Sales development

Illustration of sales development in 2023 compared to the outlook

In its combined management report for 2022, PUMA forecast a currency-adjusted increase in sales in the high single-digit percentage range for financial year 2023. Sales development was affected by the significant devaluation of the Argentine peso and the associated translation effects at the closing rate, which had an extraordinary impact in the fourth quarter and on the full-year 2023. Due to the extent and timing of these currency effects, we were unable to fully compensate for the overall negative impact at the end of the year. Nevertheless, sales development was largely in line with the outlook. More details on sales development in the financial year 2023 are provided below.

Sales

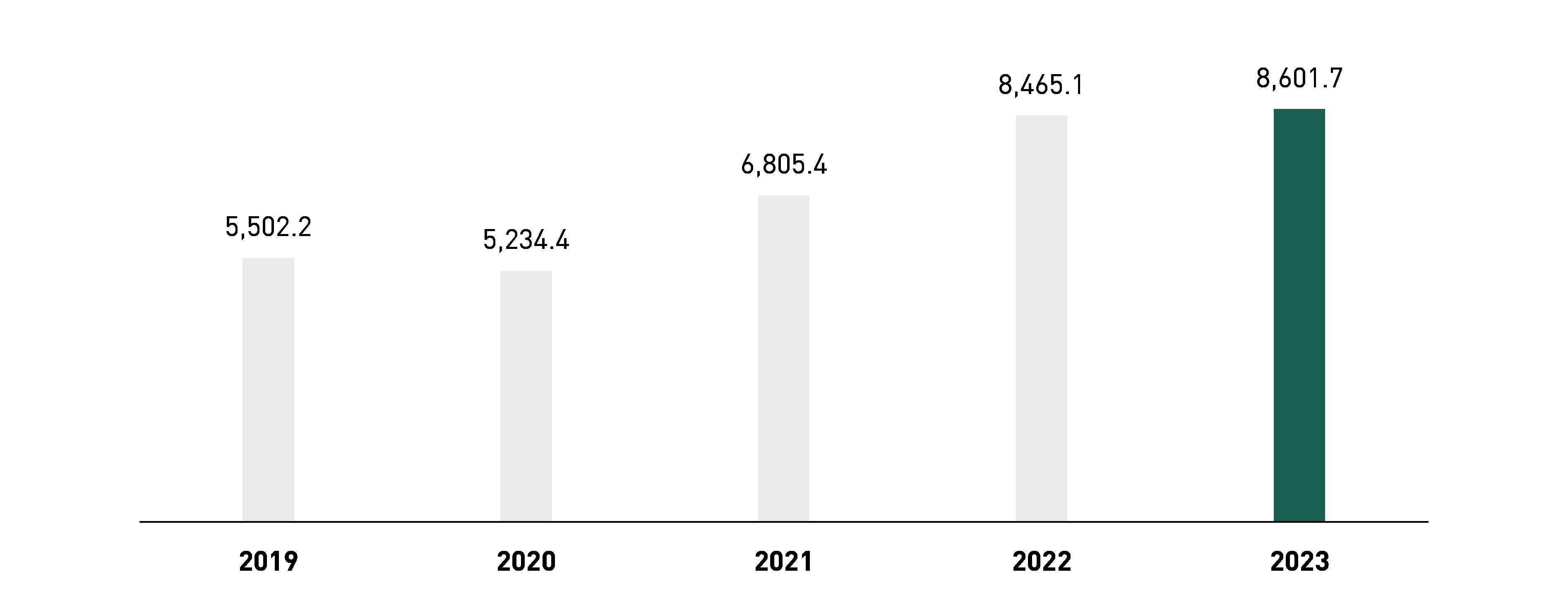

PUMA's sales in the reporting currency, the euro, increased by 1.6% to € 8,601.7 million in the financial year 2023 (previous year: € 8,465.1 million). Currency-adjusted sales increased by 6.6%. This allowed PUMA to achieve record sales of € 8.6 billion in 2023, the year of the 75th anniversary of the company, despite the difficult market environment.

↗ G.05 SALES (€ million)

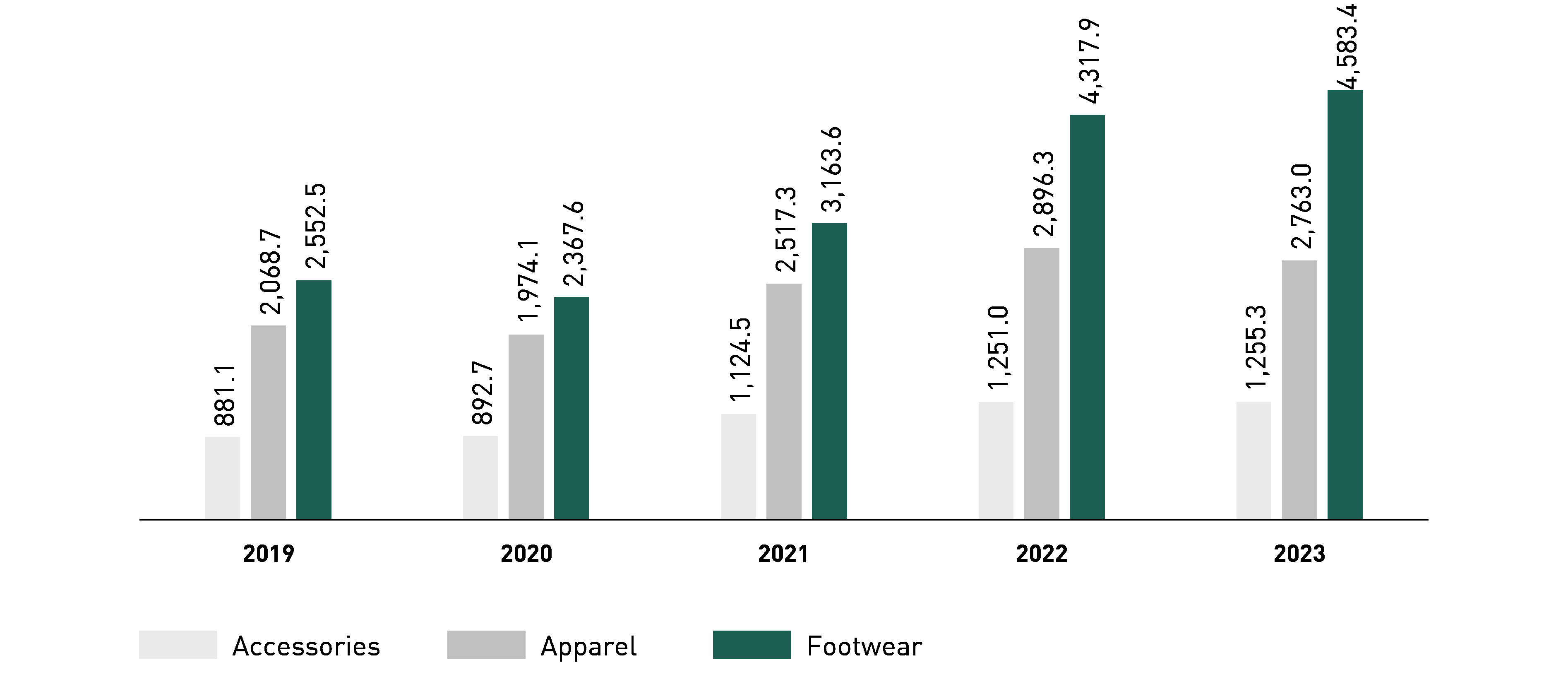

In the footwear division, sales increased in the reporting currency, the euro, by 6.1% to € 4,583.4 million. Currency-adjusted sales increased by 12.4%. The footwear division continued to be the growth driver and the strongest growth was achieved in the Sportstyle, Teamsport and Basketball categories. The share of the footwear division in total sales rose from 51.0% in the previous year to 53.3% in 2023.

Sales in the apparel division fell by 4.6% to € 2,763.0 million in the reporting currency, the euro. Adjusted for currency effects, sales fell only slightly by 0.3%. Higher sales in the categories Teamsport and Running & Training were compared to lower sales in the Sportstyle and Motorsport categories. The share of the apparel division decreased to 32.1% of Group sales (previous year: 34.2%).

The accessories division reported an increase in sales in the reporting currency, the euro, of 0.3% to € 1,255.3 million. This corresponds to a currency-adjusted sales growth of 3.1%. The growth in the Teamsport category was partly offset by slightly lower sales with Cobra golf clubs. In 2023, the share of the accessories division decreased to 14.6% of Group sales from 14.8% in the previous year.

↗ G.06 SALES BY PRODUCT DIVISIONS (€ million)

Own retail activities

PUMA's own retail activities include direct sales to our consumers ("Direct-to-consumer business"). This includes selling to our customers in PUMA's own retail stores, the so-called "Full Price Stores" and "Factory Outlets". Our e-commerce business on our own online platforms and on the platforms of online retailers, which we refer to as "marketplaces", is also part of the direct sales to our consumers. Our own retail businesses ensure regional availability of PUMA products and the presentation of the PUMA brand in an environment suitable to our brand positioning.

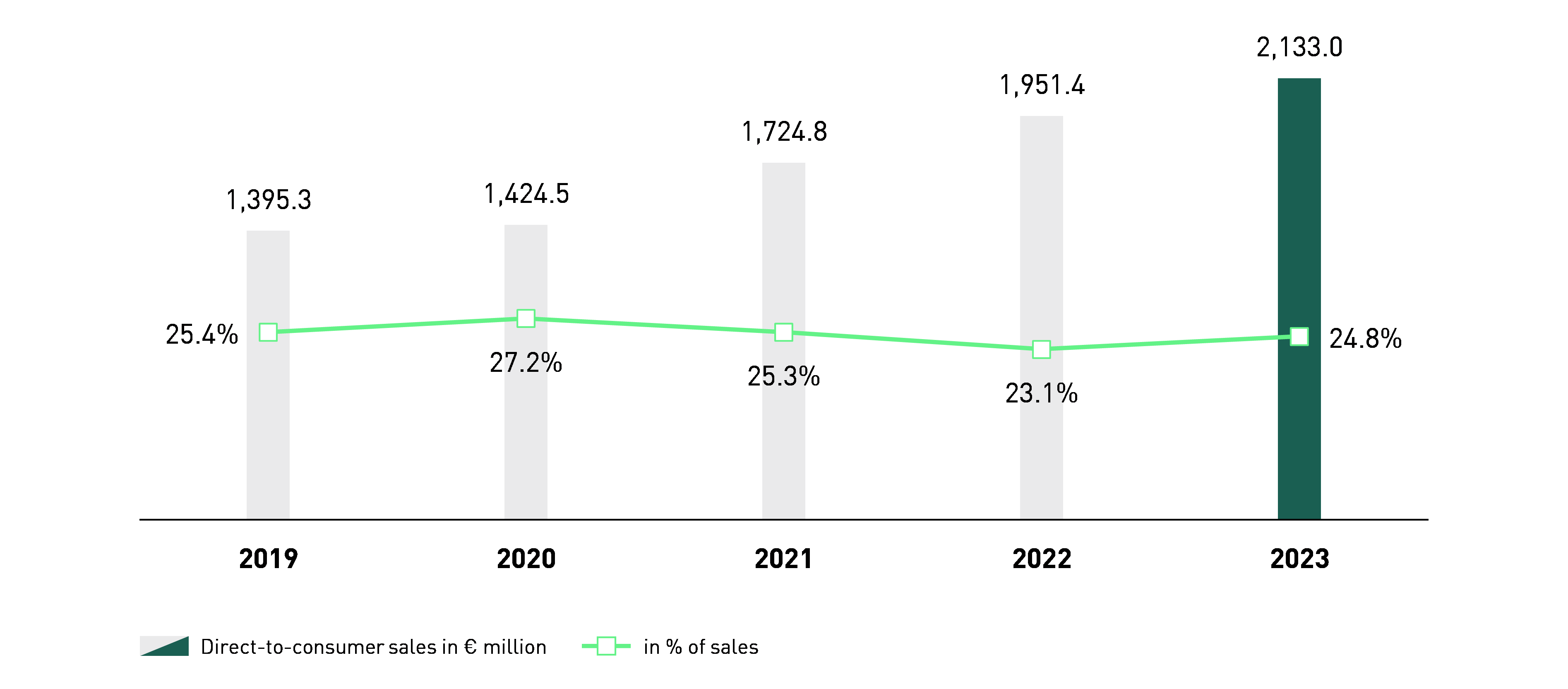

PUMA's direct-to-consumer sales increased by 17.5% currency-adjusted to € 2,133.0 million in the financial year 2023. This corresponds to a share of 24.8% of total sales (previous year: 23.1%). Adjusted for currency effects, sales in PUMA's own full-price stores and factory outlets increased by 18.8% in 2023. In the e-commerce business, sales increased by 15.0% in 2023, adjusted for currency effects. The continued strong sales growth in our DTC business was due to continued brand desirability, the opening of own retail stores and their increase in productivity.

↗ G.07 DIRECT-TO-CONSUMER SALES

Licensing business

PUMA grants licenses to independent partners for various product divisions, such as watches, glasses, safety shoes, workwear and gaming accessories. In addition to design, development and manufacture, these companies are also responsible for product distribution. Income from license agreements also includes some distribution licenses for different markets. PUMA's royalty and commission income increased by 14.0% to € 38.5 million in the financial year 2023 (previous year: € 33.8 million). The main reason for the increase was the granting of new licences in the golf and accessories segment.

Regional development

In the following explanation of the regional development of sales, the sales are allocated to the customers' actual region ("customer site"). It is divided into three geographical regions (EMEA, Americas and Asia/Pacific).

PUMA's sales in the reporting currency, the euro, increased by 1.6% in the financial year 2023. This corresponds to a currency-adjusted sales increase of 6.6% compared to the previous year. This currency-adjusted growth resulted in particular from good sales performance in the EMEA and Asia/Pacific regions, which both achieved double-digit growth rates. In contrast, the Americas region recorded a slight decrease in sales.

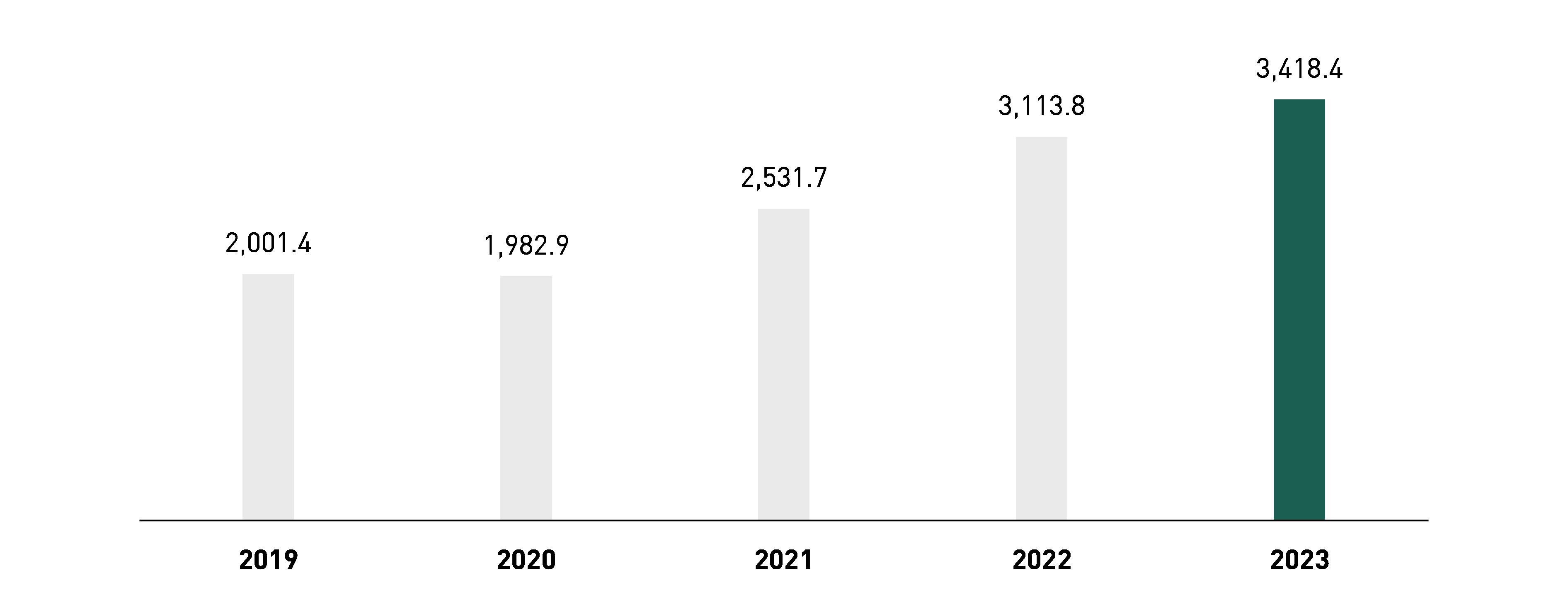

In the EMEA region, sales in the reporting currency, the euro, rose by 9.8% to € 3,418.4 million. Adjusted for currency effects, this corresponds to an increase in sales of 13.4%. Almost all countries in the region, with the exception of Great Britain and Sweden, contributed to this development with sales growth. Particularly strong growth came from Germany, Spain, Italy and Turkey. In terms of Group sales, the EMEA region's share rose from 36.8% in the previous year to 39.7% in 2023.

With regard to product divisions, sales from footwear recorded a currency-adjusted increase of 21.7%. Currency-adjusted sales of apparel increased by 8.2%. Currency-adjusted sales of accessories rose by 2.5%.

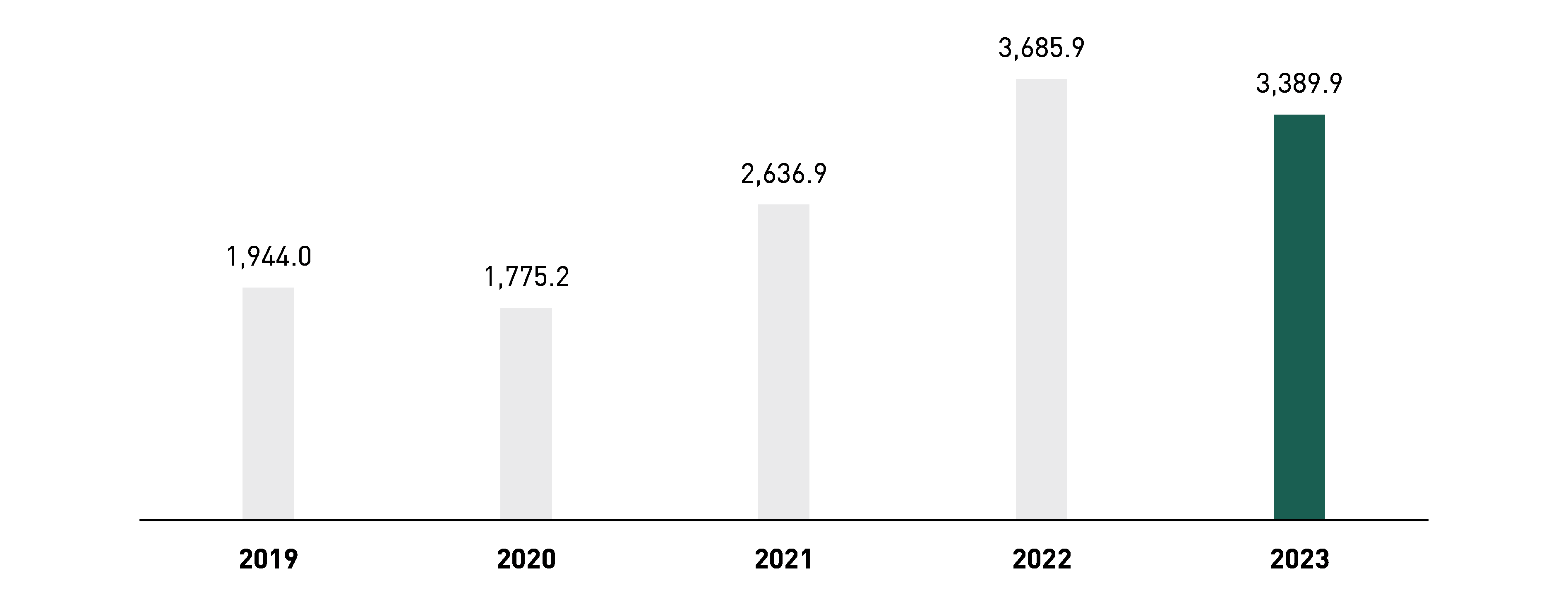

↗ G.08 EMEA SALES (€ million)

In the Americas region, sales in the reporting currency, the euro, decreased by 8.0% to € 3,389.9 million. The decline in sales in the reporting currency was impacted by negative exchange rate effects due to the strong devaluation of the Argentine peso against the euro. Currency-adjusted sales decreased by 2.4%. The currency-adjusted sales decline was mainly due to a difficult macroeconomic environment, high inventory levels in the trade and PUMA's relative dependence on the off-price wholesale business in the USA. The Americas region's share of Group sales decreased from 43.5% in the previous year to 39.4% in 2023.

In terms of product divisions, both footwear (+1.5% currency-adjusted) and accessories (+4.8% currency-adjusted) recorded sales growth compared to the previous year. In contrast, currency-adjusted sales in the apparel division fell by 13.3%.

↗ G.09 AMERICAS SALES (€ million)

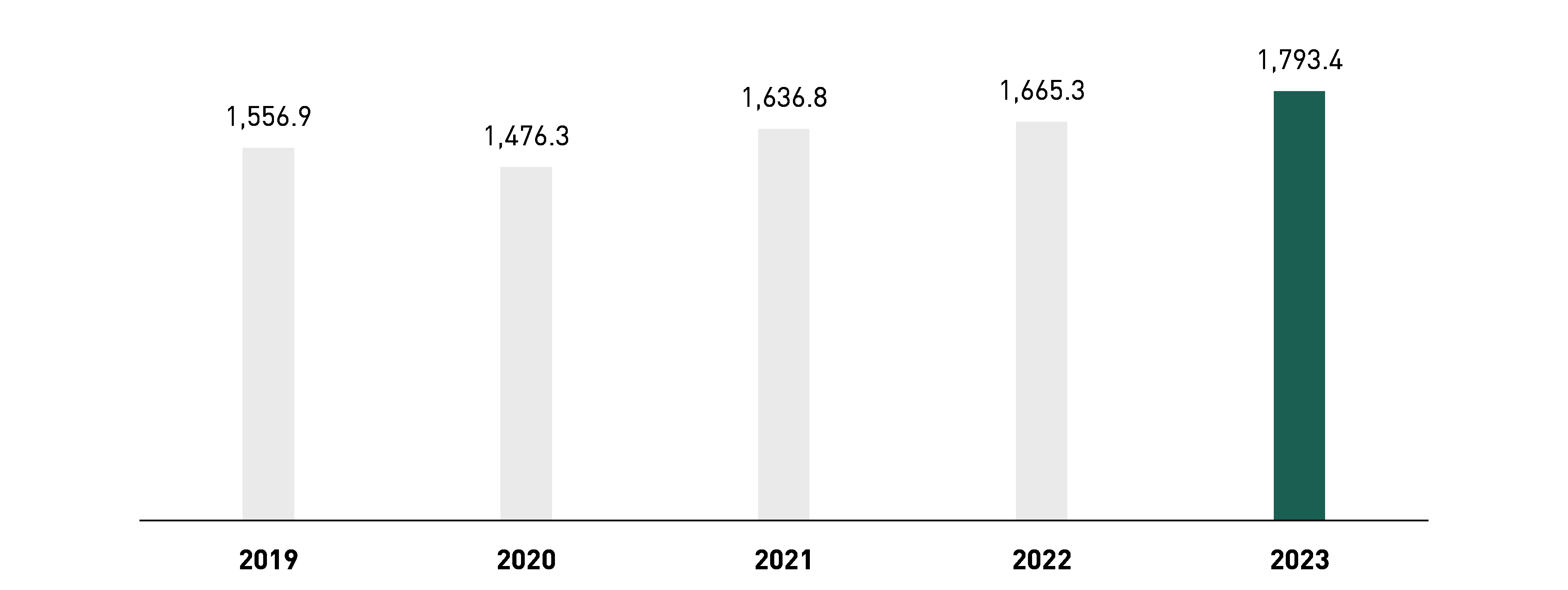

In the Asia/Pacific region, sales in the reporting currency, the euro, rose by 7.7% to € 1,793.4 million. Adjusted for currency effects, this corresponds to an increase in sales of 13.6%. While China, India and Singapore, among others, recorded double-digit sales growth, sales declined in South Korea and Australia. The share of the Asia/Pacific region in Group sales increased from 19.7% in the previous year to 20.8% in 2023.

In terms of product divisions, both footwear (+22.6% currency-adjusted) and apparel (+5.9% currency-adjusted) recorded sales growth compared to the previous year. In contrast, currency-adjusted sales in the accessories division fell by 1.4%.

↗ G.10 ASIA/PACIFIC SALES (€ million)