Environment

The purpose of our environmental efforts is to ensure that PUMA and its suppliers are in full environmental compliance and that any negative impact on the environment is minimised. Over the last ten years, PUMA has not incurred any environmental violations or fines known to us. Ultimately, we are aiming for a positive environmental impact of PUMA and our supply chain on the environment.

Environmental management at PUMA’s own entities

We conduct energy efficiency audits every four years at our own entities. In 2023, we commissioned 19 audits at PUMA offices, stores and warehouses in Germany, the Netherlands, France, Spain and Sweden. Compulsory in the European Union, these audits help us to identify energy-saving opportunities at our offices, stores and warehouses and roll them out globally. In 2023, for example, we replaced some lights at our headquarters with more energy-efficient LED lights.

In 2022 we achieved the ISO 14001 Environmental Management certification for our headquarters and published a stand-alone environmental policy. We also compiled and published an environmental handbook specific to our own offices, stores and distribution centres. We continued our global data collection and management processes for our own entities and set up a quarterly subsidiaries call for peer learning and good practice sharing. These calls are also used to re-emphasize our Sustainability Strategy and goals with our PUMA countries worldwide. The progress towards those goals is reported in this report.

Environmental management in the supply chain

ENVIRONMENTAL RISK ASSESSMENT

In 2023, we developed a Civil Society Organisations (CSOs) engagement policy to engage with them reactively and proactively. Please refer to the Due Diligence and Risk Assessment section of this report.

In 2023, we conducted an environmental risk assessment using EiQ platform by Elevate. EiQ is a data-driven supply chain ESG due diligence platform used by businesses to enhance Environmental, Social, and Governance (ESG) risk management. We focused on two risk areas; firstly, environmental country risk exposure for supply chain and secondly environmental material risk exposure.

Country risk exposure

We evaluated the environmental risk profile of our key sourcing countries. In 2023, the six most important sourcing countries, comprising 90% of the total volume, are located in Asia. China is the biggest production country in 2023 with a total of 30%, followed by Vietnam is the second biggest production country with 26%, Cambodia with 13%, Bangladesh, which focuses on apparel, at 12%, Indonesia with 5% and India – only serving the local market at 3%.

The parameters for the country risk include indexes such as air emission, environmental management, waste management, environment permits and wastewater violations. The supply chain risk environmental profile indicates that Indonesia and the Philippines are extreme-risk countries, whereas other key sourcing countries like Vietnam, China, Bangladesh, India and Cambodia are high-risk countries. Taiwan is a medium-risk country from supply chain environment risk. For environmental permits violations, Indonesia and Bangladesh are indicated as extreme-risk countries.

The risks mitigation measures in place for extreme-risk and high-risk countries, excluding India include; factory performance evaluation through Higg FEM verification, chemical management following ZDHC guidelines, compliance to ZDHC Wastewater Guidelines and core factories’ participation in cleaner production programmes, capacity building training programmes, supplier scorecard with E-KPIs followed by meetings with these core suppliers.

Publicly disclosed goals on reduction in water consumption, reduction in production waste to landfill and increased use of renewable energy help to track the performance of core suppliers and hence help to mitigate environmental risks. In China, the country with the largest sourcing volume in 2023, our suppliers have been disclosing their environmental performance data on The Institute of Public & Environmental Affairs (IPE) platform.

India production is only serving the local Indian market, and we have prioritised compliance with our Zero Tolerance Issues. We have not yet launched mitigation measures such as Higg FEM verification, chemical management following ZDHC guidelines, and compliance to ZDHC Wastewater Guidelines to all factories. We will gradually enroll these factories in these programmes in the coming years. In 2024, we will strengthen our existing measures to improve the environmental performance of supplier factories. We will focus on the transition to Higg FEM 4.0 which is a more exhaustive evaluation. It will help factories to further improve their performance and in turn help PUMA to manage its environmental risks. We plan to discuss the results of this risk assessment with our sourcing teams for business consideration.

Material Risk

We evaluated the environmental risk of our key materials such as cotton, polyester, leather & rubber. The environmental risk covers water use, non-GHG air pollutants, terrestrial ecosystem use, soil pollutants, solid waste and water pollutants. The results indicate that material environment risk is highest for natural rubber, followed by synthetic rubber and leather. Polyester has the lowest environmental risk. Furthermore, we mapped our sourcing share by country of these materials.

Cotton: In 2023, we sourced 63% of cotton from the USA, followed by Brazil (15%), Australia (8%) and India (4%). The USA is a high-risk country while Brazil and India are extreme-risk countries; Australia is a medium-risk country. The risks are water use, air pollution and biodiversity and ecosystem.

We have required our suppliers to source only cotton grown in farms that are licensed as having good farming and human rights standards (BCI), or recycled cotton from factories that are either Global Recycled Standard (GRS) or Recycled Claim Standard (RCS) certified by 2025.

PUMA is taking steps to mitigate some of the environmental risks associated with cotton sourcing which includes the adoption of BCI cotton, increased usage of recycled cotton, innovation to increase the share of recycled cotton in our products, conducting Life Cycle Assessments of products and materials to evaluate the environmental impact in lifecycle stages and engaging with the industry such as Textile Exchange to stay informed on industry best practices.

We collect material data consumption on an annual basis along with the country of origin and require our suppliers to keep all the supportive documentation available. We have also established an on-going due diligence programme with our partner laboratory in Germany where we regularly test samples of cotton-finished garments before shipment. This further strengthens traceability and control across our supply chain, from the raw material to the finished products.

Through our partnership with Better Cotton, we support farmers in developing a better understanding of Integrated Pest Management and phasing out the use of Highly Hazardous Pesticides (this helps to address improper disposal of used agrochemical containers which can contaminate air, soil, water and local ecosystems), to use water responsibly, to better protect the soil and to conserve and enhance biodiversity on their land. Better Cotton has set up goals to reduce greenhouse gas emissions by 50% per ton of Better Cotton lint produced by the end of the decade, ensure 100% of Better Cotton Farmers have improved the health of their soil and reduce the use and risk of synthetic pesticides by at least 50%.

In 2023, the share of BCI cotton was 90.3% and recycled cotton was 8.6% of total cotton sourced by PUMA.

Polyester: We sourced 79% of our polyester from China in 2023, followed by Taiwan at 9.2% and Vietnam at 7.4%. China is a high-risk country. Risk profiles for polyester from Vietnam and Taiwan are not available on the EIQ platform. High-risks are air pollution, water use and solid waste.

We have required our suppliers to source only polyester-certified by Bluesign/Oekotex, or recycled polyester from factories that are either Global Recycled Standard (GRS) or Recycled Claim Standard (RCS) certified by 2025. PUMA has joined the Textile Exchange polyester challenge since our 2025 goal of 75% recycled polyester is aligned with this challenge. We engage our core fabric manufacturing plants in energy efficiency programmes and support them to the transition to 25% renewable energy processing in 2025. We monitor and report chemical discharges, and work to eliminate pollutant chemicals.

In 2023, we sourced bio-based, high-performance polyester fibre known as Sorona, to up to 0.11% of our total polyester consumption. Sorona contains over 20% bio-based carbon content, which helps to reduce environmental impact, while maintaining quality and performance. Sorona is produced via a fermentation process that utilizes corn sugar as the main ingredient.

In 2023, 61.8% of the polyester used in our products was recycled, 23.3% certified by Bluesign/Oekotex and 0.11% biobased.

Leather: In 2023, we sourced, 61% of our leather from the USA, followed by Argentina 27%, Australia 6% and Brazil 5%. The USA, Brazil and Argentina are high-risk countries, while Australia is a medium-risk country. High risks are air pollution, water use and impact on ecosystem.

PUMA is taking several steps to mitigate environmental risks associated with leather sourcing. These include sourcing leather from Leather Working Group-rated tanneries, committing for sourcing deforestation-free bovine leather, and focusing on innovation for the development of recycled and other bio-based alternatives. We engage with Fashion Pact, Textile Exchange and the Leather Working Group (LWG) to remain updated about industry best practices.

We have committed to sourcing all the bovine leather used in our products from verified deforestation-free supply chains by 2030 or earlier. We have signed up for the Deforestation-Free Call to Action for Leather, launched by global non-profits Textile Exchange and LWG.

99.7% of the leather that PUMA sourced in 2023 is from Leather Working Group-certified tanneries. This means that the leather used in PUMA products comes from manufacturers who are working to implement industry good practice standards of environmental management and traceability. PUMA currently monitors its LWG medal-rated tanneries’ upstream traceability performance.

Around 76% of the leather used at PUMA is Suede, a byproduct of the full-grain leather business. The challenge faced currently by PUMA and others in the industry is that most suede tanneries work with agents and intermediaries alongside direct tanneries, to guarantee a stable supply which creates a challenge to have full traceability at the cattle ranch level.

Our innovation team has worked to address the technological limitations of a shoe designed for composting and launched the RE:SUEDE experiment. The upper of the RE:SUEDE is made of Zeology tanned suede.

Synthetic Rubber: We sourced, 74% of our synthetic rubber from China, followed by Vietnam 14% and South Korea 4%. China and South Korea are high-risk countries. The risk profile for synthetic rubber from Vietnam is not available on the EiQ platform. High risks are greenhouse gas emissions, water use and solid waste.

We have not yet mapped the manufacturing plants supplying synthetic rubber to our outsole manufacturers. As part of our 10FOR25 targets, we work on developing recycled materials as alternatives to rubber. In 2023, 5% of synthetic rubber was recycled. We engage our strategic outsole suppliers in Higg FEM (environmental performance tool measurement of which includes energy use and greenhouse gas emissions, water use, wastewater, emissions to air and waste management) and work with them to eliminate pollutant chemicals.

Natural Rubber: In 2023, we sourced 29% of natural rubber from Vietnam, followed by Brazil 25%, Pakistan 13%, and Thailand 5%. Vietnam is categorised as an extreme-risk country. Risk profiles for natural rubber from Brazil, Pakistan and Thailand are not available on the EiQ platform. High risks are mainly water use and impact on the ecosystem.

In 2023, only 2% of the rubber used in our products was natural rubber. We aim in the future to only source FSC-certified rubber. The FSC certification includes standards to maintain, conserve, and/or restore the ecosystem and environmental values of managed forests and also avoid, repair, or mitigate negative environmental impacts.

SUPPLIER ENVIRONMENTAL SCORECARD

In 2023, we developed environmental performance scorecards for core supplier factories to visualize their progress towards our 10FOR25 targets and 2022 goals. During one-to-one meetings, we explained the need for setting Science Based Targets to 21 selected suppliers, we reviewed the 2022 Environmental KPIs (E-KPIs) for 60 suppliers and discussed their 2023 plans; the need for participation in cleaner production and renewable energy programmes for some factories was also discussed. Environmental KPIs include Higg FEM score, FEM chemical module score, MRSL conformance rate, wastewater test results, percentage of renewable energy usage, greenhouse gas emission per product or volume of material, percentage of water consumption reduction (per product or volume of material), percentage of production waste sent to landfill (per product or volume of material).

These meetings were useful for understanding the challenges of our suppliers and for prioritizing our actions to support them. Key meetings outcomes:

- Alignment on setting Science-Based Targets (SBT): In summer 2023, 20 out of 21 selected suppliers agreed to set climate goals based on SBT methodology. In these meetings, we followed up our suppliers decision to set up SBT. In October 2023, in partnership with Guidehouse, we launched a capacity development programme for eight suppliers called Leadership on Climate Transition (LoCT), to support suppliers in this journey. In 2024, this programme will be expanded to other suppliers who do not have sufficient in-house or external expertise.

- Enrolment in cleaner production programmes: Factories were nominated to participate in Cleaner Production programmes based on their performance through E-KPIs and the expertise of their team members. In August 2023, Clean by Design (CbD) program phase three was launched in the China and Taiwan region for seven factories. A new programme called Resource Efficiency (REF) in partnership with ENERTEAM was started in Vietnam in August 2023 for four factories. The Cambodia Decarbonization Programme (CaDP) with IFC will be launched in early 2024 for four factories in Cambodia.

- Enrolment in renewable energy programmess:Suppliers shared their plans to complete feasibility studies or install rooftop solar systems. In the absence of adequate rooftop solar capacity, RECs purchases were discussed. The suppliers also highlighted their challenges. Subsequently, GIZ-PDP programme phase II was rolled out in Cambodia in February 2023 for one factory and in Vietnam in March 2023 for four factories to support rooftop solar installation.

- Phase-out of coal-fired boilers: We discussed this challenging goal with the relevant suppliers to align on a phase-out plan. Suppliers raised their concerns about the unstable availability of biomass, the absence of sustainable biomass guidelines, and the increased cost of natural gas. We will bring these challenges to the Fashion Charter working group to find solutions to address them.

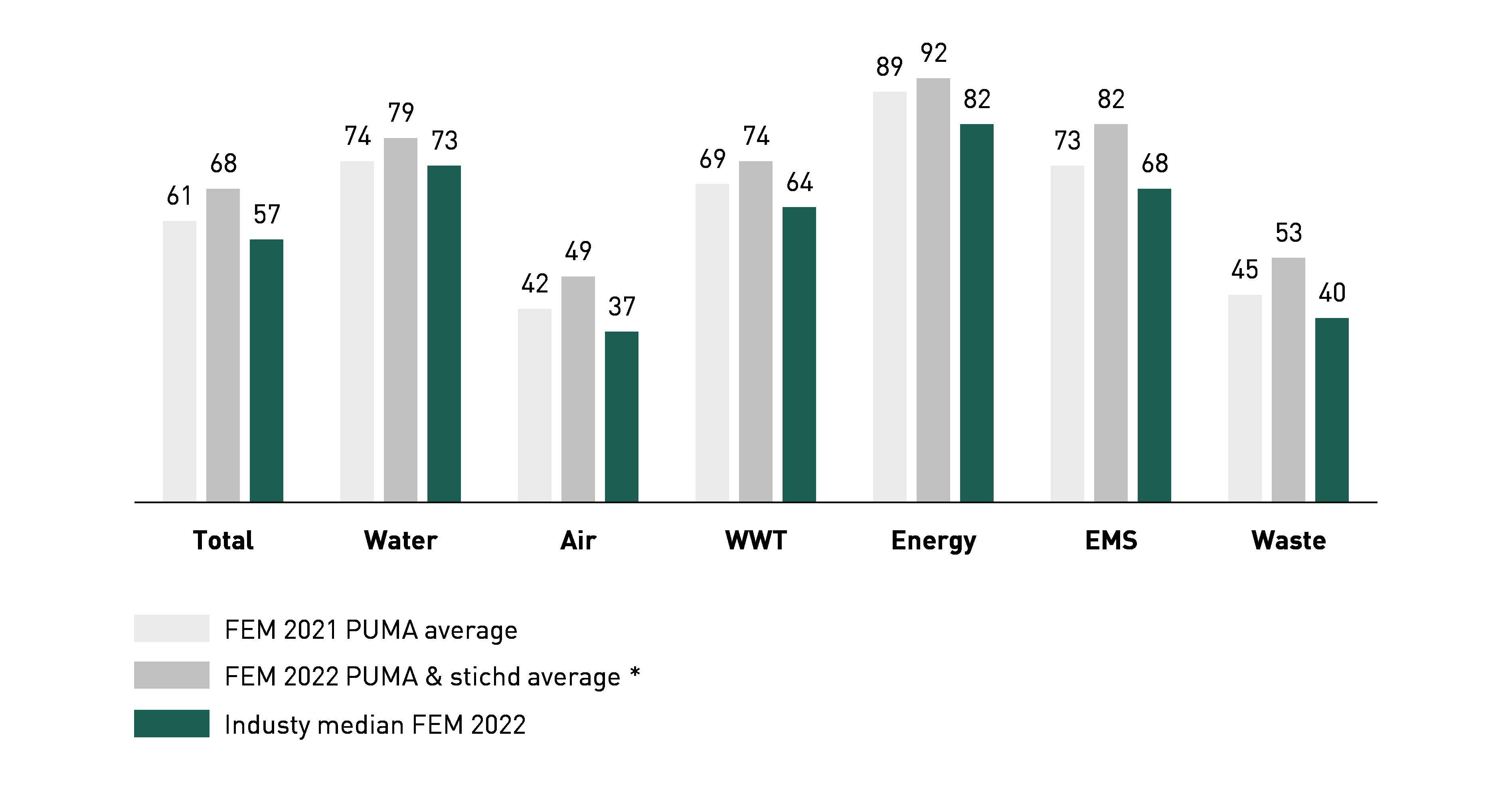

- Higg FEM Performance: Discussions focused on FEM (Facility Environmental Module) score. We also acknowledged improvements made by factories with an increased score in 2022 (2021 FEM score). We aligned on the need for additional training and/or support, such as one-to-one support for low performing factories to improve their score. 210 factories in total were provided training on Higg FEM in 2023. As a result, the average 2022 FEM score of core factories improved to 69% from 61% (2021 FEM score).

- Chemical Management: we focused on the factories with low compliance with MRSL standards and ZDHC Wastewater Guidelines. We aligned with factories on the need to bring in chemical suppliers disclosing their chemicals to the ZDHC gateway, a platform used to upload factory chemicals inventory lists and measure their MRSL conformance rate. In February 2023, we invited chemical suppliers to join the training session on ZDHC MRSL conformance. We also worked with some key chemical suppliers to support them in complying with ZDHC MRSL standards. As a result of the efforts, the MRSL conformance rate has increased from 68% in 2022 to 71% in 2023, and the average Higg FEM Chemical module score improved from 39% in 2022 to 51% in 2023. For factories with low ZDHC Wastewater pass rate tests, we discussed their corrective action plans. In 2024, we will continue to engage them to get more chemicals to comply with ZDHC MRSL.

FACTORY ENVIRONMENTAL PERFORMANCE MONITORING

Social compliance audits: For suppliers, our PUMA social compliance audits (detailed in the Human Rights section) contain a dedicated section on environmental and chemical compliance. For example, during each audit, we inspect environmental permits, waste management and effluent treatment plants. In general, PUMA social compliance audits are used for onboarding new factories.

Monitoring tools: For monitoring the environmental performance of suppliers, PUMA has used an industry-wide tool, the Higg Index Facility Environmental Module (FEM) 3.0. PUMA requires an annual external verification of the self-assessment FEM modules. This external verification may be completed by approved verifiers from PUMA’s internal team, other credited brands, or third-party organisations on the approved list from SAC. 100% of verification inspections are announced.

PUMA’s Environmental Performance Rating System is based on the ratings developed from the factories’ Higg FEM score verified by SAC-approved verifiers: A, B+, B-, C and D. The minimum passing grade from the environmental perspective is 40% (i.e., only A, B+ and B- ratings are passing grades) and C and D are failure ratings. This rating system was presented to suppliers in 2022 and implemented gradually during 2022 and 2023. Our environmental handbook has been updated accordingly. This rating system was included in our vendor supplier scorecard along with social and chemical ratings.

2023 | 2022 | |||||

Number of factories with FEM verified score | Core T1 | Core T2 | Core L&P | Core T1 | Core T2 | Core L&P |

A | 14 | 12 | 3 | 8 | 10 | 2 |

B+ | 34 | 33 | 8 | 25 | 25 | 1 |

B- | 9 | 11 | 2 | 30 | 22 | 7 |

C | 1 | 3 | 0 | 2 | 8 | 2 |

D | 1 | 0 | 0 | 0 | 0 | 0 |

Total | 59 | 59 | 13 | 65 | 65 | 12 |

Number of factories | 131 | 142 | ||||

|

|

|

|

|

|

|

1 Excluding stichd and PUMA United

↗ T.16 NUMBER OF STICHD FACTORIES WITH FACILITY ENVIRONMENT MODULE (FEM) VERIFIED SCORE

stichd 2023 (FEM2022) | |

A | 5 |

B+ | 15 |

B- | 7 |

C | 2 |

D | 0 |

Total | 29 |

|

|

* stichd has 32 core Tier 1 factories of which 30 have completed verification. One core factory is a common factory between PUMA and stichd and hence counted once under PUMA

Further data on the environmental performance of PUMA and our suppliers can be found in the Climate and Environmental Key Performance Data sections.

↗ G.11 AGGREGATED VERIFIED FEM SCORE FOR PUMA FACTORIES BENCHMARKED WITH INDUSTRY1-3

*Verification in 2023 is for FEM2022; Verification in 2022 is for FEM2021

1FEM 2022 PUMA and stichd average: 160 factories

2FEM 2021 PUMA average: 142 factories

3Industry median FEM (6,980 factories): Filters used: Industry sector: Apparel; Footwear; Accessories (includes handbags, jewellery, belts, and similar products) and Facility Type: Final Product Assembly; Printing, Product Dyeing and Laundering; Material Production (textile, rubber, foam, insulation, pliable materials); Packaging Production

The Higg FEM assesses:

- Environmental Management Systems

- Energy use and greenhouse gas emissions

- Water use

- Wastewater

- Emissions to air (if applicable)

- Waste management

- Chemical management (FEM chemical module is explained under the Chemicals section of this report)

Since 2020, we have communicated to our core factories our expectation for them to improve their score by setting up annual goals and using our new grading system. In 2021, 2022 and 2023 we facilitated training sessions conducted by FEM experts. This training was compulsory for low-performance factories and for those not familiar with this industry tool to attend. We closely monitor the factories to ensure completion of the verification of their self-assessment.

Throughout 2023, we continued to provide customised training sessions by FEM experts for our existing core Tier 1 and Tier 2, as well as non-core Tier 1 suppliers. The training focused on how to improve the Higg FEM score on low-performing areas for each region. We also facilitated entry-level training sessions for factories new to the Higg FEM tool. These trainings have helped our suppliers improve their environmental performance as is visible from the improved average FEM score for PUMA and stichd factories moving from 61% in 2022 up to 68% in 2023. We also facilitated for our suppliers to attend webinars and workshops on Higg FEM 4.0 to be launched in 2024, organised by SAC. In Vietnam, we facilitated for 61 factories to join the training programme, To The Finish Line (TFL) initiative, from GIZ for building capacity to transition to Higg FEM 4.0. The TFL initiative online sessions explained the changes made in this new tool and how to answer new questions. 26 core factories from six countries participated in a Higg FEM 4.0 pilot initiated by SAC, after which our suppliers provided valuable feedback to SAC on the new version of Higg FEM.

In 2023, all 131 PUMA core Tier 1 and Tier 2 factories completed the verification of their FEM self-assessment. We have set a target to achieve an annual 10% increase of the average verified score from 2021 (the goal was to reach 64% FEM score in 2023). We exceeded this target by achieving an average FEM score of 69%. Improvements are visible in all the sections of Higg FEM as compared to the previous year. PUMA’s average FEM score is higher than the industry median in each section. In 2023, we included our group company stichd’s core Tier 1 Higg FEM score. The combined average of PUMA and stichd also exceeded by achieving the target with an average score of 68%.

The number of C-rated PUMA factories came down from 12 in 2022 to four in 2023. However, one factory in Brazil which is a new core factory and new to FEM received a D rating. We will provide additional training and support to improve their performance next year.

In 2023, we continued to closely track factories to ensure the timely completion of their verifications. We saw the positive impact of our continued efforts to scale up cleaner production and renewable energy projects, climate action training, chemical projects, chemical management training and wastewater treatment training on the FEM scores of factories that had joined these programmes. For 2024 we have shared a goal of an average FEM score of 71% with our PUMA core suppliers, which needs to be reviewed as the Higg FEM will be going through a transition to Higg FEM 4.0.

Overall, our core factories have a score above 70% on wastewater, water, energy and GHG emissions, and environment management systems. We see topics like chemicals, air and waste as a key focus. In 2021, we conducted a risk assessment for chemical and waste and identified actions to be taken in the coming years. PUMA, as one of the signatory brands under ZDHC, follows up closely on the development and the progress of ZDHC air emission standards and guidelines and will apply them in the supply chain as applicable, once details are available. In 2023, we joined the ZDHC air emission pilot which we report in the Water and Air section of this report.

↗ T.17 NUMBER OF NON -CORE FACTORIES WITH FACILITY ENVIRONMENT MODULE (FEM) VERIFIED SCORE

2023 (FEM2022) verified | |

A | 18 |

B+ | 36 |

B- | 36 |

C | 15 |

D | 4 |

Total | 109 |

|

|

* Scope for non-core FEM assessment includes only PUMA factories. Does not include stichd non-core factories.

In 2022, we rolled out FEM/Facility Environmental Foundation (FEP) which is a lighter version of FEM, to non-core factories in our top three sourcing countries (Vietnam, China and Bangladesh) and to the factories which are participating in the PUMA Vendor Financing Programme. As a continuation, in 2023 we rolled out FEM/FEP to 154 of our non-core factories. The purpose is to also create a supplier scorecard for our non-core factories.

Out of 154 factories, 141 completed the self-assessment. Out of these 141 factories, 116 factories used the FEM tool, and 109 had their score verified by third party. 25 factories used the FEP tool, and 21 have completed the verification. Most of our non-core facilities that had a verified FEM achieved an A or B rating, while 15 factories got a C rating and four factories recorded a D rating. We will work with these C- and D-rated factories to improve their performance by providing training and support in 2024.

Further data on the environmental performance of PUMA and our suppliers can be found in the Climate and Environmental Key Performance Data sections.

32% of supplier factories out of the total (656 factories) were provided with Higg FEM training. Currently we are providing training to core Tier 1 and Tier 2, for which we set goals to increase their FEM score and non-core Tier 1 factories for which we just required the use of FEM/FEP tool to measure their environmental performance (in additional to their social performance) in 2023. We will expand the roll-out of the FEM/FEP tool to licensee factories in the future and will include FEM training for stichd factories in 2024.

The Finish Line (TFL) training by GIZ for Higg FEM 4.0 was only available in Vietnam and hence the percentage of total supplier factories covered is only 9%.

Similarly, the percentage of factories coverage is only 15% for sustainable material certification training, as we currently only invite PUMA Tier 1 and core Tier 2 factories supplying recycled and other sustainable materials/products. We need to expand the scope of this training to include all suppliers in the future to raise awareness of recycled and other sustainable materials, as we aim at increasing the use of more sustainable materials in our products.

Training Scope | Topics | Number of factories | Number of participants | % factories which joined | |

Supplier meetings | All core and non-core factories | Sustainability updates, best practices sharing, etc. | 559 average per round | 1,048 average per round | 85%* average per round |

Higg FEM training | PUMA core and non-core Tier 1 factories | Guiding existing factories to improve Higg FEM score and new factories to understand how to complete the Higg FEM/FEP module correctly | 210 | 600 | 32%* |

To The Finish Line (TFL) - GIZ | PUMA core and non-core factories in Vietnam | Developing understanding about changes in Higg FEM 4.0 and helping factories to transition into new standard | 61 | 294 | 9%* |

Sustainable Material (TE, GRS/RCS, RWS) | PUMA Tier 1 and Tier 2 factories supplying recycled and other sustainable materials and products | Guiding suppliers how to apply for relevant certification | 96 | 198 | 15%* |

E-KPIs collection training | Core Tier 1 and Tier 2 factories in Enablon scope | For core factories how to correctly fill in the environmental data | 75 | 188 | 77%** |

|

|

|

|

|

|

* % of factories joined the training based on total 656 factories. The 656 factories include PUMA core Tier 1 and Tier 2, non-core Tier 1, stichd factories and licensee factories.

** % of factories joined the E-KPI training, based on a total of 98 factories which are in scope to submit E-KPIs.

Improvement in HIGG FEM Verified scoreBeing a longtime partner to PUMA, Royal Footwear Group is producing PUMA products at three factories in Vietnam (Dai Loc Shoes, Sao Viet & Thien Loc Shoes). These three factories actively participated in different trainings on all sections of Higg FEM provided by PUMA and its training partner GIZ, and engaged in active consultation with PUMA’s Sustainability Team on its Performance Improvement Plan. As a result, these three factories significantly improved their verified Higg FEM total scores as compared to last year. Dai Loc increased its total verified score from 56% to 76%, Sao Viet from 40% to 77%, and Thien Loc from 46% to 75%. Significant improvements were made in sections like Environmental Management System, Chemical Management and Air Emissions. |

The Institute of Public & Environmental Affairs (IPE) in China

PUMA is actively engaged with The Institute of Public & Environmental Affairs (IPE) which is a non-profit environmental research organisation based in Beijing, China. IPE is involved in collecting, arranging and analyzing government and corporate environmental information to build a database of environmental information. IPE has developed a database called Blue Map and an online platform called BlueEcochain and both are interconnected. Powered by IPE's Blue Map Database and AI technology, Blue EcoChain platform provides an efficient means of supply chain oversight for environmental risks in China. Blue EcoChain enables PUMA to track its suppliers in China for environmental compliance at scale, and sends automated updates on regulatory violations and environmental remediation, as well as carbon emission and pollutant data disclosure continuously on a large scale.

Since 2013, PUMA has used IPE’s Blue Map database to screen its China supply chain and pre-screen its potential new factories for any legal environmental violation and requires suppliers to improve on their environmental performance. PUMA also discloses its local supplier list via the IPE supply chain map platform. In these years, PUMA engaged and influenced its Tier 1 factories in China and their upstream suppliers, e.g. core Tier 2 and selected Tier 3 suppliers, chemical suppliers, centralised wastewater treatment plants, solid waste contractors, logistics partners, etc. to join “Blue EcoChain” to monitor and disclose their own environmental performance. These disclosures include their Pollutant Release and Transfer Register (PRTR) data, carbon emissions, targets for carbon emissions, and water consumption reduction. PUMA worked with its core Tier 1 and Tier 2 factories to reduce their greenhouse gas emissions and encourage them to disclose their action taken and progress made on the IPE platform.

Through the Blue EcoChain platform and engagement with IPE, PUMA influenced its Tier 1 suppliers and their upstream suppliers to promptly issue public explanations regarding the reason for any environmental violations and encouraged them to adopt corrective actions and track their implementation. This supports PUMA Tier 1 factories in China to engage with their upstream suppliers for better practices and promote transparency.

Since 2021, PUMA published its actions annually on the Brand Stories IPE webpage to communicate to the public in China about PUMA's activities related to environmental protection.

2023 PUMA CITI & CATI ratings

PUMA participated in the first CITI (Corporate Information Transparency Index) campaign in 2014 and first CATI (The Corporate Climate Action Transparency Index) campaign in 2018 to score and rank PUMA’s environmental management and climate action.

In 2023, PUMA jumped seven places compared to 2022 and was ranked number five in CITI out of 742 brands. In the CITI 2023 rating, PUMA did well in responsiveness to inquiries and engagement with IPE, supply chain transparency, environmental compliance and corrective actions for any violations, energy conservation and GHG emission reduction. PUMA’s strength is also in publicly disclosed targets on low carbon and recycled products.

PUMA also jumped four places to be ranked number two in CATI out of 1,504 brands. In this rating, PUMA climate governance such as policy and board accountability, Scope 1, 2 and 3 emissions and progress disclosure and targets, as well as product carbon footprint disclosure and disclosures on decarbonisation actions of our value chain was evaluated as strong areas by IPE. Disclosure of climate action by affiliated companies, such as the PUMA subsidiary in China, was identified as a major improvement area. Other improvement areas include the disclosure of our performance against PUMA’s net-zero target and our action to decarbonize our own operations such as PUMA offices, stores and warehouses.

The details on our climate actions are provided in the Climate section of this report.