Risk and Opportunity Report

PUMA is continuously exposed to opportunities and risks in the competitive, fast-paced and international sport and lifestyle industry. The risk strategy is therefore to take business risks in a calculated manner in order to implement the corporate strategy with all its opportunities. For this purpose, effective risk and opportunity management is required so that opportunities can be recognised and utilised, and risks can be identified and managed at an early stage. We define risks as potential future developments or events that may lead to a negative deviation from targets for the company (see the "Risk Management System" section). Similarly, opportunities are potential future developments or events that may result in a positive deviation from targets.

Risk Management System

PUMA takes a conscious and controlled approach to risks in order to achieve the company's goals. The aim of the risk management system is to identify and manage at an early-stage material risks or risks that could even jeopardise the company's existence and thus support the achievement of the company's objectives. In addition, compliance with the related laws, regulations and standards must be ensured, as well as transparency in relation to the risk situation from the perspective of partners such as customers, suppliers and investors. Therefore, PUMA has established an appropriate and effective risk management organisation which is able to identify risks at an early stage and manage them in accordance with the corporate strategy and promote risk awareness within the PUMA Group to facilitate risk-based decisions. As part of the organisation, risks are looked at Group-wide, unless explicitly stated to the contrary. As in the previous year, PUMA's risk management system is based on a comprehensive, interactive, and management-oriented approach to risk that is integrated into the company's organisation and is based on the globally recognised COSO standard (Committee of Sponsoring Organisations of the Treadway Commission). Opportunity management is not part of the risk management system and is the responsibility of operational management teams in the respective regions, markets, and departments (see the "Opportunities" section).

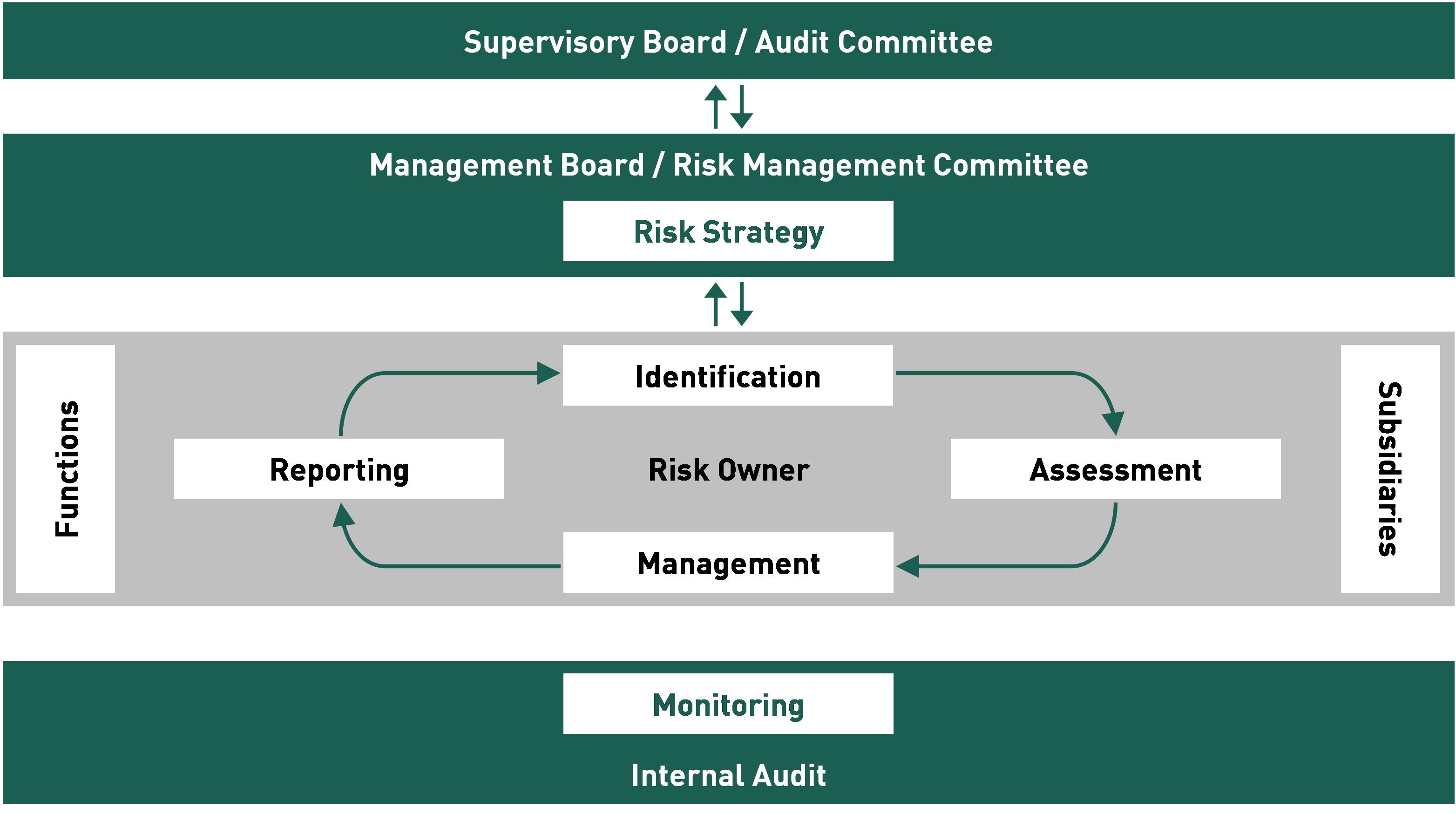

The Management Board of PUMA SE bears overall responsibility for the risk management system in accordance with Section 91(3) AktG. The Management Board regularly updates the Audit Committee of the Supervisory Board of PUMA SE. In addition, pursuant to Section 107(4), the Audit Committee has a direct right to information from the operational management departments. The Risk Management Committee, which consists of the PUMA SE Management Board and selected managers, is responsible for the design, review, and adaptation of the risk management system. For the operational coordination of the risk management process and support of the risk officers, the risk management function of the Group Internal Audit, Risk Management & Internal Control department has been assigned to prepare the regular risk reporting to the Risk Management Committee. The responsibilities, tasks and processes of the risk management system are defined in PUMA’s enterprise risk guidelines. The structure and design of the risk management system are as follows:

↗ G.19 RISK MANAGEMENT SYSTEM

The risk owners are mainly the managers of the functional areas and the managing directors of the subsidiaries. Risks are identified company-wide by performing a bottom-up analysis within the risk owner's area of responsibility. These risks are regularly reported to the risk management function and/or the local monitoring bodies in structured interviews that take place every six months or during the year using established internal reporting channels. As a part of the risk culture at PUMA, general information for risk management as well as training materials are made available for all employees.

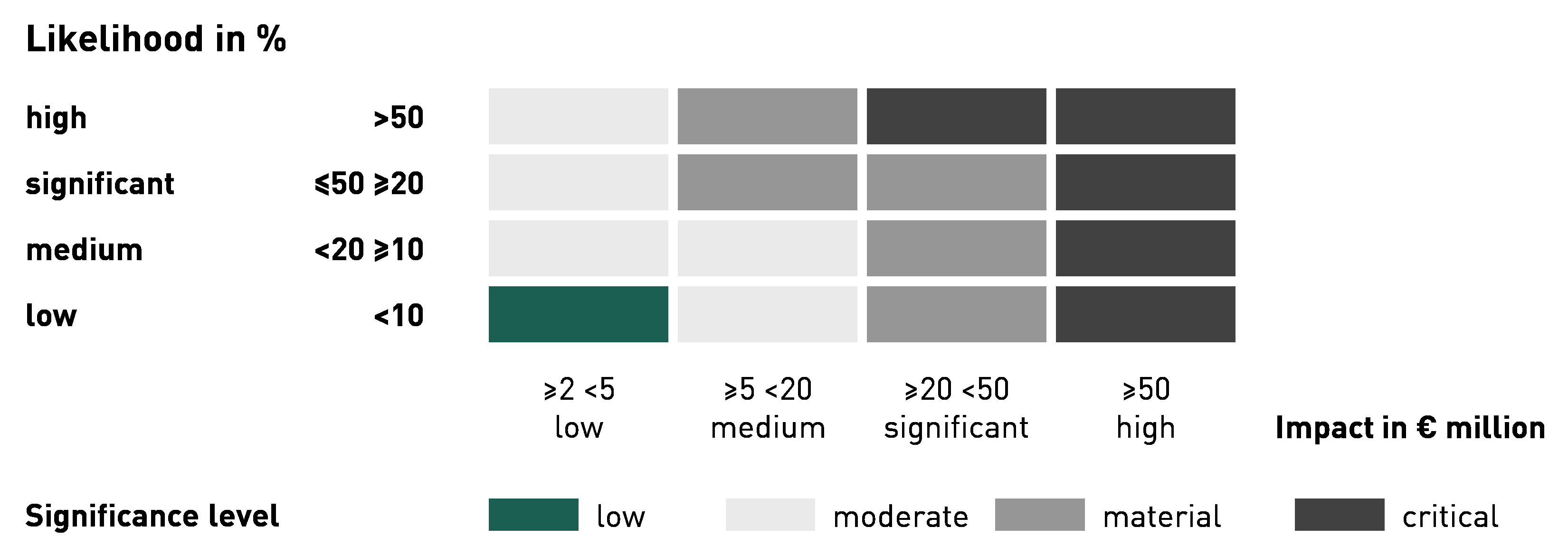

The risks are evaluated and assessed in terms of probability of occurrence and extent of damage using quantitative criteria with the help of a systematic methodology. The quantitative criteria are represented in the form of risk classification ranges on a four-level scale: Low, Medium, Significant and High. While the risk assessment of the probability of occurrence is measured as a percentage rate, the extent of damage is based on the planned operating result for the upcoming financial year. We follow a net risk approach, addressing the risks that remain after existing control measures have been implemented. The resulting risk assessments are presented as an aggregated risk group ("overall risk situation"). Thus, for the materiality assessment, the quantified risks are combined from their extent of damage and probability of occurrence and are classified in a comprehensive risk matrix regarding their significance level (“Low”, “Moderate”, “Material” and “Critical”) for internal monitoring and to assess their viability (see graphic G.21).

For example, a risk can be allocated within the most critical range, which may also include risks that could even jeopardise the company's existence, in the case that its assessment reflects a combination of highest bandwidth for extent of damage (“High > € 50 million”) and probability (“High > 50%”). The overview of the risk groups is presented in table T.7, summarised in the order of their relative importance and their change during the year.

↗ G.20 RISK MATRIX

Regular risk identification and assessment is carried out by the risk management function every six months with all major functional areas. The risks recorded and assessed are also reviewed with a top-down approach by the Risk Management Committee. This ensures that adequate consideration is given to interdependencies and the overall risk situation.

The risk owners are responsible for the operational management of identified risks. Risks can be managed by avoiding, reducing, diversifying, or transferring the risk to achieve the targeted and acceptable residual risk. Within the reporting process, material risks or those which could even jeopardise the company’s existence are coordinated with and managed by the Risk Management Committee or the Management Board, considering the risk-bearing capacity, which is also based on the planned operating result.

The methodology and structure of the risk management system are continuously monitored in terms of their appropriateness and effectiveness and adapted or improved when required. This is carried out on the one hand by the Internal Audit department, as an independent audit body within the PUMA Group, and on the other hand through the utilisation of the results of the auditor of PUMA SE, which assesses the early risk identification system annually for its fundamental suitability to be able to identify risks that endanger the company’s existence at an early stage.

Risks

The following explanations of risk groups are presented based on their relative importance from the Group perspective for the financial year 2023.

MACROECONOMIC DEVELOPMENTS

As an internationally operating enterprise, PUMA is exposed to challenges and uncertainties that affect the global economy and the associated risks may have an impact on our sales and sourcing markets. For example, macroeconomic risks because of economic recessions, changes in interest rates, or inflation and cost pressures, might have an impact on consumer behavior, production costs, sales, and profit margins. Likewise, global events such as political changes, social developments, geopolitical tensions, and natural disasters can disrupt supply chain activities or affect consumer sentiment, are also reflected in legal and macroeconomic conditions.

In 2023, the macroeconomic and geopolitical environment remain challenging. The recent conflict in Middle East, the war in Ukraine, persistent inflation, and the risks of recession weights on consumer sentiment, resulting in volatile demand in the retail sector. The pattern of China’s economic recovery after COVID-19 remains uncertain and competition with both local and global brands remains high.

Overall, we manage these challenges by having close alignment and communication with regions and key markets to follow up and deal with critical developments affecting PUMA business environment (e.g., price increases, supply chain interruptions, geopolitical tensions) and develop alternative scenarios to analyse possible occurrence of events. Moreover, the Management Board is regularly updated about country and macroeconomic developments and defines action plans to quickly adapt to changing economic conditions.

BUSINESS PARTNERS

As an enterprise with global operations, managing sourcing and supply chain related risks is of key importance for PUMA. Most of our PUMA products are produced in Asia in countries like China, Vietnam, Cambodia, Bangladesh, Indonesia and India. In addition to the challenges, production in these countries continues to be associated with significant risks for us. These risks arise, for example, from changes in sourcing, wage and logistic costs, supply bottlenecks for raw materials or components, and quality issues, as well as from the possibility of overdependence on individual suppliers. Sourcing and the supply chain must also react to risks, such as changes in duties and tariffs as well as trade restrictions and government requirements. The transport of products to the distribution countries is also exposed to the risk of delays and failures by warehouse and logistics service providers due to extraordinary events and/or human or system error.

To mitigate business partners related risks, we have implemented a functional framework for sourcing and supply chain processes. Our sourcing portfolio is regularly reviewed and adjusted to avoid creating a dependence on individual suppliers and sourcing markets. Generally, long-term master framework agreements are concerted to secure the required production capacities for the future. Regular communication with PUMA entities allows us to anticipate any price increase and strengthen our forecast activities. A quality control process and the direct and partnership-like collaboration with suppliers should permanently secure the quality and availability of our products. Moreover, we continuously analyse political, economic, and legal framework conditions and have further enhanced our close cooperation with our logistics partners to be able to react to changes in the supply chain early on and to continuously strengthen the supply chain. The collaboration with warehouse and logistics service providers is accordingly secured by selection processes, consistent contractual terms, and permanent monitoring of relevant indicators.

In 2023 global sourcing markets normalised because of the end of COVID-related restrictions: However, there are continued supply chain and sourcing challenges regarding rising costs and the potential threat of a larger recession that could still cause disruptions and delays in the operations. To diminish these challenges, we have further intensified the cooperation with our suppliers and logistics partners to be able to act flexibly and base our actions around finding the right solutions.

CURRENCY RISKS

As a group that operates internationally, PUMA is exposed to transactional foreign currency risks. The currency risks exist to the extent that the exchange rates of currencies in which purchase and sales transactions as well as lending transactions and receivables are carried out fluctuate against the functional currency of the PUMA Group - the euro.

PUMA's biggest sourcing market is Asia, where most payments are settled in US dollars (USD), while sales of the PUMA Group are mostly invoiced in other currencies. PUMA manages currency risk in accordance with internal guidelines. Material risks are hedged, in accordance with the Group directive, up to a hedging ratio of 95% of the estimated foreign currency risks from expected purchase and sales transactions over the next 12 to 15 months. Forward exchange contracts and currency options, usually with a term of around 12 months from the reporting date, are used to hedge the foreign currency risk. For significant risks that are subject to large hedging costs, high hedging ratios can only be achieved over shorter terms.

To hedge signed or pending contracts against currency risk, PUMA only concludes currency forward contracts and currency options on customary market terms with reputable international financial institutions. As of the end of 2023, the net requirements for the 2024 planning period were adequately hedged against currency effects, if possible.

Foreign exchange risks may also arise from intra-group loans granted for financing purposes. Currency swaps and currency forward transactions are used to hedge currency risks when converting intra-group loans denominated in foreign currencies into the functional currencies of the group companies (EUR).

In addition, as an international group with its own presence in a large number of countries, PUMA is also exposed to translation risks. These arise in the course of consolidation when individual financial statements of foreign subsidiaries that do not prepare their accounts in euros are translated into the PUMA Group's functional currency, the euro.

In countries with high interest and inflation rates, both transaction risks and translation risks can arise to a considerable extent. PUMA does not hedge these risks, as the hedging costs in high-interest countries - insofar as hedging is possible at all - in some cases significantly exceed the benefits of hedging. The negative effects of currency and inflation are generally compensated for by adjusting the prices of products in the respective market.

In order to disclose market risks, IFRS 7 requires sensitivity analysis that show the effects of hypothetical changes in relevant risk variables on earnings and equity. The periodic effects are determined by relating the hypothetical changes caused by the risk variables to the balance of the financial instruments held as of the balance sheet date. The underlying assumption is that the balance as of the balance sheet date is representative for the entire year.

Currency risks as defined by IFRS 7 arise on account of financial instruments that are denominated in a currency which differs from the functional currency and are monetary in nature. Differences resulting from the conversion of the individual financial statements to the group currency are not taken into account. All non-functional currencies in which the Group employs financial instruments are generally considered to be relevant risk variables.

The currency sensitivity analysis is based on the net balance sheet risk denominated in foreign currencies. This also includes intra-company monetary assets and liabilities. Outstanding currency derivatives are also reassessed as part of the sensitivity analysis. It is assumed that all other influencing factors, including interest rates and raw material prices, remain constant. The effects of the forecasted operating cash flows are also ignored.

Currency forward contracts, used to hedge against payment fluctuations caused by exchange rates, are part of an effective cash-flow hedging relationship pursuant to IAS 39. Changes in the exchange rate of the currencies underlying these contracts have an effect on the hedge reserve in equity and on the fair value of these hedging contracts.

PANDEMIC

PUMA first identified the COVID-19 pandemic as a new risk in the financial year 2020 and accordingly established the risk category "Pandemic”. Risks related to a pandemic event such as supply chain disruptions, economic and financial strains, lockdowns, retail store closings, cancellations of sport events or social restrictions could lead to severe business disruptions, reduced consumption, loss of sales, or liquidity shortfalls. For financial year 2023, the negative impacts of the pandemic have diminished as countries and regions ended pandemic-related restrictions and economic and life activities are normalising. In principle, uncertainties arise in relation to new variants that could lead to possible lockdowns or restrictions.

To mitigate pandemic-related risks, different strategic approaches have been established to ensure and prioritise the health and safety of our employees and customers, as well as continuous monitoring of the situation and possible restrictions. There is continuous monitoring of the latest economic events and close alignment with our regions and key markets to manage critical developments and adapt to market conditions. Close cooperation with partners and suppliers is essential to implement and monitor contingency strategies. In addition to Direct-to-Consumer business, the e-commerce business and PUMA App are an essential part of our distribution structure.

PRODUCT & MARKET ENVIRONMENT

The sport and lifestyle markets are defined by intense competition, constant innovation, and changing consumer preferences. PUMA faces the challenge of continuously innovating and differentiating its product offering to capture consumer interest and gain and edge over its competitors. Product and market environment risks could arise from a non-anticipated or late response to consumer demand within the fast-moving lifestyle and sports markets. Constant changes in consumer lifestyle/sports trends and long product lifecycles bear the risk of creating products that are not relevant to our consumers, launching them at the wrong time, launching them with the wrong marketing campaign or placing them in the wrong distribution channels. As a result, these risks could lead to a loss in market share, sales shortfalls, and lower brand attractiveness. Media reports about PUMA also play a key role in brand image. For example, reports about the infringement of laws or internal/external requirements, product recalls and exposure on social media as well as reports about workforce diversity and tolerance can cause significant damage to brand image and ultimately result in the loss of sales and profit.

To mitigate these risks, we conduct market research and systemic monitoring of market environment for early recognition and taking advantage of relevant consumer trends. Targeted investments in product design and product development are to ensure that the characteristic PUMA design of the entire product range is consistent with the overall brand strategy ("Forever Faster"), thereby creating a unique level of brand recognition. Accordingly, we have set the guiding principle that "We want to become the fastest sports brand in the world" to underline the company's long-term direction and strategy. The "Forever Faster" brand promise does not just stand for PUMA's product range as a sports and lifestyle company, but also applies to all company processes. Brand image is particularly strengthened through cooperation with brand ambassadors who embody the core of the brand and PUMA's brand values ("brave," "confident," "determined" and "joyful") and have a large potential for influencing PUMA's target group. We additionally counter this risk through careful press, social media, and public relations work as well as by monitoring the press and social media environment.

PROJECTS

The strategic program portfolio of PUMA contains important and critical projects to ensure that the flow of goods and information is sufficiently supported by modern warehouse, logistics and IT infrastructure. These include, for example, the implementation of IT systems to enhance operations, such as centralised systems or e-commerce platforms and systems in the warehouse and supply chain. Risk associated with projects include ineffective change management, lack of resources, high costs, exceeding budget, overrun time frames, non-acceptance of users due to weak communication, increase vulnerability to potential data breaches and disruption to business processes.

To manage project-related risks effectively, PUMA has established group and regional project teams as well as policies to manage the roll-out of new and existing projects that have a significant impact on the core value chain. In addition, as part of project management practices, continuous alignment with stakeholders and steering meetings to monitor, provide support and guidance on strategic projects are implemented to ensure its execution is in line with pre-defined objectives and milestones such as time frames and budgets.

INFORMATION TECHNOLOGY

The ongoing digitalisation of business environments brings new challenges to PUMA in the field of information technology which – in case of incidents - may have an impact on our operations, data security and privacy, as well as overall performance. Key business procedures and processes such as supply chain management, e-commerce, and financial reporting depend on digital services, infrastructure, and their unimpaired availability. Interruptions of service availability can disrupt essential processes and cause operational problems. Moreover, information security is of outmost importance for PUMA, the risk of a data breach might lead to financial loss, brand damage, legal claims, and loss of customer trust.

To mitigate these risks, we continuously carry out technical and organisational measures. Key business procedures, processes and infrastructure on information technology and security are established based on best -practice frameworks, regularly updated and controlled. These processes are subject to internal and external audits to ensure their reliability and the appropriateness of control mechanisms. Appropriate procedures and guidelines related to IT-incident response are in place and updated accordingly. Moreover, PUMA has an Information Security Committee which consistently updates the Management Board on the latest status and developments. In addition, trainings and information campaigns are conducted regularly to increase awareness and knowledge on information security related issues.

DISTRIBUTION STRUCTURE

PUMA relies on different distribution channels including the Wholesale business with our retail partners and the Direct-to-Consumer (DTC) business with our PUMA-owned and operated (O&O) retail stores and e-commerce platforms. This diversified distribution mix enables PUMA to reduce its dependency on individual distribution channels and/or retail partners.

The wholesale business represents the largest share of sales overall and is characterised by strong partnerships with all our retail partners. The company’s DTC business has a complementary role and is intended to ensure a better and more comprehensive presentation of PUMA products in a controlled brand environment, direct interaction with our end consumers and a higher gross profit margin.

In the wholesale business, growing retailers, including those offering their own brands, and direct competitors pose the risk of intensified competition for market shares, price pressures or reduced profit margins. Consumer purchase behavior is also changing, focusing more on e-commerce and a combination of stationary and digital trade. This requires continuous adjustment of the distribution structure. Distribution through our O&O retail stores and e-commerce platforms is, however, also associated with various risks including the required investments in expansion and infrastructure, setting up and refurbishing stores, higher fixed costs, and leases with long-term lease obligations. This can have an adverse impact on profitability in the event of a business decline.

To avoid risks, we carry out permanent monitoring of distribution channels and regular reporting by Controlling and the dedicated functions. We maintain strong collaborations with all our retail partners in line with our wholesale-focused strategy. The company's reporting and controlling system allows us to detect negative trends early on, and to take the countermeasures required to manage individual stores and overall to monitor the evolution of the distribution landscape. A detailed location and profitability analysis is carried out in our DTC business before making any investment decision. In e-commerce, global activities are harmonised and investments in IT systems are carried out to further improve the shopping experience for our consumers and to drive conversion. This includes the continued global roll-out of the PUMA Shopping App.

SUSTAINABILITY

Sustainability topics are highly important for PUMA specially in sourcing as well as along the entire value chain. Natural resources crises and the resulting increase in customer requirements regarding sustainability have led to a stronger ecological focus in our product range, both at our own locations and along the production and supply chain. A more efficient use of resources, reduction in greenhouse gas emissions and compliance with environmental standards as well as the increased use of environmentally preferred materials and environmentally friendly chemicals in production are crucial parts of our sustainability strategy. The risk of not implementing an effective sustainability approach to our products and along the supply chain could lead to serious brand damage, loss of customer loyalty, supply chain disruptions, increased costs, and non-compliance with environmental regulations.

PUMA’s efforts towards managing sustainability risks and efficient use of resources are reflected in the comprehensive “Forever Better” strategy which defines 10 target areas to improve sustainability performance: Human Rights, Climate Action, Circularity, Products, Water and Air, Biodiversity, Plastics and the Oceans, Chemicals, Health & Safety as well as Fair Income. For each of these target areas, which are aligned to the UN Sustainable Development Goals (SDGs), there are measurable targets and KPI’s which are regularly monitored and reported to Board Members, Supervisory Board, and stakeholders. Additionally, risk assessments and audits are performed to ensure our suppliers follow environmental standards. PUMA’s efforts to engage with stakeholder dialog through different events like “Conference of the People” or "Voices of a RE:GENERATION" allowed to discuss sustainability topics with generation Z representatives, industry peers, experts and activists.

PUMA's sustainability report (the Non-financial Report) for the financial year 2023 is published together with the combined management report and can be accessed at the following page on our website: https://about.PUMA.com/en/investor-relations/financial-reports.

MONITORING OF WORKING CONDITIONS

An important aspect of corporate responsibility is maintaining and monitoring good working conditions and compliance with human rights in PUMA’s own operations and throughout the supply chain to ensure that employee’s rights and well-being are protected. This risk considers the event of human rights violation or social and environmental non-compliance (e.g., child labor, excessive overtime, forced labor, sexual harassment, gender-based violence, unsafe work environment, fair income) in PUMA’s own business and its supply chain.

To mitigate these risks, PUMA has implemented clear policies that are aligned with all relevant legislation on sustainability like the German Supply Chain Act, United Nations’ (UN) Declaration of Human Rights, the UN Guiding Principles (UNGPs) on Business and Human Rights, the International Labor Organisation’s Core Labor Conventions, and the ten principles of the UN Global Compact (UNGC). Regular audits and human rights/environmental risk assessments are conducted at the corporate and the supply chain level to evaluate compliance with applicable standards. Stakeholder dialogue with NGOs and partnerships with organisations (e.g., Fair Labor Association) enable transparent communication channels to address concerns and share best practices regarding human rights and environmental standards.

PUMA’s Sustainability Report (the Non-financial Report) for the financial year 2023 is available here: https://about.PUMA.com/en/investor-relations/financial-reports.

LEGAL

As an internationally operating group, PUMA is exposed to various legal risks. These risks could arise from Intellectual Property (IP) infringements that involve using a trademark, patent or copyright without proper authorisation and resulting in legal disputes, brand damage or loss of exclusivity rights. Contractual risks or risks that a third party could assert claims and litigations for infringements of its trademark rights are also considered. Counterfeit products are often of inferior quality and may not meet safety standards which can undermine the PUMA’s brand reputation, reduce consumer trust and lead to legal disputes.

The continuous monitoring of contractual obligations and the integration of internal and external legal experts in contractual matters should ensure that any legal risks reduced to the minimum. The legal team is responsible for protecting our intellectual property in order to act against brand piracy. This not only ensures that we have a strong global portfolio of property rights, such as trademarks, designs and patents, but also works closely with customs, police and other authorities and provides input to legislators regarding the implementation of effective measures to protect intellectual property.

COMPLIANCE

As an international group, PUMA is exposed to compliance risks resulting from the potential non-adherence to corporate governance rules, legal and regulatory requirements, or industry standards. These risks include fraud, conflict of interest, money laundering, antitrust law, corruption as well as deliberate misrepresentations in financial reporting which may lead to significant penalties, legal consequences, reputational damage, and disruption to business operations.

PUMA has implemented various tools to manage such risks. This includes a functioning compliance management system, the internal control system, group controlling and the internal audit departments to prevent, detect and sanction compliance-related topics at an early stage. Through the compliance management system, clear roles and responsibilities are assigned to group and local compliance functions. To ensure PUMA employees comply with PUMA ‘s values there are ongoing trainings, communication and awareness campaigns for policies and procedures. PUMA employees also have access to a whistleblowing system for reporting illegal or unethical behavior.

TAX

As a global company PUMA is exposed to a complex tax environment in which main challenges arise from cross-border transactions involving intercompany transfer of goods, services, and intellectual property. To minimise tax exposure, it is essential to optimise tax planning activities and ensure compliance with local and international laws and reporting requirements. In addition to compliance with national tax regulations to which the individual group companies are subject, there are increasing risks related to intra-group transfer pricing, which must be applied for various internal business transactions in accordance with the arm's length principle between related parties. Different countries have implemented laws and guidelines for international taxes in alignment with the Organisation for Economic Co-operation and Development (OECD) recommendations to standardise requirements for transfer-pricing documentation and update global tax policy.

In order to manage tax-related risks in an effective manner, PUMA established a solid tax governance framework. An adequate tax organisation with internal and external tax experts to comply with the relevant tax regulations and to be able to react to changes in the constantly changing tax environment. For the group-internal transfer pricing, corresponding documentation and policies are in place and aligned with international and national requirements and standards. There are guidelines and specifications for determining transfer prices for intra-group transactions that are common for foreign companies, which comply with the applicable internal procedural rules and are binding for employees who act on behalf of the group. By means of internal tax reporting, external and internal tax experts can control and monitor tax developments at PUMA on an ongoing basis. Training and awareness activities are performed on a regular basis to ensure relevant stakeholders are informed about current tax developments and acquire further expertise for tax treatment activities. Both, the Management Board, and the Supervisory Board, are regularly informed about ongoing tax developments at PUMA to identify and avoid tax-related risks as early as possible.

PERSONNEL DEPARTMENT

The creative potential, commitment and performance of PUMA employees are essential factors for achieving our strategic and financial targets. Personnel-related risks involve the management of workforce, talent acquisition and retention, employee engagement and compliance with employment laws. Any shortfall in staffing may lead to inadequate performance of tasks and have a negative impact on operational efficiency. In addition, there is still strong global competition for highly qualified personnel. Therefore, loss of key personnel and difficulties in identifying, attracting, and retaining key talent could lead to loss of know-how and decrease business performance. Likewise, non-compliance to health and safety laws and regulations could lead to accidents, penalties, employee dissatisfaction, business interruptions and reputational damage at Group level.

Through our human resources strategy, we seek to encourage independent thinking and action, which are key in an open corporate culture with flat hierarchies on a long-term and sustainable basis. To achieve this goal, a control process is in place to detect and assess human-resource risks. PUMA pays particular attention to talent management, identifying key positions and talent, ensuring this talent is trained and positioned optimally, and succession planning. We have also instituted additional national and global regulations and guidelines to ensure compliance with legal provisions and safeguard the health and safety of our employees. Moreover, employee surveys are conducted to obtain feedback and measure employee engagement (e.g., “Great Place to Work”, “Diversity Leader”). During 2023, PUMA received several awards which recognised the ongoing efforts to create a diverse, inclusive, and equal workforce (e.g., “Top Employer”). We will continue to make targeted investments in the human resource needs of functions or regions to meet the future requirements of our corporate strategy.

LIQUIDITY AND INTEREST RATE RISKS

PUMA continually analyses short-term capital requirements by rolling cash flow planning at the level of the individual companies in coordination with the central Treasury department. In order to ensure the company's solvency, financial flexibility and a strategic liquidity buffer, PUMA maintains, for example, a liquidity reserve in the form of cash and confirmed credit facilities. In this respect, as of December 31, 2023, the PUMA Group had unused credit lines totaling € 896.1 million.

Medium and long-term funding requirements that cannot be directly covered by net cash from operating activities are financed by taking out medium and long-term loans. For this purpose, various promissory note loans were issued in several tranches with fixed and variable coupons and different remaining terms. The utilised promissory note loans amount to a total of € 551.5 million as of December 31, 2023 and have a remaining term of between one and five years.

Changes in market interest rates around the world have an impact on future interest payments for variable interest liabilities. As PUMA only has a limited amount of variable interest-bearing liabilities, interest rate hedging instruments are used to a limited extent.

DEFAULT RISKS

Due to its business activities, PUMA is exposed to default risk on trade receivables. These risks consider delayed payments and losses of accounts receivables (e.g., default of a customer) as well as default risks from counterparty's other contractual financial obligations (e.g., bank deposits, derivative financial instruments). This could lead to bad debt expenses and reduced liquidity and could have a negative impact on cash flow and profitability, as trade receivables are one of the most significant financial assets.

The default risk is managed by continuously monitoring outstanding receivables and recognising impairment losses, where appropriate. The default risk is limited, if possible, by credit insurance. The maximum default risk is reflected by the carrying amounts of the financial assets recognised in the balance sheet. In addition, default risks also arise to a lesser extent from other contractual financial obligations of the counterparty, such as bank balances and derivative financial instruments.

Risk Overview Table

The following table summarises the risk groups described above based on their relative importance (significance level) and any changes during the year:

↗ T.07 OVERVIEW OF RISK GROUPS

Risk Groups | Classification | Description | Significance level | Change compared to previous year |

Macroeconomic Developments | Strategic | e.g., economic development, political situation, geopolitical tensions | Critical | ↗ |

Business Partners | Operational | e.g., raw material bottlenecks, supply chain disruptions, sourcing and logistic costs, quality problems | Critical | → |

Currency Risk | Financial | e.g., exchange rate fluctuations | Critical | ↗ |

Pandemic | Strategic | e.g., store closures, supply problems, health of employees and customers | Critical | ↘ |

Product and Market Environment | Strategic | e.g., trends, customer requirements, brand image, media reports | Material | → |

Projects | Strategic | e.g., IT infrastructure, construction projects | Material | → |

Information Technology | Operational | e.g., cyberattacks, network and system failures | Material | → |

Distribution Structure | Strategic | e.g., change in the distribution landscape | Material | → |

Sustainability | Regulatory | e.g., climate change, environmental standards | Material | → |

Working Conditions | Regulatory | e.g., labor law, human rights, German Supply Chain Due Diligence Act | Material | → |

Legal | Regulatory | e.g., trademark law, patent law, counterfeit products | Material | → |

Compliance | Regulatory | e.g., fraud, corruption | Material | → |

Tax | Financial | e.g., transfer prices | Material | → |

Personnel Department | Operational | e.g., key positions, employee retention, health & safety | Moderate | → |

Liquidity and Interest Rate | Financial | e.g., cash, credit lines, custody fees, interest rate developments | Moderate | → |

Default Risk | Financial | e.g., payment claims against customers | Moderate | → |

|

|

|

|

|

Opportunities

Opportunities should be identified by PUMA at an early stage, assessed and - where possible - materialised. The operational management teams in the markets and departments are responsible for opportunity management. In course of the budget- and mid-term process, the identified opportunities are incorporated into PUMA’s overall planning approach. PUMA has identified and defined multiple key opportunity categories for the current planning period and beyond.

PUMA is operating in an external environment that is characterised by increasing geo-political risks, continued macro-economic headwinds, a muted consumer sentiment and a strong volatility in foreign exchange rates. In addition, the speed of recovery in the important U.S. and Chinese markets remains uncertain. In response, PUMA will continue to focus on managing short-term challenges without compromising the mid- and long-term momentum of the brand, always prioritising sales growth and market share gains over short-term profitability. Therefore, PUMA will continue to focus on being the best partner to its wholesale accounts and end consumer, providing them with the best possible service.

Within our corporate strategy, we have defined the following six strategic priorities which offer significant opportunities: elevate the brand, enhance product excellence, improve distribution quality, focus on people first, digitalise our infrastructure and evolve sustainability. Within this overarching framework, we’re currently placing a special focus on brand elevation, winning in the important U.S. market, and accelerating our rebound in China. PUMA will continue to invest into the brand and sees significant opportunities to increase market shares in all key markets. Supported by new landmark partnerships with brand ambassadors such as Rihanna and A$AP Rocky, our lifestyle products continue to enjoy strong relevance and demand across all age groups and regions. We have also made great progress in performance in recent years and have significantly improved our market position across football, running, fitness, basketball, golf, and motorsport. PUMA's product range is being continuously optimised and further developed across all categories with a special emphasis on innovation and franchise management. In 2024, multiple international sport events such as the UEFA Euro Cup in Germany, the Olympic & Paralympic Games in Paris, and the Copa America in the U.S. will give us a platform to underline our performance credibility and to increase brand heat and visibility. The major global interest in these events and sports in general will further support the growth of the sporting goods industry. We are also seeing a continued trend toward a healthier lifestyle, greater sports participation, and more casual clothing, which opens corresponding opportunities for our industry. Meaningful marketing campaigns supported by relevant brand ambassadors in all major markets are essential to anchor PUMA deeply in the hearts and minds of our consumers and create brand relevancy and loyalty. To further elevate the brand and strengthen our consumer connection, PUMA will also launch a big brand campaign in 2024.

In terms of distribution, PUMA will continue to focus on the wholesale channel. The strong partnerships with our wholesale accounts offer opportunities for future market share gains and business growth. However, we also see significant opportunities in our Direct-to-Consumer (DTC) business with a special emphasis on PUMA’s e-commerce channels. Since 2022, we’re rolling out a dedicated PUMA shopping app which is showing strong results and significantly better KPIs compared to our traditional puma.com e-commerce channels. The PUMA shopping app will be expanded to other markets in the coming years and will open further opportunities regarding customer loyalty and sales growth. New store formats and improvements to the overall shopping experience in our own retail stores can and should also lead to additional business opportunities. In China, we introduced a new store format that was developed by a local agency to fit the needs of the Chinese consumers and that is showing strong results. In terms of distribution, ensuring delivery excellence through new, state-of-the art multi-channel distribution centers in key markets also continues to support business development.

In information technology, improved communication with wholesale accounts and consumers via digital channels also offers opportunities – e.g., through the increased use of 3D technology. In addition, new or more efficient processes supported by digital technology may add value or result in cost optimisation. The digitalisation of key business processes such as product design will continue to be advanced in order to increase efficiency and effectiveness.

With end consumers paying more attention to sustainability, there is an opportunity to improve sustainability-related communication and sell more sustainable products. PUMA’s strategic approach for sustainability is centered around creating maximum possible impact within the supply chain and final customer. Numerous initiatives are ongoing and aligned with the UN Sustainable Development Goals. For example, in 2023 PUMA reached another milestone: 7 out of 10 products were produced from better materials such as recycled polyester. PUMA started the "Voices of a RE:GENERATION" initiative which aims to have constant communication with GEN-Z activists and environmentalists and give feedback to our senior management on how PUMA can further strengthen its sustainability initiatives and communicate its sustainability efforts to young audiences. All these initiatives will help us to evolve sustainability within PUMA and leverage corresponding business opportunities.

Overall Assessment of the Risk and Opportunity Situation

The assessment of the overall risk and opportunity situation of the Group and PUMA SE is the result of a consolidated view of the risk and opportunity categories described above for the financial year 2023. Following the description in our 2023 combined management report, our assessment of PUMA's overall risk situation this year is predominantly influenced by the macroeconomic environment and volatile retail demand specially in key markets, as described above, and is focused on the major challenges these pose. The Management Board is currently not aware of any material risks that, either individually, on an aggregated basis or in combination with other risks, could jeopardise the continued existence of the Group and PUMA SE.

However, we cannot exclude the possibility that in the future influencing factors, of which we are currently unaware or which we currently do not consider to be material, could have a negative impact on the continued existence of the Group or PUMA SE or individual consolidated companies. Also due to the extremely solid balance sheet and the positive business outlook, the Management Board does not see any significant threat to the continued existence of the PUMA Group and PUMA SE.

Main Features of the Internal Control and Risk Management System as it relates to the Group's Accounting Process

The Management Board of PUMA SE is responsible for the preparation and accuracy of the annual financial statements, the consolidated financial statements and the combined management report of PUMA SE. The consolidated financial statements were prepared in accordance with the International Financial Reporting Standards that apply in the EU, the requirements of the German Commercial Code (HGB), the German Stock Corporation Act (AktG) and the German SE Implementation Act (SEAG). Certain disclosures and amounts are based on current estimates by the Management Board and the management.

The Management Board is responsible for maintaining and regularly monitoring a suitable internal control and risk management system covering the consolidated financial statements and the disclosures in the combined management report. This control and risk management system is designed to ensure the compliance and reliability of the internal and external accounting records, the presentation and accuracy of the consolidated financial statements, and the combined management report and the disclosures contained therein. It is based on a series of process-integrated monitoring steps and encompasses the measures necessary to accomplish these, such as internal instructions, organisational and authorisation guidelines, the relevant company guidelines and handbooks, a clear separation of functions within the Group and the dual-control principle. The adequacy and operating effectiveness of these measures are regularly reviewed by the Group Internal Audit, Risk Management & Internal Control Department.

For monthly financial reporting and consolidation, PUMA has a group-wide reporting and controlling system that makes it possible to regularly and quickly detect deviations from projected figures and accounting irregularities and, where necessary, to take countermeasures.

By means of established internal reporting channels, the risk management system can regularly identify events that could affect the Group's economic performance and its accounting process so that it can analyse and evaluate the resulting risks and take the necessary actions to counter them.

In preparing the consolidated financial statements and the combined management report, it is sometimes necessary to make assumptions and estimates based on the information available at the time the financial statements and management report are prepared that affect the amount, presentation and explanation of recognised assets and liabilities, income and expenses, contingent liabilities, and other reportable information.

The Audit Committee of the Supervisory Board meets on a regular basis with the independent statutory auditors, the Management Board and the Group Internal Audit, Risk Management & Internal Control Department to discuss the results of the internal audits and statutory audits with reference to the internal control and risk management system as it relates to the accounting process. At the annual meeting on the financial statements, the auditor reports to the Supervisory Board (including the Audit Committee) on the results of the audit of the annual and consolidated financial statements.

Internal Control System

PUMA's internal control system applies to all employees throughout the Group as it incorporates the principles, procedures and measures established by PUMA Group management. All essential business processes that support the organisational implementation of management decisions must be taken into account.

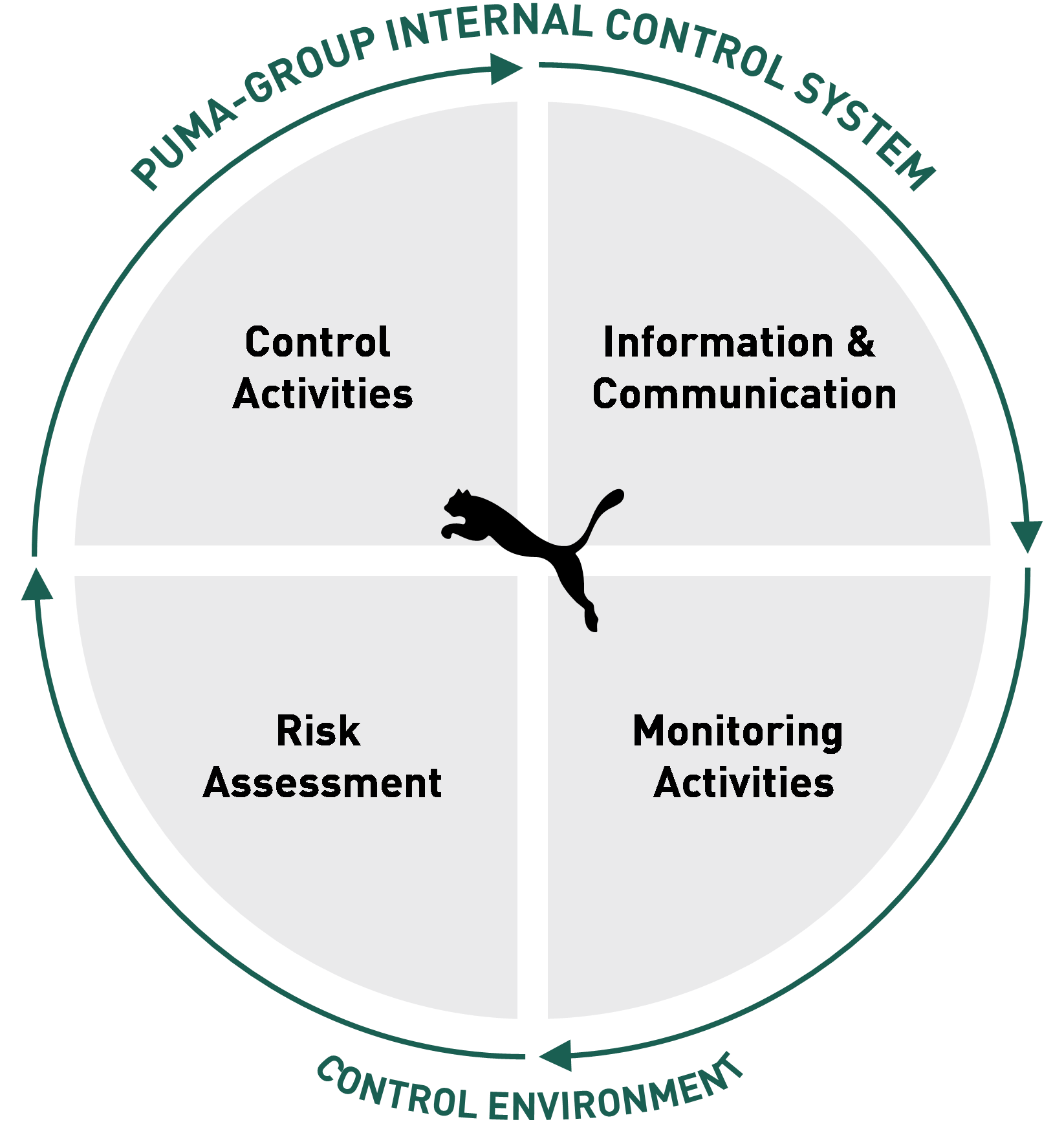

Within the PUMA Group, the methodology of the internal control system is based on the COSO Framework, which describes internal management and monitoring considerations for key processes within the company. Its purpose is to support the objectives of ensuring proper financial reporting, improving the efficiency and effectiveness of the processes and maintaining compliance with legal framework conditions.

The PUMA control framework is applied uniformly to the entire Group. The requirement here is to manage the significant risks through appropriate control activities. The objective is to continuously improve the internal control system and to identify specific risks and potential for improvement in the control environment at process level in order to define appropriate recommendations for action and to systematically track their timely implementation. Independent monitoring bodies such as the Supervisory Board and the Audit Committee help ensure that the control environment remains up-to-date. The Management Board of PUMA SE bears overall responsibility for the internal control system. The Management Board regularly updates the Audit Committee of the Supervisory Board of PUMA SE. The internal control function of the Group Internal Audit, Risk Management & Internal Control Department has been tasked with preparing regular reports for the Management Board in order to help coordinate the internal control system from an operational perspective. The responsibilities, tasks and processes of the internal control system are defined in guidelines.

With regard to the PUMA control framework, the following five core components must be kept in mind: control environment, risk assessment, control activities, information and communication, and monitoring activities.

↗ G.21 Internal Control System

The internal control system is based on the control environment established within the PUMA Group, in that it lays out principles for employee and management behavior within the company. The standards practiced are underpinned by internally formalised procedures and by clear guidelines on giving instructions and authorisations to do so. Together with external regulations, these internal standards form a control environment that applies to all employees of the PUMA Group, supported by the relevant management and the process manager in the entities.

As described in the previous section headed "Risk Management," the PUMA Group is also subject to a large number of risks that may potentially impact on company goals. Risk identification and assessment is carried out every six months in order to manage material risks at Group level. Using the resulting risk portfolio, the objective of the internal control system is to ensure that the compensating control measures fully correspond to the risk assessment/evaluation. In addition, the internal control system's risk assessment also includes a large number of more detailed risks in day-to-day operations – for example, operational activities in accordance with compliance regulations.

Control activities serve to counteract the identified business risks. In order to ensure that the control framework is continuously up-to-date and to monitor its application in business processes, an annual "Internal Control Self-Assessment" (ICSA) is completed by the key business units of the PUMA Group. The internal control function ensures that the key business units - at parent and subsidiary company level - are included in the ICSA. The managers of these business units evaluate the specified control objectives of the PUMA Group in relation to their business area. When doing so, the existing control framework is assessed based on internal and external guidelines and best-practice standards. Based on the responses, a level of implementation of the controls is determined, which undergoes independent verification by the Internal Control function and is then communicated to the Management Board using established reporting channels. The results of the ICSA are also reported to the Audit Committee and the statutory auditors and are used by the internal audit function of the Group Internal Audit, Risk Management & Internal Control Department in risk-oriented audit planning.

The purpose of informing and communicating potential business risks and control activities is to help make sound business decisions, with the information required to do so being accessible within an appropriate and timely framework. Established communication channels are continuously used in the PUMA Group to achieve this. The internal control function coordinates awareness training and regular coordination meetings in order to continuously guarantee, and also strengthen, its cooperation with the Management Board and other managers of business units.

The use of a standardised software system as the basis for monitoring activities is intended to ensure the systematic and uniform implementation of ICSA across the entire company. The internal control function analyses the results of the ICSA and derives recommended actions, which are coordinated with the managers of the business units and the implementation status of which is reviewed and monitored continuously.

┌

The Management Board also monitors the effectiveness of the risk management and internal control system in a holistic manner. Accordingly, key aspects of the systems are reviewed on a quarterly basis as part of cyclical reporting. This is to ensure that material risks are managed with an appropriate level of transparency, that individual issues are discussed in an appropriate form and can be tracked, and that possible improvements to the systems are considered. Supported by an established control environment, the continuous system monitoring, and improvement reflects the PUMA Group's open risk culture. During the reporting period, PUMA SE was not aware of any relevant circumstances that cast doubt on the adequacy and effectiveness of the risk management and internal control systems nor that had not been rectified by the balance sheet date. Nevertheless, it is worth noting that even systems that have been characterised as appropriate and effective are subject to inherent limitations. As such, it is not possible to guarantee the complete prevention of any procedural violations and/or risks arising.

└