Sourcing

The Sourcing OrganiSation

PUMA Group’s sourcing functions, referred to as PUMA Group Sourcing (PGS), manages all sourcing related activities for PUMA and Cobra, including supplier selection, product development, price negotiation and production control. These activities are centrally managed by PUMA International Trading GmbH (PIT), the group’s global trading entity, with its head office in the Corporate headquarters in Herzogenaurach (Germany). In addition, PIT is responsible for procurement and supply into the PUMA distribution channels worldwide. PIT receives volume forecasts from PUMA subsidiaries and licensees worldwide, translates these forecasts into production plans which are subsequently distributed to the third-party vendors. The PUMA subsidiaries confirm their forecasts into purchase orders to PIT, which in turn consolidates these requirements and purchases from the vendors. There is a clear buy/sell relationship between the sales-subsidiaries and PIT and between PIT and the vendors, for added transparency.

The centralisation of the sourcing and procurement functions supported by a cloud-based purchase order management and payment platform has enabled the digitalisation of the supply chain creating transparency, operational efficiency and reducing complexity. For example, container fill rates are optimised, foreign currency risks are managed by PIT directly via a centralised currency hedging policy, and all payments to vendors are automated and paper free.

To meet the needs of our customers in terms of service, quality, social and environmental sustainability, we focus on six core strategic pillars: partnership, product quality, growth management, margins, acquisition costs and sustainability. The integration of PUMA's sustainability function into the sourcing organisation ensures that industry standards, including social, environmental, chemical safety, as well as product compliance are closely integrated with all our sourcing activities.

Another key aspect in our sourcing setup since 2016 has been the PUMA Forever Better Vendor Financing Program. The program allows suppliers to be paid earlier. The International Finance Corporation (IFC), banking group BNP Paribas, HSBC and Standard Chartered offer attractive financing terms to our suppliers, allowing them to maintain their own lines of credit.

In 2023, no sourcing countries experienced material COVID restrictions. The lifting of restrictions enabled full normalisation of the supply chain to pre-pandemic levels.

High inflation, fluctuating raw material cost and freight cost impacted the company's operations. In view of the global macroeconomic situation, which has led to a change in customers' ordering behavior and increased inventory levels resulted in a need for more cautious procurement from our suppliers. Hence, we actively adjusted sourcing activities respectively and continued to provide transparency to our sourcing partners so they can adjust their capacities accordingly. Despite these challenges, we remained committed to delivering value to our stakeholders and implemented strategies to mitigate the adverse effects of the prevailing market conditions. Together with sustained demand for PUMA products in 2023 this led to a further normalisation of PUMA inventory levels, in line with expectations.

Our supplier partners form an integral part of the PUMA business. To recognise our suppliers, we organised a Supplier Summit in June 2023 at PUMA Headquarters in Herzogenaurach, bringing them together across all divisions for the first time in over six years. During the Summit, we shared recent and upcoming business developments and expressed gratitude for their partnership with PUMA.

The Sourcing Markets

During the financial year 2023, PIT purchased from 158 independent suppliers (previous year: 141) in 29 countries worldwide. The strategic cooperation with long-term partners continues to be one of our key competitive advantages and was crucial in navigating through ongoing supply chain challenges of 2023.

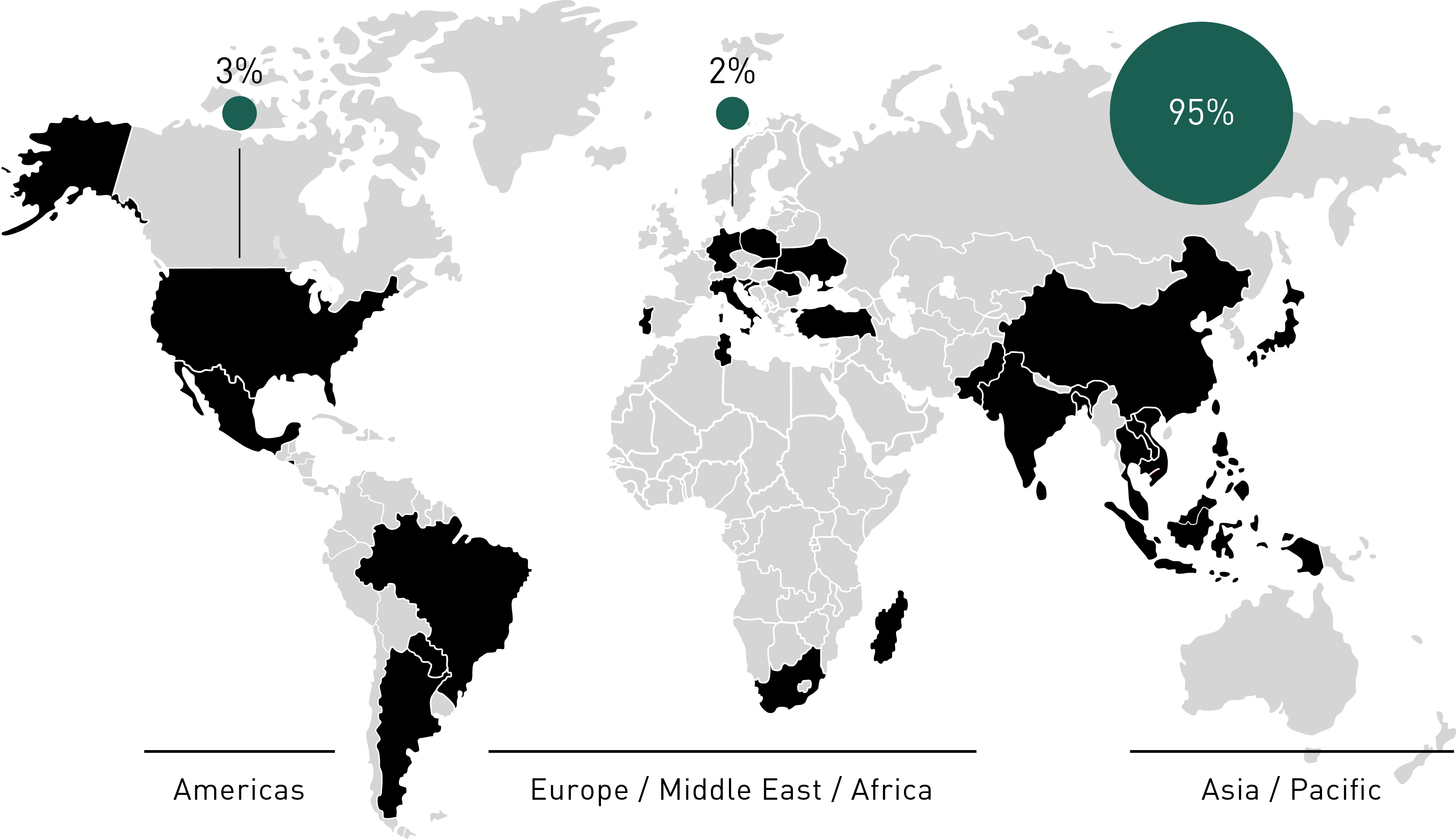

Asia is the strongest sourcing region overall with 95% of the total volume, followed by the Americas with 3% and EMEA with 2% (thereof Europe with 1% and Africa with 1%).

As a result, the six most important sourcing countries (94% of the total volume) are all located in the Asian continent. China is the biggest production country in 2023 with a total of 32%. While the absolute volumes in China for apparel have decreased, it was further strengthened as a strategic origin for footwear in 2023. Vietnam – a key development and sourcing hub for all three divisions – is the second biggest production country with 30%. Cambodia is in third place at 13%, Bangladesh, which focusses on apparel, is in fourth place at 12%. Indonesia, with an initial focus on footwear production and increasing volumes for apparel, produces 4% of the total volume and is in fifth place. India – only serving the local market - is in sixth place at 3%. In the growth market of India, we see ourselves in a good competitive position due to local sourcing and are therefore also able to limit the impact of the government's protectionist measures on our business.

Rising wage costs, fluctuating material prices, macroeconomic developments and evolving sustainability regulations, have continued to influence sourcing markets in 2023. Such impacts need to be considered in allocating the production to ensure a secure, sustainable, and competitive sourcing of products. In this regard sourcing continues to extend its local supply chain initiatives for markets such as China, India, Latin America, Türkye and others. Our sourcing activities resumed with business travel to key sourcing markets in order to visit our existing partners but also evaluate new vendors and opportunities in sourcing countries such as Indonesia.