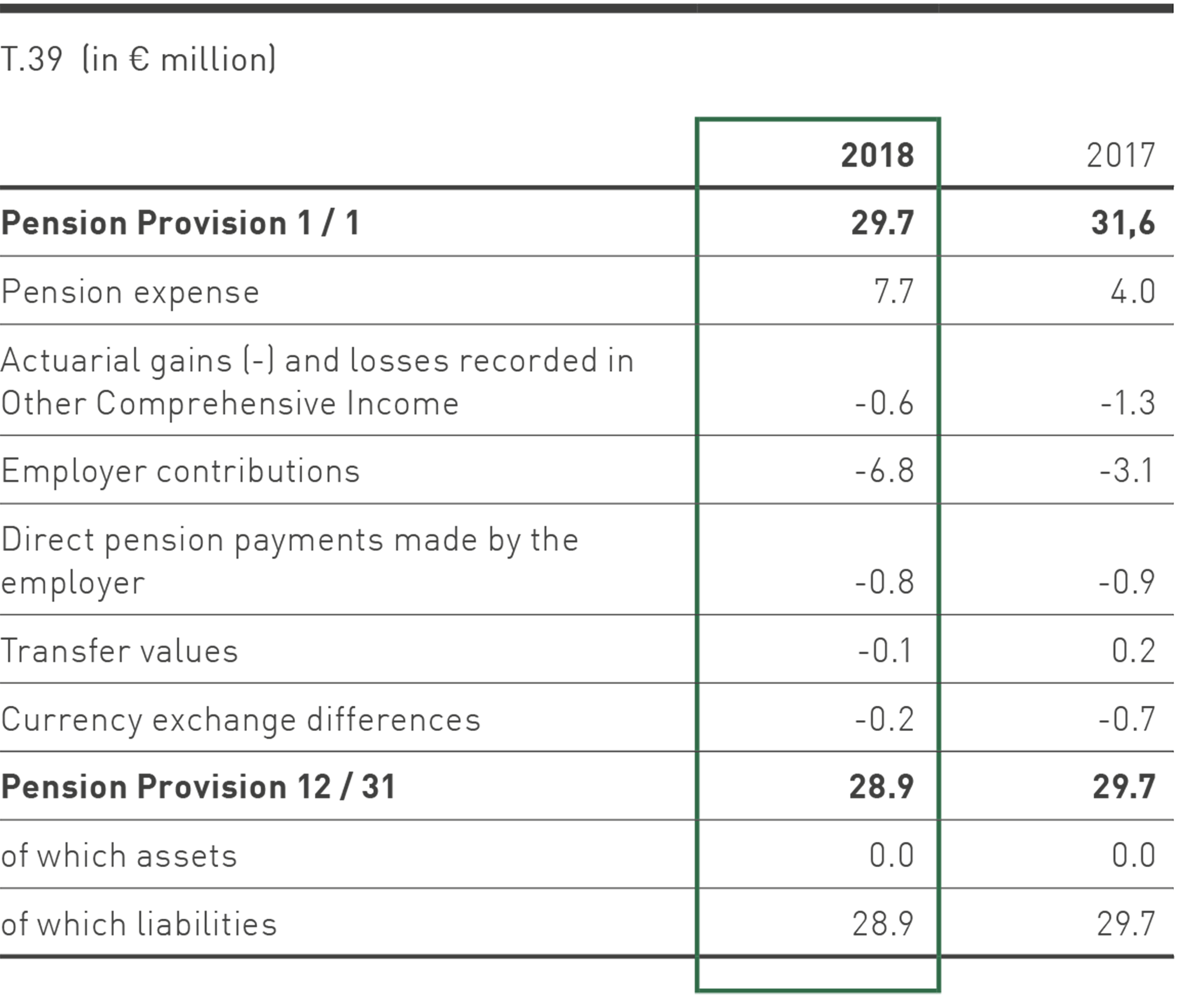

In 2018, benefits paid amounted to € 1.7 million (previous year: € 2.3 million). Contributions in 2019 are expected to amount to € 2.2 million. Of this, € 1.1 million is expected to be paid directly by the employer. Contributions to external plan assets amounted to € 6.8 million in 2018 (previous year: € 3.1 million). Contributions in 2019 are expected to amount to €2.0 million.

The changes in pension provisions are as follows:

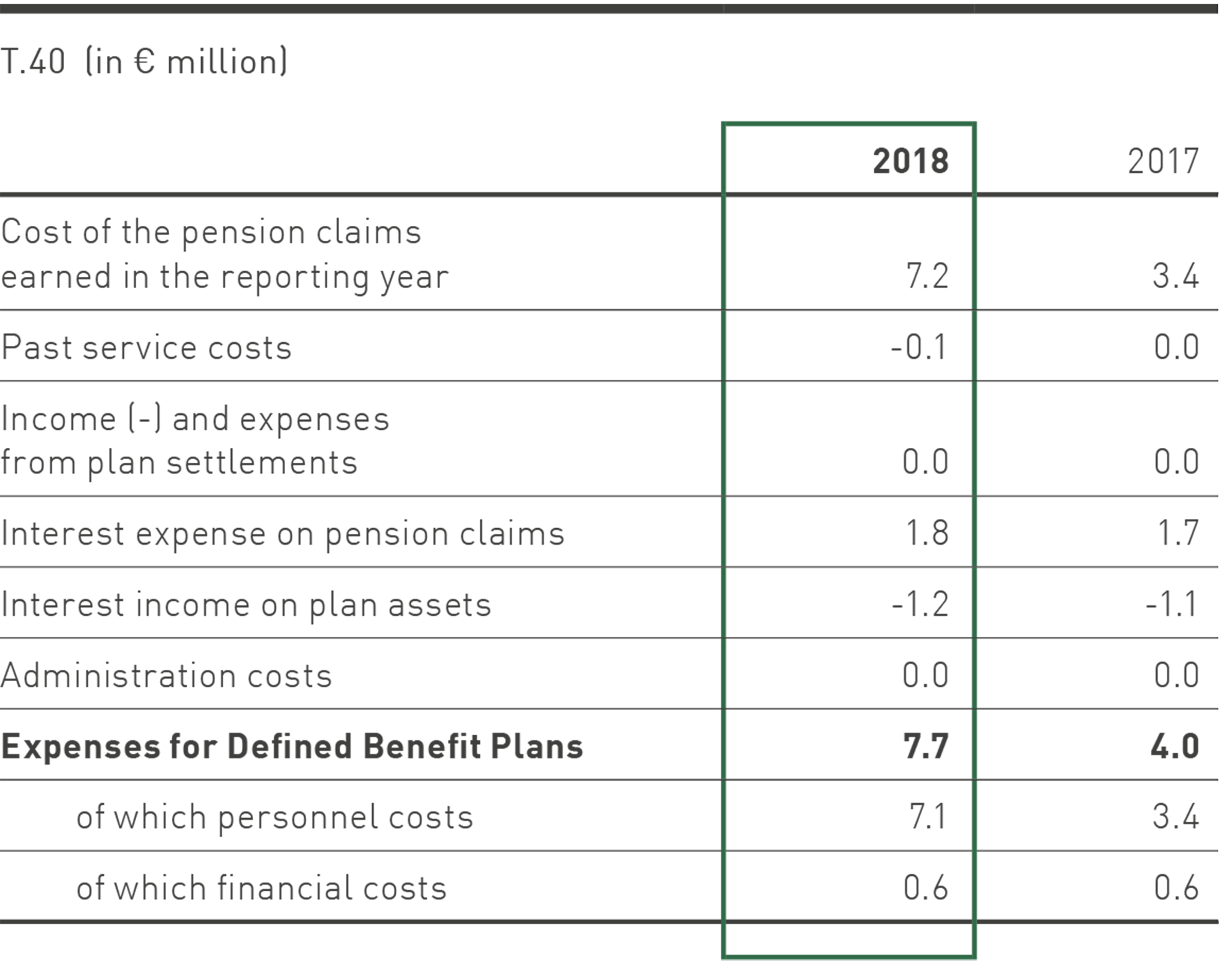

The expenses in the 2018 financial year are structured as follows:

In addition to the defined benefit pension plans, PUMA also makes contributions to defined contribution plans. Payments for the financial year 2018 amounted to € 12.5 million (previous year: € 11.7 million).

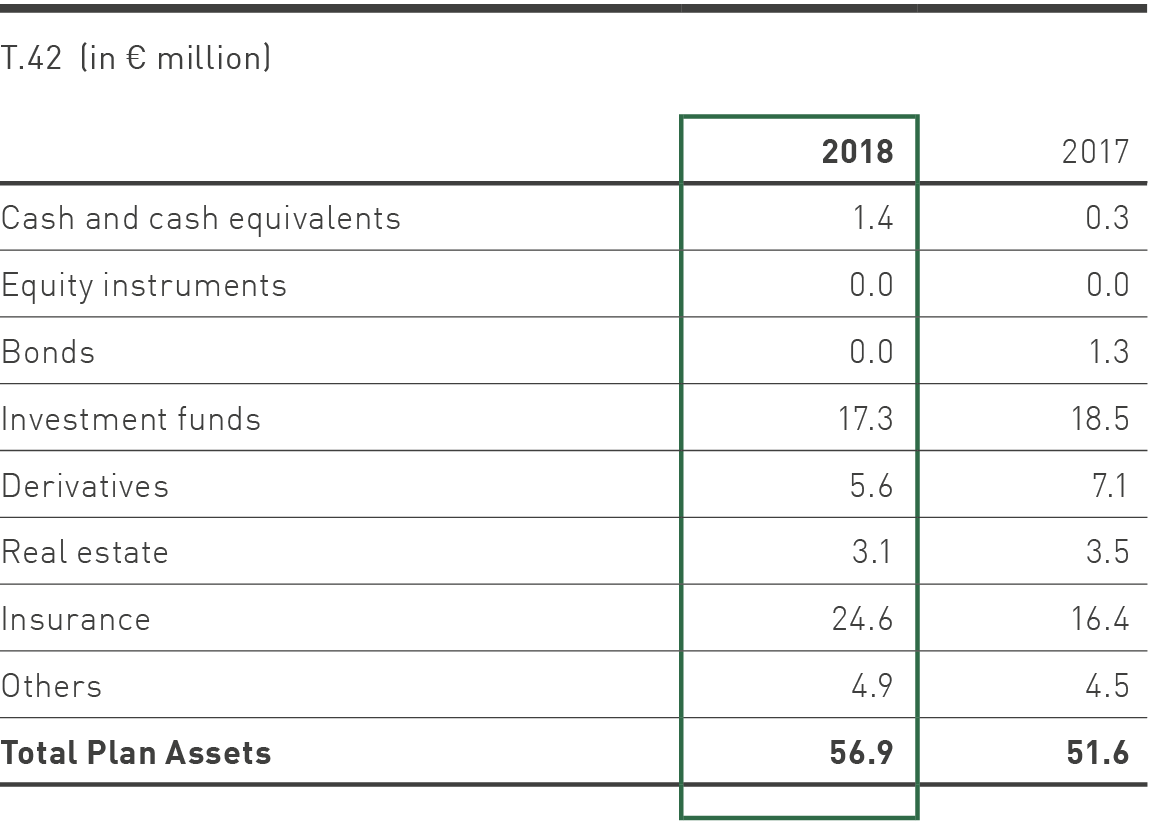

Plan assets investment classes:

Of which investment classes with a quoted market price:

Plan assets still do not include the Group’s own financial instruments or real estate used by Group companies.

The plan assets are used exclusively to fulfill defined pension commitments. Legal requirements exist in some countries for the type and amount of financial resources that can be chosen; in other countries (for example Germany) they can be chosen freely. In the UK, a board of trustees made up of Company representatives and employees is in charge of asset management. Its investment strategy is aimed at long-term profits and low volatility. It was revised in 2017 and 2018 and the risk profile was reduced.

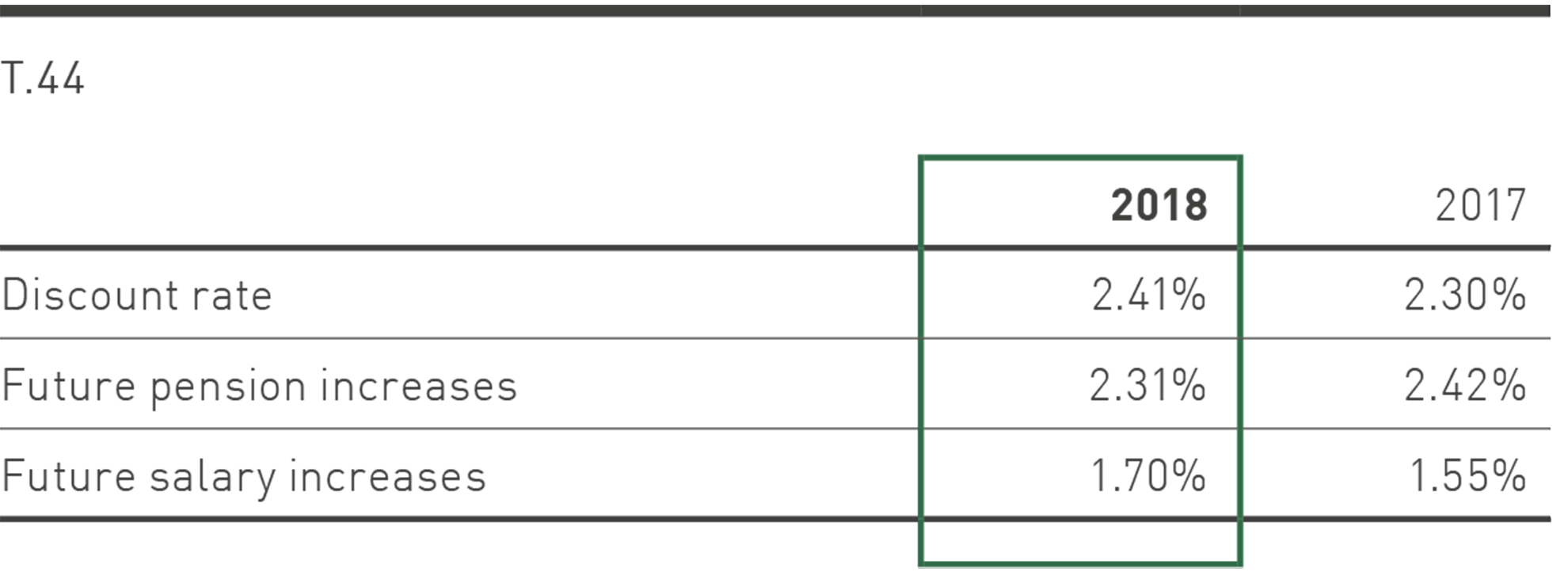

The following assumptions were used to determine pension obligations and pension expenses:

The indicated values are weighted average values. A standard interest rate of 1.75% was applied for the Euro zone (previous year: 1.75%).

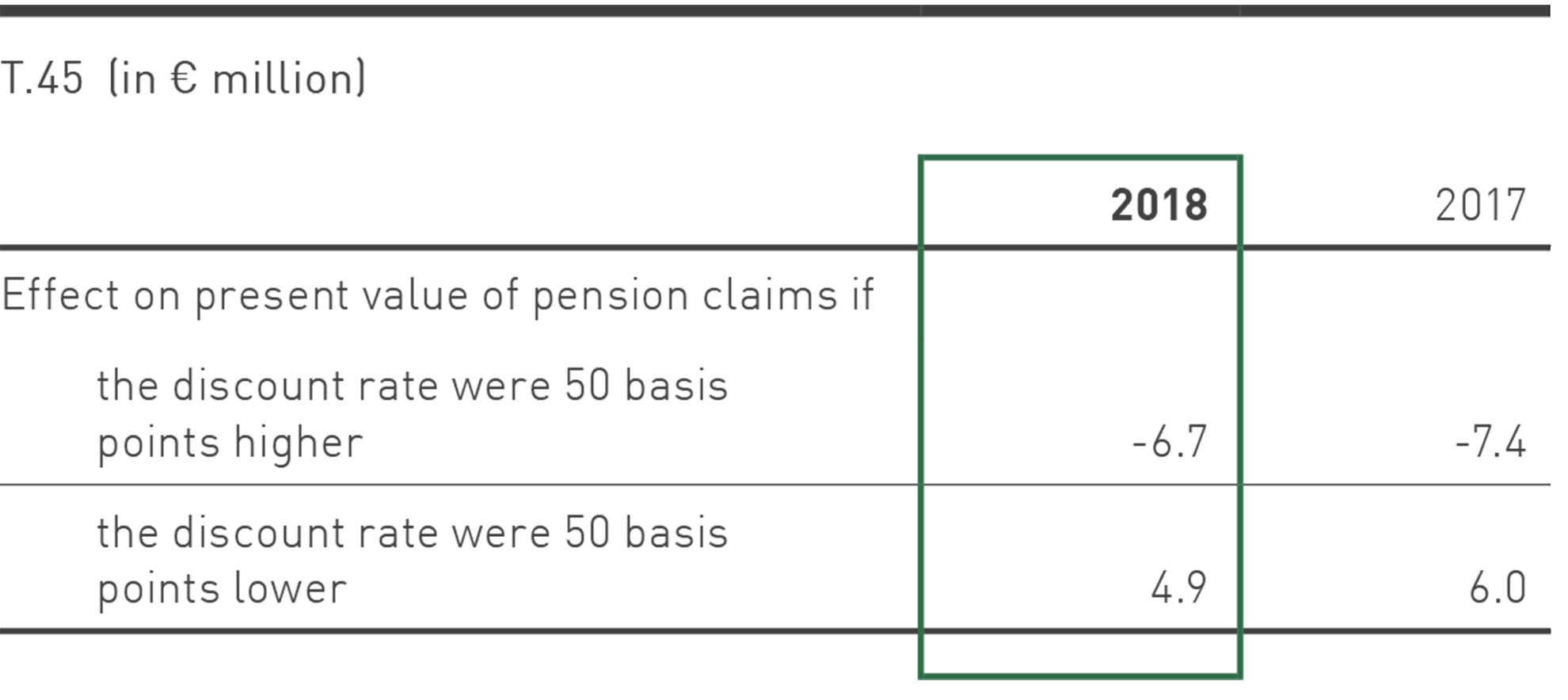

The following overview shows how the present value of pension claims from benefit plans would have been affected by changes to significant actuarial assumptions.

Salary and pension trends have only a negligible effect on the present value of pension claims due to the structure of the benefit plans.

The weighted average duration of pension commitments is 17 years.

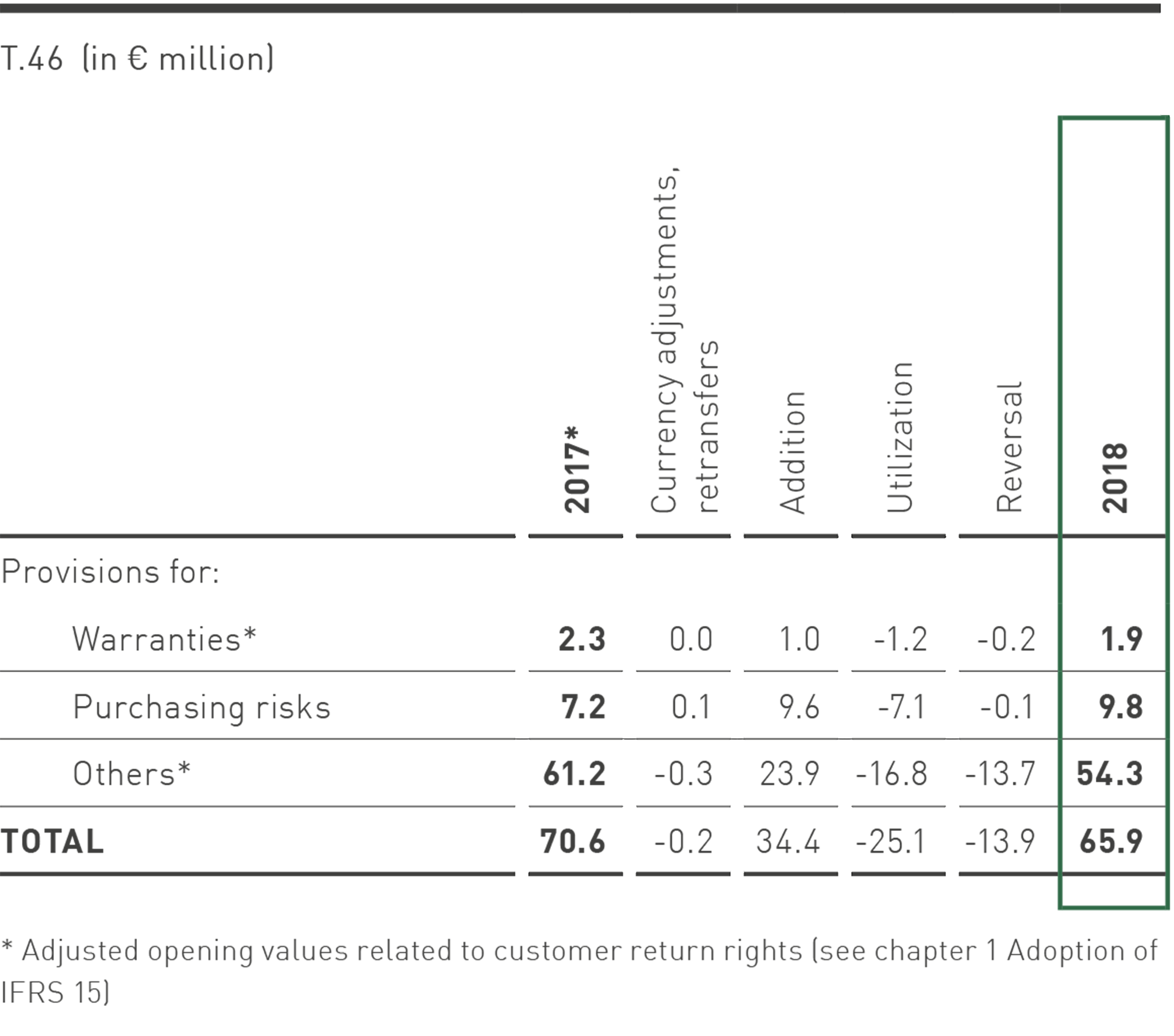

16. Other Provisions

The warranty provision is determined on the basis of the historical value of sales generated during the past six months. It is expected that the majority of these expenses will fall due within the first six months of the next financial year. Purchasing risks mainly relate to material risks and to moulds required for the manufacturing of footwear.

The provisions for warranties and purchasing risks contain no non-current provisions (previous year: € 0.0 million).

Other provisions comprise risks in connection with litigation in the amount of € 25.9 million (previous year: € 30.0 million), provisions for asset retirement obligations, and other risks in the amount of € 28.4 million (previous year: € 31.2 million). Other provisions include € 26.3 million (previous year: € 34.6 million) in non-current provisions.

Short-term provisions are expected to be paid out in the following year, while long-term provisions are not expected to be paid out until the end of the following year at the earliest.

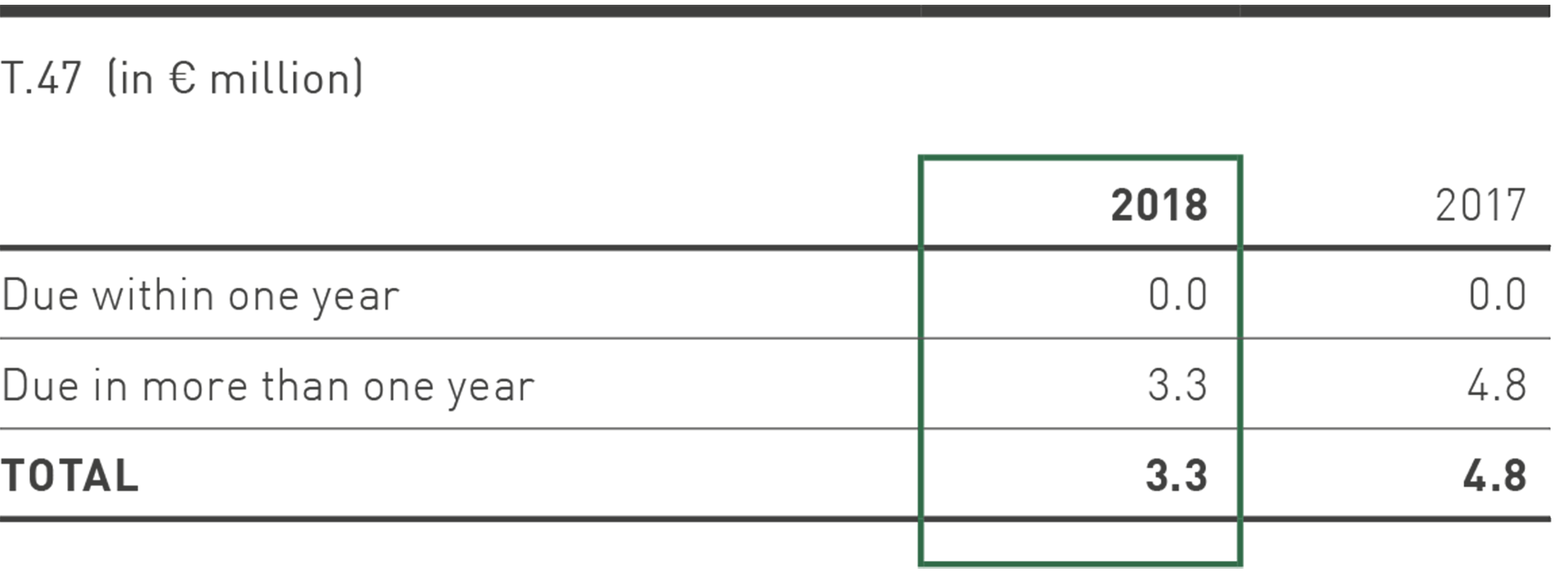

17. Liabilities from the Acquisition of Business Entities

Pursuant to the contracts entered into, purchase price liabilities associated with acquisitions of business enterprises lead to payments. The resulting nominal amounts were discounted at a reasonable market interest rate, depending on the expected date of payment.

The existing purchase price liability relates to the acquisition of Genesis Group International Ltd. and is made up as follows:

18. Equity

Subscribed Capital

The subscribed capital corresponds to the subscribed capital of PUMA SE. As of the balance sheet date, the subscribed capital amounted to € 38.6 million and is divided into 15,082,464 bearer shares. Each no-par-value share corresponds to € 2.56 of the subscribed capital (share capital).

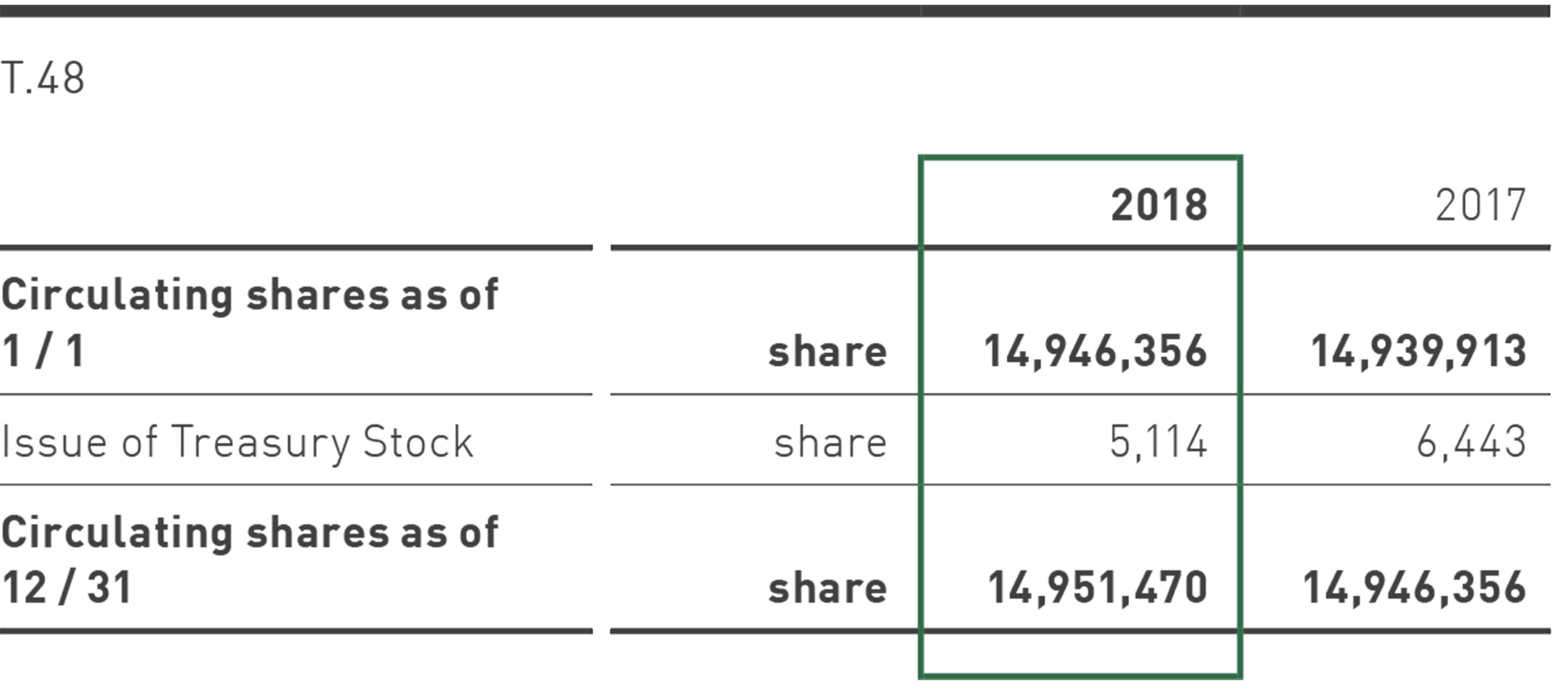

Changes in the circulating shares:

Capital Reserve

The capital reserve includes the premium from issuing shares, as well as amounts from the grant, conversion and expiration of share options.

Retained Earnings and Net Profit

Retained earnings and net profit include the net income of the financial year as well as the income of the companies included in the consolidated financial statements achieved in the past to the extent that it was not distributed.

Reserve from the Difference Resulting from Currency Conversion

The equity item for currency conversion serves to record the differences from the conversion of the financial statements of subsidiaries with non-Euro accounting compared to the date of first consolidation of the subsidiaries.

Cash Flow Hedges

The “cash flow hedges” item includes the market valuation of derivative financial instruments. The item amounting to € 34.1 million (previous year: € -44.8 million) is offset by deferred taxes of € -1.4 million (previous year: € 3.7 million).

Treasury Stock

The resolution adopted by the Annual General Meeting on May 6, 2015 authorized the company to purchase treasury shares up to a value of 10% of the share capital until May 5, 2020. If purchased through the stock exchange, the purchase price per share may not exceed or fall below 10% of the closing price for the Company’s shares with the same attributes in the XETRA trading system (or a comparable successor system) during the last three trading days prior to the date of purchase.

The Company did not make use of the authorization to purchase treasury stock during the reporting period.

As of the balance sheet date, the Company holds a total of 130,994 PUMA shares in its own portfolio, which corresponds to 0.86% of the subscribed capital.

Authorized Capital

As of December 31, 2018, the Company’s Articles of Association provide for authorized capital totaling € 15,000,000:

Pursuant to Section 4.2. of the Articles of Association, the Management Board is authorized with the consent of the Supervisory Board to increase the Company’s share capital by April 11, 2022 by up to € 15,000,000 (Authorized Capital 2017) by issuing new no-par value bearer shares against cash and / or non-cash contributions on one or more occasions. In case of capital increases against contributions in cash, the new shares may be acquired by one or several banks, designated by the Management Board, subject to the obligation to offer them to the shareholders for subscription (indirect pre-emption right). The shareholders shall generally be entitled to pre-emption rights. However, the Management Board is authorized with the consent of the Supervisory Board to exclude shareholders’ subscription rights in whole or in part in the cases specified in Section 4.2. of the Articles of Association.

The Management Board of PUMA SE did not make use of the existing authorized capital in the current reporting period.

Conditional Capital

By resolution of the Annual General Meeting of April 12, 2018, the Management Board was authorized until April 11, 2023, with the consent of the Supervisory Board, through one or more issues, altogether or in parts and in various tranches at the same time, to issue bearer or registered options and / or convertible bonds, profit-sharing rights or participation bonds or a combination of these instruments with or without a term limitation in a total nominal amount of up to € 1,000,000,000.00 (Conditional Capital 2018).

In this connection, the share capital was increased conditionally by up to € 7,722,219.52 by the issue of up to 3,016,492 new units of registered stock. The conditional capital increase will be performed only insofar as use is made of options or conversion rights or a conversion or option obligation is fulfilled or insofar as deliveries are made and if other forms of fulfillment are not used for servicing.

No use has been made of the authorization to date.

Dividends

The amounts eligible for distribution relate to the retained earnings of PUMA SE, which is determined in accordance with German Commercial Law.

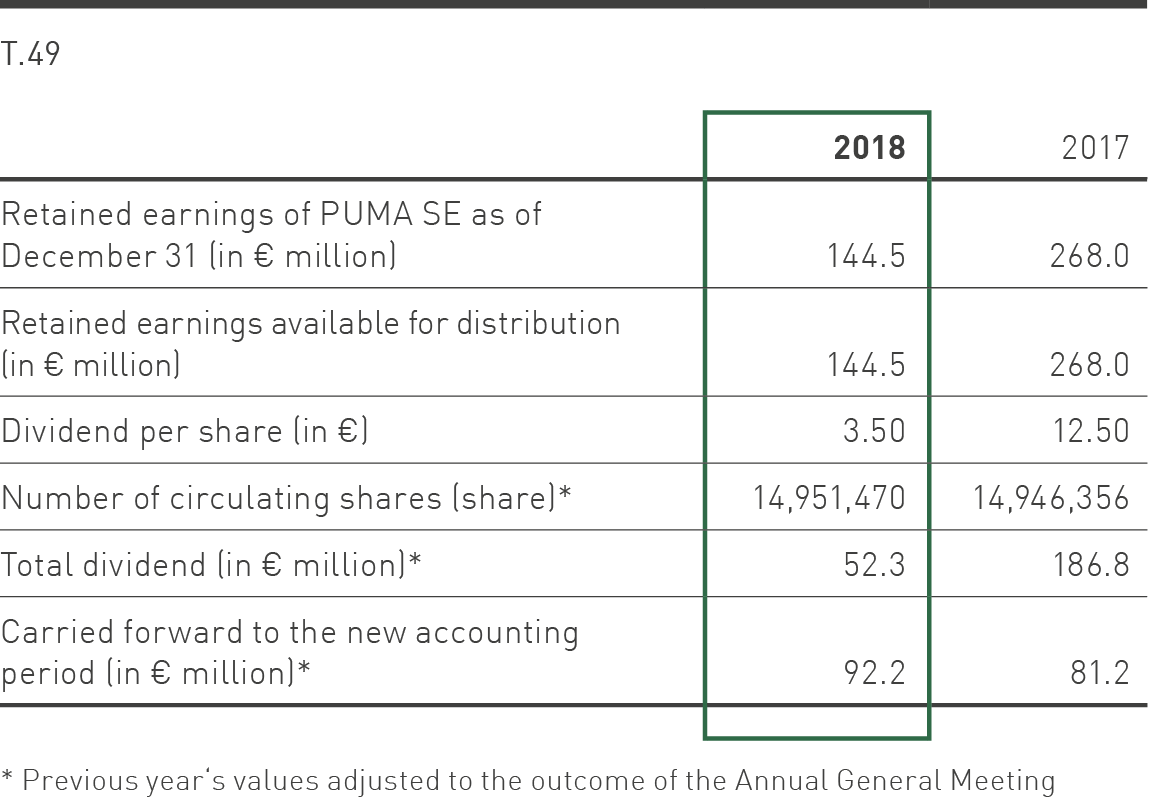

The Management Board and the Supervisory Board will propose to the Annual General Meeting that a dividend of € 3.50 per circulating share, or a total of € 52.3 million (with respect to the circulating shares as of December 31, 2018), be distributed to the shareholders from the retained earnings of PUMA SE for the 2018 financial year.

Proposed appropriation of the retained earnings of PUMA SE:

Non-controlling interests

The non-controlling interest remaining as of the balance sheet date relates to the company PUMA Accessories North America, LLC with € 1.3 million (previous year: € 4.9 million), Janed, LLC with € 14.6 million (previous year: € 21.3 million), PUMA Kids Apparel North America, LLC with € 0.0 million (previous year: € 1.3 million), and Janed Canada, LLC with € 3.0 million (previous year: € 2.4 million), PUMA North America Accessories Canada, LLC with € 0.1 million (previous year: € 0.5 million) and PUMA Kids Apparel Canada, LLC, with € -0.2 million (previous year: € 0.8 million); see also chapter 30.

Capital Managements

The Group’s objective is to retain a strong equity base in order to maintain both investor and market confidence and to strengthen future business performance.

Capital management relates to the consolidated shareholders’ equity of PUMA. This is shown in the consolidated balance sheet as well as in the reconciliation statement concerning “Changes in Equity.”

19. Management Incentive Program

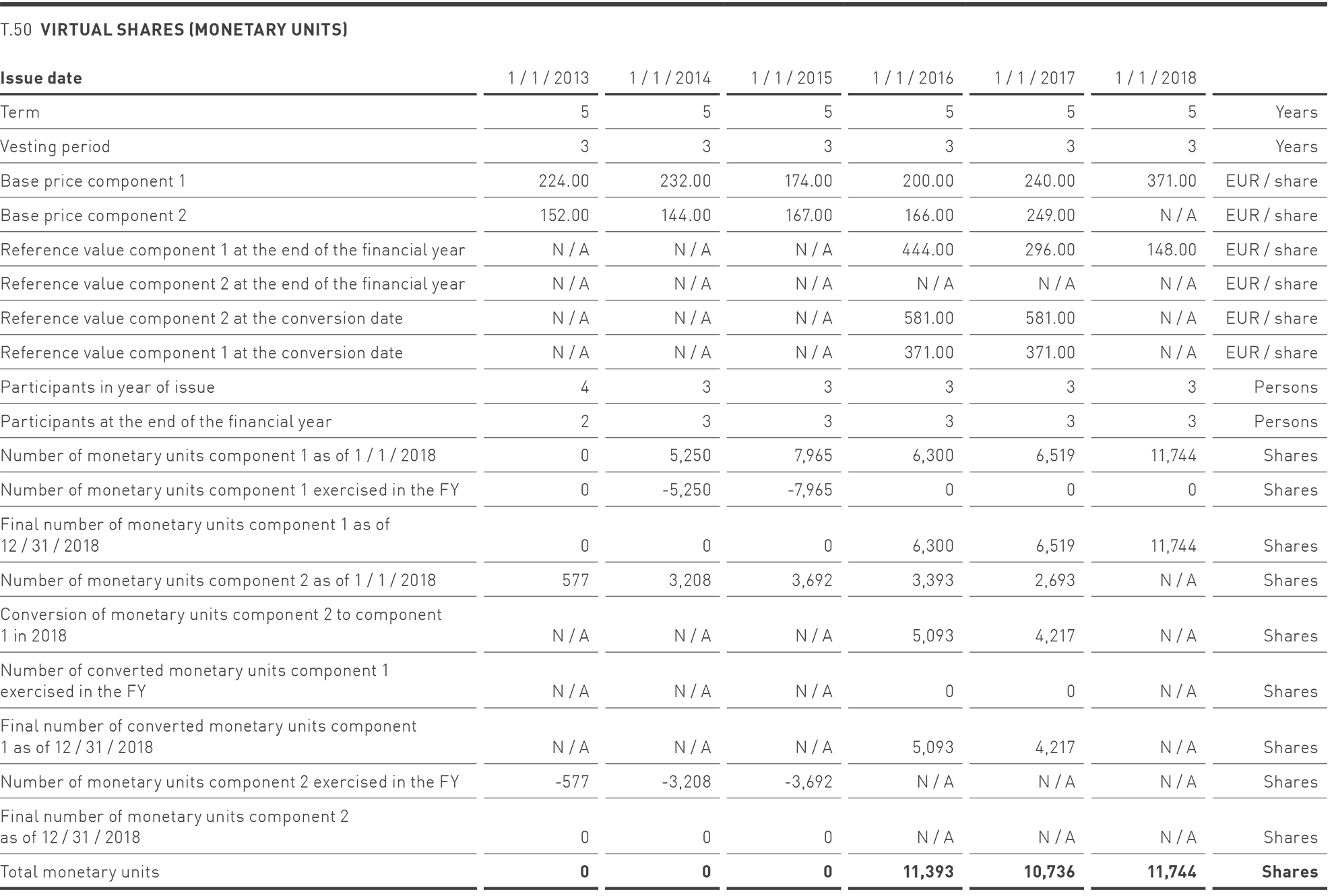

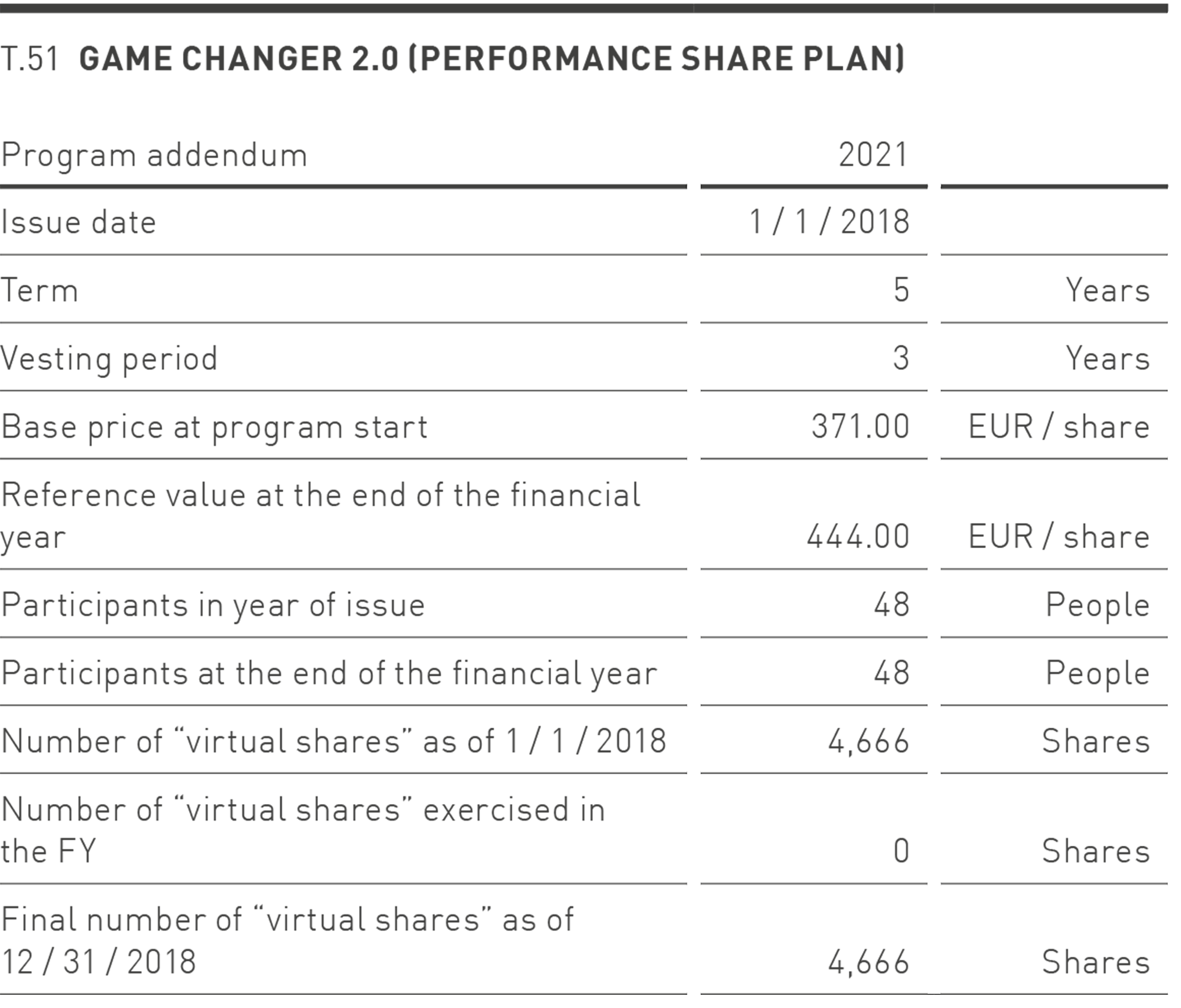

In order to tie the management to the company with a long-term incentive, virtual shares with cash settlement and other long-term incentive programs are used at PUMA.

The current programs are described below:

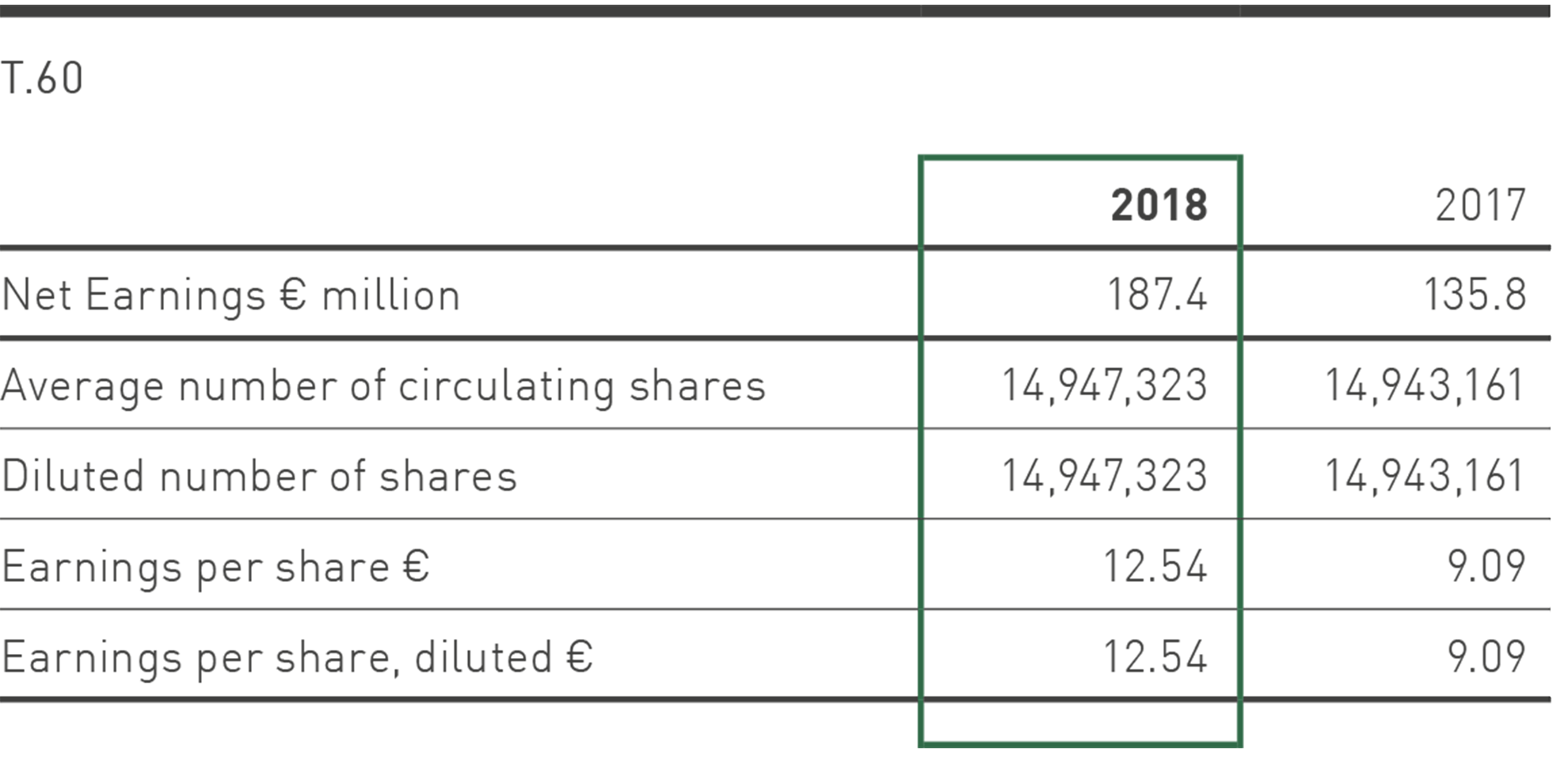

Explanation of “virtual shares”, termed “monetary units”