Fair Income

TARGET DESCRIPTION:

- Make sure all PUMA employees are paid a living wage

- Carry out fair wage assessments including mapping a specific wage ladder for top five sourcing countries to help improve their wage levels and practices

- Ensure bank transfer payment to workers at all core suppliers by 2022

- Ensure effective and freely elected worker representation at all core Tier 1 suppliers

Relates to United Nations Sustainable Development Goals 1, 2 and 10

KPIs:

- Percentage of average wages compared to minimum wage

- Percentage of workers with permanent contracts

- Percentage of workers with social insurance coverage

- Percentage of workers paid via bank transfer

- Percentage of factories with freely elected worker representation

- Percentage of factories with collective bargaining agreements

- Number of countries with fair wage assessments over the last five years

For the definition of fair wages, PUMA follows the requirements for compensation set out in the Code of Conduct published by FLA. The Fair Wage Network conducts wage assessments and evaluates the wage systems of selected factories across 12 dimensions, focusing on five major areas: legal compliance, wage levels, wage adjustments, pay systems and social dialogue and communication. It also assesses the priority the wage policy takes within the company’s Human Resources policy and its Sustainability Strategy (considered as a thirteenth cross-cutting dimension).

Fair wages at PUMA'S own entities

The increasing cost of living is an emerging risk for PUMA. In 2021, we purchased a license for the living wage database of the Fair Wage Network. In 2021 and 2022, we used this database to check that a living wage was being paid to all PUMA employees globally. In 2022, our global leadership team implemented performance indicators - tied to bonuses - related to ensuring PUMA employees earned a living wage. The results of this internal assessment show that in 2022 all regular PUMA employees globally who were working full time were paid according to living wage thresholds at the regional/city level or above the Living Wage National Adjusted Mean as defined by the Fair Wage Network. This was also the case for 2023. See Our People section for further details.

Fair wages in the supply chain

As part of our efforts to ensure fair wage practices at the factories of our suppliers, we have defined the failure to make a full payment of at least the minimum wage as a zero-tolerance issue. This means that to be taken on as or to remain an active PUMA supplier, a company must pay minimum wages in full compliance with local regulations. 99.97% of workers in 2023 were paid at least minimum wage. Provisions around the payment of overtime hours and social insurance are also clearly articulated in PUMA’s Code of Conduct and are scrutinised regularly as part of our Compliance Audit Programme. The performance of PUMA‘s suppliers in other Fair Wage dimensions is also assessed through fieldwork assessment surveys (among both the workers and management) carried out by the Fair Wage Network.

DIGITAL PAYMENT

In 2023, 100% of our core factories paid 224,444 employees digitally. We are further expanding the digital mapping to all Pakistan factories, where 1,742 employees from four suppliers are not yet paid digitally. We will follow up in 2024.

FAIR COMPENSATION DASHBOARD

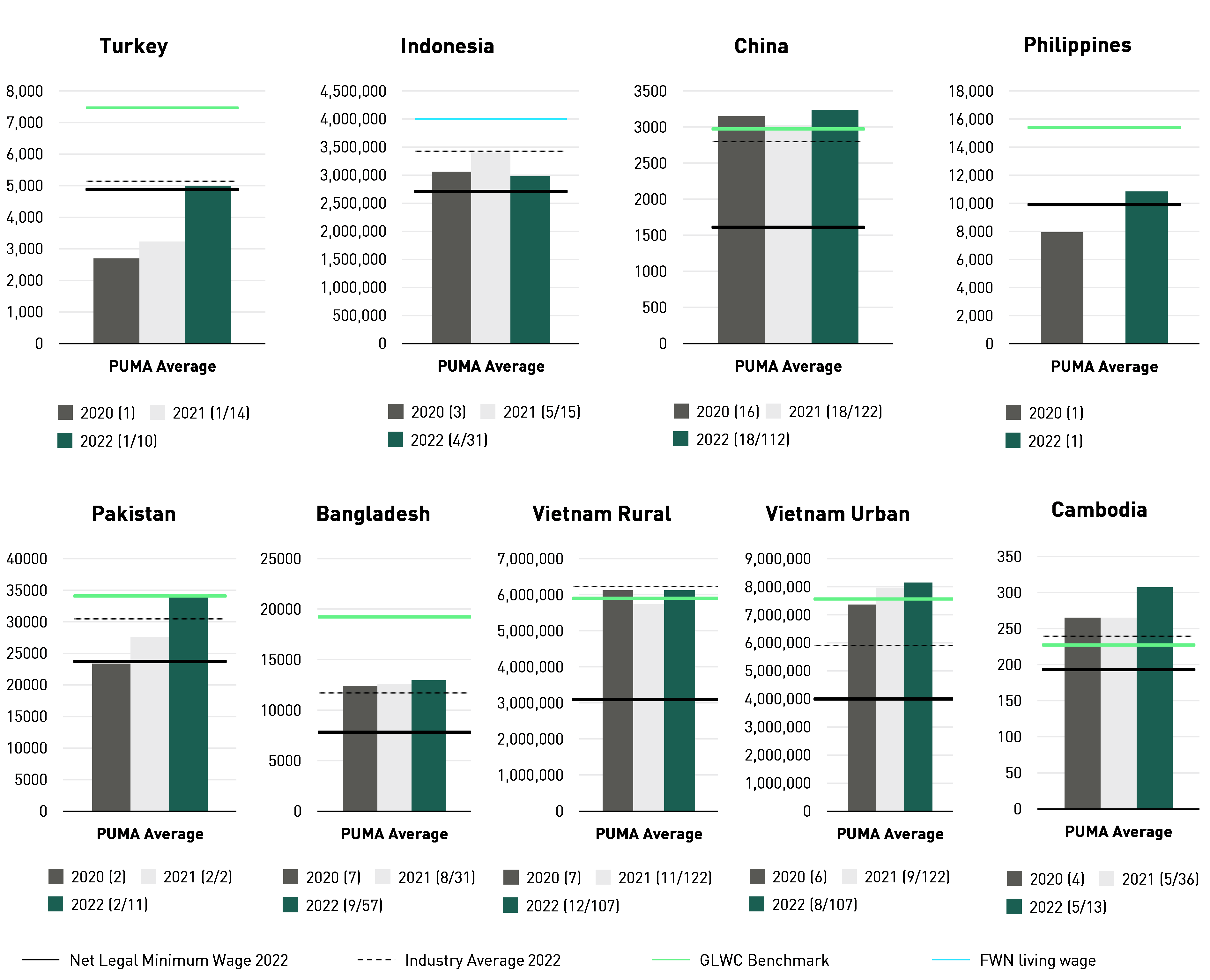

We have collected wage data annually from our core Tier 1 factories for several years. We use this data to report S-KPIs (see table T. 12). In 2022, we used the FLA’s Fair Compensation Dashboard* to analyze 2021 wage data for 59 strategic Tier 1 factories, and 2022 wage data for 60 strategic Tier 1 factories in 2023. We use the Dashboard to compare aggregated and anonymised data from industry peers and, where available, against living wage estimates of the Global Living Wage Coalition (GLWC), developed by the Anker Research Institute**. Where GLWC estimates are not available, namely in Indonesia, we used 2022 Fair Wage Network benchmarks***.

Graph G.10 shows the results of our benchmarking for 60 core Tier 1 factories in local currency, covering wages in 2022. This data covers approximately 75% of PUMA’s global production volume for 145,834 workers employed under those suppliers. 32 factories paid a living wage to 83,089 workers in Cambodia, China, Pakistan and Vietnam, covering 45% of PUMA’s global production volume. Those 83,089 workers represent 13% of our total supply chain workforce.

Below is our analysis of the results:

- All of our five strategic factories in Cambodia, one out of two strategic factories in Pakistan, 13 out of 18 strategic factories in China and 13 out of 20 strategic factories in Vietnam pay, on average, a living wage as set by the Global Living Wage Coalition. For Vietnam, as the GLWC provided a breakdown of the living wage benchmark into four different levels instead of two previously, seven Vietnam factories out of 20 fell below GLWC benchmarks. These seven factories now have a higher living wage level to reach.

- One supplier in the Philippines, which is below GLWC benchmark, will go through a Fair Wage Assessment in 2024.

- In Indonesia, all strategic factories went through Fair Wage Assessments or Remediations. One of the factories received the Fair Wage Certificate. At two factories re-assessed after remediation, we saw improvements in their scores on the 12 Fair Wage Dimensions, especially on prevailing wage, real wages, communication and social dialogue. These actions were taken between 2022 and 2023, which explains why there is a wage gap towards a living wage. We will keep following the remediation actions of these four core factories in Indonesia.

- The Turkey factory’s net pay has increased by 55% compared to 2021 due to the high inflation. We plan to enroll this factory for a Fair Wage assessment in 2024 to evaluate its wage system, so the factory can set up an action plan and workers’ income can increase.

- One supplier in Pakistan reached the Global Living Wage Coalition Benchmark. Another supplier reached 97% of the GLWC benchmark. We will launch Fair Wage Remediation with the latter in 2024.

- Wage payments in Bangladesh, despite being above industry average, fell well short of the Global Living Wage Coalition Benchmark and reached 67% of the Global Living Wage Coalition Benchmark in 2022; (70% in 2021, 69% in 2020).

* Industry average wage data from the FLA Fair Compensation Dashboard from November 2020 and October 2021. Users of the FLA’s Fair Compensation Dashboard have access to live anonymised monthly average net wage calculations based on all wage data uploaded per country and year. Averages are updated as wage data is uploaded into the dashboard and includes the Net Wage = Basic (Contracted) Wage + Cash Benefits + In-Kind Benefits – Mandatory Taxes and Legal Deductions. Payment of overtime is excluded.

** Global Living Wage Coalition: The GLWC estimates and reference values are developed by the Anker Research Institute. The methodology for these estimates uphold the definition of the living wage, which includes the standard remuneration received by a worker for a workweek, in a particular place, to afford a decent standard of living for the worker and his/her family. Elements of a decent standard of living include food, water, housing, education, healthcare, transportation, clothing and other essential needs, including provision for unexpected events.

***Fair Wage Network methodology: It takes into account the minimum living wage necessary for a worker to cover his/her family's basic needs considering multiple income earners in the family (the necessary family budget being covered by the sum of income earners). FWN also proposes a more ambitious living wage threshold that would consider one income earner and not multiple income earners. PUMA used multiple income earners thresholds in our fair wage analysis.

In 2023, we conducted Fair Wage Assessments with ten factories in Bangladesh, Pakistan, Indonesia, Cambodia and China, including seven re-assessments at factories in Bangladesh, Cambodia, Pakistan and Indonesia and three first-time assessments at two suppliers in China and one in Bangladesh.

↗ G.10 FLA FAIR COMPENSATION DASHBOARD 2020 – 2022

FAIR WAGE ASSESSMENT

Since 2018, we have asked Fair Wage Network (FWN) to conduct fair wage assessments at our core factories based in Bangladesh (2018), Cambodia (2019), Cambodia and Indonesia (2021), Bangladesh, Vietnam, Pakistan (2022), and China (2023) at 27 factories in total. Six factories obtained a Fair Wage Certificate, meaning that across the 13 dimensions of Fair Wage, wage and overtime payment, communication, and social dialogue for example, factories received at least 280 points out of 400 with no more than two dimensions below a 40% score, and workers are paid above the Fair Wage Network Living Wage threshold.

A positive outcome is that factories are strong in some institutional elements such as wage grids, monitoring the wages’ cost progression within the total production cost (including involving worker representatives to discuss and negotiate wage related issues and paying wages above competitors’ rates and above companies from other sectors located in the same area. However, similar developments were not always reported on in collective agreements, which have rarely been signed at the factory level, and monitoring process for moving towards the payment of a living wage. These insights still provide valuable information for follow-up and remediation in these factories. Worker satisfaction with wages and working conditions was found to be relatively good, with most workers being either ‘fully’ or ‘partly’ satisfied with their wages and working conditions. At one supplier, however, it was found that nearly half of the workforce were not satisfied with the working conditions, we will follow up on this in 2024.

In 2023, out of 10 factories that went through a fair wage assessment, six were re-assessed after a nearly one-year remediation phase with the support of Fair Wage Network (three in Bangladesh, one in Cambodia and two in Indonesia). All six factories improved significantly in communication and social dialogue, wage structure and also competitiveness. Under the Fair Wage Network Remediation Framework, social dialogue activities took place at those six factories and the wage structure was jointly reviewed as a result. Although wage adjustment mechanisms were improved, there is still room for improvement as regards the living wage. At the three factories assessed for the first time, we will work with the Fair Wage Network to further improve their wage strategy and pay systems. One factory in Pakistan was re-assessed as they previously had reached the GLWC living wage threshold. The factory has not yet received fair wage certification although its score has improved.

The Fair Wage Remediation programme provides a remediation plan to factories based on their individual assessments, and guides factories in setting up a Fair Wage Implementation Committee (consisting of workers and management representatives). The Committee is trained by the Fair Wage Network, on fair wage dimensions, wage grid, and how to a conduct living wage survey. The committee is responsible -under FWN guidance- for implementing the remediation plan.

In Indonesia, both factories under the remediation programme opened a dialogue channel with trade unions to negotiate the pay systems. One supplier included a seniority bonus into its basic wage, 90% of workers had a 0.46%-1.15% wage increase since January 2023; the factory also provided 14% to 28% as skill bonuses to workers having the ability to operate more than one machine. Another supplier pays workers higher than the legal requirement, providing a seniority bonus of 0.42%-0.48% of the minimum wage to workers who have worked more than one year, and providing a skill bonus that ranges from 0.65% to 16.34% of the minimum wage. All of these measures improve not only the fairness but also the efficiency of pay systems.

In Bangladesh, all three suppliers developed training modules and trained almost 100% of the workers using a skills matrix for all the designations. This ensures that workers’ wages increase in step with human capital developments (people skill development, working experience, creativity, strengths and attributes) and that the promotion system is fair and transparent. Training programmes were also provided to both management and workers on their roles and responsibilities based on the skills matrix and its connection to wage increases. Suppliers also looked at the gap between workers’ gross income and the living wage, and took initiative to minimize this gap. For example, one supplier introduced a fair price shop on the premises of the factory, so that the workers get the daily products they need at an affordable price, allowing workers to keep part of their wages for other needs. As a result of actions taken by our suppliers, we witnessed an improved dialogue between workers and factory management on the topic of wages. Workers, in one of three factories, formed a Trade Union during the remediation, so workers will be able to better coordinate their workforce concerns through this platform. We got to understand that the management of this particular supplier was highly supportive of the Trade Union’s creation, and it was found that their concerned parties are currently engaged in a congenial relationship.

In Cambodia, with the involvement of the Fair Wage Implementation Committee, the factory that started its remediation programme in mid-2022, reviewed its wage structure by creating more bonuses such as productivity bonuses and multi-skill bonuses. All of these are contributing to an almost 6% wage increase on average for about 3% (122) of qualified workers. This helped the factory to stabilize its workforce, with a 14.8% reduction of annual staff turnover in 2022 and a further 68.5% reduction in 2023.

BangladeshA factory in Bangladesh was assessed by Fair Wage Network team in 2018 to evaluate its wage practices. The factory could not be certified, joined the Fair Wage Remediation Programme in 2022 and was re-assessed at the end of the programme in 2023. The company has developed a rather comprehensive wage policy. One of the major improvements was in ‘Communication and social dialogue’. A committee, consisting of an equal number of representatives from management and workers, was formed to implement a remediation plan. The workers’ representatives on the committee were engaged in the decision-making process while developing and implementing the skills matrix, performance evaluation processes, for example. A robust communication strategy was set, ensuring that employees are well-informed about their wage levels and pay structures. The company set up a social dialogue policy, allowing representatives of workers to be involved in discussions and negotiations on wage matters. The intention is for these negotiations to lead to regular talks on wage issues and the possible endorsement of a collective agreement in future. The improved labour relations led to a 0.5% reduction in the staff turnover rate. In March 2023, while the remediation programme was underway, the workers at the factory created a Trade Union. This action suggests that the workers recognise the potential benefits of having a collective organisation to represent their interests. By establishing the Trade Union, the workers have created a structured platform that allows them to collaborate more effectively on matters of collective concern. Currently, approximately half of the workers of the factory are members of that Trade Union. The factory is working with Better Work Bangladesh, who provide training for both management and union members on their roles and responsibilities under the Labor Law. |

Gender pay gap

For the first time in 2023, we collected wage data by gender. There is no wage gap between female and male workers on a global average. We notice a difference of a few cents of Euros per hour in Pakistan, China, Cambodia and Turkey, mainly because factories are paying higher wages for working positions, such as polishing, or in warehouses that require the use of chemicals or heavy lifting and are positions predominantly filled by male workers.

SOUTH ASIA | SOUTHEAST ASIA | EMEA | 2023 | ||||||

Social KPI | Bangladesh | Pakistan | China | Cambodia | Indonesia | Philippines | Vietnam | Turkey | Average |

Hourly average gross wage excluding overtime and bonuses (%) | 0.0 | -0.2 | 0.0 | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Hourly average gross wage including overtime and bonuses (%) | -0.1 | -0.2 | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | -0.1 | 0.0 |

Number of factories | 8 | 2 | 18 | 5 | 4 | 1 | 18 | 1 | 57 |

|

|

|

|

|

|

|

|

|

|

1 Data received from 57 PUMA core suppliers representing 72.1% of 2023 production volume, 72.4% of 2023 production value; reporting period for data collection: January 2023 – October 2023 (November and December 2023 were calculated based on the estimation method)

2 Wage gap calculation – Average of total female workers’ hourly gross wage – Average of total male workers’ hourly gross wage

RECRUITMENT FEES

PUMA signed the Fair Labor Association/American Apparel and Footwear Association Commitment to Responsible Recruitment in 2018. Since then, we have been actively involved with suppliers, industry peers and the UN’s International Organization for Migration (IOM) to ensure that the labour rights of foreign and migrant workers are upheld in our supply chain.

We map on a yearly basis if our factories employ foreign migrant workers and how much workers paid in recruitment fees. We then engage with our sourcing leaders, supplier top management, and in some cases other brands the supplier produces for, to come up with an agreement on a timeline to pay migrant workers back. The back payment could in certain cases be made in different instalments and not a lump sum to not disturb the factory as not all workers are entitled to this payment – an issue which could lead to misunderstandings between workers.

Through the efforts of multi-stakeholder engagements, factories paid back more than $ 100,000 to 255 foreign migrant workers at six factories in Japan, South Korea, China (Taiwan) and Thailand in 2022. PUMA has used e-learning from the International Organization for Migration in employer guidelines to train 36 factories from Mauritius, China (Taiwan), South Korea, Thailand and Japan in 2022. In 2023, we kept monitoring factories’ recruitment practices.

In May 2023, we found that eight foreign migrant workers had paid recruitment fees before starting to work at three factories (two core Tier 2, one non-core Tier 2) in Taiwan; through communication with factories and support from our sourcing team, over $ 16,000 in total was paid back to these workers.

During an audit at one South Korea factory, we found that one worker had paid $ 370 for a flight ticket from their home country to South Korea. The factory immediately reimbursed this worker after the audit.

During audits conducted at the end of 2023, we found that 12 migrant workers had paid a total of approximately $ 33,000 before they started to work at three factories in Japan. Two factories agreed to pay back a total of $ 23,109 to nine migrant workers in January 2024; we will terminate our business relationship with the third factory which refused to reimburse workers since it is in breach of PUMA’s standards. We will phase out this supplier by June 2025, so that they have sufficient time to find another customer to replace PUMA’s business and to avoid impacting workers’ employment.

In 2023, the IOM trained PUMA’s Sustainability Team in the following areas:

- How fair and ethical recruitment due diligence can help prevent and mitigate adverse human and labour rights for migrant workers.

- Practical knowledge on how to apply Ethical Recruitment Due Diligence Tools, particularly the supplier Self-Assessment Checklist, Corrective Action Plan, and the Interview Questionnaire for Migrant Workers.

- Features and functions of the Ethical Recruitment Due Diligence tools as a trainer.

In 2024, the IOM will further support PUMA to develop suppliers’ guidelines regarding responsible migrant workers recruitment and working conditions. These will be included into our Social Standards and translated into all relevant languages. PUMA’s Sustainability Team will train our suppliers who employ foreign migrants on these new requirements.

2023 | Baseline 2020 | Target 2025 | |

Digital payment (% of core Tier 1 and Tier 2 suppliers) | 100% | 90% | 100% |

% of workers that are receiving wage payments digitally | 100% | * | 100% |

Percentage of core Tier 1 supplier facilities that have trade unions or freely elected worker representation (core Tier 1) | 66% | 33% | 100% |

Fair wage assessments | 5 out of 5 | 2 out of 5 | 5 out of 5 |

|

|

|

|

*No baseline in 2020

2022-2023 PUMA PLWF REPORT: LEADING

The Platform Living Wage Financials (PLWF) is a coalition of 20 financial institutions that engage and encourage investee companies to enable living wages and incomes in their global supply chains. The 2022-2023 PLWF report presents the annual assessments of investee companies on living wage and responsible purchasing practices. In 2023, PUMA was the only company that reached the Leading category for its work on fair income, out of 31 companies from the Garment and Footwear sector.

Supporting legal minimum wage increase in bangladesh

In 2023, PUMA received a letter from four Bangladeshi Unions calling for support for minimum wage to increase, through social dialogue, and by making a long-term commitment to continue sourcing from Bangladesh.

PUMA answered through a public statement recognizing that the current legal minimum wage in the Ready-Made Garment sector is significantly below a living wage. In this statement, we share PUMA’s standards regarding legal minimum wage, overtime and social insurance payment-related issues, as well as our continuous monitoring and methodology, regarding living wage benchmarks and assessments. We reiterated the importance of freedom of association and collective bargaining as a key means through which employers, their organisations and trade unions can establish fair wages and working conditions. We also supported the FLA’s letter shared in August 2023, which appeals to the Chairman of the Minimum Wage Board to champion local union demands for increases in the minimum wage.

In October 2023, PUMA also joined other FLA-affiliated brands to ask the government to consider that the minimum wage consultations should be made in an environment to support dialogue with relevant stakeholders and Unions, seek to raise the minimum wage to a level that is sufficient to cover workers’ basic needs and some discretionary income and takes into account inflationary pressures, while ensuring that the minimum wage is reviewed annually. Signatory brands are AEO, Inc. Abercrombie & Fitch, adidas, Amer Sports, Burton, Gap Inc., Hugo Boss AG, KMD Brands, Levi Strauss & Co., lululemon, Patagonia, PUMA SE, PVH Corp, SanMar and Under Armour.

In both letters, PUMA shared its commitment to implement Responsible Purchasing Practices to support negotiations and wage increases and to continue sourcing in Bangladesh.

Worker representatives project

Effective social dialogue and sound industrial relations are key components of achieving decent work. Ensuring effective and freely elected worker representation in all core Tier 1 suppliers is among our 10FOR25 Sustainability Targets. PUMA encouraged our suppliers to join the ILO Better Work Programme, which coaches the factory management to create or work with an existing bipartite or worker/management committee to discuss and resolve workplace issues on an ongoing basis.

For factories that are not part of the Better Work programme, we partnered with Timeline Consultancy, a China-based consultant experienced on improving worker-management cooperation, who trained PUMA’s Sustainability Team in 2022 and 2023. Our PUMA Sustainability Team gained the ability to independently promote the establishment of an effective Worker Representative Committee and to evaluate its effectiveness.

Since 2022, 12 factories in China have established a Worker Representative Committee. 358 worker representatives were freely elected by production workers, 59% of which are female workers. For a better understanding of the worker-management dialogue mechanism, 380 representatives of factory management were trained by PUMA’s Sustainability Team on the Significance of Dialogue and Worker Representation before the worker representative election. After the election, all these factory management and worker representatives were trained on their roles and responsibilities, rights and obligations, how to conduct adequate information sharing and how to establish a dialogue mechanism, which enables open dialogue between factory management and worker representatives.

In 2023, we expanded the programme to include two Vietnamese factories and one factory in Indonesia: worker representative elections will be held in three factories in 2024.

Social-KPIs

On average, our core suppliers paid basic wages that exceed minimum wage levels by 12.7% in 2023. When adding overtime and bonus payments, our core suppliers pay 62.7% above minimum wage. In view of the global macroeconomic situation, which has led to a change in customers' ordering behaviour, we saw a decline in the order book in the first half of 2023 and stabilisation during the second half of 2023; as a result, overtime working hours decreased on average by 2.4 hours per week compared with 2022, which explains why the percentage of gross wages (including overtime and bonuses) above minimum wage decreased compared with 2022. At the same time, in 2023, the minimum wage increased over a 12-month average by 104% in Turkey, by 11% in Pakistan, by 2% in Indonesia, by 4% in the Philippines, by 3% in Cambodia and 0.3% in China. For Bangladesh the new minimum wage came into effect on the first of December 2023, and increased by 56%.

100% of workers are covered by social insurance in all countries except for China where 80.4% are covered: this represents a 4.4% increase compared to 2022 due to factories making an effort to explain the benefits of the programme and convincing workers to join social insurance schemes. The total average coverage with social insurance increased from 97% to 97.5%.

In 2023, 32.3% workers are covered by a collective bargaining agreement (in 2022 34.4%). This number decreased as one of our suppliers in Indonesia with a CBA dropped off our core supplier list.

The percentage of women in managerial positions increased slightly to 50.4% (in 2022 49.1%) as some factories reached their goals of increasing the number of females in managerial roles.

The percentage of permanent workers increased from 74.2% to 76.7% on average, mainly due to labour law changes in Cambodia, under which more workers get an Undetermined Duration Contract (UDC), after completing a two-year Fixed Duration Contract (FDC). In addition, since there was a decrease in orders during the first half of 2023, factory management teams recruited fewer temporary workers.

The turnover rate decreased due to factories implementing worker retention programmes. However, in countries such as Pakistan, Indonesia and Turkey turnover rates increased due to downsizing business or workers entering into retirement.

The average injury rate was reduced to 0.2% (0.3% in 2022). We followed up on action plan implementation after various OHS trainings, such as Accident Prevention and Reporting training, conducted by PUMA since 2021. In view of the 2023 global macroeconomic situation, which led to a change in customers' ordering behaviour, we saw a decline in the order book in the first half of 2023 and stabilisation during the second half. This led to a downturn in working hours, fewer temporary workers being recruited and potentially fewer risks of injury. This could also explain why the injury rate decreased this year.

SOUTH ASIA | SOUTHEAST ASIA | EMEA | 2023 | 2022 | 2021 | 2020 | ||||||

Social KPI | Bangladesh | Pakistan | China | Cambodia | Indonesia | Philippines | Vietnam | Turkey | Average | |||

Gross wage paid above minimum wage excluding overtime and bonuses (%) | 23.6 | 33.2 | 5.9 | 6.1 | 1.3 | 0.0 | 31.4 | 0.4 | 12.7 | 13.4 | 14.5 | 13.0 |

Gross wage paid above minimum wage including overtime and bonuses (%) | 58.6 | 38.9 | 166.6 | 63.3 | 38.3 | 18.0 | 93.3 | 24.9 | 62.7 | 71.0 | 80.2 | 54.7 |

Workers covered by social insurance (%) | 100.0 | 100.0 | 80.4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 97.5 | 97.0 | 95.1 | 95.6 |

Overtime (hours per week) | 6.0 | 0.3 | 13.5 | 4.9 | 4.5 | 6.0 | 3.5 | 3.8 | 5.3 | 7.7 | 8.3 | 5.4 |

Workers covered by a collective bargainning agreement | 0.0 | 0.0 | 93.3 | 40.0 | 25.0 | 0.0 | 100.0 | 0.0 | 32.3 | 34.4 | 37.2 | 26.9 |

Female managerial position (%) | 7.4 | 7.7 | 56.3 | 64.6 | 73.8 | 76.9 | 71.2 | 45.3 | 50.4 | 49.1 | NA | NA |

Female workers (%) | 42.0 | 9.7 | 61.6 | 83.1 | 82.8 | 63.9 | 76.2 | 58.5 | 59.7 | 60.0 | 59.5 | 58.8 |

Permanent workers (%) | 100.0 | 100.0 | 28.6 | 62.7 | 99.2 | 77.2 | 45.6 | 100.0 | 76.7 | 74.2 | 75.5 | 74.4 |

Annual turnover rate (%) | 27.3 | 32.9 | 52.8 | 41.9 | 26.5 | 15.1 | 39.9 | 34.8 | 33.9 | 35.6 | 34.0 | 29.9 |

Injury rate (%) | 0.3 | 0.0 | 0.4 | 0.3 | 0.3 | 0.0 | 0.1 | 0.5 | 0.2 | 0.3 | 0.3 | 0.4 |

Hourly average gross wage excluding overtime and bonuses (%) | 0.0 | -0.2 | 0.0 | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |||

Hourly average gross wage including overtime and bonuses (%) | -0.1 | -0.2 | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | -0.1 | 0.0 | |||

Number of factories | 8 | 2 | 18 | 5 | 4 | 1 | 18 | 1 | 57 | 65 | 63 | 58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

*New KPI

1 Data received from 57 PUMA core suppliers representing 72.1% of 2023 production volume, 72.4% of 2023 production value; reporting period for data collection: January 2023 – October 2023 (November and December 2023 were calculated based on the estimation method)

2 Injury rate calculation – Number of OSHA Recordable cases X 200,000 / Number of Employee Labor hours worked

3 Wage gap calculation – Average of total female workers’ hourly gross wage – Average of total male workers’ hourly gross wage