Cash flow

1-12/2023 | 1-12/2022 | ||

€ million | € million | +/-% | |

Earnings before taxes (EBT) | 478.3 | 551.7 | -13.3% |

Financial result and non-cash effected expenses and income | 485.7 | 367.2 | 32.3% |

Gross cash flow | 964.1 | 918.9 | 4.9% |

Change in current assets, net | -129.2 | -343.3 | -62.4% |

Payments for taxes on income | -181.3 | -157.4 | 15.2% |

Net cash from operating activities | 653.6 | 418.3 | 56.3% |

Payments for investing in fixed assets | -300.4 | -263.6 | 13.9% |

Other investing and divestment activities incl. interest received | 15.8 | 22.9 | -31.1% |

Net cash used in investing activities | -284.6 | -240.8 | 18.2% |

Free cash flow | 369.0 | 177.5 | 107.9% |

Free cash flow (before acquisitions) | 369.0 | 177.5 | 107.9% |

Dividend payments to shareholders of PUMA SE | -122.8 | -107.7 | 14.0% |

Dividend payments to non-controlling interests | -92.4 | -73.3 | 26.2% |

Proceeds from borrowings | 299.6 | 17.9 | 1571.2% |

Cash repayments of borrowings | -59.1 | -69.5 | -14.9% |

Repayments of lease liabilities | -208.0 | -190.0 | 9.4% |

Interest paid | -94.3 | -53.8 | 75.3% |

Net cash used in financing activities | -277.1 | -476.4 | -41.8% |

Exchange rate-related changes in cash and cash equivalents | -2.1 | 4.4 | -146.8% |

Changes in cash and cash equivalents | 89.8 | -294.4 | -130.5% |

Cash and cash equivalents at the beginning of the financial year | 463.1 | 757.5 | -38.9% |

Cash and cash equivalents at the end of the financial year | 552.9 | 463.1 | 19.4% |

|

|

|

|

Net cash from operating activities

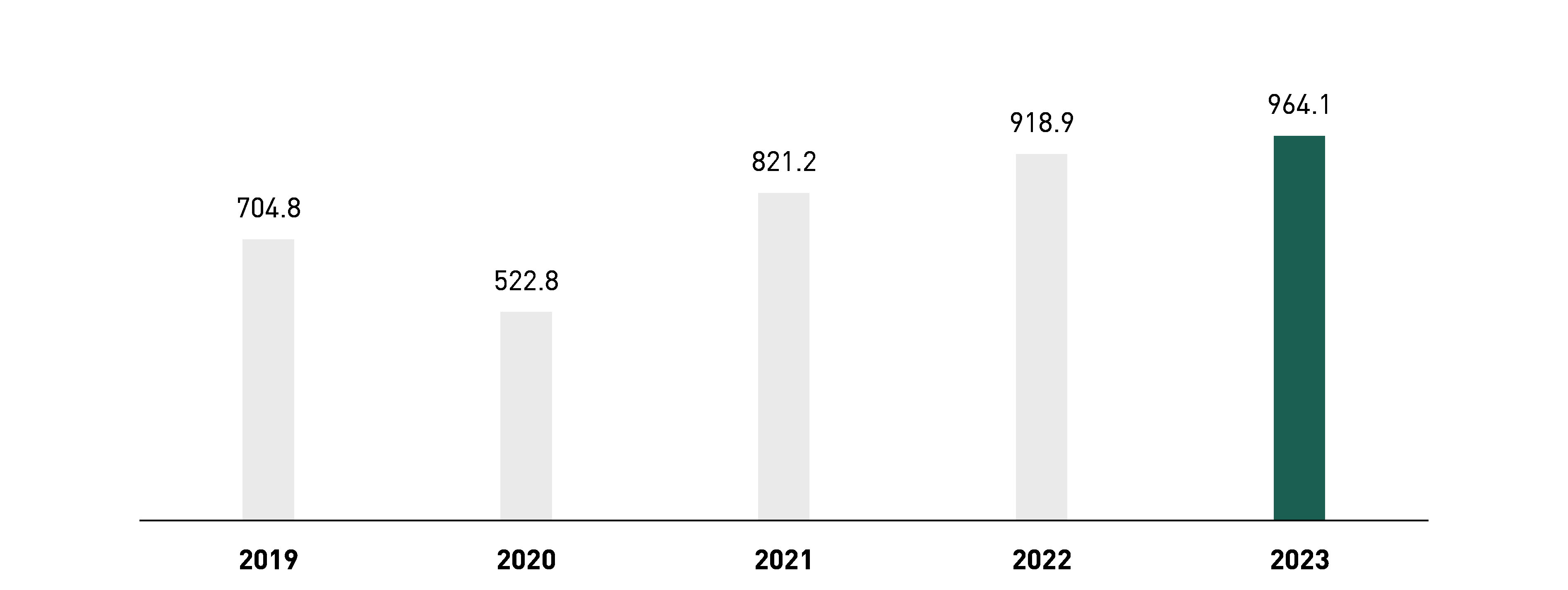

Gross cash flow increased by 4.9% to € 964.1 million in financial year 2023 (from € 918.9 million in the previous year). This development was due to the increase in non-cash adjustments relating to the financial result and other non-cash expenses and income by 32.3% to € 485.7 million. In contrast, earnings before taxes decreased by 13.3% to € 478.3 million.

↗ G.17 GROSS CASH FLOW (€ million)

As a result of the smaller increase in working capital compared to the previous year, there was a lower cash outflow from the change in net working capital* of € - 129.2 million in financial year 2023, compared to a cash outflow of € - 343.3 million in the previous year. The cash outflow from payments for income taxes increased from € - 157.4 million in the previous year to € - 181.3 million in financial year 2023. On balance, due to the improvement in gross cash flow and the lower cash outflows in connection with working capital, there was a significant improvement in cash inflow from operating activities, which rose by 56.3% to € 653.6 million (from € 418.3 million).

Net cash used in investing activities

In the financial year 2023, cash outflow from investment activities increased from a total of € 240.8 million to € 284.6 million. The investments in fixed assets included in this figure increased from € 263.6 million in the previous year to € 300.4 million in 2023 in line with our investment planning. The increase mainly related to investments in our own retail stores, in our logistics infrastructure and in investment properties. In addition, investments in the modernisation of the IT infrastructure continued to be made. The increase in capital expenditures relates in particular to the North America and Latin America segments and the central area, which is not allocated to the business segments.

Free cash flow before acquisitions

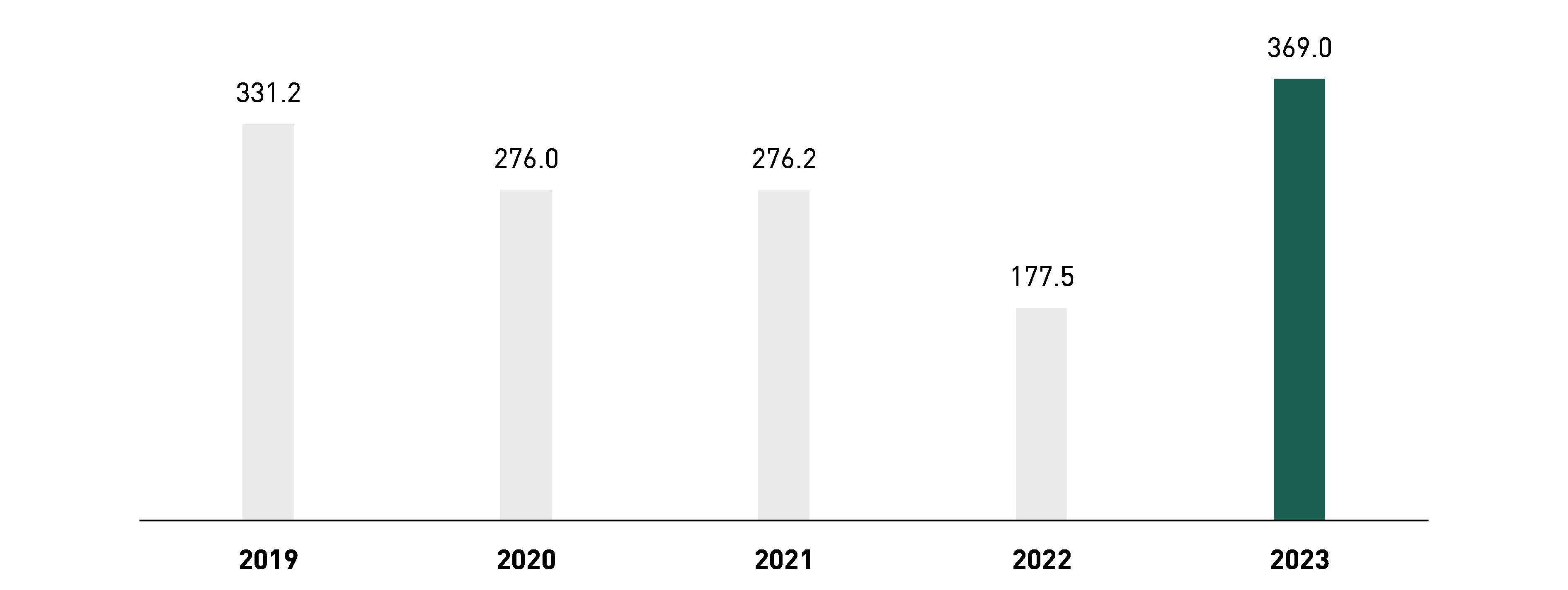

The free cash flow before acquisitions is the balance of the cash inflows and outflows from operating and investing activities. In addition, an adjustment is made for incoming and outgoing payments that relate to the purchase or sale of shareholdings, where applicable. No acquisitions or disposals of investments were made in 2022 and 2023.

Free cash flow before acquisitions improved from € 177.5 million in the previous year to € 369.0 million in the financial year 2023. Free cash flow before acquisitions was 4.3% of sales compared to 2.1% in the previous year.

↗ G.18 FREE CASH FLOW (BEFORE ACQUISITIONS) (€ million)

Net cash used in financing activities

The net cash used in financing activities decreased overall from a cash outflow of € 476.4 million in the previous year to a cash outflow of € 277.1 million in 2023. The decline in cash outflow was mainly due to increased proceeds from taking on financial borrowings.

A dividend payment of € 122.8 million was distributed to the shareholders of PUMA SE for the financial year 2022. In the previous year, the dividend payment was € 107.7 million. The net cash used in financing activities also included payouts to non-controlling interests totalling € 92.4 million in 2023 (previous year: € 73.3 million). Cash inflows from borrowings amounted to € 299.6 million, compared with cash inflows of € 17.9 million in the previous year. In the financial year 2023, payments made for the repayment of financial borrowings totalled € 59.1 million (previous year: € 69.5 million). The cash outflows for the repayment of leasing liabilities and related interest expenses included in the cash outflow from financing activities increased from a total of € 228.7 million in the previous year to € 254.8 million in 2023.

As of 31 December 2023, PUMA had cash and cash equivalents of € 552.9 million, an increase of 19.4% compared with the previous year (€ 463.1 million). The PUMA Group also had credit lines totalling € 1,552.8 million as of 31 December 2023 (previous year: € 1,271.0 million). Unutilised credit lines amounted to € 986.1 million as at the balance sheet date, compared to € 943.7 million in the previous year.